Understanding Average Settlements for Rear End Collisions

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Understanding Average Settlements for Rear End Collisions

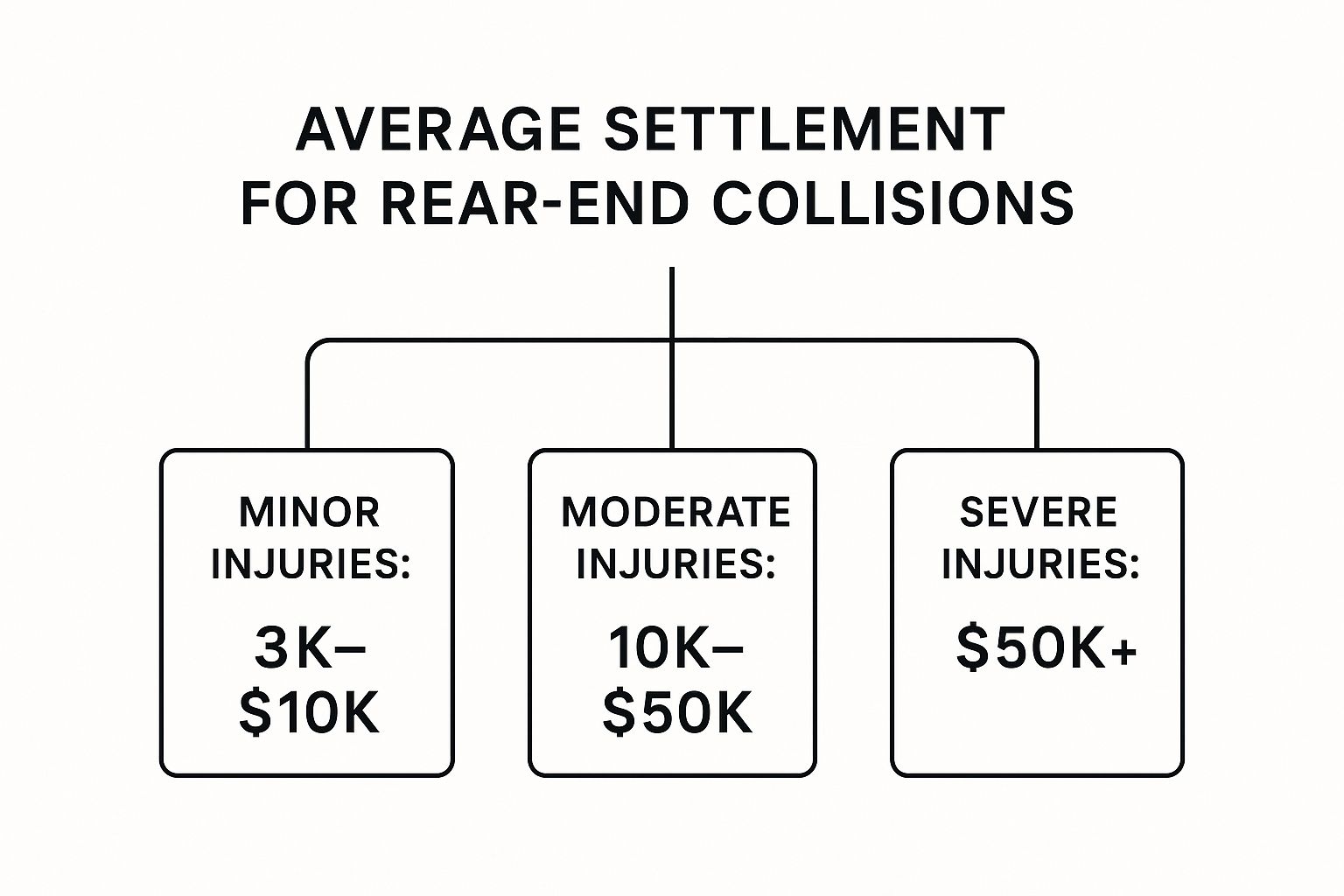

If you've been in a rear-end collision, one of the first questions on your mind is probably, "What is my case worth?" It’s a completely fair question, but the answer isn't simple. While there's no magic number, average settlements for rear-end collisions can range from a few thousand dollars for minor whiplash to well over $50,000 for more serious injuries.

Ultimately, the final amount comes down to the unique facts of your case. Think of it less like a fixed price and more like a spectrum, where the value is built by stacking up all the different ways the crash has impacted your life.

What Is a Typical Rear End Collision Settlement?

A minor fender-bender with a quick trip to the doctor is going to be on the lower end of that spectrum. But a crash that leads to surgery and long-term health problems? That's going to command a much, much higher value.

This visual gives a great breakdown of how settlement values tend to stack up based on how badly someone is hurt.

As you can see, the settlement value climbs steeply as the physical harm and the need for medical care increase. It's a direct correlation.

Understanding the Settlement Tiers

To put some real numbers to it, let's look at what these different settlement tiers generally represent.

To give you a clearer picture of how these factors play out, here’s a look at some estimated settlement ranges based on the severity of the injuries involved.

Estimated Settlement Ranges by Injury Severity

This table breaks down potential settlement values, showing how they correspond to common types of injuries from a rear-end collision.

| Minor | Soft tissue sprains, whiplash, bruising, minor cuts | $3,000 – $10,000 |

| Moderate | Herniated discs, concussions, simple fractures, significant whiplash requiring physical therapy | $10,000 – $50,000 |

| Severe | Traumatic brain injuries (TBI), spinal cord damage, surgical repairs, permanent disability | $50,000+ (often much higher) |

These are just general guidelines, of course. A case with "moderate" injuries could easily exceed $50,000 if it involves significant time off work or a lengthy recovery period.

It's crucial to remember that an initial offer from an insurance company rarely reflects the true value of your claim. They often make lowball offers hoping you'll accept quickly, especially before you even know the full extent of your medical needs.

The legal landscape also plays a big role. Oregon is an "at-fault" state, which means you can claim directly against the responsible driver’s insurance. This is different from "no-fault" states, where your own insurance covers initial costs, and you can only sue the other driver for severe injuries. This distinction often leads to higher potential settlements here in Oregon.

Because every single case has its own unique set of circumstances, getting a precise estimate requires a careful look at your specific damages. You can get a rough idea by using a car accident compensation calculator to get a personalized starting point. In the next sections, we'll dig into the exact factors that insurers analyze to decide what they'll pay.

Key Factors That Define Your Settlement Value

While settlement charts give you a ballpark idea, the real story is in the details of your specific accident. Think of your potential settlement not as one fixed number, but as a structure built from several crucial pieces. Each factor adds weight and value, and knowing what they are is the first step toward building a solid claim.

The two main categories that shape average settlements for rear end collisions are what we call economic damages and non-economic damages. Economic damages are the black-and-white, easy-to-prove costs, while non-economic damages cover the very real, but less tangible, human cost of the crash.

The Foundation: Economic Damages

Economic damages are the concrete foundation of your entire claim. Why? Because they represent direct, out-of-pocket financial losses that you can back up with a paper trail. These are the hard numbers—bills, receipts, and pay stubs—that an insurance adjuster can’t easily dispute.

Here’s what makes up that foundation:

- Medical Expenses: This is usually the biggest piece of the puzzle. It includes everything from the ambulance ride and ER visit to surgery, physical therapy, medications, and even the cost of any medical care you’ll need down the road.

- Lost Wages and Earning Capacity: If your injuries kept you out of work, you’re owed that lost income. For more severe injuries that permanently impact your ability to do your job or earn a living, you can also claim damages for what you would have earned in the future.

- Property Damage: This one is straightforward—it’s the cost to fix or replace your car. Getting a detailed estimate from a professional is key. For many, finding quality auto repair services is a critical first step in documenting this part of the claim properly.

These hard costs are the starting point for any settlement talk. Keeping meticulous records of every single expense is absolutely essential.

The Structure: Non-Economic Damages

If economic damages are the foundation, non-economic damages are the rest of the house. They represent the human toll of the collision. While you can’t get a receipt for pain, these losses are just as real and often make up a huge part of the final settlement.

Insurance companies have a formula for this. They typically use a "multiplier" method, where they take your total economic damages and multiply that number by something between 1.5 and 5, depending on how badly you were hurt and how much the accident turned your life upside down.

Key Takeaway: The more severe and life-altering your injuries are, the higher the multiplier. A minor case of whiplash might get a 1.5x multiplier, while a permanent disability could justify a 5x multiplier or even more.

Let's break down what falls under this category:

- Pain and Suffering: This is compensation for the physical pain, discomfort, and general misery you’ve had to endure because of your injuries. A broken leg that requires surgery and months of grueling rehab is worth a lot more in this category than minor bruising.

- Emotional Distress: Accidents are scary. This factor covers the psychological fallout, like anxiety, depression, a new fear of driving, or even post-traumatic stress disorder (PTSD).

- Loss of Enjoyment of Life: This is about your inability to do the things you loved before the crash. If you were an avid hiker who can no longer hit the trails because of a back injury, that loss has real, compensable value.

- Loss of Consortium: In some cases, a spouse can file a claim for the loss of companionship, support, and intimacy that resulted from their partner’s injuries.

These elements feel subjective, but they are incredibly powerful. A personal journal detailing your struggles, statements from friends and family, and reports from mental health professionals can all help prove these damages and push for a higher settlement.

Other Critical Influences on Your Settlement

Beyond the two main types of damages, a few other factors can dramatically shift the final number. Think of these as the outside forces that can either strengthen or weaken your position.

First up is clear liability. In most rear-end collisions, the driver in the back is assumed to be at fault. When there's no question about who caused the crash, the path to a settlement is much smoother. But if the other driver’s insurance company tries to claim you were partly to blame—maybe arguing your brake lights were out—it can complicate everything and reduce your payout.

Finally, the at-fault driver's insurance policy limits act as a hard ceiling. If your total damages add up to $75,000, but the other driver only has a $50,000 policy, their insurance company simply won't pay a penny more. In that situation, you’d have to look at your own Underinsured Motorist (UIM) coverage or consider other legal options to get the full amount you deserve.

How Insurance Companies Calculate Your Payout

When you’re dealing with the aftermath of a rear-end collision, the settlement offer from an insurance company can feel like a number plucked from thin air. It’s not. There’s a method to the madness, but it’s a method designed to protect their bottom line, not yours.

Adjusters use specific formulas and sophisticated software to translate your injuries, bills, and suffering into a dollar figure. Understanding their playbook is the first step in fighting back against a lowball offer. It also helps to have a handle on the general principles of auto insurance to see the bigger picture of how your claim fits into their system.

The Multiplier Method Explained

One of the oldest tricks in the adjuster’s book is the multiplier method. This is how they attempt to put a price tag on your "pain and suffering"—the real-world, human impact of the crash that doesn't come with a receipt.

First, they add up all your concrete financial losses, what we call economic damages. This includes every dollar of your medical bills and every paycheck you missed. Then, they multiply that total by a number, typically between 1.5 and 5.

- For minor injuries like mild whiplash that heals quickly, they'll push for a low multiplier (1.5 to 2).

- For severe injuries—the kind that require surgery, leave you with a permanent impairment, or cause chronic pain—a high multiplier (4 to 5, or sometimes more) is more appropriate.

This multiplier is almost always the biggest point of contention. Your attorney will be building a case to justify the highest possible multiplier, highlighting the true extent of your suffering. The adjuster, on the other hand, will be looking for any excuse to use the lowest number they can get away with.

The Role of Claims Software

These days, adjusters aren't just working with a notepad and a calculator. Major insurers rely heavily on powerful software programs—Colossus is one of the most well-known—to spit out an initial settlement range. This software crunches data from thousands of past claims to find cases similar to yours and suggest a payout value.

But here’s the problem: a computer program can’t grasp what you've actually been through.

An algorithm can’t quantify the panic you feel every time a car gets too close behind you. It can’t understand the frustration of not being able to lift your own child without pain. It’s a data-driven tool that sees medical codes and treatment timelines, not a human being whose life has been turned upside down.

This is precisely why the first offer is almost always too low. It's based on averages, not on your unique story. Your personal journals, detailed medical records, and statements from family and friends are what bridge that gap and prove you are more than a statistic in their system.

An Adjuster’s Perspective on a Hypothetical Case

Let's put ourselves in the adjuster’s shoes for a minute. A claim comes across their desk for a rear-end crash. The victim has a herniated disc, with $5,000 in medical bills and $2,000 in lost wages.

The first thing the adjuster does is hunt for weaknesses. They'll check the timeline—did you wait a few weeks to see a doctor? They’ll use that delay to argue your injury isn't from the accident. They’ll also scrutinize the treatment. Is it from a specialist, or just a long course of chiropractic care they can question?

After poking holes, they’ll plug the numbers into their software. The system, seeing the "red flags" they’ve identified, might suggest a low-end multiplier of 2x. The math would look like this:

- Economic Damages: $5,000 (medical) + $2,000 (lost wages) = $7,000

- Non-Economic Damages: $7,000 x 2 (the multiplier) = $14,000

- Total Offer: $7,000 + $14,000 = $21,000

This purely formulaic number completely ignores the victim’s reality—the chronic pain, the missed family events, the lost hobbies. Your job, with an attorney's help, is to paint that human picture so vividly that they have no choice but to abandon their formula and deal with the real value of your claim.

Why Your Location Matters So Much

It’s a strange but true fact of personal injury law: the exact same crash can have a completely different value depending on where it happened. A rear-end collision in Portland, Oregon, might be worth thousands more—or less—than an identical one in Boise, Idaho. Average settlements for rear end collisions aren't just a simple formula of injuries plus car damage; state lines draw invisible but powerful boundaries that reshape the entire process.

Think of it like playing a game where the rulebook changes the moment you cross a state line. This is easily one of the most overlooked factors, yet it can have a massive impact on your claim. The specific laws, insurance regulations, and even the history of jury verdicts in your area all influence what an insurance company is willing to offer. Getting a handle on your local legal landscape is the first step to setting realistic expectations.

At-Fault vs. No-Fault States: The Great Divide

The single biggest difference from state to state is whether you're in an "at-fault" or a "no-fault" system. This one distinction completely changes who pays for your damages and how you get that money.

- At-Fault States (like Oregon): Here, the concept is simple: the person who caused the wreck is responsible for the damages. You file a claim against their insurance company to recover everything—medical bills, lost income, and your pain and suffering. This system often opens the door to higher settlements because you can pursue the full range of your losses right from the start.

- No-Fault States: In these states, your own insurance policy is your first stop. Your Personal Injury Protection (PIP) coverage pays for your initial medical bills and lost wages, no matter who was at fault. The catch? You can only go after the at-fault driver for pain and suffering if your injuries meet a certain legal threshold, like being "serious" or "permanent." This can make it tough to get fairly compensated for less severe, but still painful, injuries.

This difference is huge. A whiplash injury that might settle for $15,000 in Oregon could, in a no-fault state, result in you only getting your medical bills paid by your own PIP coverage, with nothing extra for your pain and disruption.

State-Specific Laws and Insurance Minimums

Beyond the big at-fault vs. no-fault question, every state has its own quirky set of rules that can make or break a claim.

For example, some states put a "cap" on how much money you can receive for non-economic damages (pain and suffering). A jury might award you a significant amount, but a state law could slash it down. Thankfully, Oregon doesn’t have these kinds of caps for most personal injury claims.

State-mandated insurance minimums also play a huge role. If an at-fault driver in a state with a low minimum—say, just $15,000 for liability—causes a serious accident, that’s all the insurance money available. It becomes a massive roadblock when your medical bills alone are higher than that.

For a real-world comparison, look at Texas, which is also an at-fault state. The average payout for a rear-end collision there hovers around $20,000 to $25,000. But the range is enormous, from $2,000 for minor fender-benders to over $500,000 for catastrophic injuries, showing just how much these regional factors can swing the outcome.

Local Court Culture and Deadlines

It even gets more granular than the state level. The legal culture in your specific city or county can matter. Juries in one part of a state might be known for being more generous with pain and suffering awards than juries just one county over. A good local attorney knows these unwritten rules and uses that knowledge to negotiate a better settlement for you.

Finally, every state has a strict deadline for filing a lawsuit. In Oregon, you generally have two years from the date of the crash to file. You can read the specifics on the statute of limitations for Oregon personal injury cases. If you miss that window, your right to seek compensation is gone forever. It’s a harsh deadline that underscores just how critical local knowledge really is.

A Look at Real-World Rear-End Collision Payouts

It's one thing to talk about economic damages and pain and suffering multipliers in theory. But where the rubber really meets the road is in actual, real-life cases. The story of what happens after the crash—the doctor's visits, the lost time at work, the back-and-forth with adjusters—is what truly builds the value of a claim.

Let's walk through a few anonymized examples. By seeing how these scenarios play out, you'll get a much clearer picture of how all the factors we've discussed come together to shape the average settlement for a rear-end collision in Oregon. We'll look at three distinct situations, from a seemingly minor fender-bender to a life-changing event.

Case Study 1: The "Minor" Whiplash Injury

Picture "Sarah." She’s stopped at a red light when another car, going maybe 10 mph, bumps into her from behind. It was jarring, but the damage looked minimal. Sarah felt a little stiff but told everyone she was fine and didn't take an ambulance.

The next morning was a different story. She woke up with a pounding headache and a neck so sore she could barely turn her head. A trip to urgent care confirmed what many people experience after these impacts: a cervical strain, better known as whiplash.

- Medical Treatment: Sarah’s path to recovery involved eight weeks of physical therapy and a prescription for muscle relaxants. Her total medical bills added up to $4,000.

- Lost Wages: She had to miss three days of work, costing her $600 in lost pay.

- Settlement Breakdown: Her hard costs, or economic damages, were $4,600. The at-fault driver's insurance adjuster initially downplayed the claim, pointing to the low-speed impact. But after some firm negotiation from her attorney, they secured a final settlement of $13,500 that properly compensated her for the pain and disruption.

Case Study 2: The Herniated Disc & A Long Road Back

Now, let's consider "Michael." He was rear-ended on the freeway, and the impact was much more significant. He felt a sharp, immediate pain in his lower back that shot down his leg. An MRI later gave him the bad news: a herniated disc in his lumbar spine.

This is a much more serious injury, and it often means a longer, tougher recovery.

Michael's case highlights a crucial point: the power of diagnostic proof. An MRI provides objective, black-and-white evidence of an injury. It’s much harder for an insurance company to argue your pain isn't real when they're looking at a clear picture of the damage.

His journey back involved multiple specialists and put his life on hold.

- Medical Treatment: He needed a series of steroid injections to manage the inflammation and pain, followed by six months of intensive physical therapy. His medical bills hit $18,000.

- Lost Wages: As a construction worker, his injury made it impossible to do his job. He was out of work for two full months, resulting in $8,000 in lost income.

- Settlement Breakdown: With $26,000 in clear economic damages and solid medical evidence, his lawyer argued for a higher multiplier. They emphasized his chronic pain and the long-term impact on his ability to perform a physically demanding job. The case ultimately settled for $75,000.

Case Study 3: The Catastrophic Injury & A Changed Future

Finally, there’s "Emily." Her car was hit from behind at high speed by a driver who was texting. The collision was violent, leaving her with multiple leg fractures and a severe spinal cord injury that required emergency surgery.

In an instant, her entire life was altered. Her legal case had to account not just for the bills she had today, but for a lifetime of future care, lost dreams, and profound changes.

Settlements for rear-end collisions can swing wildly depending on injury severity and state laws. Over in California, for instance, a moderate injury settlement might average around $44,975, while cases with herniated discs can go from $25,000 to $100,000. For catastrophic injuries like Emily's, settlements often blast past $100,000 and can top $1 million. You can get a better sense of these calculations by reviewing insights on California rear-end collision settlements.

- Medical Treatment: Emily's costs were staggering. They included the initial surgery, a long hospital stay, inpatient rehab, and the projected cost of a lifetime of care—including home modifications and ongoing therapy. Her past and future medical expenses were calculated to be $450,000.

- Lost Earning Capacity: The accident left her with a permanent disability, making it impossible to return to her career. An expert calculated her lost future earnings at over $500,000.

- Settlement Breakdown: With overwhelming evidence and life-altering damages, her case settled for $1.2 million. This figure reflected the full scope of her financial losses and the devastating, permanent impact on her quality of life.

Practical Steps to Maximize Your Settlement

It’s one thing to understand the factors behind average settlements for rear end collisions, but it's another thing entirely to take the right steps to protect your own claim. The actions you take in the hours, days, and weeks following a crash are absolutely critical. Every move you make—or don't make—can dramatically affect the compensation you ultimately receive.

Think of yourself as the lead investigator of your own case. Right from the start, you're building the foundation. The stronger you make that foundation with smart, immediate decisions, the tougher it will be for an insurance company to poke holes in your claim or lowball you later on.

Seek Immediate Medical Attention

Your health always comes first, but getting checked out by a doctor right after a crash also plays a vital role in your claim. Adrenaline is a powerful thing; it can easily hide serious injuries like whiplash or a concussion, which might not show symptoms for hours or even a few days.

If you wait to see a doctor, you’re handing the insurance adjuster an argument on a silver platter. They'll almost certainly suggest that your injuries weren't that bad, or worse, that something else must have caused them after the accident. A prompt medical exam creates a clear, official paper trail linking your injuries directly to the collision—and that’s evidence you can’t afford to miss.

Document Absolutely Everything

From the second the accident happens, your new job is to be a relentless record-keeper. Memories fade, but pictures and notes are permanent. This documentation will become the very backbone of your insurance claim.

Here’s a quick checklist of what you need to capture:

- Photos of the Scene: Get pictures of everything before the cars are moved. This includes the position of the vehicles, damage to both cars, any skid marks, and the general road conditions.

- Injury Photos: As soon as you notice any bruises, cuts, or swelling, take clear photos. Continue to document how your injuries change over time.

- A Personal Journal: This is crucial for your pain and suffering claim. Every day, jot down your pain levels, any physical limitations you're experiencing, and how your injuries are impacting your daily life.

Report the Accident but Be Careful What You Say

Always call the police to the scene. An official police report is a cornerstone piece of evidence. When you talk to the other driver and the police, just stick to the basic facts. Most importantly, do not apologize or admit any fault. A simple "I'm sorry" can be twisted and used against you later to argue that you accepted some of the blame.

You can also bet that the other driver's insurance adjuster will call you, and probably very quickly. Be polite, but be guarded. Their job is to get you to say something that minimizes their company's payout. You have no obligation to give them a recorded statement right away. You can simply provide your basic contact info and tell them you won’t discuss the accident further without getting some advice first.

You have the right to control the flow of information. An early, rushed statement can box you in before you even know the full extent of your injuries and damages.

Protecting your claim also means being ready for the negotiation stage. Insurance adjusters are professional negotiators, but that doesn't mean you have to be at their mercy. Learning how to negotiate an insurance settlement can give you the tools you need to push back against lowball offers and fight for what's fair. By taking these practical steps, you put yourself in the driver's seat and build a much stronger case for the compensation you truly deserve.

Frequently Asked Questions About Rear-End Settlements

When you're dealing with the aftermath of a car accident, it’s natural to have a lot of questions. Let's walk through some of the most common ones that come up when you're trying to figure out a fair average settlement for a rear-end collision.

How Much Is a Lower Back Injury Worth?

This is one of the most common questions, and the answer truly depends on the severity. For a minor sprain or strain, you might be looking at a settlement in the $10,000 to $25,000 range. These are injuries that usually heal with a bit of time and conservative treatment.

But if the accident caused something more serious, like a herniated disc that needs ongoing physical therapy or epidural injections, the value jumps significantly. In those cases, a fair settlement could fall anywhere from $25,000 to $75,000.

And for injuries that change your life—those requiring surgery or leaving you with chronic pain and long-term limitations—the settlement value can easily push past $100,000. It all comes down to the hard numbers: medical bills, lost wages, and the very real impact the injury has had on your day-to-day life.

What Should I Expect for an Initial Settlement Offer?

Let's be blunt: the insurance company's first offer will almost always be low. It's a business tactic, plain and simple. They're testing the waters to see if you'll take a quick and easy payout before you've had a chance to grasp the true, long-term cost of your injuries. For a minor crash, that first offer might only be a couple of thousand dollars.

A Word of Caution: Never, ever accept the first offer. It's almost guaranteed to fall short of covering your future medical needs, all of your lost income, and what you truly deserve for your pain and suffering.

How Do You Put a Price on Pain and Suffering?

There's no simple formula for calculating something as personal as pain. To bring some structure to it, insurers often lean on the "multiplier method."

Here's how it generally works: they add up all your medical bills (the "special damages") and then multiply that total by a number, typically between 1.5 and 5.

- A 1.5x multiplier might be used for a straightforward whiplash case that resolves quickly.

- A 5x multiplier (or even higher) could be argued for a severe, permanently disabling injury.

A skilled attorney's role is to build a compelling case that justifies the highest possible multiplier, making sure the final number reflects everything you've been through.

At Bell Law, we know that getting fair compensation is about more than just a check—it’s about giving you the resources to put your life back together. If you're navigating a rear-end collision claim in Oregon, our experienced attorneys are ready to fight for you. Contact us for a free consultation and let's talk about the settlement you deserve.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.