Using a Car Accident Compensation Calculator

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Using a Car Accident Compensation Calculator

Wondering what your car accident claim might actually be worth? A compensation calculator is a great place to start. It gives you a ballpark estimate by adding up your concrete financial losses and then applying a formula to figure out a value for your pain and suffering.

The whole point is to get a rough idea of what a fair settlement could be before you're on the phone with an insurance adjuster. It helps set realistic expectations.

How a Compensation Calculator Estimates Your Claim

When you plug your details into a car accident compensation calculator, you're essentially running a simplified personal injury valuation. It’s not just pulling numbers out of thin air. The logic mimics the initial formulas that insurance companies often use themselves, breaking the claim down into two main buckets.

The Foundation: Your Economic Damages

First things first, you have to tally up your economic damages. These are all the direct, out-of-pocket financial losses you've racked up because of the crash. Think of these as the "hard numbers" of your claim—the items you have receipts and statements for.

A good calculator will ask you to enter specific totals for things like:

- Medical Bills: This is a big one. It covers everything from the ambulance ride and ER visit to surgery, physical therapy, prescriptions, and follow-up appointments with specialists.

- Lost Wages: This isn't just your base salary. You need to include any income you lost while you couldn't work, such as missed overtime, bonuses, or commissions you would have otherwise earned.

- Property Damage: This is usually the cost to fix or replace your car. But don't forget other personal items that might have been wrecked in the crash, like a laptop, cell phone, or even eyeglasses.

These figures create the solid, factual base of your settlement estimate. Getting these numbers right is absolutely crucial; if you miss something, your initial valuation will be way too low.

A common mistake is only including bills you've already paid. You must also account for future medical needs—like a recommended surgery or continued therapy—to get a truly accurate picture of your economic losses.

The Human Side: Non-Economic Damages

The second piece of the puzzle is much more subjective: non-economic damages. This is the legal term for "pain and suffering." Unlike a medical bill, these losses don't come with a neat price tag, which is where the "calculator" function really kicks in.

Most of these tools use what's called a multiplier method to put a number on your suffering. Here’s how it works: the calculator takes your total economic damages and multiplies that figure by a number, typically somewhere between 1.5 and 5.

The multiplier itself depends entirely on how severe your injuries are and how much they've impacted your life. For instance, a minor case of whiplash that resolves in a few weeks might get a 1.5 multiplier. On the other hand, a serious, permanent injury that required surgery and changed your ability to work or enjoy life could easily justify a multiplier of 4 or 5.

Below is a table that breaks down the key factors that go into this calculation, whether you're using a calculator or working with an attorney.

Key Factors Influencing Your Compensation Estimate

This table summarizes the primary inputs that determine the final value of a car accident claim, used by both calculators and legal professionals.

| Economic Damages | Medical bills, lost income, vehicle repair/replacement costs. | Forms the concrete, verifiable base value of the claim. |

| Injury Severity | Whiplash, broken bones, spinal cord injury, traumatic brain injury. | Directly influences the "multiplier" for non-economic damages. |

| Impact on Life | Inability to work, chronic pain, loss of hobbies, emotional distress. | A higher impact leads to a higher multiplier and overall value. |

| Recovery Period | Weeks, months, or permanent disability. | Longer and more difficult recoveries increase the claim's value. |

Ultimately, a good estimate combines these quantifiable costs with a reasonable figure for the human toll of the accident. In 2022, the average auto liability claim for bodily injury in the U.S. was around $26,501, which shows just how significant these claims can be. If you want to dive deeper, you can learn more about the components of vehicle accident claims.

Getting a Real Number for Your Economic Damages

The bedrock of any solid car accident claim is the hard numbers. We call these economic damages, and they represent every single dollar you've lost because of the crash. If you want to get a realistic estimate from a car accident compensation calculator, you have to be almost obsessive about tracking these costs.

This isn't just about collecting a pile of hospital bills. It's about creating a detailed ledger of every expense, starting from the very moment the accident happened.

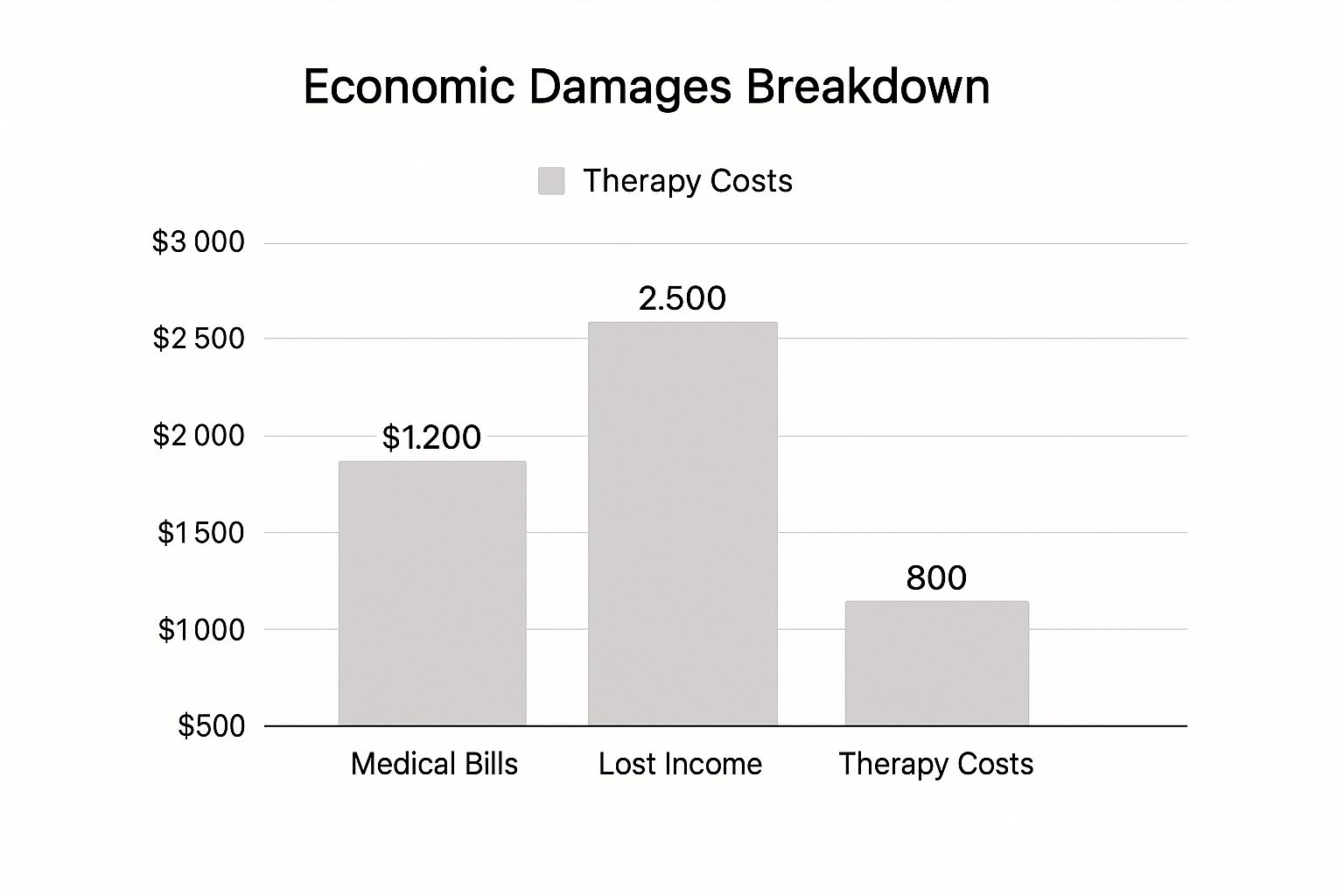

This infographic gives you a great visual breakdown of where these costs typically come from.

As you can see, what people often miss is that lost income can be a huge piece of the puzzle, sometimes even bigger than the initial medical expenses.

Rounding Up All Your Medical and Related Expenses

First things first, let's get all your medical paperwork in one place. And I don't just mean the big summary bill from the hospital. You need a complete file of every single related cost, big or small.

- The Immediate Aftermath: Dig up the receipts for the ambulance ride, the ER visit, and any urgent care you needed right after the crash.

- Ongoing Medical Care: This is a big one. It includes bills from your surgeon, any specialists you saw, your family doctor, and all those physical therapy appointments. Also, make sure you have the costs for any X-rays, MRIs, or CT scans.

- Prescriptions and Equipment: Don't forget the little things. Pharmacy receipts for your prescriptions and invoices for things like crutches, a wheelchair, or special braces all add up.

- What's Down the Road: This is crucial. If your doctor has said you'll likely need another surgery or long-term physical therapy in the future, the projected cost for that care is a vital part of your claim. A calculator can only work with the numbers you give it, and leaving out future medical needs is one of the most common mistakes people make.

Figuring out how to handle all these bills as they come in can be overwhelming. For a deeper dive, take a look at our guide on what to do about your car accident medical bills.

Accounting for Lost Wages and Damaged Property

Now, let's talk about the other financial holes the accident created. Being unable to work is a massive one. Calculating your lost income isn't as simple as just grabbing a couple of missed pay stubs. You need to think bigger and account for all your lost earning potential. This includes any missed overtime, bonuses you were on track to earn, or sales commissions you lost out on while you were recovering.

Then there's your property. Most of this will be the cost to either fix or replace your car. But it's gotten more complicated recently. Even though there are fewer accidents, the value of vehicles is on the rise. In fact, the value of total-loss vehicles has jumped about 8.5% above what we'd normally expect. This makes getting an accurate estimate for your car's value more critical than ever.

Let's Walk Through an Example: Say you broke your arm in the accident. You'd pull together the hospital invoices (let's say $4,500), your pay stubs showing you missed two full weeks of work (another $2,000), and the pharmacy receipts for your pain medication ($150). Just like that, your initial economic damages add up to $6,650. That's the solid, evidence-backed number you need to start with.

Putting a Number on Pain and Suffering

Tallying up your medical bills and lost paychecks is relatively simple—it's just math. But how do you put a price on the actual pain you've endured? What's the dollar value for the emotional distress or the loss of enjoyment in your life? This is where a settlement calculation gets tricky, and it's often the most significant part of your claim.

These intangible losses are what we in the legal world call non-economic damages. Since a settlement calculator can't actually feel your pain, it has to rely on a common industry formula to come up with an estimate. This is known as the multiplier method.

At its core, the multiplier method is straightforward. You take the total of your concrete financial losses (economic damages) and multiply that figure by a number, which we call the "multiplier." This number usually falls somewhere between 1.5 and 5. The more severe, permanent, and life-altering your injuries are, the higher that multiplier climbs.

How Injury Severity Drives the Multiplier

Picking the right multiplier is crucial, and it’s not just a guessing game. It's directly tied to the seriousness of your injuries, how long your recovery takes, and the overall impact the accident has had on your day-to-day life. Insurance adjusters will scrutinize your medical records and treatment history to justify the number they use.

Think about it this way: a minor whiplash injury that clears up after a few weeks of physical therapy isn't going to command a high multiplier. The impact was temporary and you made a full recovery. In a case like that, a multiplier of 1.5 or 2 might be appropriate.

But if you suffered an injury that required surgery—like a herniated disc or a shattered bone—the whole picture changes. You're now dealing with a long, difficult recovery, potential long-term complications, and the mental toll that comes with it. For these kinds of severe injuries, a multiplier of 3.5, 4, or even 5 is much more realistic.

The multiplier is what tells the human story behind the cold, hard numbers. It's meant to account for the chronic pain that keeps you up at night, the inability to play with your kids, or the depression that can set in after a traumatic injury.

This is a fundamental aspect of any bodily injury claim. Getting a handle on how multipliers work is one of the best ways to understand what a fair settlement offer could look like for you.

To make this clearer, here's a general guide for how multipliers often correspond to different levels of injury.

Pain and Suffering Multiplier Guide

| Minor | 1.5 - 2.5 | Soft tissue sprains, whiplash, or bruising with a full recovery in a few months. |

| Moderate | 2.5 - 3.5 | Simple bone fractures, a concussion, or injuries requiring extended therapy. |

| Severe | 3.5 - 5+ | Injuries requiring surgery, resulting in permanent limitations, or chronic pain. |

Keep in mind this is a simplified guide. Every case has unique details that an insurance company—and your attorney—will consider when negotiating this figure.

Comparing Scenarios With a Multiplier

Let's look at two real-world examples to see just how dramatically the multiplier can affect the bottom line.

- Scenario A (Minor Injury): Someone is in a fender-bender and has soft tissue injuries. Their total economic damages (doctor visits, therapy, missed work) come to $4,000. Because the injury was minor and they recovered quickly, a 1.5x multiplier is used.

- Pain and Suffering: $4,000 x 1.5 = $6,000

- Total Estimated Claim: $4,000 (Economic) + $6,000 (Non-Economic) = $10,000

- Scenario B (Serious Injury): A driver in a more serious crash suffers a broken leg that needs surgery. Their economic damages total $30,000. The long recovery, permanent limp, and significant pain justify a 4x multiplier.

- Pain and Suffering: $30,000 x 4 = $120,000

- Total Estimated Claim: $30,000 (Economic) + $120,000 (Non-Economic) = $150,000

As you can see, the multiplier does the heavy lifting. It's what transforms the raw numbers from your bills into a figure that more accurately reflects everything you’ve been through.

How Fault and Policy Limits Change the Final Number

The number a settlement calculator spits out is a great starting point, but it's just that—a start. Two major real-world factors, fault and insurance limits, can drastically change the amount you actually pocket. This is where a raw estimate collides with the hard realities of the legal and insurance systems.

A calculator's initial total usually assumes the other driver was 100% to blame, but life is rarely that clean-cut. If an investigation shows you were partially responsible for the wreck, your final compensation will be reduced. This is all thanks to a legal doctrine called comparative negligence.

When you're trying to figure out how fault might impact your claim, it's vital to get comfortable with the numbers. A solid grasp of understanding percentages in legal claims can help you set much more realistic expectations for what a fair settlement looks like.

The Impact of Comparative Negligence

How much your settlement gets cut depends entirely on the laws where you live. The rules generally fall into one of two buckets, and the difference between them is massive.

- Pure Comparative Negligence: In states with this rule, your compensation is simply reduced by your exact percentage of fault. If you were 20% at fault, you can still recover 80% of your damages. It’s straightforward math.

- Modified Comparative Negligence: This is the most common system. Here, you can only recover damages if your fault is below a certain line—usually 50% or 51%. Cross that line, and you get absolutely nothing.

Real-World Example: Let's say your total damages add up to $100,000, but the investigation finds you were 20% at fault.

- In a "pure" state, your award drops to $80,000.

- In a "modified" state, you'd also get $80,000.

- But if you were found 60% at fault? You'd get $40,000 in a pure state but $0 in a modified state. A huge difference.

The Hard Cap of Insurance Policy Limits

The second big hurdle is the at-fault driver's insurance policy limit. No matter how high a calculator estimates your damages, you simply can't squeeze more money out of an insurance policy than it holds.

If the driver who hit you only has a $50,000 bodily injury liability limit, their insurance company will not pay a penny more than that. It doesn't matter if your medical bills and lost wages are $150,000; their legal obligation stops at $50,000.

This is why it's so important to understand the role of underinsured/uninsured motorist coverage on your own policy. Once the other driver's insurance is exhausted, you might need to turn to your own coverage to fill the gap. Knowing these limits helps you move from a theoretical estimate to a practical negotiation target.

Knowing When to Go Beyond the Calculator

An online car accident compensation calculator is a fantastic starting point. It gives you a clean, data-driven estimate that can help manage your expectations and provide a solid reference number when you first speak with an insurance adjuster. But you have to know its limits.

These tools are built to crunch clean numbers. They're great at adding up your existing medical bills and applying a standard formula. The problem is, real-life accidents are rarely that neat and tidy.

Signals Your Case Needs a Human Expert

Certain factors can make a calculator's estimate completely miss the mark. These are the red flags telling you that the unique details of your case are too complex for an automated tool. If you see your situation in the points below, it’s probably time to talk to a professional.

You should seriously consider consulting an attorney if your accident involves:

- Long-Term or Permanent Injuries: A calculator has no way of predicting the true cost of injuries that require future surgeries, years of physical therapy, or lead to a permanent disability. An experienced attorney knows how to project these lifetime costs, including future medical care and your lost earning capacity.

- Disputed Liability: Is the other driver's insurance company trying to pin some or all of the blame on you? A calculator works on the assumption that the other party is 100% at fault. When liability is a fight, you need a real person to investigate the crash and defend your right to fair compensation.

- Multiple Parties Involved: Crashes with more than two cars, or collisions involving commercial vehicles like a semi-truck, are a different ballgame. These scenarios can involve a tangled web of insurance policies and corporate legal teams that a simple calculator just isn't designed for.

- A Shockingly Low Offer: If the insurance company’s initial offer is worlds away from what even a basic calculator suggested, that’s a major warning sign. It usually means they're planning to fight you on the severity of your injuries or the necessity of your medical treatments.

A calculator gives you a snapshot of what's already happened. It can't think ahead, anticipate the insurance company's next move, or tell the powerful story of how this accident truly turned your life upside down.

Taking the Right Next Step

Catching these complexities early on is crucial. An attorney can start gathering the sophisticated evidence needed to prove your case's actual value, from hiring medical experts to commissioning accident reconstruction reports. Understanding the full car accident settlement process makes it clear why this level of expert guidance is so vital.

If you do decide to schedule a consultation, be ready. Bring everything you have: the police report, all medical bills and records, pay stubs showing lost income, and any photos of the scene and your injuries. With this information, an attorney can give you a far more precise and personalized valuation of your claim than any online tool ever could.

Got Questions? We’ve Got Answers.

Even when you know what numbers to plug in, using a car accident compensation calculator can feel a bit like guesswork. They’re a fantastic starting point, but the number they spit out isn’t the final word. Let’s clear up a few of the most common questions people have.

Getting a handle on these details makes the calculator a much more powerful tool in your corner. You’ll go from just getting a rough number to strategically preparing for what’s ahead.

So, How Accurate Are These Calculators Anyway?

Think of a calculator's result as a solid ballpark figure, not a guaranteed check. Its accuracy is only as good as the information you feed it. For a simple case with clear-cut bills and minor injuries, the estimate can be a pretty reliable benchmark to have.

But here’s the thing: a calculator can’t account for the human element or legal twists. It doesn't understand the nuances of your state's comparative negligence laws or the hardball negotiation tactics an insurance adjuster will definitely use. It gives you a great starting point, but it’s never the final say.

The Bottom Line: A calculator provides a baseline. Your final settlement will be hammered out through negotiation, the strength of your evidence, and the unique details of your case that an online tool just can't process.

Should I Really Try to Guess Future Medical Costs?

Yes, and it’s not a guess—it's a critical part of the calculation. If your doctor has already told you that you're looking at more treatment down the road, whether it's physical therapy, prescriptions, or another surgery, you have to include those projected costs.

This isn't just a number you pull out of thin air. You'll typically need a report or formal opinion from a medical expert to back up the necessity and the estimated cost. Overlooking future medical needs is one of the biggest and most expensive mistakes people make. Once you sign that settlement agreement, the case is closed. You can't go back and ask for more later.

What’s the Catch with the Insurance Company’s First Offer?

Accepting the first offer is almost always a mistake. You’re likely leaving a serious amount of money behind. Insurance companies are businesses, and their initial offers are strategically low. They’re testing the waters, hoping you’ll take a quick, cheap payout so they can close the file and move on.

Once you sign their release form, it’s a done deal—forever. That’s true even if you later discover your injuries are far worse than you realized. Always get an independent estimate of your own and talk to a professional before you even think about accepting an offer.

What if the Other Driver Doesn't Have Enough Insurance?

This is exactly why your own Uninsured/Underinsured Motorist (UM/UIM) coverage is so important. It’s a real lifesaver in this situation. If the at-fault driver's policy is too small to cover all your damages, you can turn to your own insurance company and file a claim under your UM/UIM policy to cover the rest.

When you're running the numbers through a calculator, the most important "policy limit" to be aware of isn't just the other driver's—it's the limit on your own UM/UIM coverage.

Trying to figure all this out after a car accident is overwhelming, but you're not in it alone. The experienced attorneys at Bell Law can give your claim a thorough and professional evaluation, making sure every single factor is accounted for to get you the compensation you deserve. Reach out today for a free consultation at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.