Does Insurance Cover DUI Accident? does insurance cover dui accident

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Does Insurance Cover DUI Accident? does insurance cover dui accident

When you’ve been hit by a drunk driver, the most urgent question is usually, "Will their insurance even cover this?" It’s a valid concern. The answer, thankfully, is almost always yes.

In Oregon, the at-fault driver's liability insurance is legally on the hook to pay for your injuries and property damage. Think of it this way: their insurance policy is a contract to cover the harm they cause, and that contract doesn't just disappear because they broke the law by driving drunk. The responsibility to the victim remains.

Unpacking Your Insurance Options After a DUI Crash

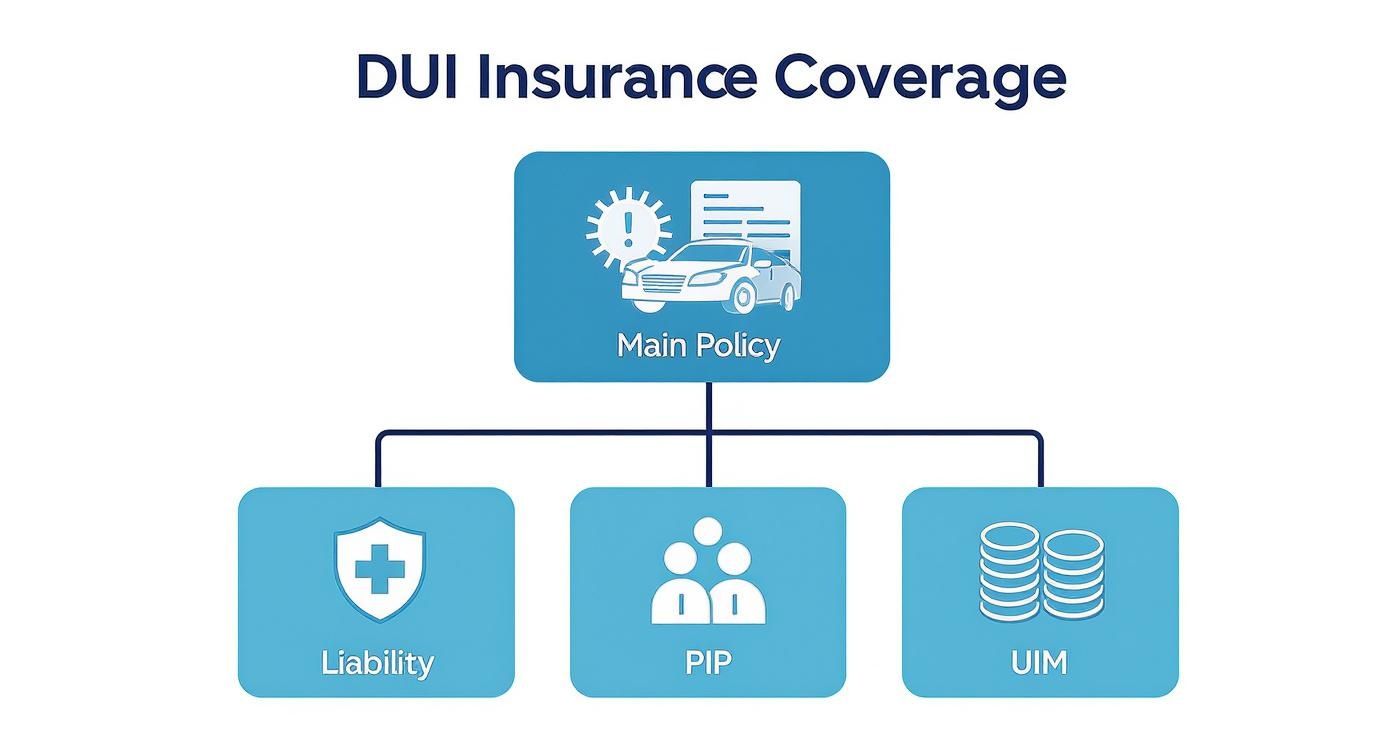

After an accident with an impaired driver, figuring out where the money for your recovery will come from can feel like navigating a maze. Several different types of insurance can come into play, and each one has a specific role. Getting a handle on these key coverages—Liability, Personal Injury Protection (PIP), and Uninsured/Underinsured Motorist (UIM)—is the first step toward getting the compensation you're entitled to.

The Three Pillars of DUI Accident Coverage

Each insurance type works like a different tool in a toolkit. The drunk driver's liability insurance is the primary one, meant to cover your medical bills, lost income, and car repairs. But your own policy has critical safety nets built in, offering immediate help and protecting you if the other driver’s coverage isn’t enough to make you whole.

This diagram shows how the main types of insurance can help after a drunk driving crash.

As you can see, your auto policy isn't just one thing; it's a bundle of distinct coverages that provide different layers of financial protection when you need them most.

Across the United States, the insurance rules for DUI accidents can get complicated. While standard liability policies are designed to cover victims' injuries and property damage, insurers often look for ways to limit their exposure. They might try to deny other types of claims or simply non-renew the at-fault driver's policy later on. You can find more information about these national insurance practices on sandlawnd.com.

Navigating a DUI accident claim isn't just about filing paperwork; it's about strategically using every available insurance resource to ensure your recovery is fully funded.

To help you get your bearings, let's lay out how these different policies work in a typical Oregon DUI accident. The table below is a quick reference guide to whose policy pays, what it covers for you, and the main catch to be aware of.

Quick Guide to Insurance Coverage in an Oregon DUI Accident

This table summarizes the primary types of auto insurance and how they typically apply to a car accident caused by a drunk driver in Oregon.

| Liability (BI/PD) | The At-Fault Driver | Medical bills, lost wages, vehicle repairs, pain & suffering. | The coverage is capped at the policy's dollar limits, which may be insufficient for severe injuries. |

| Personal Injury (PIP) | Your Own Policy | Immediate medical expenses and wage loss, regardless of fault. | It only covers economic damages up to your policy limit and does not pay for pain and suffering. |

| Uninsured (UM/UIM) | Your Own Policy | Your damages if the drunk driver has no insurance or not enough to cover your total losses. | You must have purchased this specific coverage before the accident occurred. |

Understanding these distinctions is the foundation for building a strong claim. Each policy is a piece of the puzzle, and knowing how they fit together is crucial for a successful financial recovery.

How the Drunk Driver's Liability Insurance Works

When an intoxicated driver hits you, your first thought might be about your injuries. Your second is probably about who will pay for everything. The answer starts with their liability insurance policy.

It's a common and completely understandable fear: will the insurance company refuse to pay because their client committed a serious crime? Thankfully, that's just a myth.

In Oregon, an auto insurance policy isn't just a private contract; it's a promise to the public. An insurer can't simply walk away from its responsibility to an innocent victim just because their policyholder was driving drunk. Their duty to cover the harm they caused remains firmly in place.

The tragic reality is that drunk driving is a persistent danger on our roads. According to the NHTSA, about 34 people die every day in the U.S. from drunk-driving crashes. This devastating toll underscores why strong insurance protections for victims are so critical.

The Power of a DUI in Your Civil Claim

In a typical car accident claim, the burden falls on you, the victim, to prove the other driver was negligent—that they failed to drive safely and caused the crash. But when the at-fault driver is convicted of a DUI, that burden gets a whole lot lighter.

The DUI conviction itself becomes powerful, almost undeniable, evidence of their negligence. This gives you a massive legal advantage, making it extremely difficult for the insurance company to argue their driver wasn't at fault. It strengthens your negotiating position right from the start and helps streamline the process of proving liability.

Key Takeaway: A DUI charge against the at-fault driver isn't just a criminal issue; it's one of the most powerful pieces of evidence you can have for your personal injury claim.

Breaking Down Liability Coverage Components

The at-fault driver’s liability insurance is split into two distinct parts, each designed to cover different types of losses you've suffered. To see how a drunk driver's policy responds, it's helpful to first understand what liability insurance typically covers after an accident.

These two components work together to compensate you for the harm done:

- Bodily Injury (BI) Coverage: This is the part of the policy that pays for the human cost of the crash. It covers your medical bills, physical therapy, lost wages, and future medical needs. It also provides compensation for non-economic damages like your pain, suffering, and emotional trauma.

- Property Damage (PD) Coverage: This part is much more straightforward. It pays to repair or replace your vehicle and any other personal property damaged in the collision, like a laptop, phone, or child's car seat.

Understanding what is third-party liability is key here, as it forms the legal foundation for your right to seek compensation from the driver who injured you.

The Critical Issue of Policy Limits

While the insurer is obligated to pay, there's a huge catch: they only have to pay up to the dollar amount specified in the driver’s policy. This is called the policy limit.

In Oregon, the minimum required liability coverage is just $25,000 per person for bodily injury and $20,000 for property damage.

Unfortunately, these minimums are often nowhere near enough to cover the costs of a serious accident. If your medical bills, lost income, and vehicle repairs add up to more than these limits, the at-fault driver's insurance will only pay up to that maximum amount. This can leave you facing a huge financial shortfall.

This is precisely where your own insurance policy—specifically your Underinsured Motorist (UIM) coverage—becomes an essential safety net. When the drunk driver doesn't have enough insurance to cover all your losses, your UIM coverage can step in to bridge that gap. Without it, you could be left paying for someone else’s catastrophic mistake out of your own pocket.

Using Your Own Insurance as a Financial Shield

After a drunk driver hits you, the last thing you want is a drawn-out battle with their insurance company. But that’s often what happens. While they investigate, delay, and look for reasons not to pay, your medical bills are stacking up and you might be out of work. This is exactly when your own car insurance policy becomes your most valuable asset—your first line of defense.

A lot of people think they have to wait for the at-fault driver’s insurance to step up. That’s a myth. Here in Oregon, your own policy has powerful tools built right in, designed to give you immediate help and shield you from the financial chaos caused by someone else’s horrible decision.

Instead of being stuck waiting for the other insurance adjuster to call the shots, you can turn to your own carrier for help right away. Let's walk through the three key coverages that can protect you.

Your First Stop: Personal Injury Protection (PIP)

In Oregon, every single auto policy must include Personal Injury Protection (PIP). After a DUI crash, this coverage is an absolute lifesaver. Think of it as your policy’s built-in emergency fund for medical care and lost wages.

The best part? PIP is "no-fault." It doesn't matter who caused the crash; your own insurance pays. You don't have to wait for the police report or for the other guys to admit their driver was at fault. You can access these benefits immediately.

PIP is designed to cover:

- Immediate Medical Expenses: It can pay for the ambulance, the ER visit, follow-up doctor's appointments, and physical therapy. The minimum required PIP coverage in Oregon is $15,000, but you can purchase more.

- Lost Wages: If your injuries keep you from working, PIP can reimburse you for a large chunk of your lost income, typically for up to 52 weeks.

Using your PIP benefits gets your medical bills paid on time so you can get the treatment you need. It allows you to focus on getting better while the more complicated claim against the drunk driver gets sorted out.

When the Drunk Driver Has No Insurance: Uninsured Motorist (UM) Coverage

What if the drunk driver who hit you takes off? Or worse, what if you find out they were driving without a single shred of insurance? It’s a terrifying and surprisingly common scenario. Suddenly, the person who caused all this chaos has no way to pay for it.

This is precisely why Uninsured Motorist (UM) coverage exists.

If you have UM coverage, your own insurance company essentially steps into the shoes of the uninsured drunk driver. It will pay you for the damages you would have been entitled to recover from them, including medical bills, lost income, and your pain and suffering.

Without UM coverage, you could be left holding the bag for everything, forced to shoulder the financial weight of a crash you didn't cause. Taking a moment to learn more about uninsured motorist coverage in Oregon really shows why this protection is a must-have.

When the Drunk Driver Has Too Little Insurance: Underinsured Motorist (UIM) Coverage

A more common—and often more dangerous—situation is when the drunk driver has insurance, but it's the bare-minimum plan. Oregon's minimum liability limit is just $25,000 per person for bodily injury. One trip to the ER and a minor surgery can blow past that limit in a heartbeat.

This is where your Underinsured Motorist (UIM) coverage becomes your financial lifeline.

UIM kicks in when your damages are more than what the at-fault driver's policy will pay. For instance, let's say your medical bills and lost wages total $100,000, but the drunk driver only has the $25,000 minimum policy. Your UIM coverage can step in to cover the remaining $75,000, up to the limits of your own policy.

It’s the coverage that bridges the gap, ensuring that another person’s irresponsible choice doesn’t leave you financially ruined.

Navigating Insurance Company Tactics After a DUI

You’d think that if a drunk driver hit you, getting fair compensation from their insurance would be straightforward. Unfortunately, that's rarely the case. The moment an accident happens, the at-fault driver's insurance company switches into damage control mode, and their primary goal is protecting their bottom line, not making you whole.

The adjuster assigned to your case is a professional negotiator trained to minimize what their company pays out. They aren't your friend, and they aren't on your side. Knowing their playbook is the first step to protecting your rights.

Common Strategies Used by Insurance Adjusters

It often starts with a phone call. An adjuster from the other driver's insurance company will reach out, usually sounding incredibly sympathetic and concerned. This is a deliberate tactic. They want to build a quick rapport to get you to lower your guard and share information they can use against you later.

One of their favorite moves is the quick, lowball settlement offer. They might dangle a check for a few thousand dollars in front of you within days of the crash. They’re hoping you’re stressed about medical bills and will take the fast cash before you realize the true cost of your injuries, lost wages, and future medical needs. It’s a trap designed to close out your claim for a fraction of its real value.

Watch out for these other common tactics, too:

- Questioning Your Medical Care: The adjuster might challenge your doctor's recommendations, arguing that physical therapy or chiropractic visits aren't "reasonable and necessary." It’s a way to chip away at the value of your claim by refusing to cover legitimate medical costs.

- Trying to Shift Blame: They'll look for any opportunity to pin some of the fault on you. Were you going two miles over the speed limit? Did you react a split-second too late? In Oregon, any percentage of fault assigned to you reduces their payout, so they’ll try anything to muddy the waters.

- Pressuring You for a Recorded Statement: They'll insist on recording a formal statement, hoping you'll misspeak or say something innocent that they can twist to undermine your case. It is absolutely critical to understand how to deal with insurance adjusters before you have this conversation.

Understanding Policy Exclusions

In their quest to deny a claim, insurers sometimes get creative with policy language. You might hear them bring up an "intentional acts" exclusion, which says they don't have to cover harm that their client caused on purpose.

Here's the thing: while getting behind the wheel drunk is an intentional choice, the crash itself is almost never considered an intentional act. It's an act of negligence.

Key Insight: The "intentional acts" exclusion is almost exclusively used to deny the drunk driver's claim for their own property damage under their collision coverage. It is very rarely a legitimate defense against paying an innocent third-party victim like you.

The insurance company has a legal duty to you, the person their driver injured. They can't just use their client's criminal behavior as a get-out-of-jail-free card to avoid paying for your medical bills, lost income, and pain. Still, it's smart to be ready for these arguments and know how to handle a refused claim.

Global Perspectives on DUI and Insurance

This tug-of-war between victims and insurance companies isn't just an Oregon problem; it's a global issue. Different countries tackle it in different ways. For instance, South Africa has the highest rate of alcohol-related traffic fatalities in the world, at a shocking 58%.

Many nations around the globe use insurance as a tool to fight drunk driving, imposing heavy surcharges and exclusions as a financial deterrent. The data shows that countries with stricter, more comprehensive penalties see a real drop in these kinds of accidents. It just goes to show how insurance frameworks can be used to promote safety and hold dangerous drivers accountable everywhere. You can explore more insights about global alcohol-related casualties on alcohol.org.

At the end of the day, these tactics prove one thing: the insurance adjuster is working for their employer, not for you. Their job is to find a way to pay you as little as possible, no matter how much harm their driver caused.

The Financial Aftermath for the DUI Driver

While your main concern is, and should be, your own recovery, it helps to understand what's happening on the other side of the table. The driver who hit you is facing a financial nightmare, which is a big reason their insurance company will fight your claim so aggressively. A DUI conviction unleashes a wave of serious, long-term financial consequences that are much bigger than just court fines.

From the moment of the crash, that driver's relationship with their insurance carrier is turned upside down. When you cause an injury accident while impaired, you instantly become one of the riskiest customers an insurer could possibly have. The fallout is usually swift and severe.

Insurance Fallout and Sky-High Premiums

Once an insurance company gets wind of a client's DUI conviction, you can bet they're going to act. For most drivers, this means their current policy gets canceled or won't be renewed when the term is up. In the eyes of the insurer, they've become too great a liability to cover under a standard plan.

If they can manage to find a company willing to insure them, the cost is going to be astronomical. A DUI on your record can make your insurance premiums explode, often jumping by 100% or more. This isn't just a slap on the wrist for a year; this massive rate hike can stick around for a very long time, turning the simple act of driving a car into a huge financial weight. It's the insurance company's way of pricing in the massive risk that driver now poses.

An SR-22 isn't actually a type of insurance. It's simply a certificate that your insurance company files with the DMV on your behalf. It’s their way of telling the state, "We are vouching that this high-risk driver has at least the minimum liability coverage required by law."

Oregon's SR-22 Requirement

On top of the brutal premium increases, the Oregon DMV will require the driver to get an SR-22 certificate. This is not a suggestion. It's a mandatory step for anyone who wants to get their license back after it's been suspended for a DUI.

The SR-22 officially flags the driver as "high-risk" in the state's system. It’s a document their insurer has to file directly with the DMV to prove they’re carrying active insurance. In Oregon, this requirement typically lasts for three straight years. If their coverage lapses for even a day, the insurance company has to report it, which immediately triggers another license suspension.

This whole system puts the driver in a tough spot:

- Constant Scrutiny: They are being watched by both their insurer and the DMV. One wrong move, and they're off the road again.

- Fewer Choices: Many insurance companies won't even bother with SR-22 filings, which drastically shrinks the pool of available insurers.

- Crushing Cost: The combination of needing a high-risk policy on top of SR-22 filing fees makes insurance prohibitively expensive for many.

All of this financial and administrative pressure is a key motivator for the insurance adjuster. Their job is to limit the company's losses, and every dollar they pay out on your claim just adds to the mountain of costs associated with their high-risk client.

What to Do After a DUI Accident to Protect Your Rights

The moments after a crash with a drunk driver are a blur of confusion, shock, and anger. It’s a chaotic scene, and it's completely natural to feel overwhelmed. But what you do in the minutes and hours that follow can make or break your ability to get the compensation you deserve.

Think of yourself as a detective at your own crime scene. The impaired driver is facing a criminal case, but you have to build a separate civil case to recover your damages. The two are handled differently, but the evidence you gather now will be the foundation for everything that comes next.

Your Immediate Action Plan at the Scene

First things first: your health is the absolute priority. Adrenaline is a powerful painkiller and can easily mask serious injuries. Even if you think you’re fine, you need to get checked out.

Once you’ve addressed any immediate medical needs, here are the critical steps to take right there at the scene:

Get Medical Help: Always call 911. This gets medical responders on their way and ensures a police officer arrives. Having a medical professional evaluate you creates an official record that ties your injuries directly to the crash.

Make Sure a Police Report is Created: Don't let the other driver talk you out of calling the police. An officer’s official report is your single most powerful piece of evidence. It will document their observations of the driver's impairment, the results of any field sobriety tests, and whether an arrest was made.

Document Everything: If you're able, use your phone. Take photos and videos of the vehicle damage, skid marks, the positions of the cars, and any relevant road signs. If there are witnesses, get their names and phone numbers. Their independent account can be invaluable.

Inform Your Own Insurance Company: Call your insurer as soon as you can. This gets the ball rolling on your own PIP benefits to cover initial medical costs. It also officially notifies them that you might need to use your Uninsured/Underinsured Motorist (UM/UIM) coverage down the line.

Gathering this information is your first line of defense. The other driver's insurance company will be looking for any reason to downplay your claim, and this evidence shuts those arguments down before they even start.

The Single Most Important Step to Take

After you've handled things at the scene and seen a doctor, there's one move that protects your claim more than any other: contacting a personal injury lawyer before you talk to the other driver's insurance adjuster.

You can expect a call from their insurance company very quickly. The adjuster will sound friendly, concerned, and helpful. Don't be fooled. Their job is to minimize the company's payout. They want to get you on a recorded line, hoping you’ll say something—anything—they can twist to argue you were partially at fault or that your injuries aren't that bad.

Warning: Never give a recorded statement or accept a quick settlement offer from the at-fault driver's insurance company without talking to a lawyer first. You could be signing away your right to the compensation you truly need.

A good lawyer acts as a buffer between you and the insurance company. They take over all communications, protecting you from adjusters' tactics. They also know exactly how to use the driver's criminal DUI case as leverage. The police report, breathalyzer results, and a potential conviction make it incredibly difficult for an insurer to argue their client wasn't negligent.

By taking these steps, you go from being a victim of someone else's horrible decision to taking control of your own recovery. You'll avoid the common pitfalls that can cost crash victims the financial support they need to heal and get back to their lives.

Frequently Asked Questions About DUI Accident Claims

When you're reeling from a drunk driving accident, a million questions can race through your mind. Getting clear, straightforward answers is the first step toward finding your footing and understanding what comes next. Here are some of the most common concerns we hear from victims in Oregon.

How Does the Driver's Criminal DUI Case Affect My Claim?

Think of the driver's DUI conviction as a powerful piece of evidence for your personal injury claim. It makes it incredibly difficult for their insurance company to argue that their driver wasn't negligent. Everything from the police report to breathalyzer results and court records helps build an ironclad case for your compensation.

It's important to know, though, that the criminal case and your civil claim are two separate tracks. The state handles punishing the driver for the crime, but you have to file your own claim or lawsuit to recover money for your medical bills, lost wages, and other damages.

What if the Drunk Driver Was in a Company Vehicle?

This can be a critical factor. If the impaired driver was on the job when they hit you, their employer's commercial insurance policy likely comes into play. This is often a huge benefit for victims, as commercial policies typically carry much higher liability limits than a standard personal auto policy.

An experienced attorney will dig in to determine if the driver was "on the clock" or acting within the scope of their employment. This investigation is crucial for uncovering every possible source of recovery, especially when injuries are severe and a personal policy just won't cut it.

Key Insight: When a commercial vehicle is involved, the employer can often be held liable. This opens up additional, and often much larger, avenues for compensation that are essential to explore.

Can I Sue the Bar That Over-Served the Driver?

Yes, you absolutely can in some situations. Oregon's "dram shop" laws allow you to hold a bar, restaurant, or even a social host liable if they served alcohol to someone who was visibly intoxicated, and that person then caused your accident.

Be warned, these are not simple cases. You have to prove the establishment knew (or should have known) the person was drunk and that serving them more alcohol contributed to your injuries. There are also very strict and short notice deadlines, so you have to act fast. It's vital to speak with an attorney immediately to even keep this option on the table.

How Long Do I Have to File a DUI Accident Claim in Oregon?

In Oregon, you generally have two years from the date of the crash to file a personal injury lawsuit. This is known as the statute of limitations. If you miss this deadline, you lose your right to sue for compensation forever.

Two years might sound like a long time, but it flies by when you're focused on healing. Building a strong case takes time—gathering evidence, interviewing witnesses, and negotiating with insurers. That's why contacting a lawyer long before the deadline is so critical to protecting your rights.

Trying to piece everything together after a DUI accident is overwhelming. You need skilled legal guidance to make sure your rights are protected every step of the way. The attorneys at Bell Law are committed to helping victims across Oregon get the full compensation they deserve. If a drunk driver has injured you, contact us for a free consultation.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.