Does Insurance Cover a DUI Wreck?

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Does Insurance Cover a DUI Wreck?

It's one of the most stressful questions someone can ask after a DUI-related accident: "Will my insurance cover this?" The answer is a bit of a "yes and no," and understanding the difference is critical.

Your liability coverage is generally required to pay for the damages and injuries you cause to other people, even if you were driving under the influence. However, when it comes to covering your own car damage or medical bills, most policies will draw a hard line.

Think of your liability insurance as a financial shield that protects everyone else on the road from your mistake. It's there to make sure innocent victims are compensated. But that shield doesn't extend to you, the driver who caused the crash. You'll likely be left to handle your own repair costs and medical expenses.

Let’s break down how the different parts of a standard auto policy typically react when a DUI is involved:

- Liability Coverage: This is the part that pays for the other person's car repairs and medical treatment. It almost always pays out, up to your policy limits.

- Collision Coverage: This covers your own vehicle. A DUI-related accident will often trigger a "criminal act" or "intentional act" exclusion in your policy, meaning the insurer can legally deny your claim.

- Personal Injury Protection (PIP) or MedPay: This coverage is for your own medical bills, regardless of fault. Like collision, it can often be denied if you were convicted of a DUI.

- Uninsured/Underinsured Motorist Coverage: This only applies if another driver is at fault and they don't have enough (or any) insurance. It doesn't come into play when you are the one at fault.

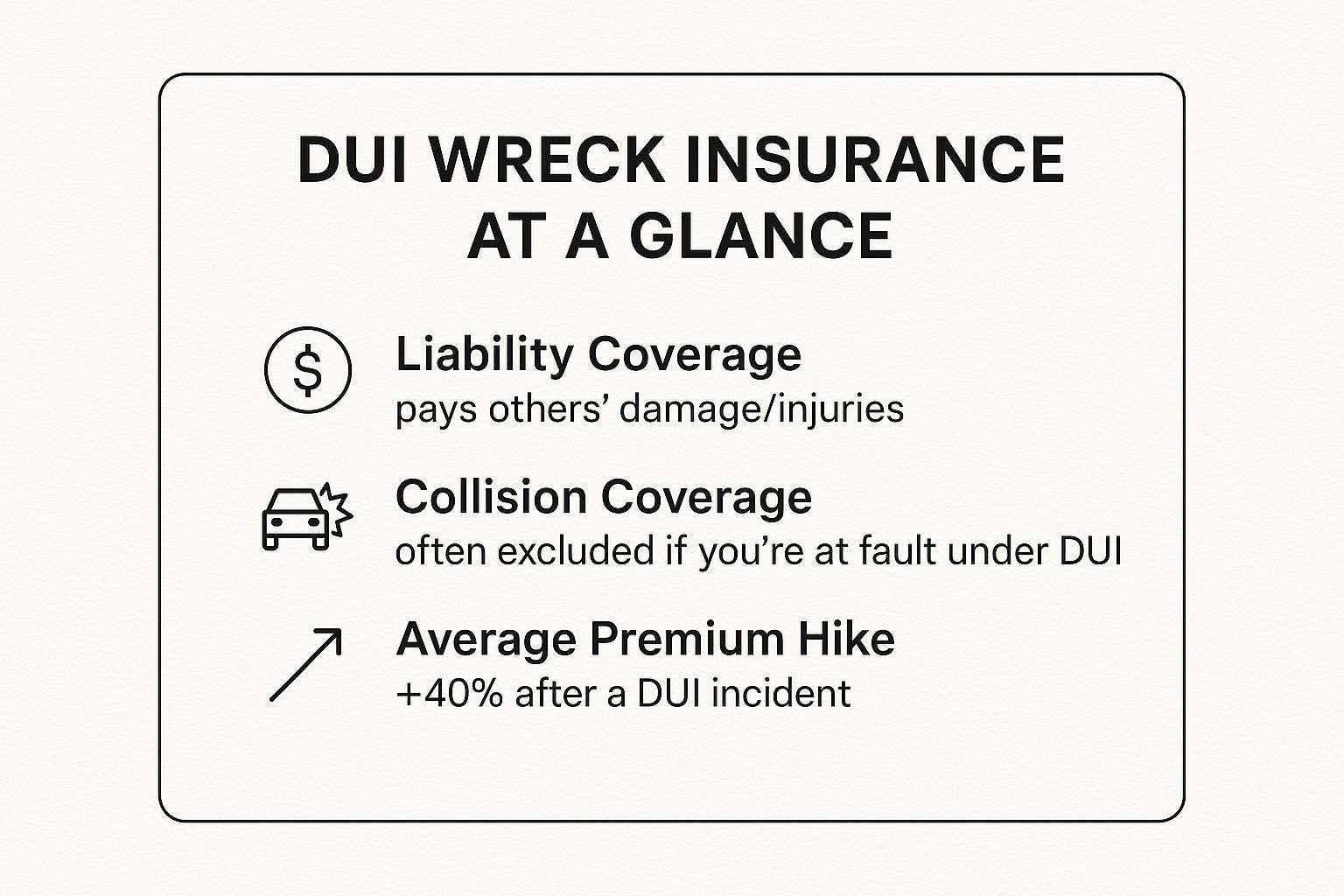

As the visual above illustrates, while your liability coverage does its job, the consequences hit you directly. You can expect your claim for your own car to be denied, and your premiums are almost guaranteed to skyrocket—sometimes by as much as 40% or more.

To simplify things, here’s a quick summary of what to expect from your insurance company.

Quick Guide to Insurance Coverage After a DUI Wreck

This table breaks down how standard insurance coverages typically respond after an at-fault accident involving a DUI.

| Liability | Damage and injuries you cause to others | Typically Paid. The claim for the innocent victims is usually covered up to your policy limits. |

| Collision | Repairs to your own vehicle | Often Denied. Most policies contain exclusions for accidents caused while committing a crime, like a DUI. |

| PIP / MedPay | Your own medical expenses | Often Denied. Similar to collision, claims can be denied based on a criminal act exclusion. |

| UM / UIM | Your costs if an uninsured driver hits you | Not Applicable. This coverage doesn't apply when you are the at-fault driver. |

Understanding your insurance policy is just one piece of the puzzle. It's also crucial to understand the broader implications of a DUI offense, which extend far beyond your insurance coverage.

The core reason for this split in coverage comes down to policy language. Insurers in many states classify driving under the influence as an intentional or criminal act, not just an accident. This classification gives them the legal grounds to refuse to pay for your personal losses.

This "one-way shield" approach ensures that public policy is met—victims are protected—while you, the driver, face the direct financial consequences of your actions, including massive repair bills, medical debt, and crippling premium increases.

Looking ahead, we'll dive deeper into exactly how liability, collision, and personal injury protections work in these situations, giving you a clear picture of what to do next.

How Liability Insurance Protects Everyone Else

Many people think of auto insurance as something that protects their car. But when it comes to liability coverage—the absolute foundation of any policy—that's not the case at all.

Think of liability insurance as a financial shield for the other people you might harm if you cause an accident. Its entire job is to cover the medical bills and property damage of your victims, which is why state law almost always forces your insurer to pay out, even if you were driving drunk. The whole system is built to make sure innocent people aren't left holding the bag for your mistake.

This coverage is typically broken down into two key components that handle different types of damage.

What Bodily Injury Liability Covers

Bodily Injury (BI) liability is the part of your policy that pays for the physical harm you cause to others. We're talking about everything from the ambulance ride and ER bills to long-term physical therapy, lost income if they can't work, and even pain and suffering.

Let's say you cause a DUI crash that sends another driver to the hospital. Your BI coverage is what steps in to pay their medical bills, up to your policy's limit. Without it, you’d be on the hook personally, and those costs can skyrocket into the tens or even hundreds of thousands of dollars in a heartbeat.

Key Takeaway: Your liability coverage isn't just a contractual obligation; it's a critical public safety net. It ensures victims have a source of funds to recover, preventing financial ruin from being added to their physical injuries.

Understanding Property Damage Liability

On the flip side, Property Damage (PD) liability pays to repair or replace other people's stuff that you damage. Most of the time, this means the other driver's car, but it doesn't stop there. It can also cover things like a guardrail, a telephone pole, a fence, or even the side of a building.

For instance, if you swerve while intoxicated, sideswipe another car, and then crash through a storefront, your PD liability would be tapped to pay for both the car repairs and the building damage—again, only up to your policy limit. This is what keeps the financial burden off the shoulders of the innocent car owner and the business you just hit.

This mandatory coverage is a global standard for a reason. Drunk driving is a worldwide crisis, contributing to an estimated 21.8% of all road fatalities globally. Because the risk is so immense, most countries require insurers to cover third-party liability for DUI incidents to protect the public. You can dig into the global statistics on the International Transport Forum's website.

What Happens When Your Policy Limits Aren't Enough?

This is where things get really serious for the at-fault driver. The biggest financial danger in a DUI wreck is blowing past your policy limits. State minimums can be surprisingly low, and the costs of a severe accident—with major injuries and totaled vehicles—can easily exceed them.

When the total damages are more than what your policy covers, here’s the chain of events:

- The insurer pays its part. Your insurance company will pay out every dollar of your coverage, right up to the limit.

- You're on the hook for the rest. Any amount leftover becomes your personal debt. The victims’ attorneys will come after you directly for the difference.

- Your personal assets are at risk. This isn't just an IOU. A lawsuit can lead to having your wages garnished, liens placed on your home, and your savings seized to satisfy the judgment.

This is the cold, hard reality of a DUI. While your insurance provides that crucial shield for others, it has a definite limit. Once the damages break through that limit, your own financial future is completely exposed.

What About Your Car? Why It Might Not Be Covered

So, your liability coverage is dealing with the damage you caused to others. But what about your own car, now a crumpled wreck on the side of the road? That's what Collision and Comprehensive coverages are for, right? Well, yes—but a DUI changes everything.

A lot of drivers think, "I pay for collision, so my insurance has to fix my car, no matter what." This is a dangerously common and often very expensive mistake. Buried in the fine print of your policy are clauses that give your insurance company the legal ammunition they need to deny your claim after a DUI.

It all comes down to how the insurer sees the crash. In their eyes, driving drunk isn't a simple mistake or a lapse in judgment. It's a deliberate, criminal act, and that distinction makes all the difference.

The "Intentional Act" Exclusion

Just about every car insurance policy has what’s called an “intentional acts” or “criminal activity” exclusion. This clause is the insurance company's escape hatch. It basically says they won't pay for damages that you cause on purpose or while committing a crime.

Here's an analogy: if you get angry and intentionally drive your car into a brick wall, you can't expect your collision coverage to pay for the repairs. Insurers argue that getting behind the wheel while intoxicated is a similarly reckless and willful decision, not a true "accident."

By framing the DUI wreck this way, they can legally refuse to pay for your car's repairs. Suddenly, you're on the hook for the entire bill.

The Hard Truth: Your insurance policy is a contract to protect you from unforeseen accidents. When the company can argue that the crash was a foreseeable result of an intentional, criminal choice (like drinking and driving), they can get out of paying for your property damage.

This is the single biggest reason the answer to "does insurance cover a DUI wreck?" is so often "no" when it comes to your own vehicle.

Finding the Exclusion in Your Policy

The exact wording will differ from one policy to another, but the goal is always the same. Look for language that excludes coverage for any loss that happens:

- During the commission of a felony. In many states, a serious DUI—especially a repeat offense or one that causes major injuries—is a felony.

- As a result of intentional or fraudulent acts. The insurance company will argue that the choice to drive impaired was an intentional act that directly caused the wreck.

- From any illegal activity. This is a broad, catch-all phrase that easily includes driving under the influence.

Let's walk through a real-world example. Imagine you crash your car and are charged with a DUI. The damage to your vehicle is $15,000, so you file a collision claim. The claims adjuster pulls the police report, sees the DUI charge, and promptly sends you a denial letter, quoting the policy's exclusion for "losses occurring during the commission of an illegal act."

Just like that, you are now personally responsible for that $15,000. And if you have a car loan? You still owe the bank for a car that might be sitting in a junkyard. This is how a single bad decision can spiral into a financial nightmare, completely separate from the court fines and legal fees. Betting on your collision policy to save you after a DUI is a gamble you’re almost guaranteed to lose.

What About Your Own Injuries After a DUI Wreck?

So, your liability coverage is meant to handle the other driver's bills. But what about you? If you’re injured in the crash, your own Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage is supposed to be your safety net.

Think of it as your first line of defense for medical bills after a crash. It’s designed to pay for your treatment quickly, no matter who was technically at fault.

Unfortunately, a DUI throws a massive wrench into this process. That same "criminal act" exclusion we talked about for vehicle damage can be used to deny your injury claim, too. The insurer’s logic is cold and simple: your injuries didn't happen by accident; they were the direct result of you breaking the law. This can leave you staring at a mountain of medical debt from a policy you’ve faithfully paid for.

When No-Fault Rules and DUI Exclusions Collide

Whether your PIP or MedPay claim gets paid often comes down to a legal tug-of-war between state laws and the tiny print in your insurance policy. This is where things get really messy.

The rules can be wildly different from one state to the next, creating a confusing patchwork of regulations.

- States Where the Policy Wins: In many places, the insurance contract is treated as the final word. If it contains a clear exclusion for injuries you get while committing a crime, the insurance company is on solid ground to say no. Your DUI charge is all the proof they need.

- States with Strong "No-Fault" Laws: On the other hand, some "no-fault" states prioritize getting people medical care above all else. The whole point of no-fault is to pay medical bills first and figure out the blame later. In these states, you might have a shot at arguing that your insurer has to cover your initial treatment, but it’s never a sure thing.

This legal gray area means you can't just assume your PIP will come through for you. The decision often hinges on very specific state laws and how courts have interpreted them in the past.

Oregon’s Approach to PIP and DUIs

Let’s look at Oregon as a real-world example. Here, PIP coverage isn't just an option—it's mandatory on all auto policies to help with medical bills and lost wages. But a DUI conviction can blow up those crucial benefits.

An insurer can legally deny PIP benefits if the injured person's own conduct contributed to their injuries in certain ways—and that includes being convicted of a DUI.

This means your "no-fault" medical coverage can be legally stripped away at the exact moment you need it most.

If your claim is denied, you’re on your own. You’ll have to fall back on your personal health insurance, which means dealing with deductibles, copays, and coverage limits. If you don't have health insurance? You are 100% personally responsible for every single dollar of your medical care. This is how a DUI wreck spirals from a legal nightmare into a financially devastating one.

This is why understanding your local laws is so critical. For example, knowing the rules around things like Oregon's uninsured motorist coverage gives you a better sense of how insurance policies are interpreted in the state. At the end of the day, it's the clash between state law and policy exclusions that will decide if you get help with your medical bills.

The Long-Term Financial Fallout from a DUI Wreck

The immediate chaos of a DUI wreck is just the beginning. Long after the flashing lights fade and the tow truck is gone, a DUI conviction kicks off a financial chain reaction that can haunt you for years. It fundamentally changes how insurance companies see you, and the denial of a claim for your wrecked car is often just the first, painful lesson.

Once a DUI is on your record, you're not just a regular driver anymore. In the eyes of an insurer, you've been instantly re-categorized as a high-risk driver. This new label isn't just a technicality; it comes with some serious and immediate financial consequences that go way beyond a single accident.

Get Ready for a Major Premium Spike

The first and most painful hit comes to your wallet: your auto insurance premiums are going to skyrocket. Insurance is all about risk, and a DUI is one of the biggest red flags you can possibly wave. The numbers don't lie.

Just how bad is it? Data shows that drivers with a DUI conviction pay an average of 67% more for their insurance than someone with a clean driving record. Think about what that actually means. If you were paying a reasonable $145 a month with a carrier like State Farm, you could easily see that bill jump to nearly $220. This isn't a one-time penalty. It's your new, much higher reality for years to come.

The SR-22: A Mark of High Risk

In many states, including Oregon, a DUI conviction means you’ll be required to file an SR-22 certificate. People often mistakenly think an SR-22 is a type of insurance, but it's not. It’s simply a form that your insurance company files with the state, basically vouching for you and proving you have at least the minimum liability coverage required by law.

You can think of the SR-22 as a giant neon sign on your driving record that screams "high-risk client" to every insurer out there.

The mere requirement of an SR-22 is enough to send your rates through the roof. It’s the state’s way of keeping you on a tight leash, and you typically have to maintain it for at least three straight years. If your insurance lapses for even a day during that time, you can expect your driver's license to be suspended immediately.

To make matters worse, many of the big, standard insurance companies won't even file an SR-22 for their clients. They see it as too much of a liability, which often leads to another gut punch: policy cancellation or non-renewal.

A DUI conviction brings a whole host of financial burdens that can be difficult to manage. The table below breaks down the most common financial hits your insurance will take.

Table: Financial Impact of a DUI on Your Insurance

| Premium Increase | Rates often increase by 67% or more annually. | Typically 3-5 years, sometimes longer depending on the insurer. |

| SR-22 Filing | A mandatory filing fee plus the associated rate hike. | Required for a minimum of 3 years in most states. |

| Loss of Discounts | Good driver, safe driver, and other discounts are revoked. | Lasts as long as the DUI is on your record for insurance purposes. |

| Policy Non-Renewal | Your current insurer may drop you at the end of your term. | Forces you to find a new, more expensive high-risk policy. |

As you can see, the financial pain isn't a one-time event but a long-term problem that reshapes your budget for years.

Shifting to High-Risk Insurance Carriers

So, what happens when your trusted insurance company decides you're too risky and drops you? You're forced into the world of non-standard or high-risk insurance carriers. These are specialty companies that make their money insuring drivers that no one else will touch.

While it’s good that they exist, getting coverage from them comes at a very steep price:

- Exorbitant Premiums: You'll pay far more than you ever did with a standard insurer, often for just the bare-bones liability coverage.

- Minimal Coverage: Forget about robust policies. You’ll be paying top dollar for state-minimum coverage, and options like collision or comprehensive might not even be available.

- High Deductibles: If you can find a policy with collision coverage, expect the deductible to be painfully high to discourage you from filing any claims.

The financial fallout from a DUI can be massive, impacting all kinds of car-related expenses. For a wider view on managing automotive finances, you might find valuable context in these general car-related financial discussions.

Ultimately, the combination of huge premium hikes, SR-22 requirements, and being pushed into the high-risk insurance market paints a grim picture. The question "does insurance cover a dui wreck" isn't just about the initial crash—it's about a multi-year financial burden that serves as a harsh reminder of a single bad choice. To dig deeper, you can learn more about what insurance covers after a DUI accident in our detailed guide.

How to Respond When Your Claim Is Denied

Getting that denial letter in the mail after a DUI wreck feels like a punch to the gut. It’s easy to feel defeated, but a denial isn’t always the final word. You absolutely have the right to question why your claim was rejected and, if the reason seems flimsy, to fight back.

Think of the denial as the start of a new conversation, not the end of one. The key is to stay calm and approach it methodically. Let’s walk through the steps.

Step One: Demand a Written Explanation

First things first: get it in writing. A denial over the phone is not good enough. You need an official letter or email that lays out the insurance company's decision in black and white.

This document is legally required to explain exactly why they are denying your claim. More importantly, it must point to the specific language in your policy that they believe justifies their decision. This letter is your roadmap for what to do next.

Step Two: Review Your Policy and Gather Evidence

With the denial letter in hand, it’s time to pull out your full insurance policy. Find the exact clause or exclusion the insurance company cited. Read it carefully, then read the sentences before and after it to understand the complete context.

Sometimes, policy language is intentionally vague, and its application to your crash might be debatable. While you’re doing this, start pulling together every piece of documentation you have.

- The police report: This is the official narrative of what happened.

- Photos and videos: Nothing tells a story like visual proof of the crash scene and the damage.

- Witness information: Statements from anyone who saw the accident can offer a crucial third-party perspective.

- All correspondence: Save every single email, letter, and note from your conversations with the insurer.

This file will be the foundation of your appeal.

Step Three: Consult With an Attorney

If you’ve gone through your policy and believe the denial is unfair, or if you're just lost in the legal jargon, it’s time to get an expert on your side. An attorney who specializes in insurance law can cut through the noise and tell you if the insurer's reasoning holds water.

The financial fallout from a DUI wreck is massive. The CDC pegs the total annual cost of alcohol-related crashes at a staggering $123.3 billion, which covers everything from medical expenses to property damage. Insurers know these numbers well, which is a big reason why a DUI can cause your premiums to jump by 71% or even more. You can see the full breakdown on the CDC's impaired driving fact sheet.

An insurance company's initial denial is often a calculated business decision. They are betting that you’ll be too overwhelmed to challenge it. An experienced attorney can spot when an insurer is operating in bad faith and build a case to overturn their decision.

Dealing with claims adjusters is a game in itself; they are trained to protect their employer’s financial interests. For more insight, our guide on how to deal with insurance adjusters is a great resource.

Bringing in a lawyer shifts the power dynamic. They can take over all communications, protect you from saying something that could hurt your case, and give you the best possible shot at a successful appeal.

Common Questions About DUI Wreck Insurance

The moments after any car accident are chaotic, but when a DUI is involved, the confusion and questions can feel overwhelming. We've gone over the basics of how insurance generally works, but let's dive into some of the specific, real-world questions that always come up.

Will Insurance Cover My Passengers' Injuries?

Yes, most of the time, your own auto insurance will cover injuries to passengers who were riding in your car. Your Bodily Injury (BI) liability coverage is designed to pay for harm you cause to other people, and from your policy's perspective, your passengers are considered "other people." They're essentially treated the same as someone you might have hit in another car.

But here's the catch: your policy has limits. It will only pay up to the maximum amount you purchased. If your passengers' medical bills are higher than your BI liability limits, they might have to turn to their own health insurance or even file a personal lawsuit against you to cover the rest. Your PIP or MedPay could also kick in for them, but you have to read the fine print carefully for any DUI-related exclusions.

Can My Insurer Cancel My Policy Immediately?

Probably not. Most states have regulations that prevent insurance companies from just dropping you mid-term, even after a DUI. They typically have to wait until your policy is up for renewal.

When that renewal date comes, however, you can almost guarantee they will non-renew your policy. A DUI conviction flags you as an extremely high-risk driver, giving them a solid reason to cut ties. They are required to give you written notice beforehand, which starts the clock on finding a new insurance company—a search that almost always ends with a much more expensive, high-risk provider.

Keep in Mind: A DUI conviction sticks to your driving record for a long time. For insurance purposes, this can be anywhere from three to ten years, depending on your state. Expect to pay sky-high premiums until that incident is outside your insurer's "look-back" period.

Am I Still Responsible For My Car Loan?

Yes, 100%. This is a devastating financial trap that catches many people off guard. Your car loan is a completely separate contract you have with your bank or lender; it has zero connection to your insurance coverage.

If your insurance company denies your collision claim because of a DUI exclusion, you are still legally on the hook for every single payment on that loan. It doesn't matter if the car is a crumpled wreck in a junkyard—the bank still wants its money. This is how people find themselves making monthly payments for years on a car that doesn't even exist anymore, turning an already bad situation into a financial nightmare.

At Bell Law, we understand that the aftermath of an accident is confusing and stressful, especially when a DUI is involved. If you've been injured in an accident in Oregon, our team is here to help you understand your rights and fight for the compensation you deserve. Visit us at https://www.belllawoffices.com to get the guidance you need.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.