Who Pays for Car Accident Medical Bills in Oregon

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Who Pays for Car Accident Medical Bills in Oregon

When you're reeling from a car accident, the last thing you want to do is navigate a maze of medical bills. The big question on everyone's mind is always: who pays for all this?

In Oregon, the answer is surprisingly straightforward. Your own auto insurance is the first to step up, specifically your Personal Injury Protection (PIP) coverage. This is true no matter who was at fault for the crash, and it's designed to get you the medical care you need, right away.

Understanding Your First Financial Steps After a Crash

Think of your PIP coverage as your financial first responder. It’s there to cover your initial ER visit, follow-up appointments, and other immediate medical costs without having to wait for the insurance companies to duke it out over who caused the collision.

This system creates a crucial buffer. It allows you to focus on what truly matters—your recovery—while the fault and other legal details are sorted out in the background.

Why Immediate Coverage Matters

Getting medical attention right after a crash isn't just about your health; it's also critical for protecting your rights. Any delay in seeing a doctor can give an insurance adjuster an opening to argue your injuries weren't that serious or, worse, that they weren't even caused by the accident.

Knowing what to do in the chaotic aftermath can make a huge difference for both your physical well-being and any potential claim. For a full checklist, you can review this guide on what to do after a car accident.

The financial stakes are incredibly high. Road traffic crashes cost a staggering $3.6 trillion annually across the globe. That figure, which is over 3% of the world's GDP, gives you a sense of the immense economic fallout from these incidents, from emergency care all the way to long-term rehabilitation.

The most important thing to remember is this: you do not have to wait for the at-fault driver's insurance to pay. Your own PIP coverage is your primary resource for immediate medical needs.

To make this crystal clear, here’s a simple breakdown of who foots the initial bill.

Who Pays First for Your Medical Bills in Oregon

This table summarizes the primary payment sources for medical bills immediately following a car accident in Oregon.

| Your PIP Insurance | Immediately after the accident. | This is your primary, no-fault coverage for initial medical care and lost wages, up to your policy limit. |

| Your Health Insurance | After your PIP benefits are used up. | Acts as a secondary payer for costs exceeding your PIP limit, but you'll be responsible for deductibles and co-pays. |

| At-Fault Driver's Insurance | After fault is determined. | This is the source for reimbursement of your out-of-pocket costs and compensation for pain and suffering. |

Ultimately, your PIP coverage is designed to be your safety net, ensuring you're not left in a lurch when you're most vulnerable.

What Your PIP Insurance Typically Covers

So, what exactly does this "financial first responder" take care of? Your Personal Injury Protection is meant to handle the most common and urgent expenses you'll face after an accident.

PIP coverage usually includes:

- Emergency Services: The ambulance ride from the scene and your initial treatment in the emergency room.

- Medical Treatments: Covers things like doctor's visits, necessary surgeries, X-rays, MRIs, and prescription medications.

- Rehabilitation Costs: This includes follow-up care like physical therapy or chiropractic treatments that are essential for your recovery.

- Lost Wages: If your injuries keep you out of work, PIP can also reimburse a portion of your lost income.

This initial layer of coverage is the bedrock of your financial and physical recovery, providing stability long before fault is ever decided.

How PIP Insurance Works in an At-Fault State

Oregon is what's known as an "at-fault" state. In simple terms, this means the driver who causes a crash is financially on the hook for the damage, including everyone's medical bills. But here's the catch: figuring out who's at fault isn't instant. It can take weeks, even months.

So, what are you supposed to do in the meantime? You're hurt, and medical bills start showing up in your mailbox almost immediately. The other driver's insurance company certainly isn't cutting you a check yet. This is exactly where the system can feel broken and confusing.

That gap is precisely why Oregon law requires every driver to carry Personal Injury Protection, or PIP.

Think of your PIP coverage as a financial bridge. It’s there to get you from the moment of the crash to the point where the at-fault insurance company finally pays up. It's a "no-fault" benefit tucked inside an "at-fault" system, designed to give you immediate access to medical funds when you need them most.

Your PIP Is the Financial First Responder

When you're injured in a collision, you can't afford to wait for insurance companies to play detective. You need to see a doctor now. Your own PIP coverage is your first line of defense, stepping in to pay for your initial medical costs and even covering some of your lost income, regardless of who caused the wreck.

This setup is designed to help you:

- Get Treatment Immediately: You can head to the emergency room, see a specialist, or start physical therapy without having to worry about paying for it all upfront.

- Cover Lost Wages: If your injuries keep you out of work, PIP can help pay the bills with wage loss benefits.

- Focus on Getting Better: This allows you to concentrate on your recovery instead of stressing out over how to pay for it.

Basically, your insurance company pays your bills first. Later, they'll go after the at-fault driver's insurance to get that money back through a process called subrogation. That all happens behind the scenes, so you don't have to deal with it.

The costs of these accidents are astronomical. In 2023 alone, the total cost of motor vehicle injuries in the United States was estimated at a staggering $513.8 billion, spread across more than 13.1 million crashes. You can dig into more of these national crash statistics on the National Safety Council's website. With numbers like that, having immediate coverage isn't just a nice-to-have—it's essential.

PIP coverage is your right. It ensures that your access to necessary medical care isn't held hostage by the often lengthy process of determining fault in a car accident.

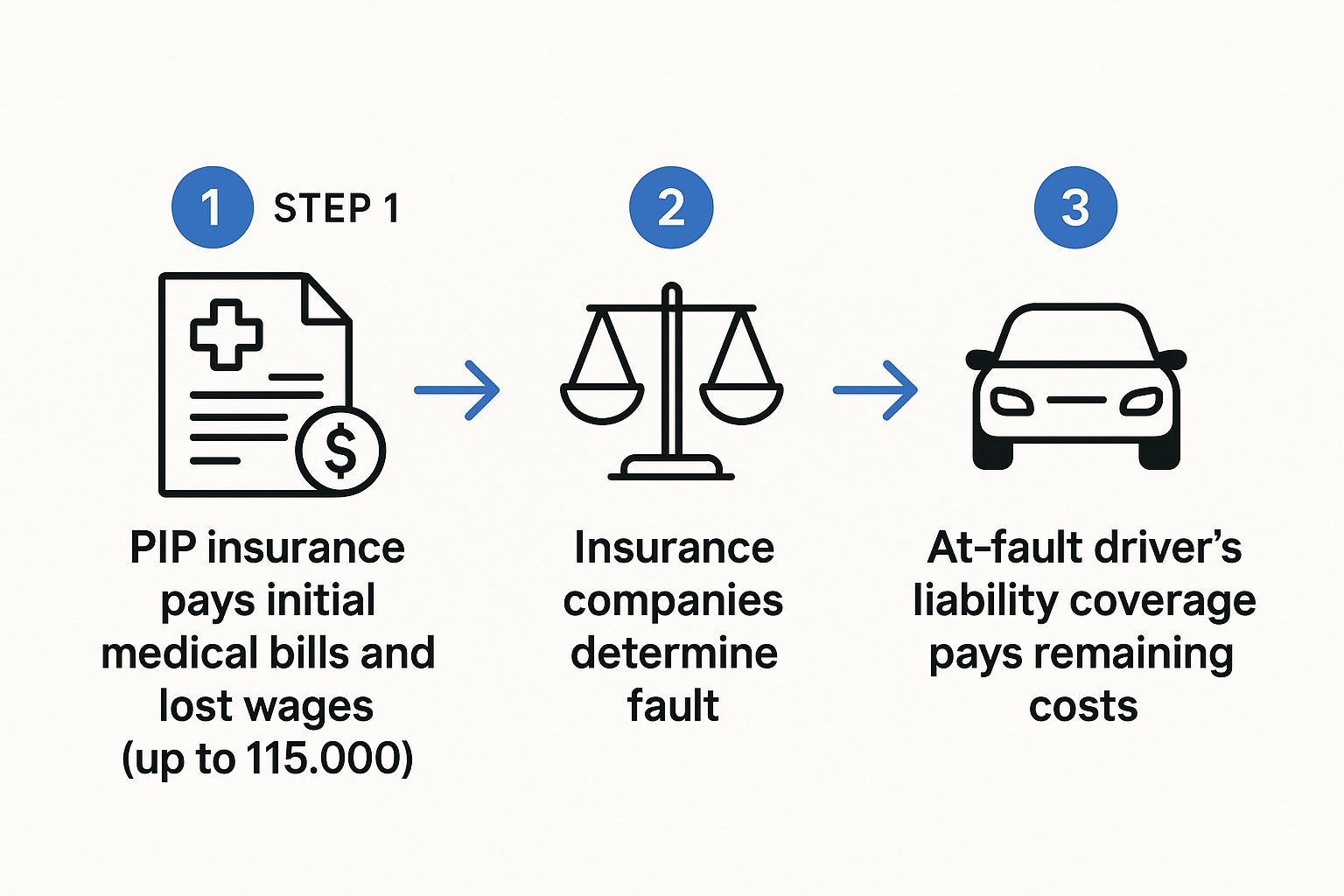

This chart breaks down how your PIP coverage and the at-fault system work together to handle your medical bills.

As you can see, your own PIP coverage is the first resource you tap into. It creates a financial cushion, allowing the fault investigation to run its course without delaying your access to medical care.

Understanding Oregon's Minimum PIP Requirements

To make sure every driver has this crucial protection, Oregon law mandates that all auto insurance policies include a minimum level of PIP coverage.

The state-required minimums are:

- $15,000 in Medical Coverage: This pays for reasonable and necessary medical, hospital, dental, and surgical expenses that you incur within two years of the accident date.

- Wage Loss Benefits: PIP also covers 70% of your lost income, up to a maximum of $3,000 per month. This benefit starts after you’ve missed 14 straight days of work.

While these are just the minimums, it’s often a smart move to purchase higher limits. A single trip to the ER can eat up that $15,000 surprisingly fast. More coverage can provide a much-needed safety net if you suffer a serious injury. Once your PIP benefits are used up, you’ll have to rely on your personal health insurance or pursue a claim against the at-fault driver to cover the rest.

Your Step-by-Step Guide to Using Insurance Coverage

After a car accident, you're suddenly juggling multiple insurance policies, and figuring out which one to use first can feel like a high-stakes puzzle. If you get the order wrong, you could face treatment delays or get stuck with unnecessary out-of-pocket costs.

Thankfully, there’s a clear and logical sequence to follow in Oregon.

Think of it like a relay race for your medical bills. Each type of insurance has a specific role and knows exactly when to pass the baton to the next runner. This system is designed to get you the medical care you need right away, while the question of who ultimately pays gets sorted out later.

This structured approach is more important than ever. The global accident insurance market is growing—projected to hit $159.60 billion by 2034—as the industry looks for better ways to manage accident expenses. You can learn more about the evolving accident insurance landscape and what it means for people like you.

Step 1: Start With Your Own PIP Coverage

Your very first move is always to file a claim under your own Personal Injury Protection (PIP) insurance. In Oregon, PIP is your primary coverage for your initial car accident medical bills, regardless of who was at fault for the crash.

This is that "financial first-aid kit" we talked about. It provides immediate funds for your emergency room visit, follow-up doctor's appointments, and can even cover a portion of your lost wages. The state-mandated minimum is $15,000, which pays for reasonable and necessary medical care you receive within two years of the accident.

Here’s how to get it started:

- Notify Your Insurer: Call your own auto insurance company as soon as you can to report the crash and open a PIP claim.

- Provide Information: You’ll get a claim number and an adjuster. Give this PIP claim information to your doctors and hospital so they can bill your auto insurer directly.

- Track Your Expenses: Keep a close eye on your PIP benefits. Your insurer should send statements showing how much has been paid and how much coverage you have left.

Taking this first step is critical. It gives you immediate financial breathing room while you focus on getting better.

Step 2: Use Your Health Insurance as a Backup

So, what happens when your injuries are serious and the medical costs blow past the $15,000 PIP minimum? This is where your personal health insurance steps in to grab the baton.

Once your PIP benefits are maxed out, your health insurance becomes the primary payer for all your ongoing medical treatments. It's crucial to let your medical providers know about this switch so they can start billing the right insurer without missing a beat.

Key Takeaway: Your health insurance acts as your secondary safety net. It covers the costs that go beyond your PIP limits, but keep in mind you’ll still be on the hook for any deductibles, co-pays, or out-of-network fees that are part of your plan.

Managing this handoff correctly is the key to preventing your medical bills from being sent to collections. It keeps the payments flowing to your healthcare providers, which is essential for uninterrupted treatment.

Step 3: Pursue a Claim Against the At-Fault Driver

The final leg of the relay involves going after the at-fault driver's insurance. After your own PIP and health insurance have covered your immediate needs, the ultimate goal is to get full compensation from the person who caused the wreck.

This is done by filing a third-party claim against their Bodily Injury (BI) liability policy. This claim is designed to "make you whole" again by reimbursing you for every single expense and loss, including:

- The money your PIP insurer paid out.

- Your health insurance deductibles and co-pays.

- Any other medical expenses you paid for yourself.

- Compensation for your pain, suffering, and emotional distress.

Dealing with the other driver's insurance adjuster requires a sharp and cautious approach—their main goal is almost always to pay out as little as possible. Knowing how to deal with insurance adjusters is vital for securing a fair settlement. This is often where an experienced attorney can step in to handle these tough negotiations for you, making sure your rights are protected and you get the compensation you truly deserve.

Navigating the different layers of insurance can be confusing, but thinking of it as a clear sequence of operations helps simplify things. Here’s a quick breakdown of who pays when.

Insurance Coverage Order of Operations

| Your PIP Coverage | Immediately after the accident. | The first $15,000 of medical bills, some lost wages, and other related expenses, no matter who was at fault. |

| Your Health Insurance | After your $15,000 PIP is exhausted. | Ongoing medical care, like physical therapy, specialist visits, and surgeries. You are responsible for deductibles and co-pays. |

| At-Fault Driver's BI | After your initial treatment is covered. | Reimburses your other insurers, covers your out-of-pocket costs, and provides compensation for pain and suffering. |

By following this order, you ensure your bills get paid promptly while building a strong case to recover all your losses from the responsible party.

What To Do When Medical Bills Are More Than Your Insurance Covers

It's the nightmare scenario for any accident victim. You’ve done everything right—you used your PIP, your health insurance kicked in—but the car accident medical bills keep showing up in your mailbox. When the total cost of your care climbs past your coverage limits, the weight of it all can be crushing.

This happens more often than you'd think, particularly after a serious wreck that involves surgery, months of physical therapy, or visits to multiple specialists. But here’s the good news: you have options. You aren't just left to deal with a mountain of debt on your own.

The most important thing is to get in front of the problem. Don't just let the bills stack up. There are concrete steps you can take to manage the shortfall and protect your credit while your personal injury claim is being sorted out. Here's a look at your toolkit for getting back in control when the numbers feel out of control.

Talk Directly with Your Medical Providers

One of the best first moves you can make is to pick up the phone and call the billing departments at the hospital and your doctors' offices. A lot of people don't realize that the price on a medical bill isn't always the final word.

Be open and honest about your situation. Explain that you were in an accident, a personal injury claim is in the works, and your insurance limits have been met. Most of the time, providers would much rather work with you than write the bill off as a total loss.

When you call, you have a few angles to pursue:

- Ask for a Reduction: Politely ask if they offer a lower rate for patients paying out-of-pocket or for those with a pending liability claim.

- Request a Payment Plan: See if they can set you up with an interest-free payment plan. Even small, consistent monthly payments can keep your account in good standing.

- Get an Itemized Bill: Always ask for a detailed, itemized bill. Billing mistakes are incredibly common, and you might spot duplicate charges or line items for services you never actually received.

Taking this direct approach shows you’re acting in good faith and can be the key to keeping your accounts out of collections.

Understanding How Medical Liens Work

When you inform a hospital or clinic that someone else is responsible for your injuries, they might agree to place a medical lien on your future settlement.

Think of a lien as a formal "IOU." Your medical provider agrees to stop trying to collect from you and will wait to get paid until your personal injury case is resolved. In return for their patience, they get a legal guarantee that their bill will be paid directly from your settlement funds—before you get your share.

A medical lien is a powerful tool that lets you continue getting the care you need without paying upfront. It bridges the financial gap, but it also means a slice of your final settlement is already spoken for.

It's absolutely critical to keep track of any liens placed against your claim. A good attorney can often negotiate with these lienholders to lower the final amount they’re owed, which can make a huge difference in the amount of money that ends up in your pocket.

The Role of a Personal Injury Attorney

This is the exact moment when having a skilled personal injury lawyer in your corner becomes invaluable. Trying to negotiate massive medical bills and fend off collectors while you're also trying to heal is an overwhelming burden. An attorney lifts that weight right off your shoulders.

One of the first things they'll do is send a "Letter of Representation" to all your medical providers. This official letter tells them you have a lawyer and that all future bills and calls should go through the law firm. This one action can stop the collection calls and protect your credit score.

Beyond that, a great attorney will:

- Handle All Negotiations: They are pros at talking with medical billing departments to reduce the total amount you owe.

- Manage Your Liens: They’ll keep a running tally of all liens and fight to get them reduced before your settlement is finalized.

- Build Your Case: Most importantly, they will focus on building a powerful personal injury claim to get you the full compensation you deserve from the at-fault driver, making sure it covers all your past, present, and future medical needs.

When facing significant medical debt, especially with a pending injury claim or maxed-out insurance, you may need to look into different medical financing options. An attorney can guide you through these choices, too, helping you make smart decisions that protect your financial health down the road.

Using a Personal Injury Claim to Cover Your Costs

So, what happens when your own PIP benefits and health insurance run out? You might be staring at a mountain of unpaid medical bills, and that’s a terrifying place to be. This is exactly where the at-fault driver's responsibility comes into play.

Filing a personal injury claim is the legal path you take to hold the person who caused the crash accountable for everything you've lost. It’s how you recover your remaining car accident medical bills and other major losses. Think of it as a formal process to make sure you're made financially whole again after someone else's mistake turned your life upside down.

The First Step: Sending a Demand Letter

Once you have a solid grasp of your injuries and the costs involved, the process officially begins with a demand letter. This isn't just a quick email; it's a formal, detailed document sent directly to the at-fault driver's insurance company. It lays out the facts of your case and clearly states the compensation you're seeking.

A strong demand letter is your opening move, and it needs to be persuasive. It should include:

- A clear, concise story of how the crash happened and why their driver is at fault.

- A complete breakdown of your injuries, backed up by all relevant medical records.

- Copies of every single bill—from the ambulance ride to your physical therapy sessions.

- Proof of any income you lost because you couldn't work.

This package is what kicks off negotiations. A thorough demand letter tells the insurance adjuster that you’re serious and have the evidence to back it up. You can learn more about what goes into a powerful bodily injury claim in our guide.

Understanding Economic and Non-Economic Damages

Your claim is about more than just the bills. The law recognizes that a serious crash inflicts harm that you can't put a simple price tag on. That's why compensation is broken down into two distinct categories.

1. Economic Damages

These are the straightforward, calculable losses you’ve faced. They have a specific dollar amount attached and cover things like:

- All your medical expenses, both past and future.

- Lost wages from time off work.

- Reduced earning capacity if your injuries impact your career long-term.

- The cost of repairing or replacing your car.

2. Non-Economic Damages

These are the very real, but intangible, losses. This category is about the human cost of the accident—the ways your life has been changed for the worse. It includes compensation for:

- Your physical pain and suffering.

- The emotional distress and mental anguish you’ve experienced.

- Loss of enjoyment of your daily life and hobbies.

- Any permanent disability or disfigurement.

A comprehensive personal injury claim fights for both types of damages to truly account for the full impact the crash has had on you and your family.

The goal of a personal injury settlement is to provide fair compensation not just for your bills, but for the physical pain and emotional trauma you have been forced to endure.

Navigating Oregon's Statute of Limitations

Here’s something you absolutely cannot ignore: the clock is ticking. In Oregon, you have a strict legal deadline to file a personal injury claim, known as the statute of limitations. For most car accident cases, that deadline is two years from the date of the crash.

If you don’t settle your claim or file a lawsuit within that two-year window, you lose your right to seek compensation forever. It’s a harsh rule, which is why it’s so critical to get the ball rolling quickly. Waiting until the last minute is a gamble you don't want to take.

Common Questions About Car Accident Medical Bills

Even when you know the basics, the financial fallout from a car wreck can be incredibly stressful. You're trying to recover, and suddenly you're facing a stack of confusing bills and a lot of tough questions. Let's clear up some of the most common worries people have about medical bills after an accident in Oregon.

Getting straight answers is the first step to taking control of the situation.

What Happens if the At-Fault Driver Has No Insurance?

This is one of the biggest fears for anyone in a collision: finding out the person who hit you is uninsured or doesn't have enough coverage. It feels like a dead end, but it isn't. Thankfully, Oregon law requires your own auto policy to include a crucial safety net for this exact scenario.

It's called Uninsured/Underinsured Motorist (UM/UIM) coverage.

Think of your UM/UIM coverage as a stand-in for the other driver's missing insurance. It's there to make sure you're protected, covering things like:

- Medical costs that go beyond what your PIP benefits cover.

- Future medical care you might need.

- Wages you've lost while out of work.

- Compensation for your pain and suffering.

So, even if the other driver was irresponsible, your own insurance is there to back you up and prevent you from being stuck with the bill.

Do I Have to Pay My Health Insurance Back from My Settlement?

The short answer is yes, you usually do. When your health insurance company steps in to pay for your accident-related treatments, they aren't just giving you that money free and clear. They have a legal right to get that money back from any settlement you eventually receive from the at-fault party.

This concept is called subrogation. In simple terms, your health insurer is saying, "We'll front the cost for now, but since someone else caused the injury, we expect to be reimbursed from the money you get from them."

This is where having a skilled personal injury attorney is a huge advantage. They can—and often do—negotiate with your health insurance provider to lower the amount you have to repay. A successful negotiation means more of your settlement money goes directly to you, where it belongs.

Can a Hospital Send My Medical Bills to Collections?

Yes, they can, and it's a terrifying thought. Hospitals are businesses, and they can send unpaid bills to a collection agency even if you have a pending personal injury claim. This can wreck your credit and add a massive layer of stress when you're already trying to heal.

But you can stop this from happening. The most effective way to protect yourself is to work with a personal injury lawyer. As soon as you hire an attorney, they will send a "Letter of Representation" to all your medical providers. This official letter lets them know you have a case and asks them to stop billing you directly.

Instead of sending your account to collections, the hospital will typically agree to place a lien on your future settlement. This gives you the peace of mind to focus on your recovery without collectors calling.

Trying to sort through the aftermath of a car accident is tough, but you don't have to face it alone. The team at Bell Law helps Oregonians navigate these complex situations every day. We're here to protect your rights and fight for the full compensation you deserve. To talk about your case with an experienced attorney, contact us for a free consultation.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.