A Guide to Attorney Fees for Social Security

"I was satisfied once John Bell took over my case."

"Communication was always timely."

A Guide to Attorney Fees for Social Security

When you're out of work and struggling with your health, the last thing you need is another bill. The thought of hiring a lawyer can seem impossible. But here's the good news: Social Security disability attorneys work on a contingency fee basis. In plain English, that means you pay nothing upfront. You won't owe a dime unless you win your case.

This system is specifically designed to make sure anyone can get expert legal help, no matter their financial situation.

How Social Security Attorney Fees Actually Work

Trying to get disability benefits is stressful enough. The most important thing to know about the legal fees is that they are tightly controlled by the federal government to protect you. This isn't the Wild West where lawyers can name their own price; the Social Security Administration (SSA) sets firm rules.

The whole payment system is built to be completely risk-free for you. Think of it like a real estate agent who only gets a commission when your house sells. Your disability attorney only gets paid if they win your case, and their fee is just a percentage of your past-due benefits (the money that built up while you were waiting for a decision). This setup puts you and your attorney on the same team, working toward the same goal.

A Partnership Built on Success

This payment model, the contingency fee agreement, creates a true partnership. Your lawyer invests their time, expertise, and resources into building your case, all without asking you for any money. Their paycheck is completely tied to getting you a successful result.

This is what makes professional legal help accessible when you need it most. You don't have to dip into savings or have a source of income to get an experienced lawyer to champion your claim. It's a world away from other types of law, where you often hear about expensive hourly rates and retainers. While there are different ways lawyers charge, like the lawyer on-demand model and managing retainers, the contingency model is standard for disability cases.

The bottom line is simple: No win, no fee. If your claim is ultimately denied, you owe the attorney nothing for all the work they did. This promise removes the biggest financial hurdle to getting the help you deserve.

What Does This Mean for You?

The contingency fee system gives you much-needed peace of mind during a tough chapter in your life. It lets you focus on your health while a professional navigates the complicated SSA bureaucracy.

Here's a quick look at what this risk-free structure means for you:

- No Upfront Costs: You won't be asked to pay a retainer or any other fee to get your case started.

- Aligned Interests: Your attorney is financially driven to win your case and get you the largest amount of back pay possible.

- Access to Expertise: You can hire a top-notch disability lawyer even when you have no income.

This is the standard practice for disability law. To get a deeper dive, you can check out our guide on https://www.belllawoffices.com/how-does-a-disability-lawyer-get-paid/. Ultimately, the system is designed to ensure that your bank account is never a barrier to justice.

How Your Attorney's Fee is Actually Calculated

When you hire a Social Security disability lawyer, you’ll almost always work under a contingency fee agreement. But what does that really mean for you? The idea is simple: you don't pay anything unless you win your case.

The fee is based on a straightforward, federally regulated formula designed to protect you. Your attorney’s payment comes out to 25% of your past-due benefits, which is the money you're owed from the time you became disabled until your claim was approved.

Crucially, there's a safety net built into the system—a maximum fee cap set by the Social Security Administration (SSA). Your attorney gets 25% of your back pay or the federal cap, whichever amount is less. This "lesser of" rule ensures that even if you receive a very large back pay award, the legal fee stays fair and reasonable.

First, What Are Past-Due Benefits (or Back Pay)?

To really get how the fee works, you need to understand back pay. Think of it as the benefits that should have been paid to you while you were waiting for the SSA to approve your case.

The clock on these benefits starts on your "established onset date"—the day the SSA agrees your disability began. It keeps running until you get that long-awaited approval letter. For instance, if the SSA determines your disability started 18 months before they approved your claim, you are owed a lump sum for those 18 months. That lump sum is your back pay.

This is the only money your attorney can be paid from. Your future, ongoing monthly checks are 100% yours.

Key Rule: Attorney fees are taken only from your past-due benefits. Your ongoing monthly disability checks are not touched for legal fees. The SSA handles this entire process, so you never have to worry about writing a check to your lawyer.

The Federal Cap on Attorney Fees

To prevent excessive fees, the federal government puts a hard ceiling on how much a lawyer can receive from a contingency agreement. This cap isn't set in stone; it’s adjusted every few years to keep up with the economy and make sure people can still find good legal help.

As of 2025, the fee is 25% of back pay, but it cannot go over $9,200. This cap was increased from $7,200 on November 30, 2024, after legal advocates pushed for an update to cover the rising costs of running a law practice. Beginning in 2026, the SSA plans to link the cap to the annual Cost of Living Adjustments (COLA), which should mean more regular, predictable updates. You can learn more about the specifics of the 2025 disability lawyer fee structure and its implications.

Let's see how this plays out with a few examples:

| $20,000 | $5,000 | $9,200 | $5,000 |

| $40,000 | $10,000 | $9,200 | $9,200 |

| $60,000 | $15,000 | $9,200 | $9,200 |

As you can see, the moment that 25% calculation hits the cap, the fee stops growing.

The SSA Handles the Payment Directly

One of the best features of this system is that the SSA plays middleman, in a good way. When you win, the SSA calculates your back pay, automatically withholds the approved attorney fee, and sends that portion directly to your lawyer. You get the rest.

This setup helps you in two big ways:

It’s simple. You never have to worry about invoices, writing a check, or figuring out payment details. The SSA does all the work, removing any chance of billing mistakes or arguments.

It’s transparent. The SSA itself calculates and approves the final fee, guaranteeing it follows the federal rules to the letter. Everything is documented and official.

This streamlined process lets you focus on your health, knowing the financial side of things is being handled correctly by a federal agency. It’s one less thing on your plate during a time when you need it most.

Navigating Social Security Claims in Oregon

While the Social Security Administration sets the rules for attorney fees on a national level, your actual experience filing a claim is always local. If you're in Oregon, knowing the lay of the land can make a huge difference. The journey isn't just about federal regulations; it's about how those rules play out in real-world offices in Portland, Eugene, and beyond.

Things like local hearing office backlogs, the network of available medical experts, and even the standard practices among regional attorneys all shape your case. Having a clear picture of what to expect locally helps you feel less like a number in a giant system and more in control of your own claim.

How Oregon Processing Times Affect Your Case

One of the most significant local variables is how long you have to wait for a hearing. In Oregon, appeals for denied claims are handled by Offices of Hearing Operations (OHO) in cities like Portland and Eugene. The longer it takes to get your day in front of a judge, the more your past-due benefits will grow.

This is where wait times directly connect to attorney fees for Social Security. A longer delay means a bigger pot of back pay, which in turn influences the final fee. For example, a 15-month wait will naturally lead to a much larger potential back pay award than a 9-month wait, even for the same monthly benefit.

It's a double-edged sword, though. A big back pay check sounds great, but it also means you've spent that much longer struggling without the income you desperately need. A good local attorney gets this. They know how to push your case along as quickly as the local system allows, balancing the need for a thorough case with the reality of your financial situation.

Understanding Local Fee Agreements and Costs

Beyond the 25% contingency fee, your agreement with an attorney will also cover out-of-pocket costs. These are the expenses required to gather the evidence to win your case, and they are completely separate from the attorney's fee. Here in Oregon, it’s standard practice for attorneys to be upfront about what these costs might look like.

Common expenses include:

- Medical Records: The fees your doctors, clinics, and hospitals charge to copy and send us your complete medical file.

- Physician Opinions: The cost for your doctor to fill out a detailed questionnaire or write a letter explaining exactly how your condition limits your ability to work.

- Expert Testimony: In more complex cases, we might need a vocational or medical expert to testify at your hearing, and they charge a fee for their time.

Most Oregon disability law firms will advance these costs for you. That means the firm pays for them upfront, and you only reimburse them out of your back pay after you win. This is a critical practice—it ensures your case doesn't fall apart just because you can't afford the evidence needed to prove it. Always make sure you understand how these costs are handled when you hire a lawyer. For a deeper dive into how this all works for local residents, you can learn more about filing for Social Security Disability in Oregon.

At the end of the day, partnering with a local attorney gives you a home-field advantage. Someone who knows the specific administrative law judges, the local medical community, and the quirks of the Oregon hearing offices can provide practical advice that you just can't get from a national firm, helping you navigate every stage of your claim with more confidence.

Understanding Exceptions to the Standard Fee

The standard "25% or the cap" contingency fee works for the vast majority of Social Security disability cases. It’s a clean, simple system that everyone understands. But, as with anything in the legal world, there are always a few exceptions.

These situations are rare, but it's good to know they exist so you have the full picture. They usually pop up when a case gets unusually complex or ends up taking a path that goes way beyond the normal appeals process. The Social Security Administration (SSA) has rules in place for these scenarios to make sure any fee an attorney charges is fair and justified.

When a Fee Petition is Necessary

Let’s say a disability case requires multiple hearings over several years. Or maybe the Appeals Council sends the case back for a do-over, and your attorney has to gather a mountain of new evidence and write complex legal arguments. In these uncommon situations, the work can sometimes go far beyond what the standard fee agreement is meant to cover.

When that happens, an attorney can't just decide to charge more. They have to formally ask the SSA for permission by filing a fee petition.

Think of a fee petition as a detailed invoice submitted to the judge for approval. It’s a formal request to be paid a fee higher than the standard cap, and it's definitely not a rubber stamp. The attorney has to provide a meticulous breakdown of all the work they did, including:

- A detailed, itemized list of every task performed.

- The exact time spent on each activity (like legal research, writing briefs, or preparing you for a hearing).

- A clear explanation of why the case was so complex that it justifies a fee beyond the normal limits.

The SSA scrutinizes these petitions very carefully to decide if the requested amount is reasonable. This is a huge consumer protection safeguard, ensuring you're never on the hook for an excessive or unapproved fee. The burden is entirely on the attorney to prove the extra work was necessary and the fee is fair.

Key Detail: An attorney can only file a fee petition if the 25% calculation of your back pay would result in a fee above the federal cap. If 25% of your past-due benefits is less than the cap, your attorney cannot petition for more money, no matter how much work they put in.

Appeals to Federal Court and EAJA Fees

So what happens if your claim is denied at every single level within the SSA, right up to the Appeals Council? The end of the road? Not quite. Your last option is to sue the Social Security Administration in U.S. District Court. This moves your case from an administrative process into the federal court system—a whole different ballgame where the fee structure can also change.

While your original contingency fee agreement may still be in effect, another important law often comes into play here: The Equal Access to Justice Act (EAJA).

In a nutshell, EAJA is a federal law that can make the government pay your attorney's fees if you have to sue them and you win. It’s designed to help people fight back when a government agency's position wasn't "substantially justified."

Here’s a quick look at how it works for a Social Security claim:

You Win in Federal Court: Your attorney successfully convinces a federal judge that the SSA made a significant legal mistake when it denied your claim. The court typically remands (sends back) your case to the SSA for a new hearing, which almost always results in an approval and an award of back pay.

Attorney Files for EAJA Fees: After the win, your attorney can petition the court—not the SSA—to order the government to pay your legal fees. These fees are paid directly from the U.S. Treasury, not from your disability benefits.

No Double-Dipping: Here's the best part. An attorney can’t get paid twice for the same work. If your attorney is awarded EAJA fees, they must refund the smaller of the two fees to you. For example, if they get $8,000 in EAJA fees from the government and also receive $7,200 from your back pay under the original agreement, they have to give that $7,200 back to you.

This powerful law ensures that you can hold the SSA accountable in court without having to worry about coming up with the money for a federal lawsuit. It's a critical tool for getting justice in the toughest of cases.

Calculating Your Potential Attorney Fee with Real Examples

Reading about the rules for Social Security attorney fees is one thing, but seeing how they play out in the real world is what makes it all click. The math behind the 25% rule and the federal fee cap can feel a bit abstract, so let's walk through a few common scenarios.

These examples will help you visualize what to expect and show how the system is designed to keep fees fair and predictable, no matter how much back pay you're awarded.

Scenario 1: A Standard Back Pay Award

Let's start with Maria. She's a former administrative assistant who had to stop working because of severe rheumatoid arthritis. After a long fight, she was finally approved for benefits, and the Social Security Administration (SSA) determined her disability began 12 months before her approval date.

Her monthly disability benefit is $1,600. To get her total back pay, we just multiply that by the number of months she was owed:

- $1,600/month x 12 months = $19,200 in total past-due benefits

Now, let's figure out the attorney's fee using the "lesser of" rule:

- The 25% Calculation: 25% of $19,200 comes out to $4,800.

- The Federal Cap: The current cap is $9,200.

Since $4,800 is the smaller number, that’s the final fee. Maria receives the remaining $14,400 from her back pay, and her ongoing monthly checks start coming in.

Scenario 2: Hitting the Federal Fee Cap

Next up is David, a construction worker who suffered a serious back injury. His case was more complicated and took quite a bit longer to win. The SSA eventually approved his claim, setting his disability onset date 26 months in the past.

David’s monthly benefit is $2,200, making his back pay award much larger:

- $2,200/month x 26 months = $57,200 in total past-due benefits

Let's run the numbers for David's attorney fee:

- The 25% Calculation: 25% of $57,200 is a whopping $14,300.

- The Federal Cap: The cap is still $9,200.

Here, the 25% figure is much higher than the cap. The "lesser of" rule does its job, limiting the attorney's fee to $9,200. David gets the remaining $48,000 in back pay. This is a perfect example of how the cap protects claimants who win large retroactive awards.

Scenario 3: An SSI Benefits Case

Finally, let’s look at Sarah, who was approved for Supplemental Security Income (SSI). SSI cases often have a few extra wrinkles. The back pay is frequently paid in installments, and other government benefits can sometimes create an "offset" that reduces the final payable amount. You can dive deeper into the specifics of how back pay works for SSI in our dedicated guide.

For this example, let's say that after all the complex SSI calculations, Sarah's final payable back pay comes to $8,000.

- The 25% Calculation: 25% of $8,000 is $2,000.

- The Federal Cap: The cap is $9,200.

The fee is simply the lesser of the two, so the attorney receives $2,000. Sarah gets the remaining $6,000 of her SSI back pay.

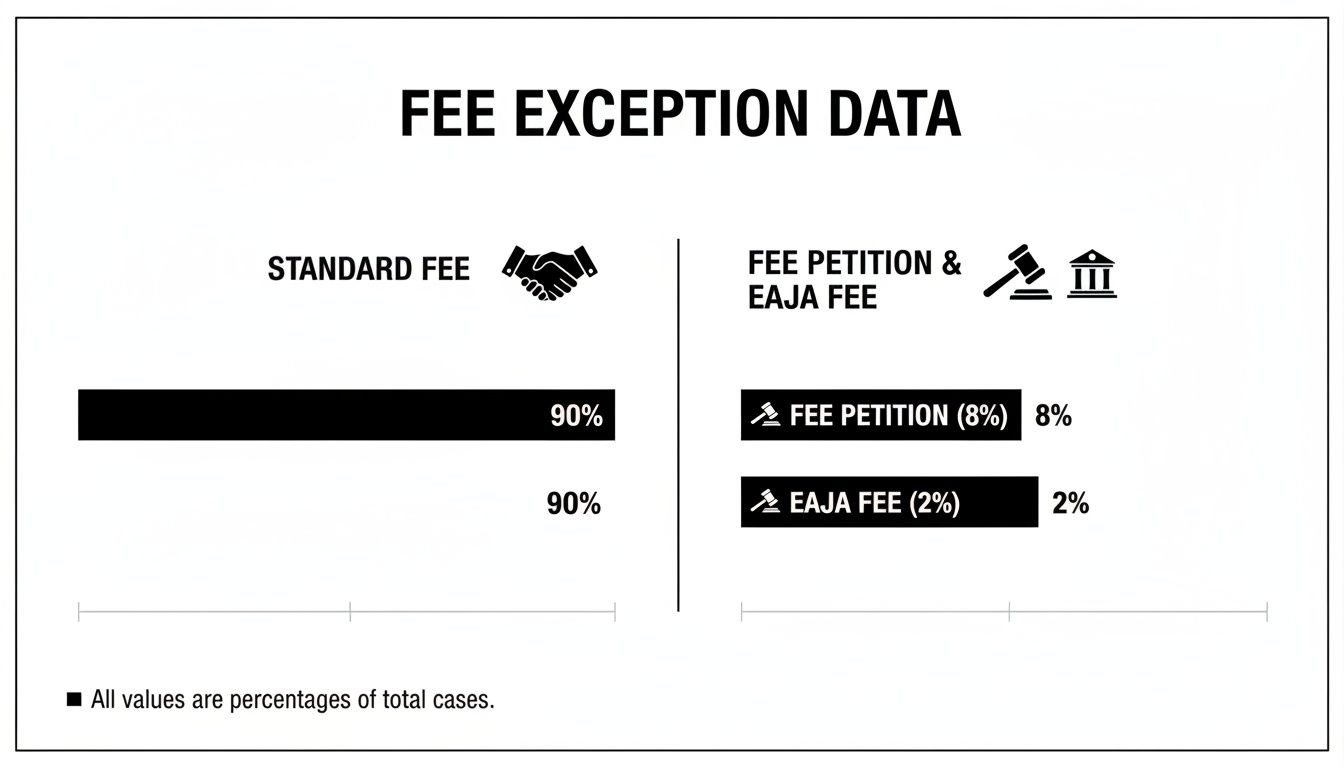

This chart shows just how common the standard contingency fee agreement is compared to the less frequent fee petition and EAJA fee arrangements.

As you can see, the standard agreement is the go-to for a reason—it provides a predictable and risk-free structure for nearly everyone applying for disability benefits.

Sample Attorney Fee Calculations

To make these comparisons even clearer, here’s a table summarizing the outcomes of our three scenarios. This visual breakdown really helps reinforce how the final fee is determined by the size of the back pay and the crucial role of the federal cap.

| Maria (Standard Award) | $19,200 | $4,800 | $9,200 | $4,800 | $14,400 |

| David (Hits the Cap) | $57,200 | $14,300 | $9,200 | $9,200 | $48,000 |

| Sarah (SSI Award) | $8,000 | $2,000 | $9,200 | $2,000 | $6,000 |

These examples show that the process is transparent and heavily regulated. The simple rule of "lesser of 25% or the cap" ensures that legal fees are always proportional and fair, giving you vital protection while you navigate the disability claims process.

Fees vs. Costs: What’s the Difference?

When you hire a Social Security disability lawyer, it’s really important to understand the two different types of money involved: the attorney’s fee and the case costs. They’re not the same thing, and knowing the difference can save you from a lot of confusion and financial surprises later on.

Think of it this way: the attorney's fee is what you pay your lawyer for their time, knowledge, and hard work. The case costs are totally separate—they're the expenses needed to actually build and prove your case.

What Exactly Are Out-of-Pocket Costs?

Out-of-pocket costs, sometimes called case expenses, are the direct, real-world expenses your attorney pays on your behalf to gather the evidence needed to win your claim. Your lawyer typically covers these expenses upfront to keep your case moving.

These aren't part of your lawyer's profit. They are simply reimbursements for the money the law firm had to spend to get the necessary documents for your file.

Common examples include:

- Getting Medical Records: Your doctors and hospitals charge for the time and effort it takes to copy your entire medical history and send it to your lawyer.

- Special Doctor's Reports: Sometimes, the best evidence is a detailed letter or a specific form filled out by your doctor explaining your limitations. Doctors charge a fee for their time to do this.

- Expert Opinions: In more complex situations, we might need a medical or vocational expert to provide a professional opinion or testify at your hearing.

The main thing to remember is that costs are separate from the contingency fee. The 25% fee is your lawyer’s payment for their work. The costs are you paying the firm back for the money it spent on evidence.

How Are These Costs Handled?

Your fee agreement should spell this all out very clearly. In almost all disability cases, the law firm pays these costs for you as they come up, so you don't have to pay anything while you're waiting for a decision.

If you win, these costs are usually paid back to the firm from your past-due benefits, but only after the attorney's fee is taken out. Let's say your back pay award is $20,000. First, the $5,000 attorney fee is paid. Then, if the firm spent $350 getting your medical records, that amount is reimbursed from the remaining funds. This way, you never have to pay for case expenses directly from your own pocket.

Before you sign anything, make sure you're crystal clear on how a firm handles these expenses.

Good Questions to Ask a Potential Attorney:

- Do you pay for all case costs, or will I be expected to cover some of them myself?

- Roughly how much do you expect the costs will be for a case like mine?

- How will you show me a breakdown of the costs when my case is over?

- What happens if we lose? Do I still have to pay back these costs?

Asking these questions upfront ensures there are no misunderstandings and helps you feel confident you've found the right person to represent you.

Answering Your Questions About Attorney Fees

Even after laying out the basics of the contingency fee system, I find that clients often have a few specific questions that pop up. Let's tackle some of the most common ones I hear in my practice.

What Happens If I Change Attorneys Mid-Case?

It happens. Sometimes a relationship with a lawyer doesn't work out, and you need to make a change. While it can add a layer of complexity, it's definitely something you can do.

When you switch, both your old and new attorneys will typically file a fee petition with Social Security. A judge will look at the work each lawyer did on your file and decide how the final fee should be divided between them. The most important thing for you to know is that your total fee is still capped. You will never pay more than the 25% or the federal maximum. You’re protected from being charged twice; the two attorneys simply have to share the one fee awarded in your case.

Are My Attorney Fees Tax-Deductible?

In most cases, yes. The money from your back pay that goes toward your attorney's fee can usually be deducted on your taxes. The IRS generally sees it as a necessary expense for securing a source of taxable income (your disability benefits).

That said, tax laws are notoriously complicated and always seem to be changing. I always tell my clients to talk with a tax professional. They can give you advice tailored to your specific financial picture and make sure you're claiming all the right deductions when it's time to file.

Important Note: Getting approved for disability benefits often brings up other financial questions. For example, after receiving SSDI for a certain period, you'll become eligible for Medicare. It's wise to start thinking ahead about things like Medicare coverage for electric wheelchairs and other healthcare needs down the road.

What if I Win My Case But Don't Get Any Back Pay?

This is a great question, though it's a pretty rare situation. It can occur if the judge finds you became disabled very recently, leaving no gap for past-due benefits to build up. It might also happen if you're awarded benefits for a "closed period" in the past but aren't found to be currently disabled.

Since your attorney only gets paid from the back pay you receive, the answer is simple: if there's no back pay, your attorney gets no fee. This is the core of the contingency fee agreement. The risk is on the attorney, not you. Any future monthly benefits you receive are 100% yours.

Trying to win a Social Security Disability claim can feel like an uphill battle, but you absolutely don't have to face it by yourself. The experienced team at Bell Law is here to walk you through every step, offering both legal skill and genuine support. Contact us today to protect your rights and fight for the benefits you've earned. Learn more at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.