How Does a Disability Lawyer Get Paid? Find Out Here

"I was satisfied once John Bell took over my case."

"Communication was always timely."

How Does a Disability Lawyer Get Paid? Find Out Here

If you're worried about how you'll afford a lawyer when you can't work, you're not alone. The good news is, most Social Security disability attorneys work on what’s called a contingency fee basis.

In simple terms, this means you pay nothing upfront. Your lawyer only gets paid if they win your case.

The “No Win, No Fee” Promise for Disability Claims

For most people applying for disability benefits, the biggest hurdle isn't the paperwork—it's the fear of legal costs. The contingency fee system was created to solve this exact problem. It makes expert legal help accessible to anyone, no matter their financial situation.

Think of it this way: it’s a lot like hiring a real estate agent. They do all the work of marketing your house and finding a buyer, but they don't see a dime until the sale goes through. A disability lawyer’s fee works on the same principle. Their payment is contingent on getting you a successful outcome.

How This Model Actually Helps You

This payment structure does more than just remove the upfront financial burden. It perfectly aligns your lawyer's goals with yours. Since they only get paid if you get paid, they have every reason to build the strongest case possible and fight for every penny you're entitled to.

This creates a powerful partnership where everyone is pulling in the same direction.

Here are the key advantages for you:

- No Upfront Costs: You get to hire an experienced professional without paying a retainer or any hourly fees.

- Zero Financial Risk: If your claim is denied, you owe your lawyer nothing for the hours they put in. The risk is on them, not you.

- A Shared Goal: Your lawyer’s success is tied directly to yours, so you know they’re completely invested in winning.

The "no win, no fee" promise isn't just a billing method. It's a system designed to level the playing field, ensuring your access to justice depends on the strength of your case, not the size of your wallet.

Ultimately, this arrangement gives you the peace of mind to focus on your health. You can let a professional navigate the maze of Social Security Administration (SSA) rules and deadlines while you concentrate on what truly matters.

Decoding Your Contingency Fee Agreement

The cornerstone of your relationship with a disability lawyer is something called a contingency fee agreement. This isn't just another piece of paper to sign; it's a critical contract that lays out exactly how your attorney gets paid. Signing it officially kicks off your partnership.

Think of this agreement as the financial roadmap for your case. It spells out the precise percentage of your back pay the lawyer will receive if you win, leaving no room for guesswork. Most importantly, it puts in writing a simple promise: if your claim is denied, you owe absolutely no attorney fees. This transparency is key to building a trusting relationship right from the start.

The SSA Manages the Payment Process

One of the biggest reliefs for many people is learning they don't have to worry about paying the lawyer directly. The Social Security Administration (SSA) handles the entire transaction once your case is approved.

Here’s a quick rundown of how that works:

- The SSA gets a copy of the fee agreement you signed.

- They calculate the lawyer's fee based on that agreement.

- The SSA pays your lawyer directly out of your back pay award.

- You receive the rest of the past-due benefits owed to you.

This system takes all the stress and confusion out of the equation. You won't get a bill in the mail or have to figure out payment deadlines. The SSA acts as a neutral third party, ensuring everything is handled correctly and fairly. Knowing the specific steps for hiring a lawyer for an SSI claim can give you even more peace of mind.

Your contingency fee agreement is a promise: your lawyer’s payment is directly tied to a successful outcome for you. It ensures their interests are perfectly aligned with yours from day one.

Understanding the Standard Fee Structure

You'll find that disability lawyer fees are remarkably consistent across the country, and that’s by design. The fee structure is regulated by federal law, so there are no surprises.

An attorney's fee is typically 25% of the past-due benefits you are awarded, but—and this is a big but—that amount is capped by law. This cap is in place to protect you and make sure the fee is always reasonable. This setup means your lawyer is fully invested in winning your case, because their payment depends entirely on your success.

Because every disability attorney in the country works under this same regulated system, you can focus on what really matters: choosing a lawyer based on their experience and expertise, not on who offers a different rate.

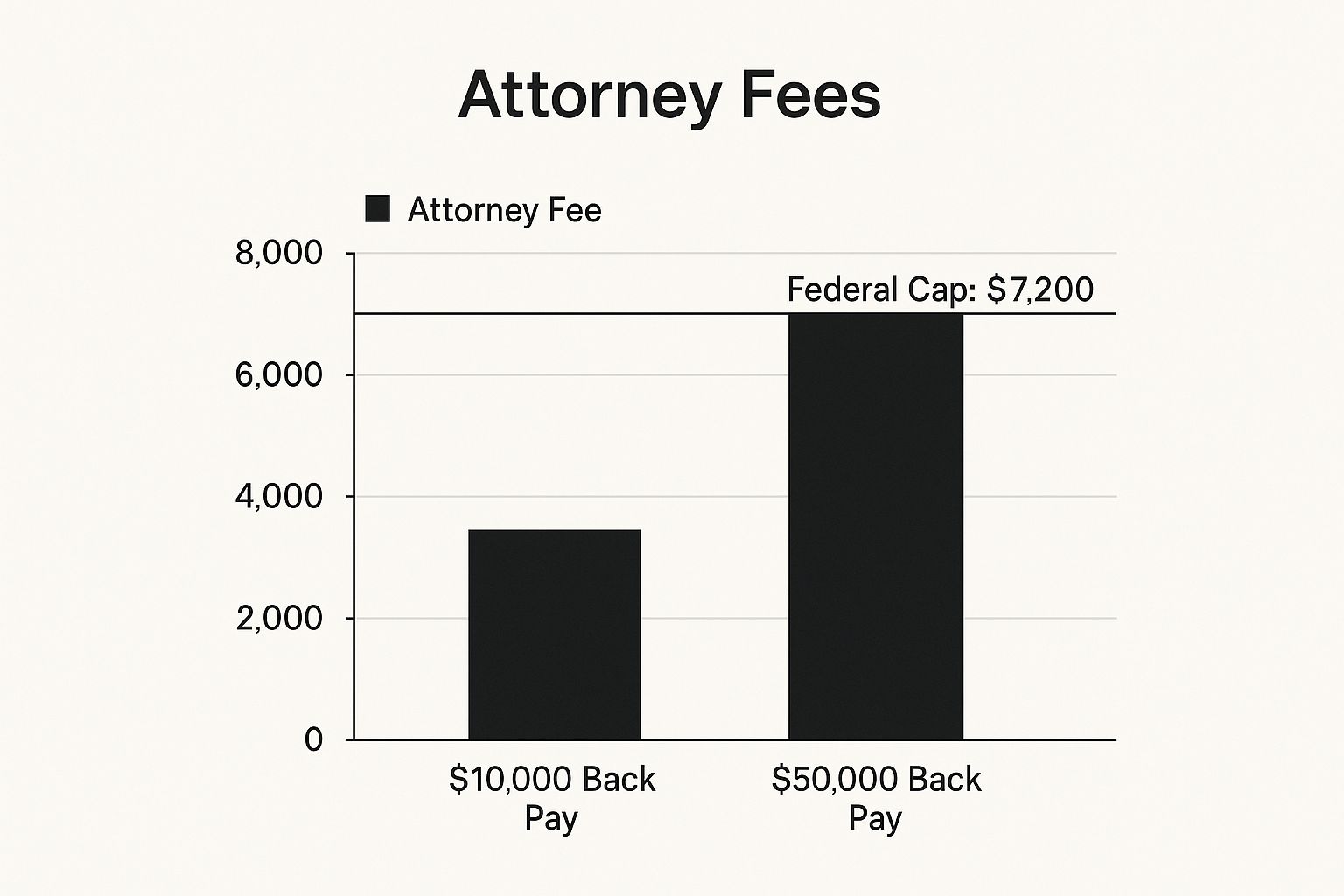

How the Federal Fee Cap Protects You

When you're looking into hiring a disability lawyer, it’s completely normal to worry about the cost. The standard agreement is 25% of any past-due benefits you're awarded, but there’s a crucial safety net built into the system: a federal fee cap.

This cap is a hard limit on the total fee a lawyer can charge, no matter how large your back pay award ends up being. The Social Security Administration (SSA) currently sets this cap at $7,200. In practice, this means your lawyer’s fee is always the lesser of two figures: 25% of your back pay, or $7,200. This setup is designed to keep legal fees from spiraling out of control, ensuring the lion's share of your hard-won benefits goes straight into your pocket.

Putting the Fee Cap into Practice

So, what does this look like in the real world? Let's walk through a couple of examples to see how the numbers play out.

Scenario 1: The 25% Rule Applies Let's say you win your case and the SSA determines you're owed $10,000 in past-due benefits.

- Your attorney's fee is calculated as 25% of that amount.

- $10,000 x 0.25 = $2,500.

- Because $2,500 is well below the $7,200 cap, this is exactly what your attorney receives.

This is a pretty straightforward case where the fee is a simple percentage of your award.

Scenario 2: The Fee Cap Kicks In Now, imagine your case was more complicated and took a long time to win. As a result, your back pay award is much larger—say, $50,000.

- A simple 25% calculation would be $12,500 ($50,000 x 0.25).

- But hold on—this is where the federal cap does its job.

- Your attorney’s fee is capped at $7,200, not the full $12,500.

This rule just saved you over $5,000. It’s a perfect example of how this protection works directly in your favor, especially when a case drags on and the back pay piles up.

The table below breaks down these calculations for different back pay amounts, showing exactly when the cap takes effect.

How the Federal Fee Cap Affects Lawyer Payment

This table illustrates how a disability lawyer's fee is calculated based on the client's back pay award, showing the impact of the 25% rule and the federal fee cap.

| $10,000 | $2,500 | $2,500 | $7,500 |

| $28,800 | $7,200 | $7,200 | $21,600 |

| $40,000 | $10,000 | $7,200 | $32,800 |

| $60,000 | $15,000 | $7,200 | $52,800 |

As you can see, once the 25% calculation hits $7,200 (at $28,800 in back pay), the fee stops increasing. For any award above that amount, the lawyer’s payment remains fixed, leaving more of the money for you.

Why This System Is Designed for You

This blend of a percentage fee with a hard cap creates a system that’s both fair and predictable. It gives your lawyer a strong incentive to fight for the highest possible back pay award for you, but it also prevents their fee from ever becoming excessive.

The federal fee cap is the SSA's way of making sure legal help is accessible and affordable for everyone. It protects you from unreasonable fees and keeps the focus right where it should be: on getting you the financial support you need to move forward.

This structure is also why you don't really need to "shop around" for a cheaper lawyer. Every Social Security disability attorney in the country operates under these exact same federally regulated rules. You can set aside worries about cost and concentrate on finding the most experienced, dedicated representative to handle your claim.

Understanding Out-of-Pocket Case Expenses

While the "no win, no fee" promise is a huge relief, it's important to understand it covers your lawyer's time and legal work, not the hard costs of building your case. Think of it this way: your attorney is the skilled carpenter building your case, but you still need wood, nails, and materials.

Those materials are what we call out-of-pocket expenses. These are direct costs your lawyer pays upfront to gather the evidence needed to prove your disability to the Social Security Administration (SSA). They are completely separate from the attorney's fee, and any good lawyer will explain them clearly in your agreement from day one.

What Do These Expenses Typically Include?

Let’s be clear: these aren't costs for keeping the lights on at the law firm. These are expenses directly tied to your specific claim. Every dollar is spent on one thing: collecting the proof needed to win your case.

Here’s a look at the most common expenses:

- Medical Record Fees: This is the big one. Doctors and hospitals charge for the time and resources it takes to copy and send your medical history. These records are the absolute foundation of your entire claim.

- Copying and Postage: The SSA deals in paper—a lot of it. The costs for printing, scanning, and mailing hundreds of pages of documents can really add up, especially over the life of a case.

- Expert Opinions: Sometimes, a medical record isn't enough. Your attorney might need to pay your doctor for a detailed written statement explaining exactly how your condition prevents you from working.

- Travel Costs: This is less common, but if your attorney has to travel a significant distance for your hearing, some of those basic expenses might be factored in.

Getting a handle on how to get medical records is a great way to understand where a significant portion of these case costs come from.

Out-of-pocket expenses are the essential building blocks of your case. Your lawyer fronts these costs for you, ensuring that a lack of funds never prevents the gathering of critical evidence.

How You Pay for Case Expenses

This is the part that brings most people peace of mind: you still don't pay for these costs until you win. Just like the attorney’s fee, these expenses are settled only after your case is successful.

Here’s how it usually works once your back pay is approved:

First, the SSA sends your attorney their contingency fee (the 25% or $7,200 cap).

Next, the law firm is reimbursed for all the out-of-pocket costs they paid on your behalf. This comes out of your remaining back pay award.

Finally, the rest of the money is yours. That final amount is sent directly to you.

This structure means you have zero financial risk while your claim is pending. Your attorney is essentially investing in your case, covering all the necessary expenses to give you the best possible shot at winning. It’s a true partnership.

What Happens If You Win But Get No Back Pay

The entire disability payment system is built around back pay, but what happens in the rare case you win and there is none? It’s an uncommon scenario, but it can happen.

For instance, if your application gets approved almost immediately after you stop working, there just isn't any "past-due" time to accumulate benefits. This sometimes comes up in Continuing Disability Review (CDR) cases, too, where benefits are continued but not paid retroactively.

In these situations, the standard contingency fee—where the lawyer gets a percentage of your back pay—doesn't apply. There’s no lump sum to draw from. This is exactly why it’s so important to understand that how a lawyer gets paid goes beyond the simple 25% rule.

When there's no back pay on the table, your attorney has to use a completely different method to get paid for their work.

The Fee Petition Process

That alternative method is called a fee petition. Instead of the Social Security Administration (SSA) automatically withholding and paying the attorney's fee, your lawyer has to formally request payment by submitting a detailed petition directly to the SSA.

Think of this document as an itemized invoice for all the work they did. It has to include things like:

- A complete log of every hour spent on your case.

- A description of each task, from phone calls and filing paperwork to representing you at the hearing.

- The lawyer’s requested hourly rate for their time and expertise.

The SSA doesn't just rubber-stamp these. They review the petition carefully to decide if the time spent and the work performed were reasonable and necessary to win your case. If they agree, the SSA will approve a specific fee they consider fair.

A fee petition is the SSA-approved method for an attorney to get paid when a successful case generates no back pay. The SSA must approve the final amount, which the client is then responsible for paying directly to the law firm.

Who Is Responsible for Payment

Here’s the biggest difference: once the SSA approves the fee petition, the responsibility for paying it falls on you.

Instead of the fee being conveniently deducted from a lump-sum award, you are responsible for paying the lawyer’s approved fee directly. This situation really highlights how beneficial the standard contingency fee system is for most people, as it removes this direct, out-of-pocket financial burden.

For a deeper dive into the mechanics of past-due benefits, our guide explaining how SSI back pay works provides additional context.

The fee petition process ensures lawyers are still compensated for their successful work, even in these unusual cases. While disability attorneys primarily rely on contingency fees, their overall earnings can vary. The average salary for a disability lawyer is around $119,097, a figure that reflects diverse compensation models beyond just back pay awards. You can find more insights about attorney salary data on ZipRecruiter.

Why This Payment System Actually Works for You

When you first hear about lawyer fees, it’s natural to be concerned. But the way disability lawyers get paid in the United States is specifically designed to protect you, the claimant. It’s a system built on a simple, powerful idea: your lawyer only gets paid if you win.

This setup, known as a contingency fee, is a game-changer. It means you don't need a dime upfront to hire an expert. Your ability to get top-notch legal help depends on the strength of your case, not the size of your bank account. This structure turns the lawyer-client relationship into a true partnership, where your goals are perfectly aligned.

A Look at the Bigger Picture

It's easy to forget just how significant the disability community is on a global scale. People with disabilities and their families represent an economic force with a disposable income of over $2.6 trillion worldwide, influencing nearly 41% of the global population. You can dive deeper into these findings on the global economics of disability.

While other countries might use state-funded legal aid, the American system's federally-capped 25% fee creates a predictable and accessible structure. This consistency is crucial for anyone navigating complex government programs, from Social Security to veteran disability benefits.

By linking a lawyer’s payment to their client’s success, the U.S. system transforms the attorney-client relationship into a true partnership. It ensures your representative is fully invested in fighting for the best possible result.

Ultimately, this model removes the financial risk from your shoulders and places it on the attorney. They invest their time, expertise, and resources into your claim because they believe in it. It's a system built on a promise: if you don’t get the benefits you desperately need, your lawyer doesn't get paid a fee. It’s that simple.

Your Top Questions About Lawyer Fees, Answered

Even after getting the basics down, it’s completely normal to have a few more questions rattling around. Let's walk through some of the most common things people ask, so you can feel totally clear on how this all works.

What Happens if I Lose My Case?

This is probably the biggest worry for anyone thinking about hiring a lawyer, and the good news is the answer is straightforward. If your claim is ultimately denied, you owe your lawyer nothing for their time.

That “no win, no fee” promise is the real deal. It doesn’t matter how many hours your attorney poured into your case; if you don't get benefits, you don't pay their fee. Just keep in mind that you might still have to cover small, direct costs like the fee a doctor's office charges for your medical records. This should always be spelled out clearly in the agreement you sign at the beginning.

Can I Haggle Over the Lawyer's Fee?

In a word, no. The fee structure for Social Security disability cases is set by the federal government—specifically, the Social Security Administration (SSA). This isn't a company policy; it's federal regulation.

Every disability lawyer in the country plays by the same set of rules: their fee is 25% of your back pay, but it cannot exceed the current cap of $7,200.

This standardization is actually a huge advantage for you. It means you can focus on finding a lawyer with the right experience and a great track record, without having to shop around for a better price.

The SSA's fee regulations level the playing field. It gives you peace of mind knowing you're getting a fair, standard rate from any qualified attorney you choose to represent you.

Will I Have to Pay Taxes on My Lawyer's Fee?

Nope, you won't. The part of your back pay that the SSA sends directly to your attorney is their income, and they are the ones responsible for any taxes on it.

You only need to worry about potential taxes on the money you actually receive. Of course, it’s always smart to run your specific situation by a tax advisor once you get your award.

At Bell Law, we're committed to total transparency so you feel confident and informed through every stage of your claim. If you're dealing with a disability case in Oregon and want an experienced team in your corner, reach out to us for a free consultation.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.