Discover auto insurance companies oregon: Compare Rates & Coverage

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Discover auto insurance companies oregon: Compare Rates & Coverage

When you start looking for auto insurance companies oregon, you might be pleasantly surprised. Compared to much of the country, Oregon's rates are quite competitive. But remember, the "average" cost is just a starting point—what you'll actually pay depends entirely on your specific situation.

Navigating the Oregon Auto Insurance Market

Picking the right car insurance in Oregon is a lot like choosing the right gear for a hike in the Cascades. You need protection that’s built for the specific conditions you're going to face on the road. The market here is a mix of big national names and smaller regional players, all offering different prices and service experiences. This guide is here to help you make sense of it all.

Even though Oregon has some of the lower insurance costs in the U.S., the price you see in an ad is rarely the price you get. Insurance companies use a complex, multi-layered formula to calculate your final premium, so it's crucial to understand what they're looking at.

What Shapes Your Insurance Premium

Insurers in Oregon don't just look at your zip code. They build a detailed profile to figure out how much of a risk you are to insure, which really just means they're trying to predict how likely you are to file a claim.

Several key factors will directly influence your rates:

- Your Driving Record: This is the big one. A history of accidents, speeding tickets, or a DUI will send your premium upward. A clean record is your best friend when it comes to getting a low rate.

- Your Credit History: It might seem unrelated, but insurers often use a credit-based insurance score to set prices. Their data shows a link between lower credit scores and a higher number of claims filed.

- The Vehicle You Drive: The make, model, age, and safety features of your car all matter. It costs more to insure a high-performance sports car or a luxury vehicle with expensive parts than a standard sedan.

- Your Location: Where you park your car at night makes a difference. Rates in dense urban areas like Portland are often higher than in rural spots because of increased traffic, theft, and accidents.

For a broader overview of how vehicle coverage works in general, you can explore some general auto insurance information.

Understanding Average Costs in Oregon

One of the perks of driving in Oregon is the affordability of insurance. The average annual cost for a full coverage policy is $2,121, which breaks down to about $177 a month. That’s a good deal cheaper than the national average. If you're just looking for basic, state-mandated protection, minimum coverage averages only $841 per year.

But these are just averages. The numbers can change dramatically based on your personal profile. Take a look at the table below to see how a few common scenarios can affect what you pay.

Average Oregon Car Insurance Costs By Driver Profile

This table illustrates how different factors like driving record and credit score can significantly impact annual full coverage insurance premiums in Oregon.

| Driver with a clean record | $2,121 | Baseline |

| Driver with one at-fault accident | $2,637 | +24% |

| Driver with a recent DUI | $3,600 | +70% |

| Driver with poor credit | $3,771 | +78% |

Data sourced from Bankrate's 2024 analysis.

As you can see, a single at-fault accident can hike your premium by 24% to $2,637, while a DUI can cause it to skyrocket by 70% to $3,600. Your credit history has an even bigger impact—drivers with poor credit can expect to pay around 78% more for the same full coverage policy.

Your personal driving history is the single most powerful factor influencing your insurance premium. While average rates provide a useful benchmark, your actions behind the wheel ultimately determine what you will pay.

This data really drives home why it's so important to shop around and get quotes from multiple auto insurance companies oregon. One insurer might heavily penalize a minor speeding ticket, while another may be more forgiving. Comparing your options is the best way to find real value.

Comparing Top Auto Insurance Companies in Oregon

Trying to find the single “best” auto insurance company in Oregon is a bit like searching for the best cell phone plan—there isn't one. The right choice depends entirely on you. Some drivers are hunting for the absolute lowest price, the no-frills talk-and-text equivalent. Others don't mind paying more for premium service, unlimited data, and extra perks. The insurance world works in much the same way.

The company with the rock-bottom premium might seem like a no-brainer for someone with a perfect driving record and a paid-off car. But what if you value a painless claims process above all else? You might be willing to pay a little extra each month for the peace of mind that comes with a company known for taking care of its customers without a fight. It’s the classic trade-off: cost versus service.

Your real mission is to find the sweet spot that fits your life and your budget. That means looking past the monthly bill and digging into a company's reputation, how they treat their customers, and, most importantly, how they respond when you actually need them.

Finding Value Beyond the Lowest Price

The cheapest policy is rarely the best deal. A low premium might hide some serious drawbacks, like a claims department that’s impossible to deal with, poor communication, or bare-bones coverage that leaves you on the hook for thousands after a crash.

To find real value, you have to weigh a few key things:

- Customer Service Ratings: How do real customers feel about the company? Check independent sources like J.D. Power or the National Association of Insurance Commissioners (NAIC) to see how many complaints an insurer gets.

- Claims Handling Reputation: This is where the rubber meets the road. An insurer that pays claims fairly and without unnecessary delays is worth its weight in gold when you're stressed and recovering from an accident.

- Financial Stability: You need to know your insurance company can actually pay your claim. Look for strong financial strength ratings from agencies like A.M. Best.

The Wide Spectrum of Oregon Insurance Rates

The price gap between different auto insurance companies in Oregon can be massive. It’s not uncommon for one insurer to quote you double what another one does for the exact same coverage. This is exactly why getting quotes from multiple carriers is the single most powerful tool you have for saving money.

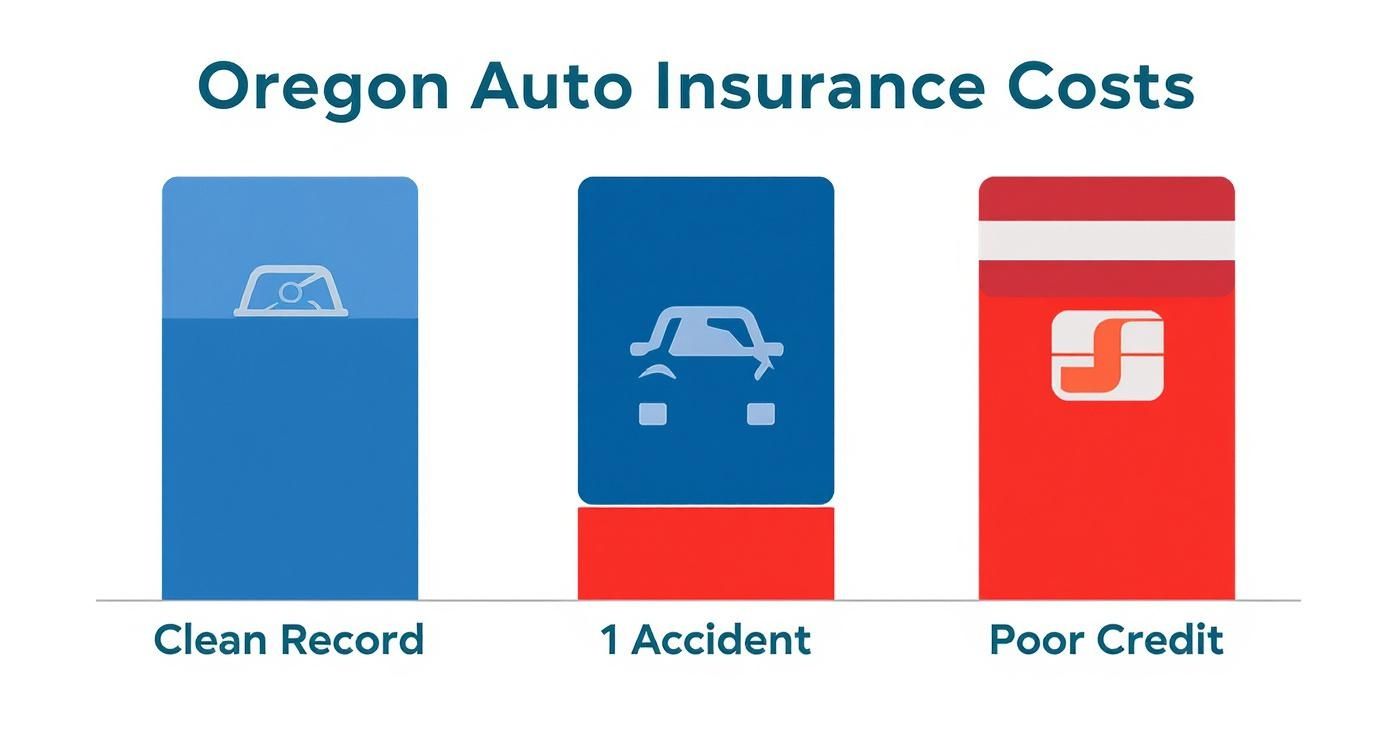

This chart gives you a quick look at how much rates can swing based on a few common scenarios.

As the numbers show, a clean driving record is your best friend for keeping costs down. But just one at-fault accident or a dip in your credit score can send your premiums soaring across the board.

Oregon’s competitive market means some insurers are built for budget-conscious drivers. For example, Mile Auto comes in with an average monthly premium of just $71, which is nearly 38% below the state average. In a city like Portland, the difference is even more dramatic. You might find basic liability coverage from Kemper for $51 a month, while big names like Travelers or State Farm could quote over $150 for similar protection. These numbers prove it: shopping around isn't just a good idea, it's essential. You can find more details about Oregon's competitive insurance rates on Compare.com.

The most important takeaway is that brand loyalty can be expensive. The company that gave you the best rate five years ago may no longer be the most competitive option today.

At the end of the day, nothing impacts your rates more than your driving history. A clean record keeps you in the low-cost club. But a single speeding ticket can easily push your monthly bill to $227-$244, and a DUI can skyrocket it to over $300. This is why making a habit of comparing auto insurance companies in Oregon is one of the smartest financial moves a driver can make.

Decoding Your Oregon Car Insurance Policy

Trying to read an auto insurance policy can feel like trying to decipher a foreign language. It's full of jargon, weird clauses, and fine print. But knowing what you're actually paying for every month is one of the most important things you can do to protect yourself and your family.

Think of it this way: your policy isn't just a piece of paper; it's a financial safety net. Let’s break down the different threads of that net so you understand exactly how it works.

Your First Line of Defense: Personal Injury Protection

One of the most powerful and immediate parts of your Oregon auto insurance is Personal Injury Protection, or PIP. This is your go-to fund for medical expenses right after a crash, and the best part is, it covers you regardless of who was at fault.

Oregon is what's known as a "fault" state, meaning the person who caused the accident is ultimately on the hook for the damages. But the legal process to determine fault can take months. You can't wait that long to see a doctor. That's where PIP comes in. Your own PIP coverage kicks in immediately to pay for your medical care.

By law, every Oregon insurer must provide at least $15,000 in PIP benefits that cover your reasonable and necessary medical costs for up to two years after the crash. To see the official rules for yourself, you can review the guidelines from Oregon's Division of Financial Regulation.

Think of PIP as the emergency fund for your health. It pays for the ambulance, the ER visit, and follow-up appointments without you having to wait for the insurance companies to finish their investigation.

This immediate access to medical funds is a lifesaver. It ensures you can get the treatment you need to start healing right away.

Your Shield Against Irresponsible Drivers

What happens when the driver who hits you either has no insurance at all or carries a bare-bones policy that won't even begin to cover your medical bills? It's a scary thought, and unfortunately, it happens all the time.

This is exactly why Uninsured/Underinsured Motorist (UM/UIM) coverage exists. It acts as your personal shield when you're hurt by an irresponsible driver.

If someone without insurance injures you, your own UM/UIM coverage steps into their shoes. It acts like the at-fault driver's missing policy, paying for your medical expenses, lost income, and even your pain and suffering. Oregon law requires every policy to include this vital protection, with minimums set at $25,000 per person and $50,000 per accident. You can learn more in our detailed guide on uninsured motorist coverage in Oregon.

Key Oregon Auto Insurance Coverages Explained

To make things a bit clearer, here’s a quick-reference table that breaks down the most common coverages you'll see on an Oregon auto policy. This should help you see how the different pieces fit together to protect you.

| Bodily Injury Liability | Injuries you cause to other people (drivers, passengers, pedestrians) in an at-fault accident. | Yes |

| Property Damage Liability | Damage you cause to someone else's property, like their car, a fence, or a building. | Yes |

| Personal Injury Protection (PIP) | Your own medical bills and lost wages after a crash, regardless of who was at fault. | Yes |

| Uninsured/Underinsured Motorist (UM/UIM) | Your injuries and damages if the at-fault driver has no insurance or not enough insurance to cover your costs. | Yes |

| Collision | Repairs to your own vehicle after a collision with another car or an object (like a pole or guardrail). | Optional |

| Comprehensive | Damage to your own vehicle from non-collision events, like theft, fire, vandalism, or hitting an animal. | Optional |

| Medical Payments (MedPay) | Extra medical coverage that can supplement your PIP or help pay health insurance deductibles. | Optional |

While only the first four are mandatory, the optional coverages provide a much more complete safety net.

Building a Stronger Policy With Optional Coverages

The mandatory coverages—Liability, PIP, and UM/UIM—form the essential foundation of your policy. But for true peace of mind, you’ll want to consider adding a few other protections for your own property and assets.

- Collision Coverage: This pays to fix or replace your car if it's damaged in an accident, whether it was your fault or not. Without it, you're on your own to cover repairs after a crash you cause.

- Comprehensive Coverage: This is for all the other chaos life can throw at your car. It covers damage from non-crash events like theft, vandalism, falling trees, or hitting a deer. Many policies also handle services like auto glass replacement under this coverage.

- Medical Payments (MedPay): This is an inexpensive, optional add-on that provides an extra layer of medical coverage above and beyond your PIP limits. It can be a great way to cover health insurance deductibles or co-pays without dipping into your own pocket.

Oregon’s minimum requirements are just that—a minimum. A serious accident can easily result in costs that soar past those limits. Investing in higher limits and optional coverages is one of the smartest things you can do for your financial security.

Your Action Plan After an Oregon Car Accident

The screech of tires, the gut-wrenching jolt of impact—a car crash is a chaotic, disorienting experience. Your mind races, and in the confusion, it’s tough to know what to do first. But having a clear game plan can make a world of difference in protecting your health and your right to a fair claim.

Think of the accident scene as a temporary, fragile piece of evidence. Your job is to preserve it. The moves you make in that first hour are absolutely critical and can shape the outcome of your entire insurance claim. Here’s a step-by-step roadmap to help you stay focused and in control.

Immediate Steps at the Scene

Safety is always priority number one. Before anything else, check yourself and your passengers for injuries. If anyone is hurt, or if the cars are in a dangerous spot, call 911 right away.

Once you know everyone is as safe as they can be, run through this checklist:

Secure the Area: If your car is drivable and you can do it safely, pull over to the shoulder. The last thing you want is another collision. Flip on your hazard lights to warn oncoming traffic.

Call the Police: A police report is an official, objective record of what happened. Even in what seems like a minor fender-bender, this document is invaluable when you’re dealing with auto insurance companies in Oregon.

Exchange Information: You'll need the other driver's name, address, phone number, driver's license number, and their insurance details. That’s it. Don't debate who was at fault or apologize—just stick to the basic facts.

Gathering Your Own Evidence

Don't ever rely on the police report or the other driver’s story alone. Your smartphone is your best friend here. The more proof you can gather on your own, the stronger your position will be when you file a claim.

Put on your detective hat. Your goal is to capture a complete, 360-degree snapshot of the scene exactly as it was just moments after the crash. Every detail helps paint a clear picture for the insurance adjuster.

Be methodical. Grab photos and videos of everything you can think of:

- Vehicle Damage: Get wide shots showing where the cars ended up and tight close-ups of the damage on all vehicles involved.

- The Surrounding Scene: Snap pictures of skid marks, debris on the road, traffic signals, and any relevant road conditions like potholes or construction zones.

- Witness Information: If anyone saw what happened, get their name and phone number. A statement from a neutral third party can be incredibly powerful.

What to Say and What Not to Say

After a crash, every word matters. You have to be careful when talking to the other driver and, later on, with their insurance company. A simple, well-meaning "I'm so sorry" can be twisted and used against you as an admission of fault.

Keep your conversations short and factual. You are only required to share your ID and insurance info. Avoid getting pulled into any discussion about who caused the accident. That's a question for the insurance companies—and maybe your lawyer—to figure out. For a deeper dive on what to say (and what to avoid), check out this complete guide on what to do after a car accident.

The Most Important Final Step: Seek Medical Care

This is the step people skip most often, and it's a huge mistake. Even if you feel perfectly fine, you need to get checked out by a doctor. The adrenaline pumping through your body after a traumatic event is great at hiding pain from serious injuries like whiplash, concussions, or internal bleeding.

Symptoms can take hours, or even days, to show up. When you see a doctor, it creates an official medical record that connects your injuries directly to the accident. Without that crucial link, the insurance company will almost certainly argue that your injuries came from somewhere else, making it incredibly difficult to get your medical bills covered. This isn't just about your health; it's about protecting your financial future.

How Insurance Adjusters Really Handle Your Claim

Sooner or later after a crash, your phone will ring, and an insurance adjuster will be on the other end. It’s natural to think they’re calling to help, but you need to understand their true role from the very first conversation. The adjuster works for the insurance company, and their primary job is to protect the company's bottom line. That means settling your claim for as little money as possible.

Don't take it personally; it's just business. But it's a business where your best interests are in direct conflict with their professional goals. They are trained negotiators who have these conversations every single day. You’re walking into their arena, and being prepared is your best defense.

The Adjuster's Playbook: Common Tactics

To drive down settlement values, adjusters often pull from a standard playbook of tactics. They know you're likely in pain, stressed about your car, and worried about paying bills. They use this stressful situation to their advantage. Recognizing their strategies is the first step toward protecting yourself.

Here are a few of the most common moves you'll see:

- The Quick Settlement Offer: One of their go-to moves is to offer you a check just a few days after the accident. It can feel like a huge relief to get quick cash, but this is almost always a lowball offer. It's designed to close your case before you even know the full extent of your injuries or what your final medical bills will look like.

- Requesting a Recorded Statement: The adjuster will say they need to get your side of the story on the record. It sounds harmless, but the real goal is to get you to say something they can use against you. They ask tricky, leading questions hoping you’ll downplay your pain ("So you're feeling a bit better today?") or accidentally admit some fault.

- Demanding Broad Medical Releases: They'll send over a stack of forms, including a medical authorization release. If you sign it, you're giving them permission to dig through your entire medical history—not just records related to the crash. They're looking for anything they can use to argue your injuries were a pre-existing condition.

Knowing how to handle these conversations is key. For a deeper dive, check out our guide on how to deal with insurance adjusters.

Red Flags in a Settlement Offer

Not every offer is a bad one, but some warning signs should make you stop and think twice. The adjuster wants to close your file quickly and cheaply, so any hint of pressure or urgency is a major red flag.

An insurance company's first offer is almost never its best offer. It's a starting point for a negotiation, and they are fully prepared for you to push back.

Be on the lookout for these specific signals that an offer is unfair:

It Ignores Future Medical Needs: The settlement only covers the bills you have right now. It completely overlooks the potential costs of future physical therapy, follow-up surgeries, or long-term care you might need down the road.

It Disregards Your Pain and Suffering: A fair settlement goes beyond just paying for receipts. If the offer only covers your medical bills and lost wages but offers little to nothing for your physical pain, emotional trauma, and the impact on your daily life, it's not a fair offer.

They Use Your Own Words Against You: The adjuster brings up something casual you said in an early phone call—like "I'm doing okay"—to justify a low offer by claiming your injuries aren't that serious.

They Create a Fake Deadline: You get told the offer is "only good for 24 hours." This is a pressure tactic designed to rush you into a bad decision before you have time to speak with a lawyer or really think it through.

Here in Oregon, you do have some protection. The Unfair Claim Settlement Practices Act (ORS 746.230) requires insurance companies to act in good faith and attempt to make "prompt, fair and equitable settlements" once liability is clear. The problem is, their definition of "fair" and what you're actually owed can be worlds apart.

When It's Time to Call a Personal Injury Attorney

After a car wreck, it often feels like you’re David going up against Goliath. The other driver’s insurance company isn’t just a faceless corporation; it's an organization with a whole team of adjusters and lawyers trained to protect their bottom line. Hiring a personal injury attorney is how you even the odds. It puts a professional advocate in your corner, someone whose only job is to fight for your best interests.

Just having a lawyer on your side sends a clear signal. It tells the insurance company that you're serious about getting what you’re owed and won't be pushed around with lowball offers or delay tactics. Your attorney immediately takes over all the back-and-forth, shielding you from the stress so you can focus on what really matters: getting better.

The Strategic Edge a Lawyer Provides

An experienced attorney does a lot more than just handle the phone calls. They become your investigator, your strategist, and your champion, meticulously building your case from the ground up. This involves a ton of critical work that’s nearly impossible for someone to manage on their own while recovering from an injury.

Right away, your legal team gets to work:

- Launching an Independent Investigation: They'll dig into the police reports, track down and interview witnesses, and sometimes even bring in accident reconstruction experts to establish exactly who was at fault.

- Calculating the Full Value of Your Claim: This is a big one. An attorney understands how to calculate all your damages—not just the medical bills you have today, but also the cost of future treatments, lost earning capacity, and the real-world value of your pain and suffering.

- Handling All Communication with the Insurer: They manage every form, every email, and every negotiation. This ensures you never accidentally say something the insurance company could twist and use to undermine your claim.

This professional, thorough approach does more than just strengthen your negotiating position; it makes a real difference in the outcome. In fact, a study from the Insurance Research Council showed that injured people who hired private attorneys received settlements that were, on average, 3.5 times larger than those who went it alone. Even after legal fees, they still walked away with more. You can see the full findings on attorney representation and claim values for yourself.

How Contingency Fees Make Legal Help Affordable

The biggest thing that holds people back is the fear of cost. But here’s the good news: personal injury attorneys almost always work on a contingency fee basis. The entire system is built to give everyone access to expert legal help, no matter their bank account balance.

A contingency fee means you pay nothing upfront. There are no hourly bills to worry about. Your attorney’s fee is simply a percentage of the settlement or award they win for you. If they don’t win your case, you owe them zero.

This setup aligns everyone's interests perfectly. Your attorney is motivated to get you the absolute best result possible because their success is directly tied to yours. It takes all the financial risk off your shoulders. When you're up against tough auto insurance companies oregon, getting a lawyer isn't a cost—it's a crucial investment in your recovery.

Common Questions About Oregon Auto Insurance

When you start digging into the details of your auto policy, it's easy to get tangled up in the specifics. Let's clear up a few of the most common questions we hear from drivers in Oregon.

Is Oregon a No-Fault State?

This one trips a lot of people up. The short answer is no, Oregon is technically a “fault” (or “tort”) state. That means whoever causes the accident is ultimately responsible for the damages.

But here’s the twist: Oregon has a “no-fault” element built into every policy. It’s called Personal Injury Protection (PIP) coverage.

This is a mandatory part of your own insurance that covers your initial medical bills and lost wages right away, no matter who was at fault. It’s designed to get you immediate medical care without having to wait for the insurance companies to spend weeks or months arguing over who should pay.

Can My Insurer Use My Credit Score to Set My Rate?

Yes, they absolutely can, and it often comes as a surprise to drivers. While it’s a controversial practice, Oregon law allows insurance companies to use a credit-based insurance score when figuring out how much you’ll pay for your premium.

They argue that data shows a link between credit history and the likelihood of filing a claim. In their eyes, it's a way to measure risk.

There are some guardrails in place, though. An insurer cannot use your credit score as the sole reason to:

- Deny you coverage or cancel your policy

- Refuse to renew your insurance

- Jack up your premium at renewal time

Important Takeaway: A good credit score can save you real money on your car insurance in Oregon. On the flip side, a lower score can unfortunately lead to much higher rates.

What Happens if I Get Hit by an Uninsured Driver?

This is exactly why Oregon requires every driver to carry Uninsured Motorist (UM) coverage. If you get hit by someone with no insurance at all, this part of your own policy kicks in to protect you.

Think of your UM coverage as a stand-in for the insurance the other driver should have had. It covers your medical bills, lost income, and even your pain and suffering, up to the limits you selected for your policy. It’s a crucial safety net that shields you from the financial fallout of a crash with an irresponsible driver.

If you’ve been hurt in an accident and feel like you're getting the runaround from an insurance company, you don't have to go through it alone. The experienced team at Bell Law knows how to protect your rights and fight for the fair compensation you deserve. Contact us for a free consultation to discuss your case.