Being Sued for a Car Accident in Oregon? An Actionable Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Being Sued for a Car Accident in Oregon? An Actionable Guide

It's a jarring moment, for sure. A stranger hands you a thick stack of papers, and just like that, you're being sued. Your mind probably starts racing. But what you do in the next few hours and days is absolutely critical.

First, take a breath. Panicking won't help. The two most important things to do right now are simple: do not ignore these documents, and call your auto insurance company immediately.

What to Do the Moment You're Served

That stack of papers is likely a Summons and a Complaint. This is the official start of a lawsuit. It’s a formal notice that someone is seeking damages from you related to that car accident, and it lays out exactly what they claim you did wrong.

Your first move is to read through everything carefully. You’re looking for two specific things:

- Who is suing you? This is the "Plaintiff."

- What is your deadline? This is the most important detail on the page. In Oregon, you typically have just 30 days to file a formal response with the court, which is called an "Answer."

Let me be blunt: Missing this deadline is a disaster. If you don't file your Answer on time, the court can enter a "default judgment" against you. That means you lose automatically, without ever getting a chance to tell your side of the story. The person suing you could get every single thing they asked for.

Your 48-Hour Action Plan

Time is not on your side. In the first two days, you need to take these concrete steps to protect yourself and get the ball rolling on your defense.

1. Document the Details

Grab a notebook or open a new file on your computer. Write down the exact date, time, and how you were served. If you remember anything about the process server, jot that down too. It might seem minor, but these details can matter later. Put the lawsuit papers in a safe place where they won't be misplaced or damaged—and don't write on them.

2. Call Your Insurance Company

This is the most important call you will make. Your auto insurance policy isn’t just for covering damages; it almost certainly includes what’s called a "duty to defend." This is a contractual promise from your insurer to hire an attorney to represent you and to pay for the legal costs. It's what you pay your premiums for.

Before you dial, get your information together:

- Your policy number

- The date the car accident happened

- The date you were served with the lawsuit

Tell the claims representative you’ve been sued in connection with an accident covered by your policy. They’ll start a litigation file and assign an adjuster to your case. That adjuster will then hire a defense attorney to represent you. From this point on, your job is to cooperate fully with them.

While your insurance company is your first line of defense, it helps to understand what makes a good lawyer. Learning about the process of hiring a personal injury attorney can give you valuable insight into the role they'll play in your case.

Why Your First Call Must Be to Your Insurance Company

When a process server hands you a stack of legal papers, your mind probably races. Should you call a lawyer? Should you just ignore it and hope it goes away?

Stop. Take a breath. Neither of those is the right move. The very first thing you need to do—the single most important action you can take—is to call your auto insurance company. This single phone call is what activates the protection you've been paying for with every premium.

Tucked away in your policy documents is a clause that is now your best friend: the “duty to defend.” This isn't just a nice-to-have feature; it's a contractual obligation. It legally requires your insurance provider to hire and pay for a lawyer to represent you in any lawsuit that stems from a covered accident.

This is the moment your policy stops being a piece of paper and becomes your shield. Your insurer takes over the heavy lifting, from finding seasoned defense lawyers to covering the legal bills. But they can’t do any of that until you let them know what's happened.

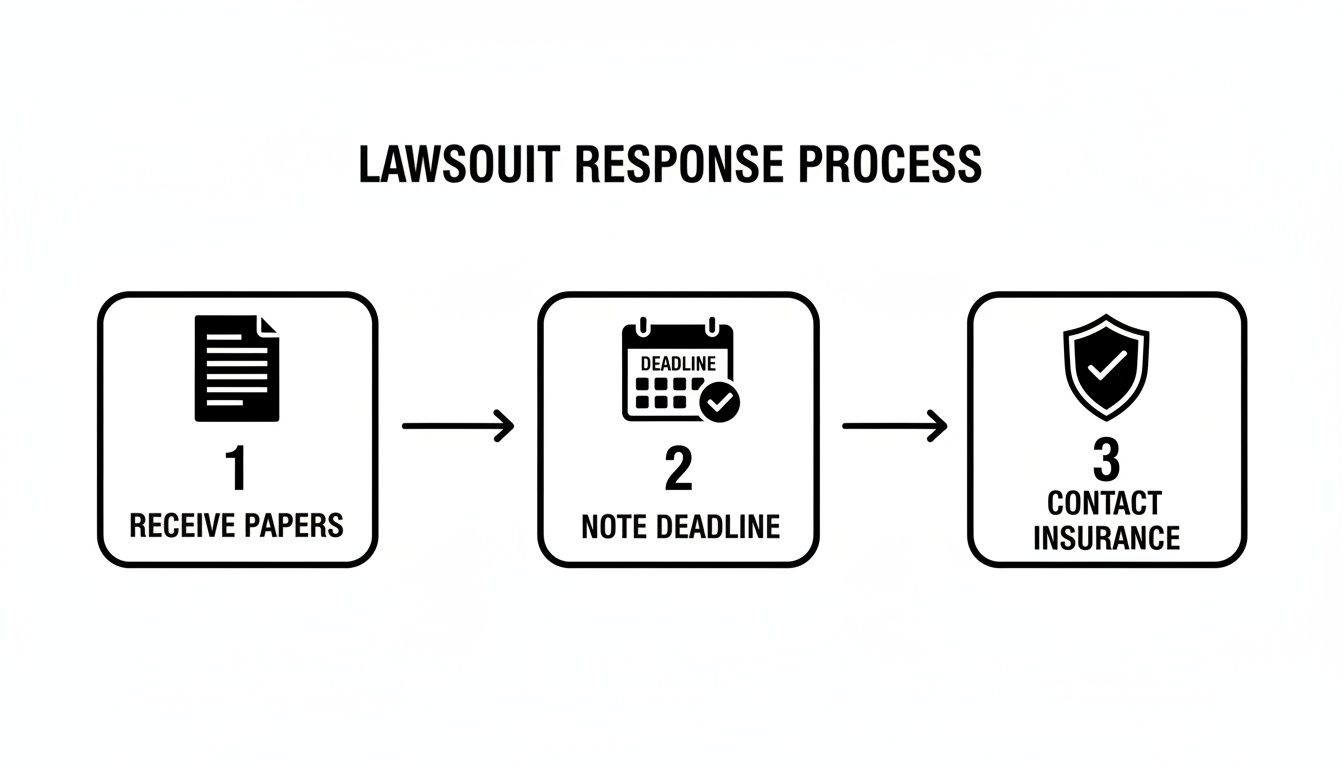

As you can see, the process is straightforward: secure the papers, pinpoint your deadline, and get your insurer on the phone immediately.

Preparing for the Call to Your Insurer

A little preparation goes a long way. Having your information ready before you dial will make the call smoother and less stressful. You're already dealing with enough.

Before calling, get these items together:

- Your Auto Insurance Policy Number: This is the quickest way for the agent to pull up your file.

- The Lawsuit Documents: Keep the Summons and Complaint right in front of you. The person you speak with will ask for details from these papers.

- The Date You Were Served: This is crucial. Your insurer needs to know the exact date you received the documents so the attorney they hire can file a response before the court's deadline passes.

When you get a representative on the line, be direct and clear: "I'm calling to report that I have been sued over a car accident." They'll take down the initial details and pass you to a claims adjuster who will handle the legal side of things.

What to Expect from Your Claims Adjuster

Think of this claims adjuster as your new main point of contact. Their job is to manage the entire claim, which now includes your legal defense. They will review the lawsuit, confirm your coverage is active and applies to the situation, and assign your case to a defense attorney from a law firm they have on retainer.

Let me be clear: you do not pay this lawyer. Their job is to defend you, but their bills go directly to the insurance company as part of their duty to defend.

One of the biggest fears people have is that calling to report a lawsuit will send their insurance rates through the roof. While any at-fault accident can impact your premiums, the simple act of being sued doesn't automatically trigger a rate hike. The key factor is the final outcome of the case and the determination of fault, not the lawsuit itself.

It's absolutely critical that you cooperate fully with the claims adjuster and the attorney they hire. They need your complete and honest story of what happened to build the strongest possible defense for you. Holding back details or ignoring their calls can seriously damage your case—and even put your coverage at risk. Knowing how to deal with insurance adjusters can make a real difference here. Your cooperation is the key to unlocking the full protection your policy provides.

How to Actively Participate in Your Own Defense

Even though your insurance company is providing the lawyer, you are still the most important person on your own defense team. It's easy to think you can just hand things off, but your attorney wasn't there when the accident happened—you were. Your involvement isn't just a nice-to-have; it's absolutely essential to building the strongest possible case.

Think of it this way: your lawyer handles the legal strategy, but you are the primary source of the facts. The more organized and thorough you are, the better equipped your lawyer will be to poke holes in the plaintiff's claims. You’re essentially the project manager for your side of the story.

This means you need to start gathering every document, photo, and memory you can find. Don't discount anything as unimportant. I’ve seen cases where a seemingly minor detail—a receipt, a text message, a vague memory of the road conditions—became a critical piece of evidence that completely changed the lawsuit's direction.

Building Your Evidence File

Your first move should be to create a central file for everything related to the accident and the lawsuit. This can be a physical binder or a digital folder on your computer. The important thing is that it’s organized and easy for both you and your attorney to access.

Start pulling these items together right away:

- The Official Police Report: If you don't have a copy, get one from the responding law enforcement agency. In Oregon, that could be the Oregon State Police or a local sheriff's department. This report contains the officer’s on-the-ground observations, witness statements, and often a preliminary sketch of the scene.

- Photos and Videos: Collect every photo and video from the accident scene. This means damage to all vehicles, road conditions, traffic signals, skid marks, and any visible injuries. Try to organize them by date and time if you can.

- Witness Information: Make a list of anyone who saw what happened. You'll want their full names, phone numbers, and email addresses. If you jotted down any notes about what they said at the scene, include those too.

Your own memory is a powerful piece of evidence. Take some time to write down everything you remember about the moments leading up to, during, and after the crash. Do this as soon as you can, because memories fade and get fuzzy over time. No detail is too small. What was the weather like? What song was on the radio? What did you see, hear, and even smell?

Understanding the Discovery Process

After your lawyer files the Answer to the complaint, the case enters a formal phase called discovery. This is simply the official process where both sides exchange information and evidence. Being sued for a car accident means you’ll be a key player here.

The other side's attorney will send your lawyer formal requests for information, and you'll work with your attorney to answer them. The two most common types you'll encounter are:

Interrogatories: These are written questions that you have to answer under oath. They might ask for a detailed timeline of your day before the accident or a list of all medical providers you've seen since.

Requests for Production of Documents: This is a formal demand for copies of documents relevant to the case. It could include anything from your car's maintenance records and cell phone bills from that day to the photos you took at the scene.

Complete honesty and cooperation with your own attorney during discovery are non-negotiable. Hiding something, even if you think it makes you look bad, can destroy your credibility and your case. Your lawyer is there to protect you, but they can only do their job if they have all the facts—the good, the bad, and the ugly.

By being an engaged and organized partner, you give your legal team the tools they need to build a powerful defense on your behalf.

Protecting Your Case: What Not to Say or Do

The moment you’re served with that lawsuit, the game changes. It's no longer just about the car accident; it's about every single word you say and every action you take from this point forward. You have to assume the other side is actively looking for any slip-up they can use against you.

From now on, your number one rule is this: all communication must go through your lawyer. This isn't a friendly suggestion—it's a critical instruction. Whatever you do, do not reach out to the person suing you (the plaintiff) or their attorney. They are not your friends, and any attempt to apologize, explain your side, or "work things out" will almost certainly be twisted and used to prove your fault in court.

The Dangers of Social Media

In this day and age, your social media accounts are an open book for the opposing legal team. They will scrutinize your profiles, digging for anything that contradicts your side of the story. What seems like a completely innocent post can quickly become a major headache for your defense.

Here’s a real-world scenario I see all the time: You’re being sued by someone claiming debilitating neck and back injuries. A week after being served, you post a photo of yourself smiling while holding your niece at a family barbecue.

Even if you only held her for a moment, the plaintiff’s lawyer will blow that photo up on a giant screen for the jury. They'll argue it’s "proof" that you're not taking this seriously and that the plaintiff’s injuries can’t be that bad. It's an unfair tactic, but it happens.

Your digital footprint is now evidence. The absolute best advice I can give is to stop posting on all social media platforms until your case is resolved. If you can't do that, at least lock down all your accounts to the highest possible privacy settings. And never, ever post anything about the accident, your health, or your daily activities.

Even posts that seem totally unrelated can create problems. A picture from a nice dinner out could be used to suggest you aren’t struggling financially. A vacation photo might be framed to imply you're carefree and unbothered by the lawsuit. It’s a minefield where silence is truly your best defense.

Communication Dos and Don'ts When Sued

Knowing how to handle conversations—even with people you trust—is crucial. Your lawyer is building a defense, and a single offhand comment can unintentionally undermine the entire strategy.

To protect your case, it’s vital to control the flow of information. This table is a quick-reference guide on how to handle communications after you've been served.

| DO direct all calls to your lawyer. | This prevents you from saying something accidentally that could harm your case. Just say, "You'll need to speak with my attorney." |

| DON'T discuss the case with anyone but your lawyer. | Friends and family can be called to testify about what you told them. Keep the details between you and your legal counsel. |

| DO be completely honest with your own attorney. | Your lawyer needs all the facts—good and bad—to build the strongest possible defense for you. |

| DON'T apologize or admit any fault. | Simple phrases like "I'm so sorry this happened" can easily be interpreted as a legal admission of guilt. |

| DON'T post anything online about the accident. | This includes your activities, your emotional state, or your physical condition. Silence is your best strategy. |

Ultimately, your goal is to create a cone of silence around your case. Let your attorney be your sole spokesperson. By carefully managing what you say and do, you deny the other side ammunition and give your defense the best possible chance to succeed.

Understanding the Path to Settlement or Trial

So, you're being sued. This might feel like you're automatically headed for a dramatic courtroom showdown, but that’s rarely how it plays out. The reality is that your case is now on a path with two main destinations: a settlement agreement or a trial.

Let’s be clear: the legal system is built to encourage people to settle. Trials are expensive, they drain incredible amounts of time, and their outcomes are a total crapshoot. A settlement, on the other hand, gives everyone a predictable end to the uncertainty. It's essentially a negotiated deal where the other driver agrees to drop the lawsuit in return for a specific payment from your insurance company.

The Dynamics of Settlement Negotiations

Settling a case isn't a single moment; it's a process, a dance. It usually kicks off when the plaintiff’s lawyer sends a “demand letter” to your insurance company. This letter will lay out their side of the story, detail the injuries and medical costs, and name a number they want to settle for.

From there, your insurer and the defense attorney they’ve hired for you will get to work. They’ll pore over every piece of evidence—the police report, photos from the scene, medical records, witness statements, and what you told them happened. Their job is to poke holes in the plaintiff's case and figure out your true level of exposure. After that deep dive, they'll come back with a counteroffer, which is almost always significantly lower than what was first demanded.

This back-and-forth can drag on for weeks or months. During this time, the case moves through what's called the "discovery" phase, where both sides exchange information. You might find yourself understanding deposition notices, for example, because sworn testimony from a deposition can dramatically shift the leverage in these settlement talks.

While your attorney is there to advise you, it's crucial to understand who's in the driver's seat. The final call on whether to accept or reject a settlement offer (within your policy limits) usually belongs to your insurance company. Their primary goal is to close the claim for a reasonable sum and avoid the much higher costs and risks of a trial.

The statistics on this are staggering. Roughly 95% of personal injury cases like these end in a pre-trial settlement. Only a tiny fraction—maybe 3-5%—actually go all the way to a jury. It’s just practical. For the injured party, a settlement gets them money faster to cover their bills. For your insurer, it caps their financial risk and dodges the unpredictable nature of a jury verdict.

What a Court Trial Really Involves

If both sides dig in their heels and a settlement just isn't happening, then a trial is the next step. It’s important to have a clear-eyed view of what this means. A trial isn't just a big day for your lawyer; it's a massive commitment for you, too. It requires an immense amount of preparation, from lining up witnesses to packaging every piece of evidence in a way a jury can understand.

Mentally and emotionally, it's draining. You will have to get on the stand, swear an oath, and tell your story. Then, you'll be cross-examined by the other side's attorney, whose entire job is to question your credibility and trip you up. Every detail of the accident is put under a microscope for a room full of strangers to judge.

And the outcome? It's a total unknown. A jury will decide who they think is at fault and what, if anything, is owed. That final number could be far more or far less than any settlement offer that was on the table. This is the single biggest reason why most legal teams work so hard to find a resolution. The entire car accident settlement process is designed to avoid the high-stakes gamble of a trial.

Making an Informed Decision

Deciding whether to settle or go to trial isn't just your call. It's a strategic decision made collaboratively between you, your lawyer, and your insurance company. Your attorney will give you their unvarnished opinion on the strengths and weaknesses of your case, what the potential financial fallout could be, and your odds of winning in court.

Several key factors will shape this decision:

- Strength of Evidence: How clear is the proof of who was at fault? Do you have solid, credible witnesses?

- Severity of Injuries: The more severe and well-documented the plaintiff's injuries are, the higher the potential value of the case.

- Your Policy Limits: This is the maximum amount your insurance company will pay out, and it's a hard ceiling on any settlement or verdict they'll cover.

- The Venue: Believe it or not, the county where the trial is held can make a difference. Some juries are known to be more generous to plaintiffs than others.

Ultimately, this entire phase boils down to weighing certainty against risk. A settlement closes the book. A trial tears the book open and lets a jury write the final chapter. Your legal team is there to guide you through this, helping you figure out the smartest path forward for your specific situation.

Answering Your Top Questions About Oregon Car Accident Lawsuits

Getting served with legal papers is disorienting. It's totally normal for a flood of practical questions and worries to pop up as you navigate this unfamiliar territory.

Let's cut through the legal jargon and address the most common concerns I hear from people who find themselves in this exact situation. Getting clear, straightforward answers will help you grasp the big picture and work better with the legal team your insurer provides.

What if the Lawsuit Demands More Than My Insurance Policy Covers?

This is, hands down, the biggest fear for most people, and it's completely understandable. You see a huge number on the complaint—let's say $250,000—and your policy only covers $100,000. It's natural to panic.

Here's the inside baseball: that initial number, often called the "prayer for relief," is almost always a strategic starting point. Think of it as the plaintiff's opening bid in a negotiation, not the final price tag.

Your insurance policy has a hard cap, your policy limit, which is the absolute maximum your insurer is on the hook for. If the case eventually settles or a jury awards an amount over that limit, you could theoretically be on the hook for the difference. This is called an excess judgment, and it's a scary prospect.

But here's the crucial part: your insurance company and the lawyer they hire have a legal duty to protect you from that exact scenario. Their job is to fight to resolve the case within your policy limits. It’s a very serious responsibility they have.

How Long is This Going to Drag On?

The legal system moves at a notoriously slow pace. If you're expecting a quick resolution, it's best to adjust your expectations now. The timeline for an Oregon car accident lawsuit can swing wildly depending on a few key things:

- The Stakes: A simple rear-ender claim is going to move much faster than a complex crash involving multiple vehicles and life-altering injuries.

- The Court's Schedule: Local courts get backlogged just like everything else. Sometimes you're just waiting for an open date on the judge's calendar.

- The People Involved: If everyone is motivated to find a reasonable middle ground, a settlement can happen in months. If one side digs in their heels, you could be looking at a year or more.

Realistically, you should prepare for the process to take anywhere from six months to two years from the day you're served to the day it's fully resolved.

It's a marathon, not a sprint. The "discovery" phase alone—where both sides are just gathering facts and evidence from each other—can take several months. Your lawyer will give you a much better estimate once they've had a chance to dig into the specifics of your case.

How Will This Lawsuit Affect My Driving Record and Insurance Rates?

This is another major concern. The lawsuit itself isn't what dings your record or your rates, but the underlying accident certainly can.

Your official driving record, which the Oregon DMV maintains, cares more about traffic tickets and criminal convictions (like a DUI) than a civil lawsuit. The at-fault accident will likely be noted, but the lawsuit is a separate civil matter.

Your insurance rates, however, are a different story. When your policy comes up for renewal, an at-fault accident that resulted in a payout will almost certainly cause your premiums to go up. Insurance is a game of risk, and from their perspective, you've become a higher-risk driver. The lawsuit is just a symptom of the accident that they are now having to pay for.

It's also helpful to understand the statute of limitations, which sets the deadline for when the other driver could file their lawsuit in the first place. Knowing these timeframes helps explain why you might be getting sued months, or even a year or more, after the actual accident.

Facing a lawsuit is a serious matter, and you don't have to go through it alone. The experienced team at Bell Law is dedicated to guiding Oregon residents through the complexities of personal injury claims. If you need expert legal representation, contact us to protect your rights and secure your peace of mind. Visit us at https://www.belllawoffices.com to learn how we can help.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.