Does Insurance Cover DUI Accidents in Oregon?

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Does Insurance Cover DUI Accidents in Oregon?

It’s one of the most common questions we hear: "Will my insurance still cover me if I cause an accident while driving under the influence?" The short answer is yes, but it’s not the whole story.

In Oregon, your standard liability insurance will almost always cover the damages you cause to other people and their property in a DUI-related crash. This isn't about letting you off the hook; it's about protecting the innocent victims. You will absolutely face the full force of the legal and financial fallout from your actions.

Why Insurance Steps In for a DUI Crash

It seems strange, right? Why would an insurance company pay for damages caused by an illegal and reckless act? The reason goes back to the very purpose of mandatory auto insurance: to create a financial safety net for the public.

Think of it this way: if your insurance didn't cover the crash, the injured person would be forced to sue you directly. This would leave them struggling with medical bills and repair costs while waiting for a legal battle to resolve, which is a terrible position for someone who did nothing wrong.

Your liability coverage acts as a shield, but it protects the public from your mistakes, not you from the consequences of them. The shield still works, even when the mistake is as serious as a DUI, ensuring the people you harmed can get the immediate help they need.

The Sobering Financial Reality for the At-Fault Driver

While your insurance company is busy paying for the victim’s medical bills and car repairs, the financial storm for you is just beginning. A DUI conviction creates a massive ripple effect that can last for years.

The first and most immediate hit is to your insurance premiums. After a DUI conviction, you're no longer just another driver; you're officially "high-risk." According to some eye-opening DUI statistics, drivers can expect their insurance rates to jump by an average of 71%.

But that staggering increase is just the start. Here’s what else you can expect:

- Getting Dropped: Your current insurer will likely refuse to renew your policy. This forces you into the "high-risk" insurance market, where coverage is much more expensive and harder to find.

- The SR-22 Mandate: Oregon will require you to file an SR-22 certificate. This is basically a document your insurer sends to the DMV to prove you have coverage, and it comes with its own set of fees and higher premiums for several years.

- Out-of-Pocket Costs: If the total damages from the accident are more than your policy limits, you’re on the hook for the rest. This can easily lead to garnished wages, property liens, and even bankruptcy.

The key takeaway is this: Your insurance pays for the victims' damages, but you pay the price through massive premium hikes, legal fees, and potential non-renewal of your policy.

DUI Accident Coverage at a Glance

To make it crystal clear, let's break down what your standard Oregon auto policy will and won't cover after you cause an accident while intoxicated. This table provides a quick reference to help you understand the boundaries of your coverage.

| Injuries to Others | Yes | Your bodily injury liability limit is the maximum amount your policy will pay. |

| Property Damage to Others | Yes | This covers the other driver's vehicle and any other property you damaged, up to your limit. |

| Your Own Medical Bills | No (Usually) | Your Personal Injury Protection (PIP) may deny your claim due to the illegal act of drunk driving. |

| Damage to Your Own Car | No (Usually) | Your collision coverage may have an exclusion for damages sustained while committing a crime. |

| Legal Defense for the DUI | No | Auto insurance does not cover criminal defense fees, fines, or court costs. |

| Punitive Damages | No | Insurance will not cover punitive damages, which are meant to punish you for reckless behavior. |

As you can see, the "coverage" you have in a DUI situation is almost entirely for the benefit of others. For the at-fault driver, the financial protection is minimal to non-existent, leaving you to face the most severe consequences alone.

How Liability Insurance Protects Others After a DUI

When an intoxicated driver causes an accident, their liability insurance is the first line of financial defense—but it’s not for them. This coverage is there to pay for the injuries and property damage they inflict on other people. Oregon’s mandatory insurance laws exist for this very reason: to make sure innocent victims aren't stuck with devastating bills after a crash.

Think of your liability policy as having two distinct parts, each with a specific job.

Bodily Injury Liability Explained

The first part is Bodily Injury (BI) liability. This is the side of your policy that deals with the physical harm caused to others in the collision. And it covers much more than just the initial ambulance ride and emergency room visit.

BI coverage is designed to handle a whole range of costs the victim might face, including:

- Ongoing medical care and physical therapy

- Lost wages if their injuries keep them out of work

- Compensation for their pain and suffering

Let’s say you cause a wreck on a busy street in Portland. If the other driver ends up with a broken arm and whiplash, your BI coverage is what steps in to handle their hospital bills and cover the income they lose while they’re unable to work.

Property Damage Liability Explained

The second part is Property Damage (PD) liability. Just as the name implies, this pays to repair or replace any property you damaged in the DUI accident. Most of the time, that means the other person's car.

But it doesn't stop there. If you swerved off the road and took out a city light post or crashed through someone's fence, your PD liability would cover those repair costs, too. This coverage is all about making sure the victims' property is restored without them having to pay out-of-pocket for your mistake.

The whole point of liability insurance is to make the victims whole again, at least from a financial standpoint. It pays for their medical recovery and property repairs, fulfilling your legal responsibility up to your policy's limits.

When Damages Exceed Your Policy Limits

This brings us to a really critical point: policy limits. Every insurance policy has a maximum amount it will pay out for both bodily injury and property damage. If the total costs from the accident go beyond these limits, you are personally on the hook for the rest.

For instance, if your policy has a $50,000 BI limit but you cause an accident that results in $80,000 of medical expenses for the other driver, you can be sued for the remaining $30,000. That could easily lead to having your wages garnished, your assets seized, and years of financial trouble.

The process for resolving these claims can get incredibly messy. To get a better sense of how these cases unfold, you can learn more about the typical car accident settlement process and see just how vital it is to have enough coverage.

What About the "Intentional Act" Exclusion?

This is where a lot of people get tripped up. Most auto insurance policies have an "intentional act" exclusion. It seems logical, right? A person chooses to drink and drive, so wouldn't any crash be considered an intentional act? It’s a reasonable question, but it’s not how insurance companies or the courts see it.

The key is separating the initial decision from the final result. Yes, the choice to get behind the wheel while intoxicated is intentional. The crash itself, however, is almost always seen as an unintended consequence of that terrible decision. Insurers classify the collision as an act of extreme negligence, not a deliberate plan to cause a wreck.

Here’s an analogy: think about a driver who decides to speed through a neighborhood. They are intentionally breaking the law. If they hit a patch of gravel, lose control, and crash into a parked car, we still call it an accident. The crash wasn't the goal; it was the result of their reckless behavior. A DUI is viewed in much the same way.

The All-Important Legal Distinction

This separation is the bedrock of why insurance generally covers a first-time DUI accident. Both the courts and the insurance carriers make a clear distinction between the act of driving drunk and the intent to cause a specific collision.

To deny your claim under an intentional act exclusion, the insurance company would have to prove you got in your car with the specific goal of crashing it.

An insurer would need solid evidence that the driver’s objective was to cause the accident. In nearly every DUI situation, the driver's goal was just to get from Point A to Point B, even if they did so with dangerous and criminal impairment.

This legal viewpoint isn't the same everywhere. Around the world, different legal systems have different takes on the DUI-insurance relationship. The global impact is staggering—studies show that alcohol is a factor in about 21.8% of all road fatalities, which translates to roughly 273,000 deaths annually. And that number is likely an underestimate. You can dive deeper into these statistics and see how different countries approach the problem by reviewing data on global alcohol-related road casualties from the International Transport Forum.

Why It All Comes Down to Negligence

At the end of the day, the crash is treated as the result of negligence—a very severe, criminal form of it, but negligence nonetheless. And this is exactly what liability insurance is for. The policy is designed to protect the public from the financial fallout of a driver's negligent actions, no matter how catastrophic their judgment was.

This interpretation is absolutely critical for the people who are hurt. It ensures that innocent victims have a way to get compensation for their medical bills, lost wages, and property damage. If insurance didn't cover these events, victims would be left with little recourse other than suing the drunk driver personally, a process that is often long, difficult, and offers no guarantee of recovery.

Will Collision Coverage Fix Your Car After a DUI?

Your liability insurance is all about covering the damage you cause to other people and their property. But what about your own car? For that, you need collision coverage.

If you have this optional coverage on your Oregon auto policy, the short answer is usually yes—your insurance will probably pay to repair your car, even if the crash was your fault due to a DUI. Think of collision coverage as your car's personal safety net. It's designed to pay for repairs after a crash, no matter who's to blame. You pay your deductible, and your insurer handles the rest.

But that "yes" comes with a massive catch. Filing a collision claim after a DUI crash is like sending up a flare to your insurance company, and the long-term financial pain can be brutal.

The Real Cost of a DUI Collision Claim

Sure, your policy might cover the immediate repair bill, but the fallout is where the real damage happens. A DUI-related collision claim screams "high-risk driver" to your insurer, and they will react swiftly and decisively. Making that claim almost guarantees one of two things will happen:

Your Premiums Will Explode: At your next renewal, get ready for a serious shock. A DUI conviction alone will send your rates soaring, but tacking on a major collision claim can push your new premium into truly unaffordable territory.

You'll Get Dropped: Many insurance companies will simply decide the risk is too great at any price. They'll send you a non-renewal notice, forcing you into the high-risk insurance market where policies are notoriously expensive.

Filing a collision claim after a DUI puts you in a tough spot. You have to decide: Do I pay for the repairs myself to fly under the radar, or do I use my coverage and brace for years of sky-high rates or a non-renewal?

How to Weigh Your Options

It’s not always a simple choice. If the damage to your car is minor—a few thousand dollars, perhaps—paying out of pocket is often the smartest financial move. It might sting now, but it could save you a fortune in inflated premiums over the next three to five years.

On the other hand, if your car is totaled or needs major, expensive work, you might not have a choice but to file the claim. Before you pick up the phone, get an independent repair estimate. Knowing the exact number helps you make a clear-headed decision: is the immediate insurance payout worth the financial consequences that are guaranteed to follow?

Navigating SR-22 Filings and Extreme Premium Hikes

The fallout from a DUI conviction doesn’t end when the police lights fade. In fact, that's just the beginning of a long road of financial and legal hurdles. Once the Oregon DMV flags you as a high-risk driver, your relationship with auto insurance changes dramatically, and the costs start to pile up.

First on the list is the dreaded SR-22 filing. It's a common point of confusion, so let's clear it up: an SR-22 isn't actually a type of insurance. It's a certificate your insurance company files with the DMV to prove you're carrying at least the state's minimum liability coverage. Think of it as a "leash" to ensure you stay insured.

In Oregon, this isn't a short-term thing. You'll need to keep that SR-22 active for three straight years after your license suspension ends. If your policy lapses for even a day, your insurer is required to notify the DMV, and you'll likely face another suspension.

The Financial Fallout of a High-Risk Label

Just finding an insurer willing to file an SR-22 can be a shock to the system. Many standard insurance companies want nothing to do with a driver who has a recent DUI—they see it as too big of a gamble. This often forces you into the world of "high-risk" insurance, where the policies are specifically designed for this situation, and the prices reflect it.

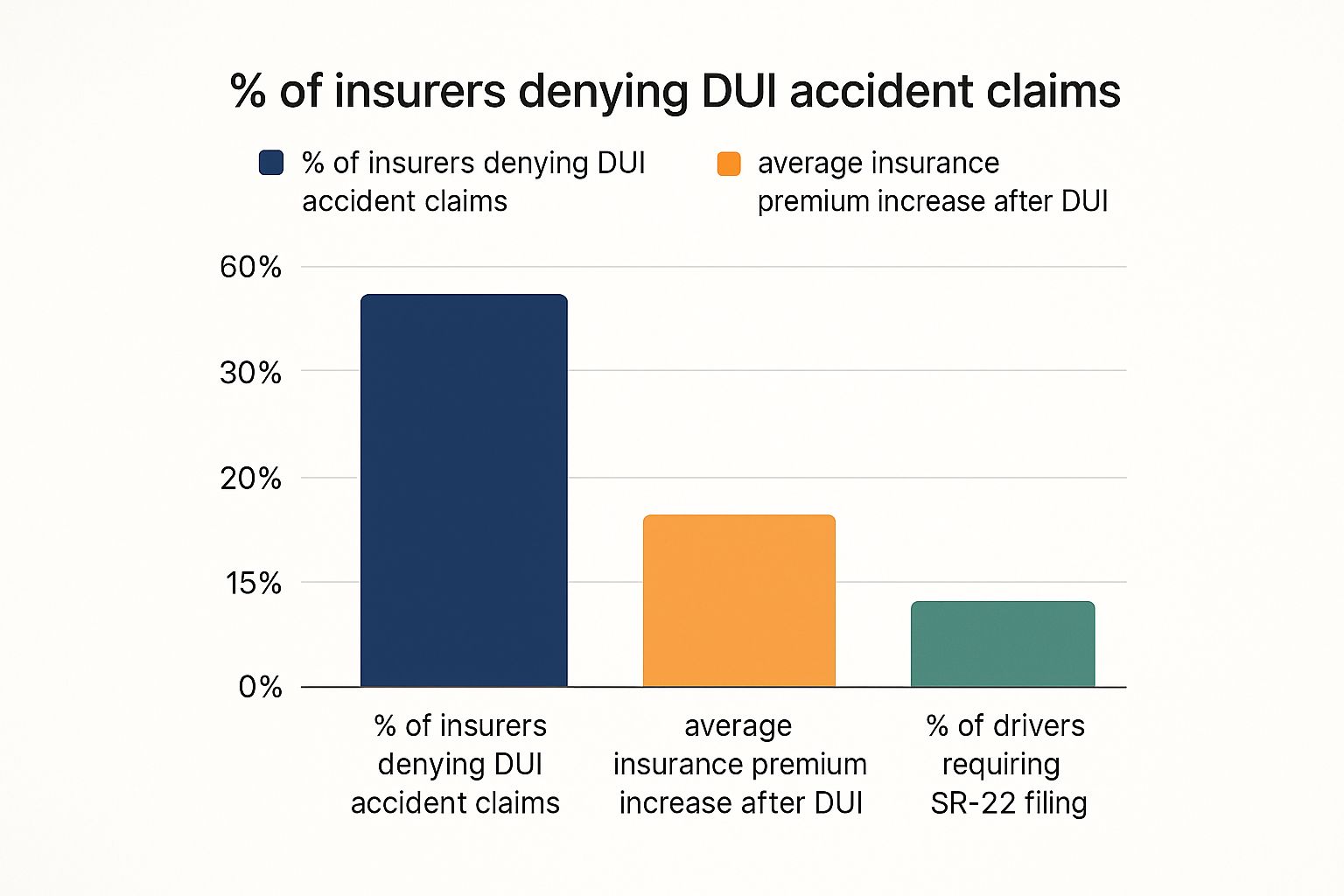

The image below gives you a snapshot of what drivers are up against after being involved in a DUI-related crash.

As you can see, while claim denials are a real possibility depending on the policy, a massive rate hike and state-mandated filings like the SR-22 are practically guaranteed.

And when we say massive, we mean it. A DUI on your record is a giant red flag to insurers, signaling a much higher chance of future claims. They pass that risk right back to you in the form of sky-high premiums. This financial strain, stacked on top of legal fees and fines, can be crushing. It's the kind of pressure that can affect your entire financial well-being, which is one of the key reasons why credit scores can drop.

The table below breaks down the typical financial adjustments you can expect after a DUI conviction in Oregon.

Financial Impact of a DUI on Your Insurance

| Premium Increase | 80% - 120% or more | 3 to 5+ years |

| SR-22 Filing Fee | $25 - $50 one-time fee | One-time |

| SR-22 Maintenance | Required by law | 3 consecutive years |

This new financial reality is a long-term commitment. Even after the SR-22 is no longer required, the conviction can haunt your insurance rates for years.

Long-Term Impact on Your Driving Record

That high-risk status and the inflated premium will stick with you for a long time. While Oregon's SR-22 requirement is three years, the DUI itself can stay on your driving record and influence your insurance rates for five years or even longer. It’s a powerful reminder of how one terrible decision can create a years-long financial headache.

Of course, the financial cost pales in comparison to the human toll. Alcohol-impaired driving is still one of the biggest dangers on our roads. In 2023 alone, drunk driving accidents claimed 12,429 lives, making up about 32% of all traffic fatalities for the year. The numbers are a sobering reminder of what’s truly at stake.

When Can Your Insurance Company Deny a DUI Claim?

While your liability coverage is there to protect innocent victims, it’s not an unbreakable promise. Insurers can, and sometimes do, legally refuse to pay out after a DUI accident. Knowing when this can happen is crucial because a claim denial leaves you on the hook for every penny of the damages.

Interestingly, the denial usually isn't because of the DUI itself. It almost always comes down to a major violation of your policy's terms—actions that fundamentally break the contract you have with your insurer.

Major Policy Violations

One of the most clear-cut reasons for a denial is insurance fraud. Let's say you lied on your application by not mentioning a high-risk teenage driver in your house or claiming your car is garaged in a low-crime suburb when it's really parked on a city street. If that lie comes to light after an accident, the insurer can void your policy from the start and refuse to pay. Their reasoning is simple: the agreement was based on false information.

Another big one is an excluded driver violation. When you sign up for a policy, you can sometimes specifically list someone as an "excluded driver" to lower your rates. If you then turn around and let that exact person borrow your car, and they cause a DUI crash, your insurance company will almost certainly deny all coverage. You explicitly promised them that person wouldn't be driving, breaking a core term of your agreement.

A claim denial shifts the entire financial burden of an accident directly onto your shoulders. The insurance company will send a formal denial letter explaining their decision, which is your signal to figure out your next steps—fast.

Getting that denial letter in the mail can feel like a gut punch. It's vital to read it carefully and understand the specific policy language the insurer is using to justify their decision. Don't just assume it's the final word. For complicated cases, you may need some guidance on navigating the personal injury claims process to protect your rights. Speaking with a legal professional can help you figure out if the denial is legitimate or if you have grounds to fight back.

Common Questions About DUI Accidents and Insurance

When you're trying to pick up the pieces after a DUI crash, a flood of confusing insurance questions is the last thing you need. Let's cut through the noise and get you some clear answers to the most common worries we see from Oregon drivers.

Will My Insurer Cancel My Policy Immediately?

Probably not. It’s rare for an insurance company to cancel your policy in the middle of its term just because of a DUI.

What’s far more likely is that they’ll wait until your policy is up for renewal and then send you a non-renewal notice. This heads-up gives you time to shop around for a new policy before you have a gap in coverage. A mid-term cancellation is usually reserved for major issues like insurance fraud or not paying your premium.

What if a Friend Crashes My Car While Drunk?

This is where things get complicated. It all boils down to a concept called "permissive use." If you let your friend borrow your car, your insurance policy typically steps up to the plate as the primary coverage for the damage they cause.

That means your insurer will likely be the one paying for the other driver's medical bills and car repairs, up to your policy limits. But here's the kicker: that DUI accident is now attached to your insurance record. You could be facing the same consequences as if you were behind the wheel—sky-high rates or even getting dropped by your insurer. And if that friend was specifically listed as an "excluded driver" on your policy, you can bet your insurance company will deny the claim.

The bottom line is simple: when you lend someone your car, you're also lending them your insurance. Their mistakes can have a direct and painful impact on your wallet.

How Long Does a DUI Affect Oregon Insurance Rates?

A DUI conviction casts a long shadow over your finances. In Oregon, you can expect that conviction to drive up your insurance premiums for a solid three to five years. Some companies might even dig deeper into your past when calculating your rates.

On top of that, the Oregon DMV will require you to have an SR-22 filing on record for three consecutive years. Once you’ve cleared that hurdle and kept your driving record clean, you can finally start looking for more affordable coverage. Knowing how to deal with insurers is critical during this time. For more on this, check out our guide on how to negotiate an insurance settlement.

The legal and financial fallout from a DUI accident can feel like too much to handle alone. At Bell Law, our experienced Oregon personal injury attorneys are here to guide you through every step and make sure your rights are protected. If you or someone you love has been injured, contact us today for a free consultation at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.