Accident with an uninsured driver: What to Do After a Crash in Oregon

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Accident with an uninsured driver: What to Do After a Crash in Oregon

Getting into an accident is jarring enough, but finding out the other driver is uninsured throws a whole new level of stress into the mix. It can feel like you’ve hit a brick wall. What you do in those first few moments at the scene can be very important for what comes next. By focusing on safety, getting the right help, and documenting everything, you build the foundation for your recovery.

Your First Steps After an Accident With an Uninsured Driver

In the chaos right after a crash, it's easy to feel overwhelmed. Discovering the at-fault driver has no insurance can make things feel worse. A potential approach is to stay calm and follow a clear plan, focusing on two things: everyone's safety and gathering information.

Even without insurance information to swap, there is still critical information to collect. One objective is to build a detailed record of the accident, who was involved, and the damage that was done.

Prioritize Safety and Call for Help

First things first: check on everyone. Are they okay? If anyone appears to be hurt, call 911 right away for paramedics and the police. Unless someone is in immediate danger (like a fire), it is often suggested not to move them if they're seriously injured.

If you can, and it is safe, move your cars out of the way of traffic to avoid another collision. Turn on your hazard lights. It is also often helpful to get the police to the scene. An official police report is an impartial, third-party record of what happened, and it can be a useful document down the line.

Document Everything at the Scene

The moment a crash happens, evidence may begin to disappear. Using a smartphone to take pictures and videos of everything from every possible angle is one way to preserve information. One of the most important first steps can be meticulously documenting the scene, including creating a detailed photo inventory for insurance claims to support your claim.

This visual record can be very helpful. Consider capturing:

- Vehicle Damage: Get close-ups of the damage on all cars, but also take wider shots to show the full context.

- The Scene: Photograph the entire area—skid marks, broken glass, road debris, traffic signals, and even the weather conditions.

- Visible Injuries: If you have any cuts, bruises, or other visible injuries, take clear photos of them.

- Driver Details: Snap a picture of the other driver's license, their license plate, and their car's VIN (usually on the dashboard or inside the driver's door).

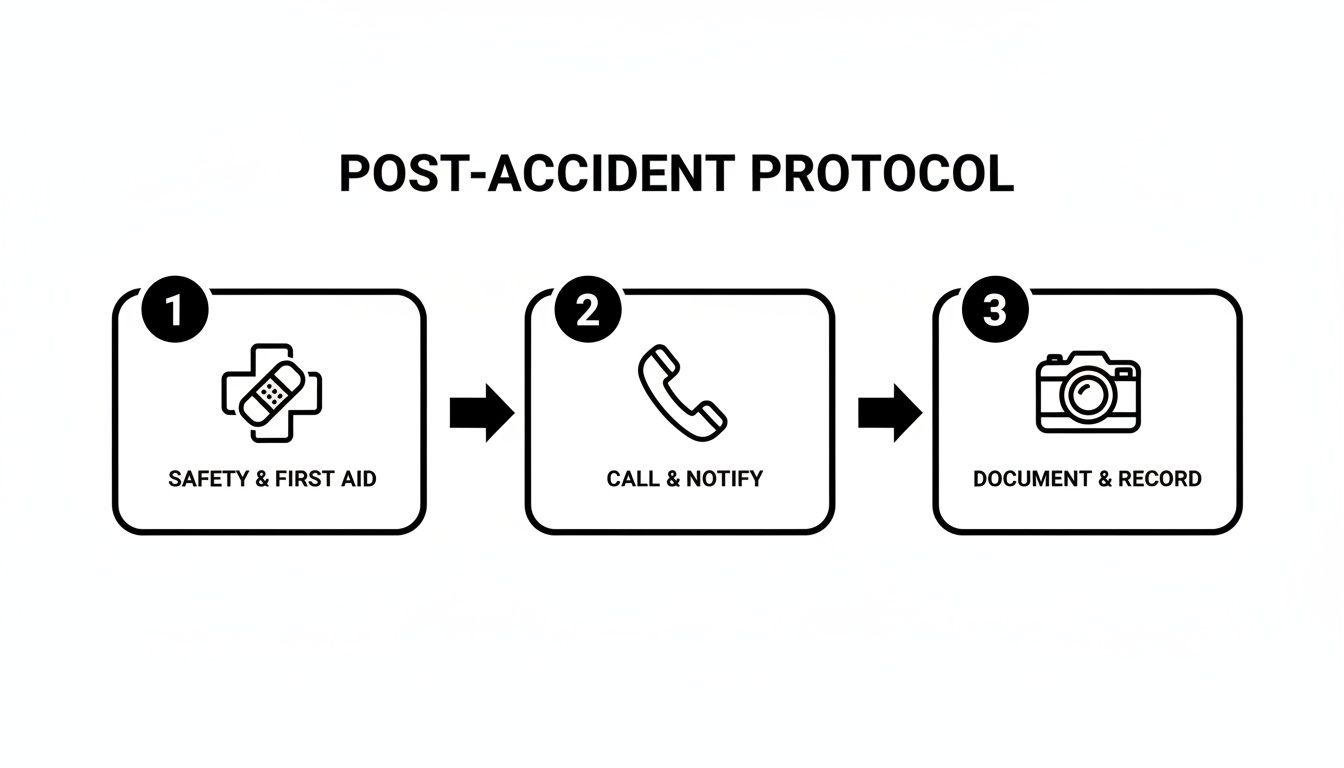

This flowchart gives you a simple, three-step protocol to consider right after a collision.

Following a sequence like this—Safety, Call, Document—helps address immediate needs while gathering the information you may need later.

To keep things organized in a stressful moment, a quick checklist can be useful. Here’s a simple table to keep in mind.

Post-Accident Checklist

| Check for Injuries & Call 911 | Health and safety are the top priority. A police report can serve as important evidence. |

| Take Extensive Photos/Videos | Visual proof of damage, the scene, and injuries can be difficult to dispute. |

| Get the Other Driver's Info | Collect their name, address, phone, and driver's license number. |

| Document Vehicle Details | Note the make, model, color, and license plate of the other car. |

| Talk to Witnesses | Independent accounts can provide crucial support for a claim. |

| Avoid Admitting Fault | Statements made at the scene can sometimes be used later. Stick to the facts. |

This checklist is not just a to-do list; it's a potential strategy for protecting your interests when the other driver lacks insurance.

Gather Information and Avoid Admitting Fault

Even without an insurance card to show you, the other driver is still required to give you their personal information. Politely ask for their full name, address, phone number, and driver's license number. Jot down the make, model, color, and license plate of their vehicle. For a more detailed breakdown, you can learn more about what to do after a car accident in our complete guide.

Also, look around for anyone who might have seen the crash. Getting the names and phone numbers of witnesses can be incredibly helpful, as their objective story could support your version of events.

Through all of this, be careful what you say. It can be a natural reaction to say "I'm sorry," but in this context, such a statement could be interpreted as an admission of fault. Be polite, stick to the facts, and just focus on swapping the necessary information.

What Happens When the Other Driver Has No Insurance?

Getting into an accident is jarring enough. But when you find out the driver who hit you is uninsured, a whole new layer of stress and confusion can set in. You may be left asking, “Who is going to pay for my medical bills? My car repairs? The time I’m missing from work?”

It’s a frustrating situation, but unfortunately, it is not a rare one. A significant number of drivers are on the road without the legally required insurance. This is not just their problem—it creates a huge financial risk for every responsible driver who does follow the law.

Just How Big is the Uninsured Driver Problem?

The number of uninsured drivers on American roads has reportedly jumped in recent years, potentially leaving insured drivers to pick up the pieces after a crash. According to the Insurance Research Council (IRC), an estimated 15.4 percent of motorists were uninsured in 2023. That’s more than one in every seven drivers.

To put that in perspective, that's a notable increase from 11.16% back in 2017. Current estimates suggest that translates to roughly 35.7 million uninsured drivers on U.S. roads. If you want to dig deeper into the numbers, the facts and statistics on uninsured motorists paint a pretty clear picture of the risk.

This is not just a national statistic; it's a daily reality on Oregon's roads. Every one of those uninsured drivers is a potential financial disaster waiting to happen for the person they hit.

Think about it this way: sharing the road means sharing the risk. With so many people driving without coverage, your own insurance policy is not just about protecting you if you cause an accident—it is an essential shield against the irresponsible choices of others.

The Financial Fallout for Injured Oregonians

When the at-fault driver has no insurance, the financial weight of an accident can feel crushing. Suddenly, you could be the one staring down a mountain of bills with no obvious way to pay them.

This coverage gap may force you to shoulder significant expenses that were not your fault. The most common costs after a crash include:

- Medical Bills: From the initial ambulance ride and ER visit to surgery, physical therapy, and follow-up appointments, the costs can add up fast.

- Lost Income: If your injuries keep you out of work, your paychecks stop. This lost income can create immense financial strain while you’re trying to recover.

- Car Repairs: Getting your vehicle back on the road is often an immediate and expensive necessity.

The hard truth is that the person who caused all this damage may not have the personal assets to cover your costs. That is why Oregon law mandates specific types of auto insurance—to create a safety net for situations just like this. The system is built on the reality that you cannot count on every other driver to be responsible. Your own policy becomes a powerful tool for recovery.

How Your Own Uninsured Motorist Coverage Can Help

When the driver who hit you doesn't have insurance, it can be easy to feel like you’re out of options. That initial panic is understandable, but the good news is you may have a powerful tool right in your own auto policy: Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage.

Think of it this way: your UM/UIM coverage is your personal financial safety net. It is designed specifically for this exact situation, allowing your own insurance company to step in and cover your losses when the at-fault driver cannot. They essentially play the part of the insurance company the other driver should have had.

What Does Uninsured Motorist Coverage Typically Cover?

The whole point of UM/UIM coverage is to help make you whole again, covering the same damages the other driver's liability insurance would have paid for. It gives you a direct path to compensation without the often difficult task of trying to collect from an uninsured individual's personal assets.

While every policy has its own specific terms, your UM/UIM coverage generally helps with several key areas.

Here’s what it typically covers:

- Medical Expenses: Everything from the initial ambulance ride and ER visit to follow-up surgeries, physical therapy, and any future medical care your injuries may require.

- Lost Wages: If you cannot work because of the accident, this coverage is there to replace the income you’re losing while you recover.

- Pain and Suffering: This is for the non-economic side of things—the physical pain, emotional trauma, and overall impact on your quality of life.

- Property Damage: Some, but not all, policies include Uninsured Motorist Property Damage (UMPD), which helps pay for your car repairs.

This coverage is crucial. It can provide a reliable way to get back on your feet when the person at fault has left you with the bill.

The Process of Filing a UIM Claim

Starting a UIM claim means working with your own insurance company, which can feel a bit counterintuitive. The first step is to notify them about the accident with an uninsured driver as soon as possible. Most policies have strict deadlines for reporting, so it's a good idea not to wait.

You will need to hand over all the information you collected from the scene—the police report, photos, witness contact info, and any details you have on the other driver. Your insurance company will then launch its own investigation to verify that the other driver was at fault and uninsured.

It is a common misconception that because it's your own insurer, the process will be easy and friendly. The reality is, in a UIM claim, your insurance company effectively steps into the shoes of the at-fault driver's insurer. They may scrutinize your claim just as closely as they would if you were a third party.

After they confirm fault, your role is to demonstrate the full extent of your damages. This means gathering and submitting all medical bills, proof of lost income, and anything else that supports your claim. Your insurer will then evaluate everything to decide on a settlement amount, up to your policy's limits.

For a deeper dive into the specifics of these policies, our guide on uninsured motorist coverage in Oregon provides a lot more detail. Knowing what to expect can be the first step toward pursuing the compensation you may be entitled to.

What If My Insurance Isn't Enough? Looking at Other Options

While your own Uninsured Motorist (UIM) coverage is your primary safety net, sometimes the costs of a serious accident exceed your policy limits. When that happens, you might wonder what other avenues are available. One potential path is to file a civil lawsuit directly against the driver who caused the crash.

This approach takes the issue out of the hands of insurance companies and puts it into the court system. Instead of filing a claim, you're filing a formal personal injury lawsuit to hold the at-fault driver legally and financially responsible for the harm they’ve caused.

What Is a Personal Injury Lawsuit?

Think of it this way: an insurance claim is often a negotiation, but a lawsuit is a formal process to present your case. You are essentially asking a judge or jury to legally order the other driver to pay for your damages because their negligence led to your injuries.

The process kicks off when you file a "complaint" with the court, which is a legal document detailing what happened and why the other driver is at fault. From there, both sides engage in a fact-finding phase called "discovery," where evidence is shared and testimony is gathered. It's a structured, rule-based system designed to get to the truth of the matter.

What Kind of Compensation Can Be Pursued?

In a lawsuit, the compensation you're seeking is called "damages." The goal is to help make you whole again, at least financially. These damages are broken down into two main types, covering everything from concrete bills to the very real human cost of the accident.

1. Economic Damages

These are the tangible, out-of-pocket costs that can be added up with a calculator. They represent the direct financial impact you experienced because of the crash. Common examples include:

- Medical Expenses: Every penny spent on ambulance rides, ER visits, surgeries, physical therapy, and any future care you might need.

- Lost Wages: The income you missed out on because your injuries kept you from working.

- Diminished Earning Capacity: If the accident left you with a long-term disability that impacts your ability to earn money in the future.

- Property Damage: The cost of repairing or replacing your car and anything else that was damaged.

2. Non-Economic Damages

This category is for the losses that don't come with a receipt. Non-economic damages are meant to compensate you for the profound, personal impact the accident has had on your quality of life. This includes:

- Pain and Suffering: For the physical pain, discomfort, and emotional trauma you’ve endured.

- Emotional Distress: Covers things like anxiety, depression, and PTSD that can follow a traumatic event.

- Loss of Enjoyment: Compensation for being unable to do the things you once loved, whether it's playing with your kids, hiking, or pursuing a favorite hobby.

A lawsuit seeks to recover both types of damages because a full recovery is not just about paying the bills. It's also about acknowledging the real, human toll the accident took on your life.

The Big Hurdle: Can the Other Driver Actually Pay?

Here’s the tough reality of suing an uninsured driver: even if you win in court, you still have to collect the money. A judge can provide a document—a judgment—saying you're owed a certain amount, but that judgment is only as good as the other person's ability to pay it.

This is the problem of collectibility. Many people who drive without insurance do so because they cannot afford it, which often means they do not have significant assets like a house, savings, or investments. You could win a $100,000 judgment, but if the at-fault driver has no money and no assets, collecting that award can be like trying to get water from a stone. It’s a crucial, practical consideration that should be weighed before deciding to take legal action.

When to Get More Information From a Personal Injury Attorney

Trying to sort things out after an accident with an uninsured driver can feel like you're navigating a maze blindfolded. Some cases are relatively simple, but it does not take much for things to get complicated, leaving you with more questions than answers. Knowing when to reach out for more information is a step toward protecting yourself.

Even just having a conversation to understand your options can bring a sense of clarity and control back into a chaotic situation. It can be helpful to know the rules of the game before you play it, especially when it comes to Oregon’s specific laws and insurance policies.

Scenarios That May Warrant Further Discussion

No two accidents are exactly alike, but certain red flags may pop up. Seeing one of these does not automatically mean you need to hire a lawyer, but it could be a sign that a professional perspective would be helpful.

Think about getting more information if your situation involves any of the following:

- Significant Injuries: If you're facing serious injuries that mean ongoing medical care, surgery, or physical therapy, it can be important to understand the full potential value of your claim. This is about more than just the immediate bills; it’s about your future.

- Disputes with Your Insurer: Is your own insurance company dragging its feet on your UIM claim? Are they making a low offer or denying your claim altogether? If you feel the people who are supposed to be on your side are giving you a hard time, it's a good idea to learn more about your rights under your policy.

- Complex Fault Determination: Sometimes it’s not immediately clear who caused the accident. If liability is being questioned or debated, you may need to build a rock-solid case based on the evidence.

It's interesting to see how much the risk varies by state. In Mississippi, for example, the uninsured driver rate is a staggering 29%—more than double the national average. Knowing this provides some context for why having solid UIM coverage in Oregon is so crucial. You can review the data on uninsured driver risks to see the bigger picture.

How an Attorney Can Provide Clarity

A personal injury attorney can act as your guide. They can sit down with you, listen to what happened, and explain your potential legal options in plain English—no confusing jargon. They can help you see the potential strengths and weaknesses of your case, get your evidence organized, and walk you through the claim process.

If you end up in a lawsuit, you will be facing a whole new set of procedures. Getting familiar with understanding legal procedures like depositions can give you a head start on what to expect. An attorney can also take over the back-and-forth communications with the insurance companies for you. To learn more, check out our guide on hiring a personal injury attorney.

Answering Your Questions About Uninsured Driver Accidents

Getting hit by someone without insurance is incredibly stressful, and it naturally brings up a lot of questions. Let's walk through some of the most common concerns people have after this kind of accident.

What Happens if the At-Fault Driver Has No Insurance?

It might feel like you're out of options, but you may not be. This is why Oregon law requires drivers to carry Uninsured Motorist (UIM) coverage as part of their own auto policy.

Your first move is often to file a claim with your own insurance company under this specific coverage. Essentially, your insurer steps into the shoes of the at-fault driver's missing insurance, potentially covering your medical bills, lost wages, and other damages up to your policy limits.

Should I Report the Accident to My Own Insurance Company?

Yes, and it is a good idea to do it as soon as you can. Even though the other driver was at fault, your insurance policy likely has a rule requiring you to report any accident in a timely manner.

Prompt reporting is especially crucial in this situation because your path to getting compensated will likely run through your UIM coverage. Waiting too long to inform your insurer could complicate your claim or even give them a reason to deny the benefits you've been paying for.

It can feel strange to file a claim with your own insurance company when you did nothing wrong. But think of it this way: your Uninsured Motorist (UIM) coverage is a safety net you've paid for, designed to protect you when the other person fails to be responsible.

Can I Sue the Uninsured Driver Directly?

Yes, you have the right to file a personal injury lawsuit against the uninsured driver who hit you in Oregon. This legal action aims to hold them personally liable for all the harm they caused—from your medical expenses to your pain and suffering.

But there's a practical reality to consider. A person who cannot afford car insurance often does not have the personal assets to pay a large court judgment. While suing is an option, it can be a long shot for actually collecting money, which is why UIM coverage is typically the more reliable first step.

How Long Do I Have to File a Claim in Oregon?

This is where things can get tricky because there may be a couple of different deadlines, known as statutes of limitations, to watch.

For a personal injury lawsuit filed against the at-fault driver, there is generally a two-year period from the date of the crash. However, the deadline for filing a UIM claim is set by your insurance policy itself. It is crucial to know both deadlines, because missing one could close the door on your ability to recover any compensation.

Figuring out the next steps after a collision with an uninsured driver can feel overwhelming. If you're dealing with this situation and need clear guidance on your rights, the team at Bell Law is ready to help. Contact us for a consultation at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.