Crash with uninsured driver: What to Do After a Collision in Oregon

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Crash with uninsured driver: What to Do After a Collision in Oregon

The seconds after a car crash are a blur. You're trying to figure out if everyone is okay, and then comes the sinking feeling when you discover the other driver has no insurance. Suddenly, a stressful situation feels a whole lot worse. Your first thought might be, "Now what?"

It’s a complicated spot to be in, but you may not be out of options. The key is understanding how to navigate the aftermath and what role your own insurance policy plays in protecting you.

After the Crash: Facing an Uninsured Driver

It’s completely normal for your mind to race with questions. Who’s going to cover my medical bills? How will I get my car fixed? What about the time I have to take off work? These are real, immediate concerns. When the at-fault driver is uninsured, one potential path to getting compensated—their insurance company—is simply gone.

This is where your own policy can become very important. Specifically, your Uninsured Motorist (UM) coverage is designed for this exact scenario. It is a type of coverage that may apply to cover your losses when the person who hit you cannot.

Here’s a quick-reference table outlining some critical first steps. These actions can be vital for protecting both your physical well-being and your ability to file a claim.

Immediate Priorities After a Crash with an Uninsured Driver

| Check for Injuries & Call 911 | Your health is the top priority. A police report also creates an official, unbiased record of the incident. |

| Exchange Information | Get the driver’s name, address, phone number, and license plate. Even without insurance, this info can be crucial. |

| Document Everything | Take photos and videos of the scene, vehicle damage, and any visible injuries. Note the time, location, and weather. |

| Get Witness Contacts | Independent witness statements can be powerful in helping to establish who was at fault. |

| Notify Your Insurer | Report the accident to your own insurance company as soon as possible to start the claim process. |

Following these steps lays the groundwork for everything that comes next. Solid documentation and prompt communication are your best allies in this situation.

A Growing Problem on Oregon Roads

Unfortunately, getting hit by an uninsured driver is more common than some might think. The number of uninsured motorists on the road has reportedly increased since the pandemic, creating a bigger risk for everyone.

A recent study from the Insurance Research Council found that in 2023, an estimated 15.4 percent of all drivers were uninsured. That's more than one in every seven people on the road. It’s a sharp jump from the roughly 11 percent seen back in 2019, showing just how much things have changed.

This trend makes having the right insurance coverage more important than ever. It also highlights the need to know exactly what to do to protect yourself. Beyond the immediate shock, you'll have practical concerns, like figuring out how to handle repairs and what the cost to replace a windshield without insurance might be. This guide is here to walk you through the process, step by step.

Securing the Scene and Gathering Information

The seconds after a car wreck can be chaotic. Your adrenaline is pumping, you might be in pain, and now you’ve just found out the driver who hit you doesn't have insurance. It's a stressful situation, but what you do in these first few minutes can be critical. Think of it as laying the groundwork for everything that comes next. The goal is to stay safe while methodically gathering the facts.

First things first: safety. Check on yourself and anyone in your car. Then, if you can, check on the people in the other vehicle. If anyone is hurt—even if it seems minor—call 911 right away for police and paramedics.

Even if it’s just a fender bender, it is a good idea to have the police come out and create a report. That police report becomes an official, unbiased record of the crash. It can lock in details like the date, location, and the officer’s initial observations, which can be a huge help down the road.

Dealing With the Uninsured Driver

This is where things can get tricky. Finding out the other person is uninsured is frustrating, and it's easy to get angry. However, keeping a level head can be the best thing you do for your safety and your potential claim. Getting into a shouting match on the side of the road helps no one.

Your job is to simply and politely exchange information. Here’s what you may need to get from the other driver:

- Their full name and contact info: Ask for their legal name, current address, and a good phone number.

- Driver's license number: Look at their license and jot down the number and the state it was issued in.

- Vehicle details: Note the make, model, color, and, most importantly, the license plate number.

- Vehicle Identification Number (VIN): You can often see the VIN on a little plate on the driver's side of the dashboard, right up against the windshield. Snap a clear photo of it.

What if they refuse? Do not push it. Your safety comes first. Just wait for the police to arrive and let them handle it. An officer has authority to gather this information.

A common scenario involves the at-fault driver promising to "pay out of pocket" to avoid getting insurance or police involved. Consider that once you leave the scene without a report or their info, it can become your word against theirs. Proving the crash even happened could become a challenge.

Your Smartphone is Your Best Friend

Right now, the most powerful tool you have is probably in your pocket. Use your phone to create a complete visual diary of the crash scene before anything gets moved. You can't take too many photos. The more you have, the stronger your story may be when you file your claim.

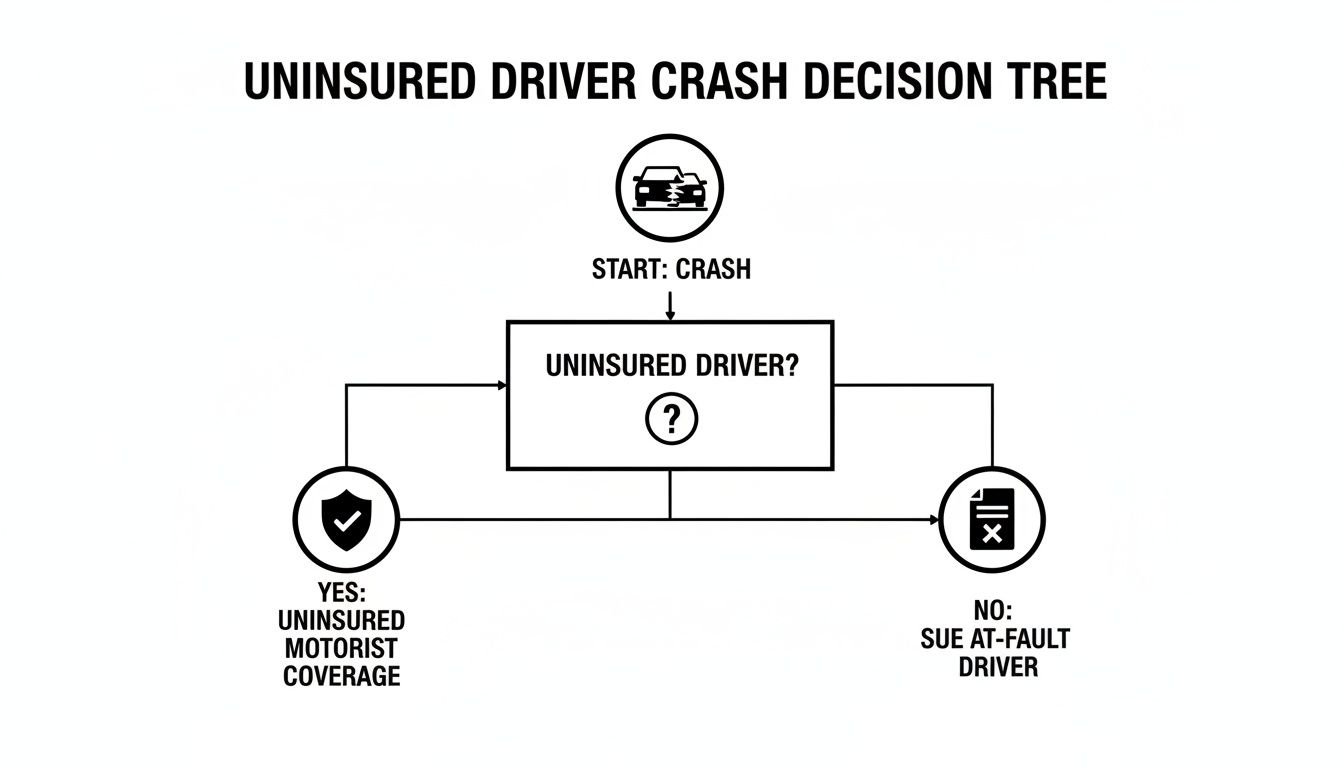

This chart shows how your path forward changes the moment you confirm the other driver is uninsured.

As you can see, everything pivots back to your own insurance policy and the evidence you managed to collect right there at the scene. Your photos and notes become the foundation of your claim.

What to Photograph and Video

Be systematic. Get shots from far away to show the whole scene, then move in closer for the details. Think like a detective.

Here’s a quick checklist of what to capture:

- Damage to both cars: Get pictures of every dent, scratch, and broken part on your car and theirs.

- The final positions of the vehicles: Before they're moved, document how and where they came to a stop.

- The surrounding area: Look for skid marks, broken glass on the road, traffic signs, and even the weather conditions.

- Any visible injuries: If you have cuts or bruises, take photos of them immediately.

This evidence helps piece together exactly what happened. For a more detailed breakdown of these first steps, check out our complete guide on what to do after a car accident.

The Power of an Independent Witness

If anyone else saw what happened, their input can be invaluable. A witness who has no stake in the outcome can provide an impartial account that can carry a lot of weight.

Just walk over and politely ask if they'd be willing to give you their name and number. Let them know your insurance company might want to call them for a quick chat. Don't try to get their whole story right there—just secure a way to contact them later.

For a great checklist on these initial steps, you can consult this recovery roadmap for steps to take after a car accident. Taking the time to gather these pieces of information builds a solid foundation from the very beginning.

What About My Uninsured Motorist (UM) Coverage?

When the driver who hit you doesn't have insurance, your first thought might be, "Now what?" It can feel like you've hit a brick wall, with no obvious way to cover your medical bills or fix your car.

But there's a good chance the answer is right in your own auto insurance policy. You’ve likely been paying for a specific protection all along: Uninsured Motorist (UM) coverage.

Think of this as your personal safety net. It was designed for exactly this kind of scenario, allowing you to file a claim with your own insurance company to cover the damages the at-fault driver should have paid for.

The Basics: Uninsured vs. Underinsured Coverage

In Oregon, UM coverage is a standard feature in most auto policies. It’s there to protect you, your family, and your passengers if you're injured by a driver with no liability insurance at all. It can even kick in for hit-and-run crashes where the other driver is never found.

A close cousin to this is Underinsured Motorist (UIM) coverage. UIM is for situations where the at-fault driver has insurance, but their policy limits are so low they can't cover the full cost of your injuries and losses. Your UIM coverage is designed to bridge that financial gap.

After a crash with an uninsured driver, your own insurance policy often becomes your single most important lifeline. Using your UM coverage isn’t admitting fault—it’s activating a protection you paid for to shield yourself from irresponsible drivers.

It's not just the completely uninsured drivers you may have to worry about. A growing number of motorists are underinsured, which can leave you in a financial hole even when they have a policy. The Insurance Research Council found that an estimated 18% of U.S. drivers were underinsured in 2023, a jump from 11% in 2017. Together, uninsured and underinsured drivers made up a third of all drivers on American roads that year. You can dig into the data on this compounding crisis of underinsured drivers to see just how widespread the problem is.

Getting a UM Claim Started

The first step is simple: notify your own insurance company about the accident right away.

When you call to report the crash, make it clear that the other driver was uninsured. This tells your insurer that you'll be opening a UM claim under your policy. They will assign an adjuster to your case, and you'll need to be ready to provide them with everything you gathered at the scene:

- The police report number

- The other driver’s name and any contact info you got

- Photos of the vehicles and the crash scene

- Names and phone numbers for any witnesses

From there, your job is to prove the other driver was at fault and document every single loss you've suffered.

Will Filing a UM Claim Make My Rates Go Up?

This is the number one question on many people's minds, and it's a valid concern. Nobody wants to see their premiums skyrocket, especially after an accident that wasn't their fault.

In Oregon, consumer protection laws are on your side. Insurers are generally prohibited from raising your rates for an accident you didn't cause. Since a UM claim is, by definition, based on the other driver's fault, filing one generally should not result in a rate hike. You're simply using a benefit you paid for—it's a contractual right.

A Strange Twist: Your Insurer Becomes Your Opponent

When you file a claim against another driver's insurance, the lines are clearly drawn. It's you against them. But with a UM claim, the dynamic gets complicated. Suddenly, you're making a claim against your own insurance company.

Even though they're "your" company, their role in a UM claim becomes adversarial. Their goal is to minimize their payout, while your goal is to get fairly compensated for everything you've lost. It's a confusing and often frustrating position to be in.

The adjuster from your own company will investigate the crash, review your medical records, and put a value on your claim. This is precisely why it’s so critical to keep meticulous records of every medical bill, lost pay stub, and out-of-pocket expense. To get a better handle on this process, you can learn more about how uninsured motorist coverage works in Oregon and what to expect.

What Damages Does UM Insurance Actually Cover?

Your Uninsured Motorist coverage is meant to pay for the same things the at-fault driver's liability insurance would have. These losses fall into two main buckets: economic (things with a clear price tag) and non-economic (the human cost).

Here’s what your UM policy can cover:

- Medical Expenses: This is comprehensive. It includes the ambulance ride, ER visit, hospital stays, surgeries, physical therapy, and any future medical care your doctors say you'll need.

- Lost Wages: If your injuries keep you out of work, UM can reimburse you for that lost income. It can even cover a loss of future earning capacity if your injuries are permanent and affect your career.

- Pain and Suffering: This compensates you for the very real, but hard-to-quantify, impact of the crash—the physical pain, emotional trauma, and the loss of your ability to enjoy life as you did before.

Realizing that your own policy may be your primary path to recovery is the first, most important step you can take after being hit by an uninsured driver.

Why Your Medical Story Is Your Strongest Asset

Right after a crash, the adrenaline rush can do a surprisingly good job of masking serious pain. You might feel a bit shaken up but otherwise okay, only to wake up the next day with debilitating neck pain or a throbbing headache. That's why getting checked out by a doctor right away is non-negotiable—not just for your health, but to create the first official entry in your medical record.

This initial doctor's visit is what formally connects your injuries to the accident. It creates a clean, undeniable starting point for your recovery journey. Without that immediate link, an insurance company might later question whether your injuries truly came from the crash or from something that happened days later.

Building Your Medical File Piece by Piece

One trip to urgent care isn’t enough. You may need to think like an investigator and build a comprehensive file that tells the complete story of your recovery. Every bill, every report, and every receipt is a piece of evidence.

Your job is to gather all these pieces so anyone looking at your case can easily see how the collision has impacted your health, your life, and your wallet.

Be a packrat when it comes to these documents:

- Bills and Invoices: Don't throw anything away. Keep every single bill from the hospital, your primary care doctor, physical therapists, chiropractors, labs, and the pharmacy.

- Explanation of Benefits (EOBs): These statements from your health insurer are crucial. They show what your doctors billed, what your insurance paid, and what you’re responsible for.

- Out-of-Pocket Receipts: Keep a folder for everything you pay for yourself. This includes co-pays, prescriptions, a pair of crutches, or even the gas money for driving to and from appointments.

- Medical Records: You have a right to your own records. Ask for copies of your doctor’s notes, treatment plans, and diagnostic reports like X-ray or MRI results.

Being diligent here means you won't forget a single expense when it’s time to show the full financial cost of your injuries.

Follow Your Doctor’s Advice—No Exceptions

This is one of the most important things you can do for both your health and your case: follow your doctor's treatment plan to the letter. If they prescribe physical therapy three times a week for a month, you go three times a week. If they tell you to stay off your feet, you rest.

When an insurance adjuster sees big gaps in your treatment or notices you stopped going to physical therapy halfway through, it can raise red flags. They might start to wonder about the severity of the injuries. Consistent care shows you're serious about getting better and reinforces that the crash is the source of your ongoing medical needs.

Skipping appointments or ignoring medical advice can unintentionally create issues for your claim. Sticking to the plan not only helps you heal faster but also creates a rock-solid, credible record of your injuries.

Your Secret Weapon: A Personal Injury Journal

Medical records are great for facts and figures, but they don't capture the human side of your suffering. They won’t mention the fact you couldn’t sleep through the night for a month or that you had to miss your daughter’s soccer game because the pain was too much. That's where a personal journal can become incredibly powerful.

This is your space to document the daily reality of your recovery in your own words. It fills in the blanks and shows how the injuries from the crash with an uninsured driver have truly upended your life.

Here’s what you might track:

- Daily Pain: Just use a simple 1-10 scale to rate your pain each morning and evening.

- Symptoms: Get specific. Are you having sharp pains, dull aches, headaches, dizziness, or stiffness? Write it down.

- Emotional Toll: It's normal to feel anxious, frustrated, or even depressed after a traumatic event. Document these feelings.

- Daily Frustrations: Note the specific things you can't do anymore. "Couldn't lift the laundry basket." "Had to ask my spouse to open a jar for me." "Couldn't sit through a movie without shifting every five minutes."

- What You've Missed: Keep a running list of missed workdays, family events, social outings, or holidays you couldn't enjoy because of your injuries.

This personal story, combined with your official medical documents, can paint a vivid and complete picture of your losses that is hard for anyone to ignore.

What Are My Options for Financial Recovery?

While your Uninsured Motorist (UM) claim is often the most direct route to getting compensated, it may not be the only path available. Let’s look at the full picture of potential options. Understanding these possibilities can help you ask the right questions when you speak with an attorney.

Suing the At-Fault Driver Directly

The first thing that comes to mind for many people is filing a civil lawsuit against the person who hit them. This is a court action that’s completely separate from your insurance claim, where you ask a judge or jury to award you damages for your injuries and losses.

However, there can be a practical roadblock: if a driver can’t afford car insurance, they may not have the assets to pay a significant court judgment. Suing someone with no money can sometimes be a hollow victory.

Uncovering Other Sources of Coverage

A good investigation can really pay off. It's critical to look at the accident from every possible angle to see if any other people or insurance policies could be held responsible. The first impression at the crash scene doesn't always tell the whole story.

For example, was the uninsured driver working at the time? Were they driving someone else’s car? These questions can sometimes reveal other pockets of insurance coverage.

Potential third-party liability could include:

- An Employer: If the driver was "on the clock"—even just running a quick errand for their boss—their employer’s commercial insurance policy could be responsible. This is a legal concept called vicarious liability.

- The Vehicle Owner: Was the driver borrowing a friend's or family member's car? If they had permission to use it, the vehicle owner's policy might provide a layer of coverage.

- Other Responsible Parties: Think beyond the other driver. Was it a multi-car pileup? Were dangerously poor road conditions a factor? In some cases, other drivers or even a government agency could share part of the blame.

Every crash is unique, but these examples show why a deep dive into the facts is so important. Each detail could open a new door for recovery.

Using the Benefits in Your Own Policy

Don’t forget to take a close look at your own auto insurance policy, beyond just the UM coverage. You've been paying premiums for a reason, and you may have additional benefits that can offer immediate help, especially with mounting medical bills.

Your insurance policy is a contract. You paid for those benefits, and you may be entitled to use them. Knowing what's in your policy is the first step to managing the financial stress after a crash, no matter who was at fault.

Two key coverages you should know about are Personal Injury Protection (PIP) and Medical Payments (MedPay). In Oregon, every auto policy is required to have PIP, which provides no-fault coverage for your medical bills and a portion of your lost wages. MedPay is optional, but if you have it, it provides an extra layer of coverage for medical costs. Tapping into these benefits can be a lifeline while your larger UM claim moves forward. It’s also wise to get a handle on how to manage your car accident medical bills right from the start.

The danger is very real. In 2023, police-reported crashes across the U.S. led to an estimated 40,901 fatalities and over 2.4 million injuries. Highlighting the risk, unlicensed drivers—a group that heavily overlaps with the uninsured—were involved in an estimated 18.4% of all fatal accidents. You can see the full scope of the national data in NHTSA's traffic safety reports. Each of these potential avenues for recovery—suing the driver, finding a third party, or using your own policy—requires a careful, strategic approach.

Common Questions About Uninsured Driver Accidents in Oregon

Dealing with the fallout from a car crash is stressful enough. When you find out the other driver has no insurance, it throws a whole new set of worries into the mix. It can be a confusing and unfair situation.

Let's walk through some of the most common questions that come up in these cases here in Oregon.

Will My Rates Go Up If I File a UM Claim?

This is a very common concern. You did everything right, paid your premiums, and now you’re worried you’ll be penalized for using the very coverage you bought for this exact scenario. It feels backward, and it’s a totally valid fear.

Oregon law generally prevents insurance companies from raising your rates for a crash you didn't cause. Since an Uninsured Motorist (UM) claim is, by definition, for an accident where the other driver was at fault, filing one generally should not lead to a rate hike.

That said, your insurance policy is a detailed contract. It's always a good idea to review the specific terms, as company practices can vary. But as a general rule, you should not be punished for an uninsured driver's mistake.

What If the Uninsured Driver Leaves the Scene?

A hit-and-run is more than just an accident; it's a crime. The shock and anger you feel are completely understandable. If a driver flees, your absolute first priority is to call 911. Get the police on their way immediately.

This is another situation where your Uninsured Motorist (UM) coverage may be a lifesaver. Even if the driver is never identified, you can often still file a claim. To do this, you’ll need to prove that an unknown "phantom" vehicle caused the crash.

This makes the evidence you can gather absolutely critical:

- Witnesses: An independent witness who saw what happened can be your strongest asset. Their account helps establish that another vehicle was involved and fled.

- Physical Clues: Did the other car leave anything behind? A broken piece of a taillight, a side mirror, or even paint scrapings can help build your case.

- Your Own Photos: Pictures of your car's damage and the crash scene itself are vital. They help tell the story of what happened.

Getting the police and your own insurance company notified as quickly as possible is key.

How Long Do I Have to File an Injury Claim?

Time is not on your side after a crash. Oregon has a strict deadline, called a statute of limitations, for taking legal action. For a personal injury lawsuit stemming from a car accident, you generally have two years from the date of the crash to file in court.

But—and this is a big but—the clock for your own insurance company is different. Your policy will have its own deadlines for reporting the accident and for filing a formal UM claim. These timelines can be much shorter. Missing a deadline could bar you from getting the compensation you might otherwise be entitled to, so it is important to stay on top of both.

The two-year court deadline for suing the at-fault driver is separate from your insurance policy's deadlines for a UM claim. It is important to track both.

Can I Get Compensation If I Was Partially at Fault?

Accidents are rarely black and white. Maybe you were going a little over the speed limit, or perhaps you didn't signal a turn quite early enough. Oregon law understands this and uses a system called modified comparative negligence.

What this means is you can still recover damages even if you were partially to blame, with one important condition: your share of the fault can't be greater than the other driver's. As long as you are 50% or less at fault, you can pursue a claim.

Your final compensation will simply be reduced by your percentage of fault. For example, if it is determined that you were 20% responsible for the crash, your total award would be cut by 20%. Figuring out these percentages is often one of the most contested parts of any injury claim.

Navigating the complexities after a crash with an uninsured driver can be challenging. If you have questions about your specific situation in Oregon, the team at Bell Law is here to provide clarity and guidance. Contact us for a consultation to understand your options by visiting our official website.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.