What To Do After Denying Workers Comp Claim

"I was satisfied once John Bell took over my case."

"Communication was always timely."

What To Do After Denying Workers Comp Claim

Getting a denial letter for your workers' compensation claim can feel like a punch to the gut. But it's crucial to understand that this isn't the end of the road. In my experience, an insurer denying a workers' comp claim is often just the first step in a much longer process. A surprising number of initial denials in Oregon are successfully overturned once an injured worker takes the right steps to fight back.

Your Oregon Workers Comp Claim Was Denied. Now What?

When you open that envelope and see the word "DENIED" in bold print, it’s easy to feel defeated. The formal language and official letterhead can make it seem like the insurance company has all the power and has made a final, unchangeable decision.

The reality is, this denial is a business tactic, not a medical or legal verdict on your injury. The letter you're holding is actually one of the most important documents you'll receive because it spells out exactly why the insurer is refusing to pay.

Your first move is to read that notice from top to bottom, even if the legal jargon is dense and confusing. It gives you the specific arguments you now have to overcome. Think of it less as a closed door and more as a challenge to prove them wrong.

Decoding the Denial Notice

Insurance companies tend to fall back on a handful of standard reasons for denying claims. Figuring out which one they're using in your case is the key to building a successful appeal. Did they claim you missed a deadline? Are they arguing the injury didn’t actually happen at work? Knowing their angle is how you start building your counter-argument.

For example, fighting a denial based on a "pre-existing condition" is a totally different ballgame than challenging one for "late reporting." The first requires strong medical opinions connecting your work activities to the new injury, while the second demands proof that you notified your employer on time.

Remember, the burden of proof now shifts to you. The insurance company has stated its position; your job is to systematically dismantle their reasoning with credible evidence and a clear, logical appeal.

Below is a table that breaks down some of the most common justifications insurers use. See if you can find the reason that matches what's in your letter—it will help you understand the challenge ahead and what you need to do next.

Common Reasons Insurers Deny Workers Comp Claims

Here's a look at the most frequent justifications insurers use for denying a claim, helping you understand the basis of your denial notice.

| Injury Not Work-Related | The insurer is arguing your injury happened outside of your job duties or wasn't caused by a specific work event. |

| Pre-existing Condition | The company claims your pain or disability is from an old injury, not your recent workplace accident. |

| Missed Filing Deadlines | The insurer is saying you failed to report your injury or file your claim within Oregon's strict time limits. |

| Insufficient Medical Evidence | The medical documentation provided doesn't adequately link your condition to your job or prove the extent of your disability in their view. |

| Disputed Facts of the Incident | Your employer’s account of what happened differs from yours, or they are pointing to inconsistencies in witness statements. |

| Failure to Seek Timely Medical Care | The insurer is suggesting your injury wasn't serious because you waited too long to see a doctor after the incident occurred. |

Once you've identified the insurer's reason, you can begin gathering the specific evidence needed to counter it. This is where you start taking back control of your claim.

Why Insurers Are Denying More Workers Comp Claims

Getting that denial letter in the mail feels like a gut punch. It’s easy to take it personally, to feel like the insurance company is calling you a liar or saying your pain isn't real. But I need you to understand something right away: this is almost never about you. It’s a business decision.

Insurance carriers are in the business of making money, and that means minimizing what they pay out in claims. They've built incredibly sophisticated systems to scrutinize every single detail, looking for any possible loophole—no matter how small—to justify a denial. This isn't just a feeling; the numbers back it up.

Take Oregon, for instance. A staggering 27% of all workers' compensation claims are initially denied. To put that in perspective, some states like Utah have denial rates as low as 15%. You can explore the data on claim denial rates yourself, but the takeaway is clear: more than one in four injured workers in Oregon get a "no" right out of the gate.

The System Is Designed to Create Hurdles

That high denial rate isn’t a coincidence. It's a feature, not a bug, of a system that often benefits when injured workers just give up. The insurance company is counting on you to be overwhelmed, confused, or too intimidated by the formal legal language to fight back.

Here are a few of the tactics they rely on:

- Automated Red Flags: Many insurers use software that automatically flags claims. Did you mention a pre-existing condition? Is it a soft-tissue injury that’s hard to see on an X-ray? The computer might have already tagged your file for extra scrutiny.

- Overloaded Adjusters: The insurance adjuster handling your case is likely juggling hundreds of others. They are trained to spot inconsistencies and find reasons to question claims from the moment they first speak with you.

- The "Delay, Deny, Defend" Strategy: This is a classic playbook in the insurance world. First, they delay processing your claim. Then, they issue a denial. Finally, they dig in their heels and prepare to defend that denial, hoping the financial and emotional strain will force you to walk away.

Understanding this is your first strategic advantage. Your denial isn't the final word on your injury. Think of it as the insurance company's opening bid in a negotiation—and you're about to make a counteroffer.

Anticipating the Insurer's Arguments

Because these denials are so often based on a formula, you can start to predict the arguments the insurer will use. They’ll likely fall back on a few common reasons, like claiming your injury didn't happen at work or that a pre-existing condition is the real cause of your symptoms.

Your job is to systematically tear those arguments apart with solid evidence. This is where meticulous record-keeping and staying on top of your medical treatment become your best weapons. The insurer is betting you won’t have the energy or organization to build a strong case. It's time to prove them wrong.

Knowing how to handle conversations with insurance adjusters is a critical piece of this puzzle. To learn more about their tactics and how to protect yourself, read our guide on how to deal with insurance adjusters. This knowledge will help you reframe the denial from a personal attack into a predictable obstacle you can overcome.

Immediate Steps to Protect Your Rights After a Denial

That denial letter from the insurance company isn't just a piece of paper—it's the starting gun for a race against the clock. The moves you make in the first few days are absolutely critical and can make or break your ability to fight back. This isn't a time to wait and hope; it's time to act decisively.

The very first thing you need to do is simple but crucial: save everything. Don't toss the envelope the denial letter came in. That little postmark is your official proof of when you were notified, and it’s the key to meeting the strict appeal deadlines in Oregon. Keep the letter, the envelope, and anything else that came with it all together in a safe place.

Get Your Hands on the Claim File

Under Oregon law, you have a right to a complete copy of your claim file from the insurer. This file is a treasure trove of information, containing every document they've gathered: your first injury report, medical records, the adjuster's private notes, and maybe even witness statements. It's the playbook they used to deny your claim.

To get it, you have to ask for it in writing. A straightforward letter or email is all you need. Just state your name, claim number, and that you're requesting a "complete and certified copy of my entire claim file." Make sure you send it via certified mail or use an email with a read receipt. You need a paper trail to prove you asked.

Getting this file isn't optional; it's essential. It lets you see their strategy, find the holes in their reasoning, and figure out exactly what evidence you need to gather to dismantle their argument.

Be Smart About Communication

Don't be surprised if an insurance adjuster calls you after sending the denial. They might ask for a recorded statement or want you to sign more medical authorizations. Tread very carefully here. Their only goal is to get you on record saying something—anything—that could damage your case even further.

Politely refuse to give any recorded statements or sign any new forms until you've spoken with a lawyer. You are under no obligation to do either. A casual comment like, "Well, my back was a little sore last year," can be twisted into an admission that a pre-existing condition is the real cause of your problems.

Here’s what you should do right away:

- DO keep the denial letter and its postmarked envelope.

- DO send a written request for your entire claim file.

- DO NOT give a recorded statement to the insurer.

- DO NOT sign any new paperwork without having it reviewed.

- DO keep up with all prescribed medical treatment.

Your Medical Treatment Is Your Best Weapon

This might be the single most important piece of advice: keep going to your doctor. If you stop treatment, you're handing the insurance company an easy argument on a silver platter. They'll claim that any gap in care proves your injury isn't serious or that you've already recovered.

You'll likely have to use your private health insurance for now, but it's worth it. More importantly, talk to your doctor at every single appointment about how your work duties caused or aggravated your injury. You need them to document that connection meticulously in your medical chart.

A consistent, detailed medical record from your own doctor is powerful. It provides a credible, expert opinion that can directly challenge the insurer's profit-driven decision. This is often the point where knowing when to hire a workers' comp lawyer becomes crucial, as an experienced attorney can help make sure your medical evidence is framed perfectly to support your appeal from day one.

Building Your Case: The Evidence You Need to Win

Once the shock of a claim denial wears off, it’s time to get to work. You can’t win an appeal just by telling the insurance company you disagree with their decision. You need to prove them wrong. This means building a powerful, evidence-based case that systematically dismantles their reasons for saying "no."

Think of it like you're the lead investigator on your own case. Every document, every conversation, every detail matters. Your goal is to assemble a file so clear and compelling that it leaves no doubt your injury is work-related and deserves coverage.

It All Starts with Your Medical Records

The most critical evidence in any workers' comp case is, without a doubt, your medical file. But just having a stack of papers isn't enough. You need the right kind of documentation—records that are detailed, consistent, and clearly connect your injury to your job.

Here’s what you absolutely must get your hands on:

- Your Doctor’s In-Depth Notes: You need more than just a diagnosis. Look for notes where your doctor explicitly states that your work accident was the major contributing cause of your injury and the reason you need treatment. That specific phrase is gold.

- Imaging and Test Results: This means X-rays, MRIs, CT scans—any objective, visual proof of your injury. It’s tough for an insurer to argue with a picture of a torn ligament or a fractured bone.

- Notes from Specialists: Did your doctor send you to a physical therapist, an orthopedist, or another specialist? Get those reports. Every additional expert opinion strengthens your claim and adds another layer of credibility.

You have to make sure your doctor understands what’s at stake. A simple, well-phrased note in your chart—something like, "Patient's shoulder pain began immediately after the fall from the ladder at his job site"—can be far more powerful than a hundred pages of generic medical jargon.

Looking Beyond the Doctor's Office

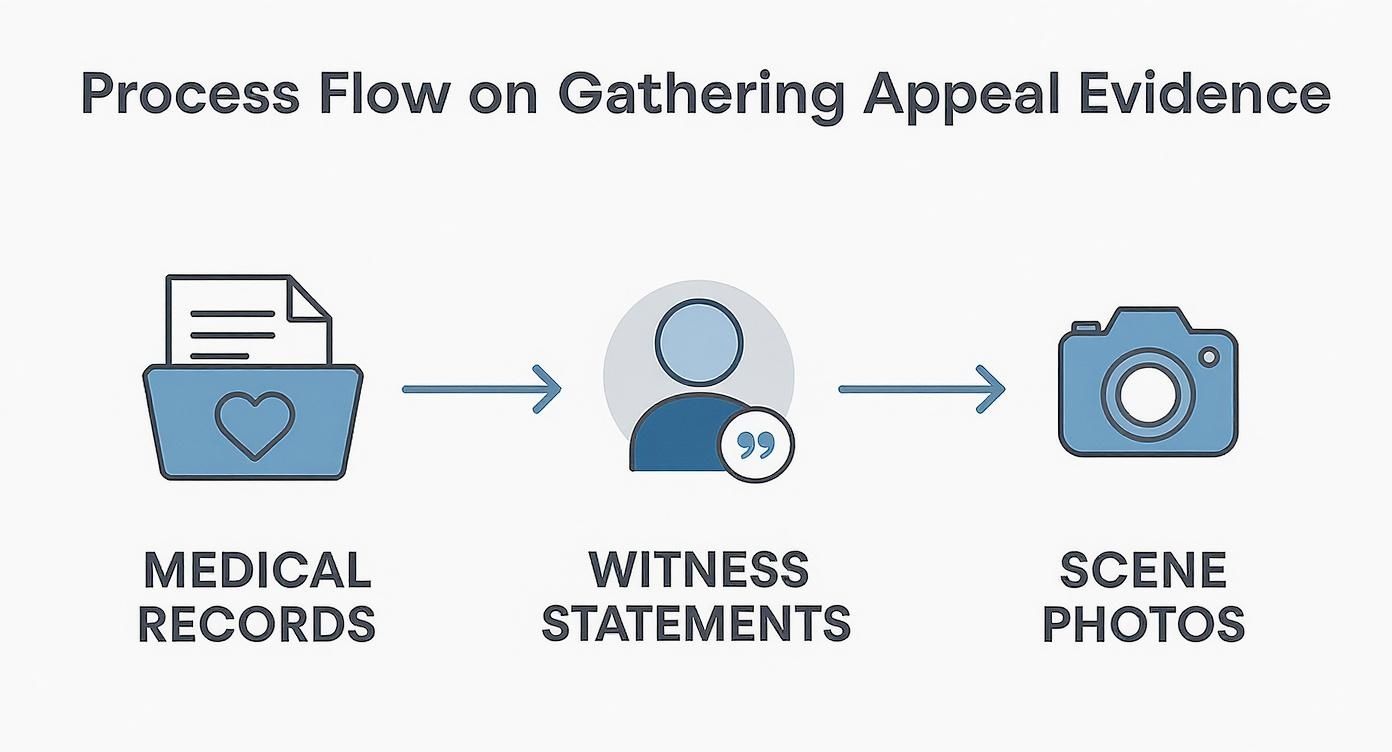

While your medical file is the foundation, a strong appeal brings in evidence from other sources to paint the full picture. Insurers love to focus only on the medical reports, taking your injury out of context. Your job is to put that context back in.

Think about a warehouse worker who injures his back. The MRI shows a herniated disc, but the insurer argues it’s just age-related wear and tear. Now, what if you add a statement from a coworker who saw him slip on an unmarked wet spot while carrying a heavy box? Or a photo of the leaking pipe that caused the spill? Suddenly, you have a story that the MRI alone can’t tell.

The insurance company has its own version of events, and it’s always the one that saves them money. Your evidence is your chance to tell the real story, backed up by undeniable facts.

If you have recorded statements or phone calls as part of your evidence, using a tool like legal transcription software can be incredibly helpful. It turns that audio into a written document you can easily search, quote, and submit as part of your formal appeal.

Facing the "Independent" Medical Examination

At some point, the insurer will almost certainly require you to attend an Independent Medical Examination (IME). Let’s be clear: there’s nothing truly "independent" about it. This doctor is hand-picked and paid by the insurance company, and their primary role is often to find a medical opinion that supports the denial.

You are required to go, but you can and should go in prepared.

Be Consistent. The story you tell the IME doctor about your injury and symptoms must match what you told your own doctor, your boss, and what's in your records. They are looking for any inconsistencies to use against you.

Don’t Exaggerate, Don't Downplay. Be honest and direct about what you can and can't do. If lifting a gallon of milk is painful, say so. If you try to act tougher than you are, they'll note you have "full function." If you overstate your pain, they'll call you a malingerer. Just be real.

Give a Clear History. Walk the doctor through exactly how the injury happened and how the symptoms have impacted your ability to do your job. Don't let them rush you.

The IME doctor’s report will become a key piece of evidence, and the insurer is counting on it to sink your claim. By being prepared, honest, and consistent, you can neutralize their biggest weapon and ensure your side of the story is accurately reflected.

Navigating the Oregon Workers’ Compensation Appeal Process

Getting that denial letter for your workers' comp claim can feel like a punch to the gut. It's easy to feel defeated, but in Oregon, that letter isn't the final word. It's actually the start of a formal legal process. You have the right to fight the insurer's decision, but you have to follow the specific roadmap set by the Oregon Workers' Compensation Board. The rules and deadlines are strict, but knowing the path forward is the first step toward taking back control.

The first move is filing a formal appeal. This isn’t a simple phone call or email—it means submitting a specific legal document, usually the "Request for Hearing" form, directly to the Workers' Compensation Board. This officially tells the state you're challenging the denial and want your case heard by a judge. A clock starts ticking the moment you get that denial, so you have to act fast.

The Critical First Step: Filing Your Appeal

In Oregon, you have a tight window—generally 60 days from the date the denial letter was mailed—to file your appeal. Missing this deadline is one of the easiest ways to lose your right to challenge the denial, no matter how solid your case might be. When you file, you’ll need to provide your personal details, claim number, and a clear statement that you're appealing.

Once your request is filed and processed, your case gets assigned to the Hearings Division and scheduled before an Administrative Law Judge (ALJ). This isn't a dramatic courtroom trial like you see on TV. Think of it more as a formal meeting where both sides present their evidence, and the ALJ acts as a neutral referee, applying Oregon's workers' comp laws to the facts of your situation.

What Happens Before the Hearing

A lot happens before you ever step foot in a hearing room. The goal of these pre-hearing steps is often to see if the dispute can be resolved without going all the way to a formal hearing.

- Discovery: This is where both sides lay their cards on the table. You and the insurer will exchange all relevant documents, including medical records and lists of potential witnesses. The insurer might also require you to give a deposition, which is sworn testimony taken outside of court.

- Mediation: Many cases are steered toward mediation. This is a confidential meeting where a neutral mediator helps you and the insurance company try to find common ground and reach a settlement. It’s a great opportunity to resolve your claim without the stress and uncertainty of a formal hearing.

The evidence you collect during this phase is the foundation of your entire case.

A winning appeal isn't just about one piece of paper. It's about weaving together strong medical evidence with real-world proof like witness accounts and photos to paint a clear, undeniable picture of your injury.

Your Day Before the Administrative Law Judge

If your case doesn't settle, it moves on to a hearing. Here, your attorney will make your case by submitting evidence, asking you to testify about your injury and how it affects your life, and calling witnesses—like coworkers or even medical experts—to back up your story. The insurer’s lawyer will do the same, cross-examining your witnesses and presenting their own evidence to try and justify the denial.

The judge's decision will be based solely on the evidence presented at the hearing. This is why all the groundwork you do gathering medical records, witness statements, and other proof is so absolutely critical to the outcome.

After the hearing concludes, the ALJ will review everything and issue a written decision called an "Opinion and Order." This order will either agree with the insurer’s denial or overturn it, forcing them to accept your claim and provide your benefits. Even if this decision doesn't go your way, you still have more options—you can appeal further to the Workers' Compensation Board and, if necessary, to the Oregon courts.

From filing the initial request to getting a final order, the entire process can feel long and overwhelming. To get a deeper dive into the specific legal strategies, you can learn more about how to appeal a workers' comp denial in our comprehensive guide. While this gives you the basic framework, having an experienced attorney navigate the legal filings, evidence rules, and tough negotiations can make all the difference.

Your Questions About a Denied Claim, Answered

A denial letter from the insurance company is a gut punch. Suddenly, a wave of questions and anxieties hits you all at once. It’s a tough spot to be in, but you’re not alone, and getting clear answers is how you start to take back control. Let's walk through some of the biggest concerns we hear from injured workers across Oregon.

Can My Boss Fire Me for Fighting a Denial?

This is the number one fear for so many people, and I want to be crystal clear: no, they cannot. Oregon law explicitly makes it illegal for your employer to fire, demote, or retaliate against you in any way for filing a workers' comp claim or appealing a denial.

This is a fundamental protection. If you even get a whiff of retaliation—a snide comment, a sudden poor performance review, a change in your duties—start documenting everything immediately. That kind of behavior can be grounds for a completely separate legal action against your employer.

What if the Insurer Blames a "Pre-Existing Condition"?

This is a classic move straight from the insurance adjuster's playbook. They'll dig through your medical history and argue that your current pain isn't from the work injury, but from something that was already there.

Don't let this scare you. In Oregon, a pre-existing condition doesn't automatically kill your claim. The legal standard is whether the work incident significantly worsened or aggravated your underlying condition. If your job was the major contributing cause of your disability or need for treatment, the claim should be accepted. This is where a strong, detailed medical report from your doctor becomes absolutely critical.

How Long Will an Appeal Take?

I wish I had a simple answer, but the honest one is: it depends. The timeline for an appeal can stretch out depending on how complicated your case is, how backed up the Workers' Compensation Board is, and how hard the insurer decides to fight.

Just getting a hearing scheduled with a judge can take several months after you file the appeal. If the case is complex and doesn't settle, pushing through the entire litigation process could take a year or more. It’s a marathon, not a sprint, which is why it’s so important to get started right away and not let any deadlines slip.

You'll often hear insurers talk about fighting fraud as a reason for denying claims. Let's put that in perspective. Real-world data shows that fraud accounts for a tiny fraction of the system—some studies put the number at just 1% to 2% of total workers' comp payments. Don't let them make you feel like you've done something wrong; the vast majority of claims, including yours, are legitimate. For more details, you can explore the real data on workers' compensation statistics.

Do I Have to Pay a Lawyer Upfront to Appeal?

Absolutely not. Reputable workers' compensation attorneys in Oregon all work on a contingency fee basis. The system is set up this way so that anyone can afford expert legal help, no matter their financial situation.

Here’s what that means:

- You pay zero dollars out of your own pocket to hire the attorney.

- The lawyer only gets paid if they win your case and secure benefits for you.

- Their fee is a percentage of the benefits they recover, and that percentage is capped by Oregon law.

It perfectly aligns our interests with yours—we don't get paid unless you do. It removes all the financial risk from getting the professional help you need.

Trying to navigate a denied claim on your own is an uphill battle. At Bell Law Offices, we’ve been fighting for Oregon workers for years, and we know how to push back against the insurance companies. If you're ready to build a winning appeal, reach out to us today for a free, no-obligation consultation to talk about your case. Learn more at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.