Car Accident Settlement Process Guide: Get Fair Compensation

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Car Accident Settlement Process Guide: Get Fair Compensation

The car accident settlement process is the formal back-and-forth between you and the other driver's insurance company. The goal? To agree on a fair amount to cover your damages without ever stepping inside a courtroom. This is how the overwhelming majority of car accident cases are actually resolved.

What to Expect from the Settlement Process

After a crash, you're suddenly dealing with a lot—unfamiliar legal terms, tight deadlines, and stressful phone calls. Getting a handle on what the process looks like is the first step toward feeling in control again.

Think of it as a journey with a clear destination: a settlement that fully compensates you for everything you've lost. This includes not just your medical bills and missed paychecks, but also the pain and suffering you've endured. The main players are the other driver's insurance adjuster and, hopefully, your own personal injury lawyer.

It’s critical to understand their motivations from the start. The adjuster’s job is to save their company money by paying out as little as possible. Your attorney's job is to fight for your best interests and get you the maximum compensation. Knowing these conflicting goals helps you set realistic expectations for the entire ordeal.

The Path to Resolution

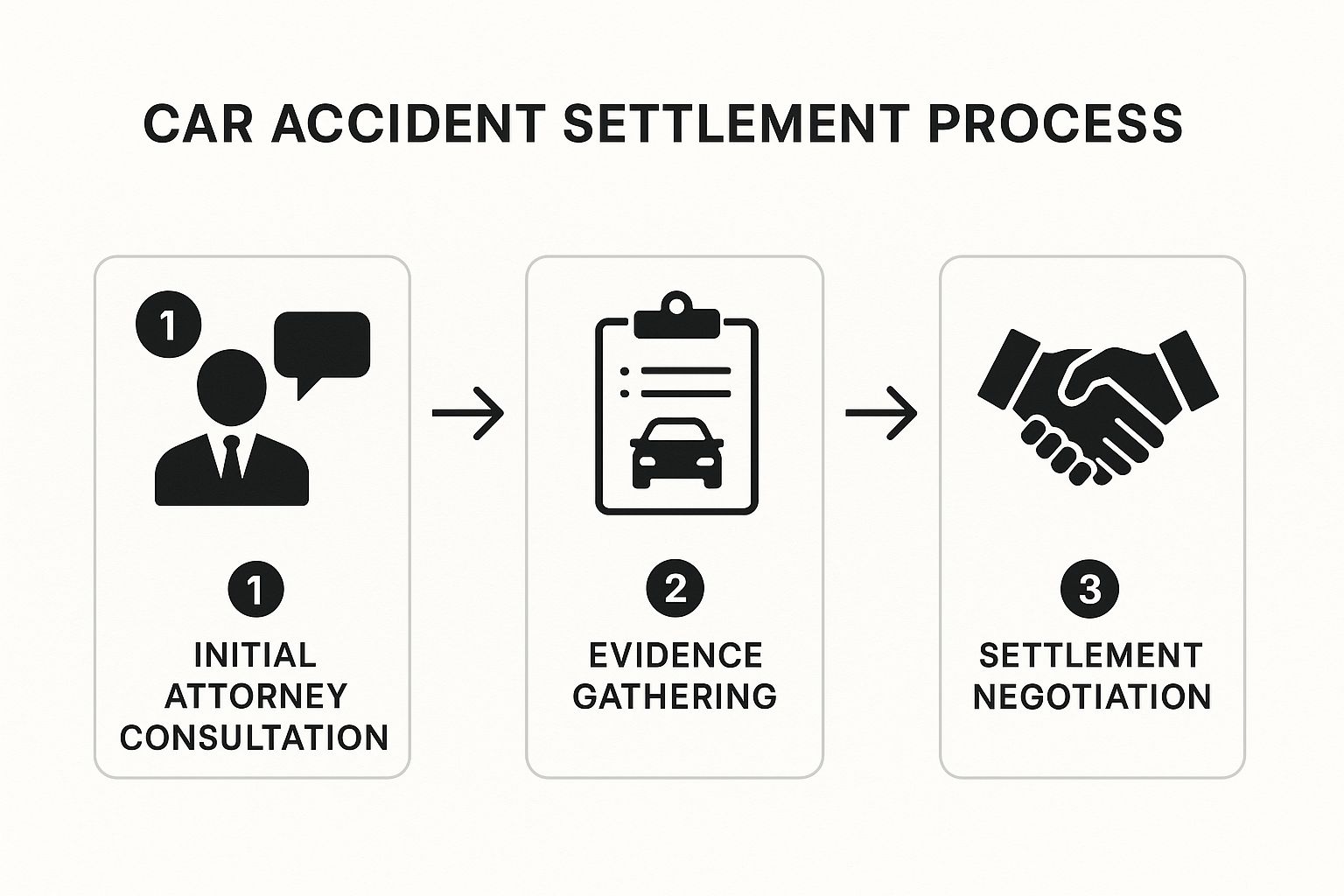

The settlement journey has a few distinct phases. It always starts with gathering evidence and, ideally, speaking with an attorney. From there, it moves into the negotiation stage, where your lawyer builds a case and goes head-to-head with the insurance company.

This visual breaks down the core steps involved.

As you can see, each stage builds on the last, transforming the initial evidence from the crash scene into a solid foundation for negotiation. Following this structured path is the key to a successful outcome.

Setting Realistic Expectations

Patience is probably the most important tool you have. One of the worst mistakes people make is jumping at the first lowball offer. It can take months to understand the full scope of your injuries and what they'll truly cost you in the long run.

The settlement process is a marathon, not a sprint. A fair outcome requires meticulous preparation, strategic negotiation, and a clear understanding of your claim's full value before any agreements are made.

The timeline for these things can feel long. For a fairly straightforward case, it’s not uncommon for the process to take six to nine months after you’ve finished all your medical treatment. While the average settlement for a car accident is around $37,248.62, this number can swing dramatically depending on the severity of your injuries and the specific details of your case.

To give you a better sense of the timing, here’s a look at the typical stages and how long each one might take.

Key Milestones in a Typical Car Accident Settlement

This table outlines the critical stages in the settlement process and provides a rough estimate of their duration. Keep in mind that every case is unique, and these timeframes can vary.

| Initial Consultation | Meeting with an attorney, discussing your case, and signing representation agreements. | 1-7 Days |

| Investigation | Your attorney gathers all evidence: police reports, medical records, witness statements, etc. | 1-3 Months |

| Demand Letter | Your attorney drafts and sends a formal demand package to the insurance company. | 2-4 Weeks |

| Negotiation | The adjuster reviews the demand and makes an initial offer. A period of offers and counter-offers begins. | 1-6 Months |

| Settlement | Both sides agree on a final settlement amount. You sign release forms. | 2-6 Weeks |

| Receiving Funds | The insurance company issues the check, your attorney pays liens, and you receive your net settlement. | 4-8 Weeks |

This timeline provides a general roadmap, but complicated cases with severe injuries or liability disputes can certainly take longer.

For a more granular breakdown, you can explore our detailed guide on the personal injury claims process. The article you're reading now will expand on that foundation, giving you actionable advice for navigating each specific phase of your car accident settlement.

Your First Moves After a Car Accident

The moments right after a car crash are chaotic and confusing. But what you do in those first few hours can make or break your settlement down the road. Once you've made sure everyone is safe, your priority has to be your health and documenting absolutely everything. Think of these first steps as laying the foundation for a solid claim.

Getting checked out by a doctor is non-negotiable, even if you think you're perfectly fine. The adrenaline pumping through your system is a powerful painkiller, and it can easily mask serious injuries. I’ve seen it a hundred times: clients feel okay at the scene, only to wake up the next day with debilitating pain from whiplash or the delayed symptoms of a concussion.

When you see a doctor, you create an official medical record. This paper trail is what links your injuries directly to the accident, and it’s a piece of evidence insurance companies have a hard time disputing. Without that early medical evaluation, the entire car accident settlement process becomes an uphill fight.

Documenting the Scene Like a Pro

While you're waiting for the police, your phone becomes your best friend. Switch into investigator mode and start taking pictures of everything. Don't just snap a quick photo of your dented bumper—you need to capture the whole story from every possible angle.

Here’s a quick checklist of what to photograph:

- The Big Picture: Get wide shots of the entire scene. Show where the cars ended up, nearby traffic signals or stop signs, and any other landmarks.

- Damage Details: Get up close and personal with the damage on all the cars involved, not just yours. Take pictures of dents, shattered glass, and even paint scrapes.

- Road Evidence: Look for skid marks on the pavement or debris scattered from the impact. These details are gold for accident reconstruction experts.

- The Environment: Was it raining? Was the sun causing a nasty glare? Photos of the road and weather conditions help paint a complete picture of what happened.

This kind of visual proof is unbiased and incredibly compelling. It's tough for the other driver to change their story when you have a library of photos that show exactly what happened.

A quick tip from experience: you can never take too many photos. Something that seems minor at the scene can end up being the one critical detail that wins your case.

After you've taken photos, you'll need to exchange information with the other driver. Get their name, phone number, and insurance policy information. But keep the conversation short and stick to the facts. Under no circumstances should you apologize or admit fault in any way. A simple, "I'm so sorry," can be twisted by an adjuster and used to argue that you accepted responsibility.

Reporting the Accident the Right Way

You’ll need to notify your own insurance company about the crash as soon as you can. When you call, give them a straightforward, factual account. Don’t guess about who was at fault or downplay your injuries. Just state what happened.

Sooner or later, you'll get a call from the other driver's insurance adjuster. This is a pivotal moment. You need to be cooperative, but you are under no obligation to provide a recorded statement right then and there. Adjusters are trained to ask questions that can trip you up and get you to say something that undermines your claim.

The smartest move is to politely refuse to give a recorded statement until you've had a chance to speak with an attorney. A simple, "I'm not ready to provide a recorded statement right now," is all you need to say. This protects you from accidentally saying something that could damage your case before it even really gets started.

How to Build a Powerful Claim and Calculate Its Value

After the initial shock of a crash wears off, you have to shift gears and start thinking about your claim. This is the part where you meticulously piece together your case to prove not just what happened, but what the accident cost you in every sense of the word.

A strong claim is built on a foundation of organized, undeniable proof. The goal is to create a complete file that tells the story of the accident and its fallout. This means putting a number on every single loss, from the obvious bills to the more hidden, personal costs.

Calculating Your Economic Damages

Let's start with the easy part: economic damages. These are the tangible, out-of-pocket expenses that you can prove with a paper trail. Think of these as the black-and-white numbers—the costs you can back up with receipts, bills, and pay stubs.

Your list of economic damages should be exhaustive. Make sure it includes:

- All Medical Bills: This isn't just the ER visit. It’s the ambulance ride, specialist appointments, physical therapy, prescriptions, and even any future surgeries your doctors say you'll need.

- Lost Wages: Add up every dollar you lost from being unable to work. This includes your regular pay, but also any overtime, commissions, or bonuses you missed out on. Don't forget to include any sick days or PTO you were forced to use.

- Future Lost Earning Capacity: This is a big one. If your injuries mean you can't go back to your old job or can't earn what you used to, we need to calculate that long-term financial hit.

- Property Damage: This covers the repair or replacement cost for your vehicle, of course, but also anything else that was damaged in the crash, like your phone, laptop, or even your glasses.

Here’s a practical tip: I almost always advise clients to handle the property damage claim separately from the personal injury claim. Car repairs usually get resolved much faster, often in just a few weeks. This lets you get back on the road without having to wait for the much longer injury negotiation process to play out.

It's also worth noting that in serious accidents, the at-fault driver's policy might not be enough. This is where you need to know about all layers of coverage. For instance, an umbrella policy can provide crucial extra liability protection. You can learn more about What does a personal umbrella policy cover? to see if that applies to your situation.

Valuing Your Non-Economic Damages

While adding up bills is straightforward, the real human cost of a crash is often found in the less tangible losses. We call these non-economic damages, and they are meant to compensate you for the pain, suffering, and emotional toll of the accident.

This is where your claim goes beyond the numbers. These damages cover things like:

- Pain and Suffering

- Emotional Distress and Anxiety

- Loss of Enjoyment of Life

- Permanent Scarring or Disfigurement

So how do you put a price tag on something like that? It comes down to telling a compelling, human story backed by evidence. One of the most powerful tools for this is surprisingly simple: a daily journal.

Real-World Example: I once had a client who kept a simple notebook after his accident. Every day, he'd jot down a few notes about his pain level, how he slept, and his frustrations—like not being able to pick up his toddler or feeling a jolt of anxiety every time he got in a car. That journal turned the abstract idea of "pain and suffering" into a real, day-by-day story that the insurance adjuster couldn't ignore. It made a huge difference.

This kind of personal account provides a vivid narrative of how the accident genuinely turned your life upside down, making your claim for these damages far more persuasive. A good attorney knows exactly how to weave this personal story together with medical records to argue for a fair number. The complexity of these damages is often why people seek legal help. You can read more on that decision here: Do I need a lawyer for my auto accident case?

Understanding How Injuries Affect Claim Value

The presence of injuries completely changes the game. When a crash only involves property damage, settlements are naturally much lower. For these no-injury accidents, you might see settlements ranging from $500 to $25,000, with an average around $9,900. The final number really just depends on how bad the vehicle damage is.

But when someone is hurt, the settlement has to cover all the economic and non-economic damages we've talked about. That’s why it is absolutely critical to document everything—from the first ambulance bill to the last sleepless night—to get the fair outcome you deserve.

The Art of Insurance Negotiation: Going Head-to-Head

Alright, this is where all your hard work and careful documentation truly come into play. Negotiating with an insurance company isn't like haggling at a market. It's a strategic process where your evidence and your story face off against the insurer's primary goal: paying out as little as possible.

To come out on top in the car accident settlement process, you'll need a healthy dose of patience, a professional demeanor, and a lot of persistence. You're shifting from simply gathering facts to actively engaging with the other side. How you handle these conversations will have a direct impact on your final compensation.

Your Opening Salvo: The Demand Letter

The first real move you'll make is sending a formal demand letter. Don't think of this as just a letter asking for money. It's your opening argument, a comprehensive narrative that lays out the facts, details the extent of your injuries, and logically breaks down why you're seeking a specific settlement amount.

A demand letter that gets taken seriously has to include a few key things:

- A Solid Liability Argument: State clearly and simply why the other party was at fault. Reference the police report, traffic laws, or witness statements you've collected.

- A Full Picture of Your Injuries: Describe not just the medical diagnosis, but the treatment you've gone through and how it has impacted your day-to-day life. This is where your pain journal entries become incredibly powerful.

- A Complete Financial Tally: You need to itemize every single economic loss. This means every medical bill, every lost paycheck, and every out-of-pocket expense, from prescriptions to parking at the physical therapist.

- A Case for Pain and Suffering: Explain why you are asking for non-economic damages. Connect it directly to the real-world consequences you've suffered—the missed family events, the chronic pain, the anxiety.

- The Proof in the Pudding: Attach copies of everything. Your medical records, bills, receipts, the police report, photos of the crash—the whole file.

Think of your demand letter as a complete, self-contained story of your case. When an adjuster gets a well-organized, thoroughly documented demand, it sends a clear message: you're serious, and you've done your homework. This alone can set a much more productive tone for the negotiations that follow.

Watching Out for Common Adjuster Tactics

Once your demand letter is sent, you can expect a counteroffer. Here's a critical piece of advice I give everyone: their first offer is almost never their best offer. Insurance adjusters are trained negotiators, and they have a playbook of tactics designed to settle claims for the lowest amount possible.

Knowing what to expect is half the battle. Be ready for them to:

- Throw Out a Quick, Lowball Offer: This is a classic. They'll offer a small sum right away, hoping you're in a financial pinch and will take the quick cash. It’s a test to see if you’ll settle for pennies on the dollar.

- Question Your Medical Care: The adjuster might imply that you received "too much" treatment or that some of it was unnecessary. Their goal is to chip away at the value of your medical expense claim.

- Minimize Your Pain and Suffering: It's common for them to dismiss your pain and suffering as "subjective" or exaggerated. This is precisely why a detailed pain journal with specific examples is your best rebuttal.

- Drag Their Feet: Sometimes, the best tactic for them is to do nothing. By delaying the process, they're hoping frustration will set in, making you more likely to accept a lower offer just to get it over with.

Never, ever take the first offer. It’s just the starting point of the conversation, not the final word on what your claim is worth. A calm, fact-based counteroffer is always the right response.

The best way to defend against these tactics is to remain professional and stick to your evidence. When an adjuster questions a treatment, you can point directly to the doctor's notes recommending it. When they downplay your pain, you refer them to a specific entry in your journal. Every tactic they use should be met with a calm, factual countermove backed by the proof you've already organized.

Knowing When to Stand Firm and When to Call for Backup

Negotiation is a bit of a dance. You have to be firm in your position, but you also have to be realistic about what constitutes a fair settlement. Expect a lot of back-and-forth communication. Make sure you document every single call and email with the adjuster, noting the date, time, and the substance of the discussion.

There are absolutely times to stand your ground, especially if the adjuster is offering a settlement that doesn't even cover your medical bills. On the other hand, holding out for a completely unrealistic number can bring the entire process to a screeching halt.

So, how do you know when you've hit a wall and it's time to bring in a lawyer? A few red flags should tell you it's time to consult a personal injury attorney:

The insurer denies all fault, even when the police report or other evidence clearly points to their driver.

The settlement offers are consistently and unreasonably low, failing to cover your documented financial losses.

The adjuster is using high-pressure or bullying tactics to try and force you into a quick, cheap settlement.

Your case involves serious, complex, or long-term injuries. Calculating future medical needs and lost earning potential is incredibly complicated and is best handled by an expert.

An experienced attorney has seen all these tactics before and knows exactly how to push back. They can take over the stressful communications, apply legal pressure, and if needed, file a lawsuit. Often, the simple act of hiring a lawyer is enough to make the insurance company come back to the table with a much more serious offer.

Finalizing Your Settlement and Getting Paid

https://www.youtube.com/embed/eQV5G7aw7eI

You’ve finally agreed on a settlement amount. It’s a huge relief, but it’s not quite time to celebrate. A common misconception is that a check is immediately on its way. In reality, you've just entered the final phase of the car accident settlement process, which is all about paperwork, legal formalities, and a careful distribution of the funds.

This is the home stretch, where everything becomes official. The most important document you'll encounter here is the settlement and release agreement. Think of this as the final handshake—a legally binding contract that closes your case for good. By signing it, you accept the settlement money in exchange for giving up any right to sue the at-fault party for this accident ever again.

Scrutinizing the Settlement and Release Agreement

Never, ever sign this document without reading it line-by-line, preferably with your attorney sitting right there with you. Insurance companies draft these releases to protect their own interests, so you need to be absolutely sure you understand what you're agreeing to.

A standard release form will include specific legal language confirming a few key points:

- You are accepting the settlement amount voluntarily.

- You are releasing the at-fault driver and their insurance company from all liability, now and in the future, for this accident.

- You acknowledge that this is the final, complete settlement for your claim.

Pay close attention to how broad the release is. It should only apply to the specific car accident you’re settling. If the language is too vague, it could accidentally prevent you from making a completely unrelated claim down the road. After the terms are set, formalizing the document is key. Understanding the steps for how to notarize legal documents effectively is often a necessary part of making the agreement official.

This is your one and only shot. Once you sign that release, the case is closed. You can't come back later and ask for more money, even if you discover a new injury. This is precisely why it is so critical to reach Maximum Medical Improvement (MMI) before you even start talking numbers.

Understanding the Payout and Deductions

Once you’ve signed and returned the release, the insurance company will finally cut the check. But it won't be sent to your home address. Standard practice is for the check to go directly to your attorney's office, made out to both you and your law firm.

From here, the final math begins. The number you agreed on—the gross settlement—isn't what will land in your bank account. Your attorney will deposit the check into a special client trust account and act as the administrator, paying off all the case-related debts before you get your portion.

Here’s a breakdown of what gets paid out from the settlement funds first:

Attorney's Fees: This is the contingency fee laid out in your initial agreement, usually a percentage of the total settlement.

Case Costs and Expenses: This covers all the money your attorney fronted to build your case. Think of things like court filing fees, the cost of getting medical records, or fees for expert witnesses.

Medical Liens and Bills: Any outstanding medical bills or liens from hospitals, doctors, or even your own health insurance company have to be settled. A good attorney will have already been negotiating these liens down to maximize the amount you get to keep.

After every one of these obligations is paid, your attorney will cut you a check for the remaining net amount. You should also receive a detailed settlement statement that itemizes every single dollar—from the gross settlement to each deduction—so you can see exactly where the money went.

For a closer look at how long this final stage can take, you might want to read our guide on how long it might take to settle an auto accident case.

Final Thoughts on a Complex Process

The settlement figures in serious injury or fatality cases are often influenced by broader national trends. In 2024, the U.S. saw a predicted 39,345 deaths from car accidents, a 3.8% drop from the previous year. While this marks a positive trend, the sheer volume of accidents highlights the importance of a structured settlement process. Discover more insights about these recent car accident statistics on teamjustice.com.

Got Questions? We've Got Answers

After a car wreck, it’s only natural to have a million questions swirling around. The whole settlement process can feel confusing and overwhelming, but getting straight answers can make all the difference. Let's walk through some of the most common things people want to know.

Think of this as a quick FAQ from someone who's been in the trenches and seen it all.

How Long Is This Going to Take?

I wish I could give a simple answer, but the honest truth is: it depends. Every single case is different. If your accident was a clear-cut fender-bender with minor bumps and bruises, you might have a check in hand within a few months.

But if you're dealing with serious injuries or the insurance companies are fighting over who’s at fault, you need to prepare for a longer haul—sometimes a year or more.

The timeline really starts once you’ve finished your medical treatment. We call this reaching Maximum Medical Improvement (MMI). It’s only at that point that we can get a true, final picture of what your damages really are.

Don't make the mistake of settling too early. I've seen it happen time and again. If you take a settlement before you know the full extent of your injuries, you could be on the hook for future medical bills yourself. A little patience now can save you a world of financial pain later.

Should I Take Their First Offer?

In a word: no. The insurance company's first offer is almost never their best one. Think of it as their opening move in a negotiation. Adjusters are trained to start low, hoping you’ll be tempted by a quick payday and close the claim for pennies on the dollar.

That initial number rarely, if ever, accounts for the full scope of your claim, especially the real-life impact like pain and suffering. The right move is to respond with a detailed counteroffer that lays out the facts.

Do I Really Need a Lawyer?

This is a big one, and it comes down to strategy. If you were in a minor parking lot tap with zero injuries, you can probably handle the claim yourself without much trouble.

However, if your situation involves any of the following, bringing in an experienced personal injury attorney is one of the smartest things you can do:

- Serious Medical Bills: When the medical costs start piling up, the financial stakes get very high, very fast.

- A Fight Over Fault: Is the other driver’s insurance trying to pin the blame on you? You need a professional in your corner to push back.

- Long-Term or Permanent Injuries: An attorney knows how to calculate complex damages like future medical needs or what you’ve lost in earning potential—things that are absolutely critical for getting what you deserve.

Study after study shows that people who hire a lawyer end up with significantly higher settlements, even after attorney fees are paid. You're not just hiring help; you're leveling the playing field against a massive corporation.

What If We Just Can't Agree?

Sometimes, no matter how hard you negotiate, the insurance adjuster won't budge. When you hit a wall like that, the next move is usually to file a lawsuit. Now, that sounds scarier than it is. Filing a suit doesn't mean you're destined for a dramatic courtroom battle.

In reality, the overwhelming majority of personal injury lawsuits settle before they ever see a trial. The act of filing suit kicks off a formal process called "discovery," which forces both sides to lay all their cards on the table. This exchange of evidence often clarifies the strengths and weaknesses of the case, and that clarity usually gets both parties talking again and leads to a fair resolution. It’s a powerful way to break a stalemate.

At Bell Law, our experienced Oregon personal injury attorneys are here to guide you through every single step. If you've been hurt in an accident and feel lost, reach out to us for a consultation. You can learn more about how we help people just like you at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.