Your Guide to Oregon Bodily Injury Claims

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Your Guide to Oregon Bodily Injury Claims

When someone else’s carelessness leaves you hurt, a bodily injury claim is the formal step you take to get financial help from their insurance company. Think of it as a detailed request to cover your medical treatments, the wages you've lost, and the real-world pain and suffering you're going through.

What a Bodily Injury Claim Really Means

"Bodily injury claim" sounds like dense legal jargon, but the concept is straightforward. It’s the official way to hold the person or company that caused your injury financially responsible for the aftermath.

This process isn't limited to car crashes. A valid claim can spring from all sorts of everyday situations:

- Slipping on an unmarked wet floor at a big-box store.

- Getting hurt by a product that was poorly designed or manufactured.

- A dog bite that happens on someone else's property.

- Tripping on a broken step at an apartment complex.

The core idea is to make you financially "whole" again, or at least as much as possible. It’s a recognition that an injury isn’t just a one-time event; it sends ripples through your life, affecting everything from your bank account to your ability to enjoy your hobbies.

The Scope of Compensation You Can Pursue

The money you can seek—legally called "damages"—falls into two distinct buckets: economic and non-economic.

Economic damages are the easy ones to tally up. They represent every dollar you've lost or had to spend because of the injury. Non-economic damages are harder to put a number on, but they're just as real. This is compensation for the human toll of the accident: the pain, the stress, and the overall disruption to your life. For a broader look at how this all fits together, check out our guide on navigating the personal injury claims process.

Key Takeaway: A bodily injury claim is more than just a way to pay off your immediate medical bills. It's a comprehensive tool for securing your financial stability, both now and in the future, while also acknowledging the physical and emotional hardship you've been forced to endure.

Why These Claims Are So Common

If you’re thinking about filing a claim, you are far from alone. Personal injury claims are a fixture of our legal and insurance systems. In the U.S., an estimated 39.5 million injuries a year require medical care, and car accidents are the cause in about 52% of those cases.

These numbers show just how common accidents are and why there are established procedures to handle them. Knowing what your claim should include is the first step toward getting the full compensation you deserve under Oregon law. The table below gives a clearer picture of the different types of damages you can claim.

Compensation You Can Pursue in a Bodily Injury Claim

The compensation available in a bodily injury claim is designed to cover both the tangible financial costs and the intangible personal impact of your injury. Here's how it breaks down.

| Economic Damages | Tangible, out-of-pocket financial losses with a clear monetary value. | Hospital bills, surgery costs, prescription medication, and physical therapy sessions. |

| Lost Wages | Income you lost while unable to work during your recovery period. | The salary you missed from taking two months off work to recover from a back injury. |

| Loss of Earning Capacity | Future income you will lose due to a permanent or long-term disability. | A surgeon who can no longer perform operations because of nerve damage in their hand. |

| Non-Economic Damages | Intangible, non-monetary losses related to the personal impact of the injury. | Chronic pain, anxiety, PTSD, depression, and loss of enjoyment of hobbies. |

Ultimately, a well-supported claim addresses every single loss—big and small—that stems from the accident.

Protecting Your Claim in the First 24 Hours

The first day after an injury is chaotic. You're likely in pain, confused, and overwhelmed, but what you do in these initial 24 hours can make or break your bodily injury claim down the road.

Your absolute first priority is your health. Get to a doctor, urgent care, or the emergency room right away. This isn't just about feeling better; it creates a crucial medical record that time-stamps your injuries and officially links them to the incident. Insurance adjusters love to see a delay in treatment. They’ll argue that if you waited a few days to see a doctor, your injuries must not be that serious—or that something else must have caused them. Don’t hand them that argument on a silver platter.

Your On-the-Scene Documentation Checklist

After you've handled your immediate medical needs, your next job is to become a detective. The scene of an accident can change in minutes, and memories start to get fuzzy almost immediately. You need to capture the evidence while it’s fresh.

- Photos and Videos Are Your Best Friend: Pull out your phone and start recording. Get wide shots of the whole area, close-ups of the hazard that caused your injury (a patch of ice, a broken stair, a spillage), and clear photos of any visible injuries like cuts or bruises.

- Find Your Witnesses: If anyone saw what happened, ask them for their name and number. Their story backs up yours, and a statement from a neutral third party is incredibly persuasive.

- Write It All Down: As soon as you have a quiet moment, write down everything you remember. I mean everything—the date, the exact time, the location, what the weather was like, and exactly what happened, step by step.

This collection of evidence essentially freezes the moment in time, preventing important facts from being forgotten or argued over later.

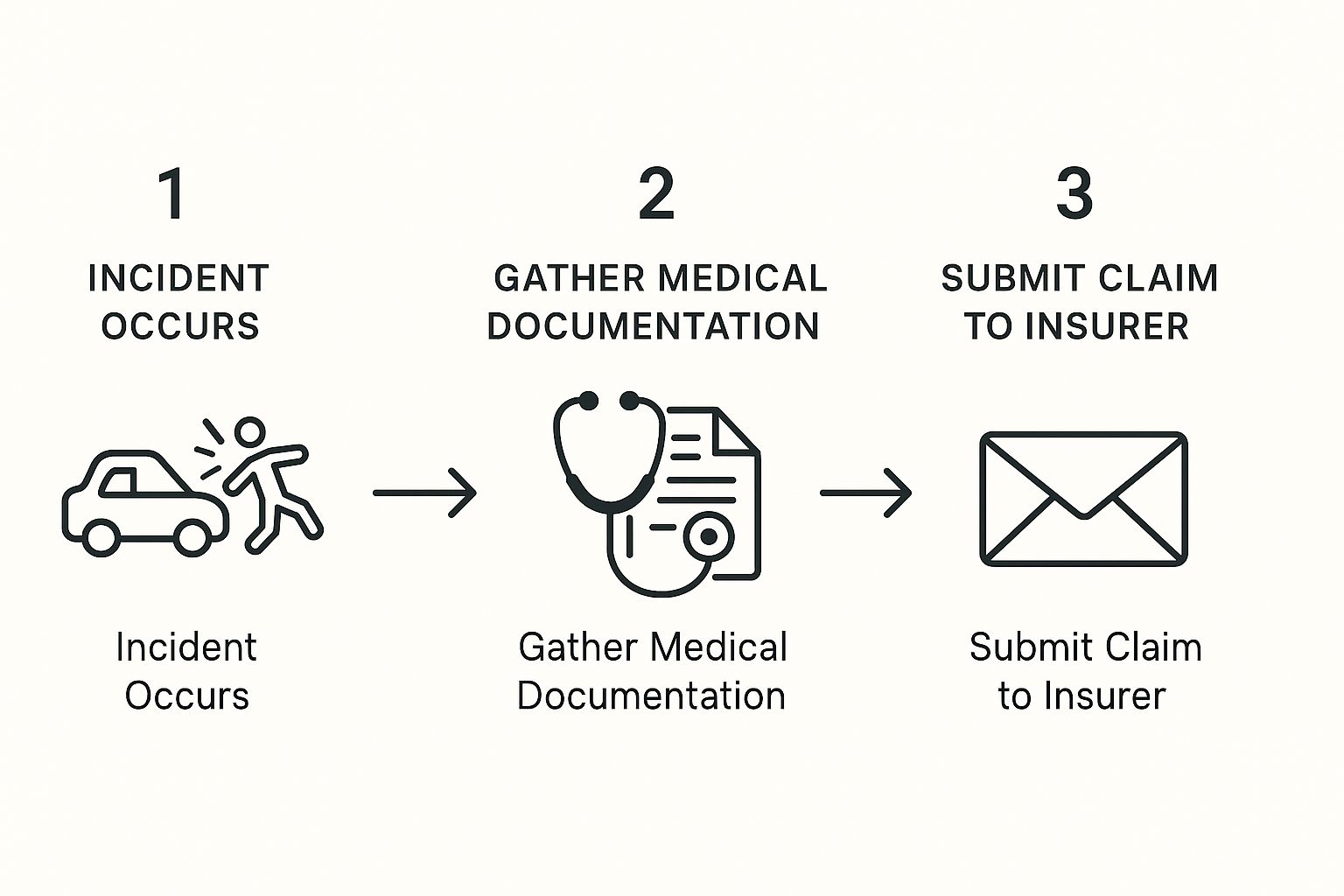

The journey from getting hurt to getting paid starts with these fundamental actions. This visual gives a good overview of the general process.

As you can see, getting that early proof, especially the medical documentation, is the bedrock of your entire claim.

What to Say and What to Avoid

You'll almost certainly have to talk to someone right after the incident—a manager, the property owner, or maybe even their insurance company. Choose your words carefully.

Stick to the simple, objective facts. "I slipped on water in aisle three," or "Your dog ran out and bit my leg." That's it. Do not apologize or say anything that could sound like you're taking the blame. A simple, well-meaning "Oh, I'm so sorry this happened" can be twisted by an adjuster to mean you were admitting you were somehow at fault.

Crucial Tip: Never, ever give a recorded statement to the other party’s insurance adjuster without speaking to an attorney first. They are trained to ask leading questions designed to trip you up, minimize your injuries, or get you to contradict yourself. You are not required to give them one.

And a modern piece of advice: stay off social media. Insurance companies hire people to comb through your profiles looking for anything that contradicts your claim. A photo of you at a family barbecue, even if you're in pain, can be used to argue that your injuries aren't affecting your quality of life.

When an injury happens in a vehicle, knowing exactly how to file a car insurance claim provides a solid framework for navigating the chaos. Having a clear set of steps helps ensure nothing critical gets missed.

Ultimately, how you handle yourself in that first day sets the tone for everything that follows. By getting medical care, documenting everything, and being careful with your words, you build a strong foundation for your claim and protect your right to fair compensation.

How To Build A Rock-Solid Evidence File

Right after an injury, you’re trying to heal and make sense of what happened. Yet proving your claim takes just as much effort as getting back on your feet.

Every form, photograph, and note you collect becomes a piece of your story. When it’s laid out clearly, adjusters find it tough to ignore.

Documenting Your Medical Journey

Building a case starts with medical documentation that shows exactly where, when, and how you were treated.

- All Physician and Specialist Reports: Gather every note, diagnosis, and follow-up plan from your primary doctor, surgeons, chiropractors and any other experts involved.

- Imaging Results: Keep copies of X-rays, MRIs and CT scans alongside the radiologist’s interpretation.

- Bills and Receipts: Organize itemized statements from hospitals or clinics, plus receipts for prescriptions, braces or over-the-counter supplies.

Exploring rehab options like physiotherapy at home can also strengthen your file by highlighting your commitment to recovery.

Expert Tip: Request a full copy of your records from each provider’s “records department” right away. If you wait until the end, you could face frustrating delays—and missing clinical notes can weaken your position.

Proving Your Financial Losses

Accurate numbers turn a vague “lost wages” claim into something insurers must reckon with.

- Pay Stubs: Pull your earnings history before the accident to establish a baseline, then show what you missed afterward.

- Employer Letter: Ask HR or a supervisor for an official statement on company letterhead detailing your role, pay rate and the dates you couldn’t work.

- Self-Employment Records: If you run your own business, collect invoices, bank statements and tax returns that reflect the income you lost.

Presenting these items side by side makes it almost impossible for an adjuster to dispute the total.

Capturing The Non-Economic Impact

Not all losses come with a price tag. Your pain, stress and lifestyle disruption need a voice—and that’s where a pain journal shines.

- Daily Pain Level: Rate discomfort on a scale of 1 to 10.

- Specific Symptoms: Note whether the pain is sharp, dull, throbbing or burning and exactly where you feel it.

- Day-to-Day Challenges: Record tasks you couldn’t do, like cooking dinner or playing with your kids.

- Emotional Reflections: Jot down feelings of anxiety, frustration or helplessness.

Imagine a broken-leg recovery journal entry:

“I woke up at 4 AM with a throbbing 8/10 pain, couldn’t dress without help, and had to miss my daughter’s recital. Felt overwhelmed and trapped.”

That genuine, human detail gives your claim a compelling edge that numbers alone can’t achieve.

Winning the Insurance Negotiation Game

Alright, you've done the hard work of gathering your evidence. Now it's time to deal with the insurance company. This is where most people get nervous, and for good reason. But your preparation is your best defense.

The insurance adjuster you'll be speaking with is a professional negotiator. Their job, plain and simple, is to protect their company's profits by paying you as little as they can get away with. It's crucial to remember this from your very first conversation. They might sound friendly and concerned, but they aren't your advocate.

Keep all your interactions professional and firm, always circling back to the facts you’ve meticulously collected.

Crafting a Powerful Demand Letter

Your first official move in the negotiation process is to send a demand letter. Think of this as the opening argument for your case. It’s a formal document that lays out your entire bodily injury claim in a clear, organized way and sets the tone for everything that follows.

A well-written demand letter needs to cover a few key points:

- The Facts: Start with a brief, clear summary of how the accident happened, making it obvious why the other party is at fault.

- Your Injuries: Describe the injuries you suffered and how they've impacted your life, referencing your medical documentation.

- Economic Damages: Create an itemized list of all your hard costs—every single medical bill, lost paycheck, and other out-of-pocket expense.

- Non-Economic Damages: This is where your pain journal comes in. Use it to explain the real-world impact of your physical pain, emotional distress, and suffering.

- Your Demand: End with a clear, specific dollar amount that you believe is fair compensation for everything you've been through.

This letter is your opportunity to frame the narrative on your terms. When an adjuster sees a logical, well-supported case right from the start, they know you’re serious and have done your homework.

Recognizing and Countering Common Adjuster Tactics

Insurance adjusters have a playbook, and their tactics are pretty predictable. If you know what to expect, you can stay in control and avoid making a critical mistake.

One of the first things you'll almost certainly encounter is a quick, lowball offer. The adjuster might call you just days after the accident, sound incredibly sympathetic, and offer a check for a couple of thousand dollars to "help with your immediate needs." This is a trap. The amount is almost always a tiny fraction of what your claim is actually worth. They are betting that you're stressed and need cash, hoping you’ll take the money before you understand the full extent of your injuries. The best response is to politely say no and explain that you're still evaluating your damages.

Another classic move is asking you for a recorded statement. They are trained to ask questions in a way that can trip you up, get you to downplay your injuries, or even make it sound like you were partially at fault. You are not legally required to give a recorded statement, and it’s almost always a bad idea to do so.

Key Insight: Never sign anything, cash a check, or agree to a recorded statement from an insurer without understanding exactly what you're agreeing to. An adjuster's primary goal is to close your bodily injury claim as quickly and cheaply as possible.

Navigating the Negotiation Process

Once you send your demand letter, the adjuster will come back with a counteroffer—and it will be much lower. Don't be discouraged; this is how the game is played. Your job now is to respond, pushing back with specific evidence from your file to justify your original number. For a closer look at this back-and-forth, our guide offers more detailed advice on https://www.belllawoffices.com/how-to-negotiate-insurance-settlement/.

The stakes are high. In 2022 alone, motor vehicle accidents resulted in 5.2 million medically consulted injuries. The total economic cost of fatal crashes in the U.S. is estimated to be a staggering $417 billion each year. These numbers, covering everything from medical treatment to legal fees, show why insurance companies fight so hard to minimize what they pay out on every single claim.

Remember to consider all your financial losses. For example, even after your car is repaired, it's worth less than it was before the crash. Taking some time for understanding diminished value claims can add another important layer to your negotiation.

Ultimately, successful negotiation is a marathon, not a sprint. Stay calm, stick to the facts you’ve gathered, and don't be afraid to hold your ground for the fair compensation you rightfully deserve.

Knowing When You Need a Lawyer on Your Side

It can be tempting to handle a bodily injury claim on your own, especially if the accident seems straightforward. For minor bumps and bruises with clear fault, that might be a viable path. But some situations are far more complicated than they appear on the surface, and going it alone can put you at a serious disadvantage.

Knowing the red flags is key. Remember, you’re not just dealing with the person who caused the accident; you’re up against their insurance company. These are massive corporations with teams of adjusters and lawyers whose primary goal is to protect their bottom line by paying out as little as possible. It's an uneven fight from the get-go.

Clear Signals to Call an Attorney

Certain scenarios should be an immediate sign to pick up the phone and get professional legal advice. These aren't just minor hiccups; they're game-changers that can dramatically alter your claim's outcome.

If you’ve suffered a severe or long-term injury, the true cost isn't just about the initial hospital bills. The full financial impact might not be clear for months or even years. This is especially true for injuries like:

- Traumatic brain injuries (TBIs)

- Spinal cord damage

- Complex fractures that need surgery

- Any injury leading to permanent disability or disfigurement

An experienced attorney knows how to think long-term. They work with medical and financial experts to project those future costs, making sure any settlement covers a lifetime of potential needs, not just today's expenses.

Another major red flag is when the insurance company disputes who was at fault. They might try to pin some or all of the blame on you. In Oregon, this can drastically reduce—or even completely wipe out—your compensation. A lawyer’s job is to build a rock-solid case that proves the other party’s negligence.

Expert Insight: If an insurance adjuster starts questioning your version of events, pushes a quick lowball offer, or pressures you into giving a recorded statement, they're not trying to help. They are building a case against you. That's your cue to stop talking and find legal representation.

What a Lawyer Actually Does for Your Claim

Hiring an attorney is about more than just having someone make phone calls for you. You're bringing in a strategist who knows the system inside and out and can manage every moving part of your claim.

A good lawyer immediately takes over all communication, shielding you from the high-pressure tactics of insurance adjusters. They handle the complex legal paperwork, launch their own investigation to gather evidence, and make sure every critical deadline—like Oregon’s statute of limitations—is met. For a more complete picture, check out our guide on hiring a personal injury attorney.

The personal injury law field is massive. In 2023, it was a $57 billion industry in the U.S., with roughly 164,559 attorneys practicing in this area. Yet, only about 4-5% of bodily injury claims actually go to trial. This shows just how critical skilled negotiation is to securing a fair settlement outside of court. You can read more about these market dynamics and what they mean for insurance claims.

Understanding the Contingency Fee Model

One of the biggest things that holds people back from calling a lawyer is the fear of cost. The good news is that nearly all personal injury attorneys in Oregon work on a contingency fee basis. This system is designed to remove the financial barrier to getting expert legal help.

Here’s a simple breakdown of how it works:

- No Upfront Costs: You don't pay a dime out of your own pocket to get your case started.

- Fees Are "Contingent" on Success: The lawyer’s fee is a set percentage of the settlement or court award they win for you.

- You Pay Nothing If You Lose: If your lawyer doesn't secure a recovery for you, you owe them nothing in attorney fees.

This model is a game-changer. It means your lawyer's interests are perfectly aligned with yours—they are financially motivated to get you the best possible outcome. It truly levels the playing field, giving you access to the same caliber of legal expertise that insurance companies have.

Common Questions About Oregon Injury Claims

After an accident, the last thing you need is confusing deadlines and legal jargon. Oregon’s rules around bodily injury claims have some quirks you’ll want to know. Below, you’ll find clear answers to the questions we hear most often.

Think of this as your personal roadmap through Oregon’s injury system. Armed with these insights, you’ll sidestep common mistakes and make smarter choices as you move forward.

What Is Oregon’s Statute Of Limitations For A Claim

Time is crucial. In Oregon, you have two years from the injury date to file a personal injury lawsuit. Miss that deadline, and you typically forfeit your right to any compensation.

The clock starts ticking the moment you’re hurt. While there are a handful of rare exceptions, you shouldn’t count on them—acting quickly is your best strategy.

Crucial Takeaway: The two-year window doesn’t pause. Filing late can destroy your case.

How Is Pain And Suffering Calculated Here

Putting a dollar sign on pain and suffering isn’t straightforward. This category covers your physical discomfort, emotional distress, and the loss of everyday activities.

There’s no one rigid formula in Oregon, but many attorneys rely on a simple multiplier method:

- Tally Up Economic Damages: Add medical bills, lost wages, and other out-of-pocket costs.

- Select A Multiplier: Usually between 1.5 and 5, based on injury severity (minor sprain ≈ 1.5; permanent disability ≈ 5).

- Generate A Starting Figure: Multiply your economic damages by that number.

For instance, if your bills and lost income total $10,000 and you need months of therapy, a multiplier of 3 would suggest $30,000 for pain and suffering. Remember, it’s an opening bid for negotiations, not a guaranteed award.

What If The At-Fault Driver Is Uninsured

Getting hit by an uninsured motorist can feel like a nightmare. Fortunately, your own policy likely includes protections—unless you explicitly declined them.

Key coverages to check:

- Uninsured Motorist (UM) Coverage: Pays for your medical bills and pain and suffering when the other driver has no insurance.

- Underinsured Motorist (UIM) Coverage: Kicks in when the at-fault driver’s limits aren’t enough.

Oregon mandates UM/UIM coverage unless you opt out in writing. It might feel odd to claim against your own insurer, but that’s exactly what these benefits are designed for—to back you when someone else drops the ball.

If you’re navigating the complexities of a bodily injury claim, you don’t have to do it alone. The experienced attorneys at Bell Law are here to defend your rights and pursue the full compensation you deserve. Contact us today for a free, no-obligation consultation: https://www.belllawoffices.com

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.