how long to settle car accident claim: A Quick Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

how long to settle car accident claim: A Quick Guide

Here's the simple truth: settling a car accident claim usually takes anywhere from a few months to over a year. There’s no magic number because every single case is different.

Your Car Accident Settlement Timeline at a Glance

If you're asking, "How long will my car accident claim take to settle?" you're not alone. After a crash, the path to getting compensation can feel uncertain and frustrating. My goal here is to pull back the curtain and give you a clear, step-by-step understanding of the road ahead.

Think of the settlement process less like a single event and more like a journey with predictable stages. Each claim moves through a distinct lifecycle, from the initial crash investigation all the way to the final check. Knowing these phases helps set realistic expectations and puts you in a better position to make smart decisions. The major milestones include gathering evidence, finishing your medical treatment, sending a formal demand letter to the insurance company, and negotiating a final figure.

Understanding the General Timelines

Nationally, most car accident claims resolve in about 3 to 18 months. The exact timing really comes down to the complexity of the crash and how severe the injuries are. A straightforward fender-bender with minor injuries and clear fault might wrap up in just 30 to 90 days.

On the other hand, more serious cases often stretch to a year or more, especially if a lawsuit becomes necessary. Legal experts who analyze national settlement data consistently see these patterns emerge.

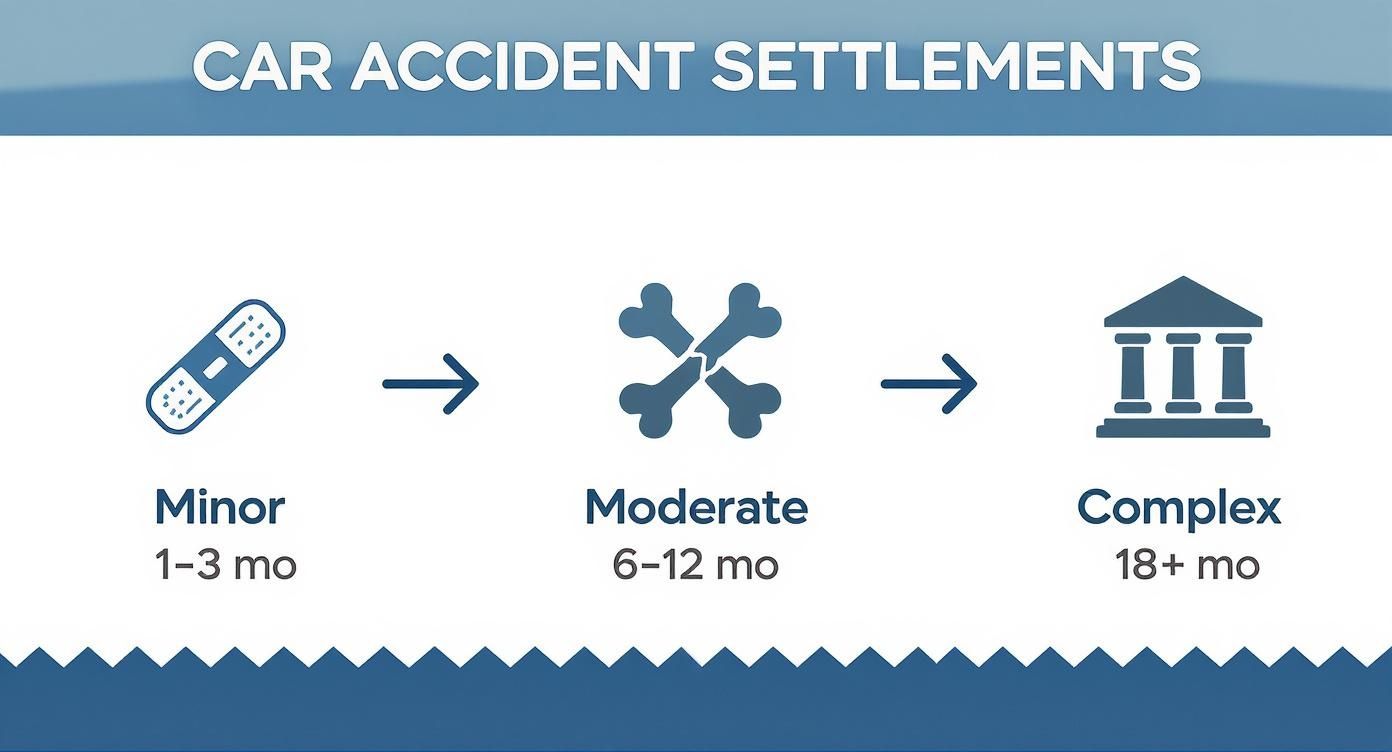

This infographic gives you a great visual for how the timeline changes based on the severity of the accident.

As you can see, the more tangled the issues of fault and the more serious the injuries, the longer the path to a fair settlement becomes.

For a quick reference, the table below breaks down what you can generally expect.

Typical Car Accident Settlement Timelines at a Glance

Here’s a summary of what the timeline might look like depending on how serious your case is.

| Minor Injury Case | 1–3 Months | Involves soft-tissue injuries like whiplash, minimal property damage, and clear evidence of who was at fault. |

| Moderate Injury Case | 6–12 Months | Includes injuries like broken bones requiring surgery, significant time off work, and more back-and-forth with the insurer. |

| Severe/Complex Case | 18+ Months | Involves catastrophic injuries, permanent disability, arguments over fault, multiple vehicles, or requires filing a lawsuit. |

Keep in mind these are just estimates, but they provide a solid framework for what to expect.

The single most critical factor that dictates your settlement timeline is reaching Maximum Medical Improvement (MMI). This is the point when your doctor says your condition has stabilized and you're as healed as you're going to get. Settling before you reach MMI is a huge mistake—you won’t know the full cost of your future medical needs.

In a personal injury claim, patience is your best friend. Rushing the process almost always means accepting a lowball offer that won't cover your long-term expenses. By understanding these timelines, you can prepare yourself for the journey ahead, both financially and emotionally.

Navigating the Five Stages of Your Claim

The question "how long does a car accident claim take?" is much easier to answer when you see the process for what it really is: a journey with distinct stages, not a single event. Each step has a purpose, builds on the last, and comes with its own rough timeline.

Thinking of it this way makes the whole thing feel less like a mystery and more like a roadmap. Let's walk through the five key milestones you'll encounter on the way to a fair settlement.

Stage 1: Initial Investigation and Evidence Gathering

This is where we build the foundation of your entire claim. The moment the accident happens, the clock starts on gathering every piece of evidence that tells the story of what happened and who was responsible. Think of your attorney as a detective piecing together a case—the more solid clues we find, the stronger your position becomes.

During this initial phase, we're focused on securing crucial information, such as:

- Police Reports: The official narrative of the crash, which often includes the officer's initial thoughts on who was at fault.

- Witness Statements: Unbiased accounts from people who saw what happened can be incredibly powerful in backing up your story.

- Photos and Videos: Visuals of the scene, vehicle damage, and your injuries are undeniable proof that words can’t always capture.

- Initial Medical Records: These documents are vital for drawing a direct line from the crash to the injuries you suffered.

This stage can take anywhere from a few weeks to a few months. It all depends on how quickly official reports are released or how easy it is to track down witnesses. A straightforward rear-end collision will move much faster than a complex pile-up on the freeway.

Stage 2: Reaching Maximum Medical Improvement

This is, without a doubt, the most important and often the longest stage of your claim. Maximum Medical Improvement (MMI) is a clinical term for the point when your doctor says your condition has stabilized. It means you've either fully healed or your injury isn't expected to get any better with further treatment.

We simply can't know the true value of your claim until you reach MMI. Why? Because until then, we don't have the complete picture of your losses.

Settling before you reach MMI is one of the biggest mistakes you can make. If you accept an offer and later find out you need another surgery or long-term physical therapy, you can't go back and ask for more money. The case is closed—forever.

The timeline here is completely dictated by your injuries. A minor soft-tissue injury might only require a few months of physical therapy. But a serious injury that needs surgery and extensive rehab could easily take over a year. Being patient at this stage is absolutely critical; it’s how you protect your financial future.

Stage 3: Crafting and Sending the Demand Letter

Once you've hit MMI and we've tallied up all your damages, it's time to make our opening move. Your attorney will compile every piece of evidence, medical bill, and calculation into a powerful document called a demand letter.

This isn't just a simple request for money. It's a comprehensive legal argument that:

Establishes Liability: It lays out exactly why the other driver is at fault, using police reports and evidence to prove it.

Details Your Injuries: It describes your diagnosis, the treatment you went through, and what your doctors say about your future.

Calculates Your Damages: It presents a specific, justified dollar amount for everything—from medical bills and lost wages (economic damages) to your pain and suffering (non-economic damages).

After we send the demand letter, the insurance company typically has 30 to 60 days to review it and respond. Their response will be an acceptance (rare), a denial (also rare if the case is strong), or, most often, a counteroffer. That first counteroffer officially kicks off the next stage.

Stage 4: The Negotiation Phase

This is the back-and-forth dance that most people think of when they imagine a settlement. The insurance adjuster, whose goal is to save their company money, will almost always come back with a lowball counteroffer.

This is where your attorney's experience really shines. We use the evidence from Stage 1 to dismantle their arguments and justify every dollar of your demand. This process of offers and counteroffers can be quick, or it can stretch out over time, lasting anywhere from a few weeks to several months. It really depends on the case's complexity, the amount of money involved, and how reasonable the insurance company decides to be.

To get a more detailed picture of this part of the journey, you can learn more about the complete car accident settlement process and what to expect.

Stage 5: Litigation, If Necessary

The good news is that the vast majority of car accident claims—well over 90%—settle out of court during negotiations. But if an insurance company simply refuses to offer a fair amount, our final option is to file a lawsuit.

Filing a lawsuit doesn't mean your case is destined for a dramatic courtroom trial. More often than not, it's a strategic move to show the insurer we mean business. This step triggers the "discovery" process, where both sides are forced to formally exchange evidence under oath. The pressure of an looming trial date is often the exact motivation an insurer needs to come back to the table with a serious offer.

Of course, if a lawsuit becomes necessary, it will add another year or more to the timeline. While it definitely extends the process, sometimes it’s the only way to get the full and fair compensation you deserve.

Factors That Speed Up or Slow Down Your Settlement

Ever wonder why a friend’s car accident claim settled in a few months, while another person’s case seems to drag on for years? It’s not random. The timeline for your settlement comes down to a specific set of variables that can either clear the path or create major roadblocks.

Think of it like a road trip. Some factors are like a wide-open highway, letting you reach your destination quickly. Others are like unexpected traffic jams, bringing everything to a frustrating halt. Understanding these key elements will help you set realistic expectations for your own claim.

Settlement Accelerators That Speed Things Up

When the stars align, certain conditions can make the settlement process much smoother and faster.

- Clear and Undisputed Fault: This is the big one. If it’s obvious who caused the crash—say, you were rear-ended at a stoplight and the other driver got a ticket—the insurance company has very little to argue about. This removes one of the biggest potential hurdles right from the start.

- Minor or Moderate Injuries: When injuries are less severe and have a predictable recovery path (like a few months of physical therapy for whiplash), it’s much easier to calculate the total damages. A shorter recovery means you reach what's called Maximum Medical Improvement (MMI) sooner, which is the green light for negotiations to begin.

- A Cooperative Insurance Company: Let's be honest, some insurance carriers are just easier to work with. When an adjuster is responsive, reasonable, and focused on resolving the claim fairly, the negotiation phase is often shorter and far more productive.

Roadblocks That Can Slow Your Claim to a Crawl

On the flip side, many factors can throw a wrench in the works, adding months or even years to the process. These issues demand more investigation, deeper documentation, and a much more strategic approach to negotiation.

- Disputed Liability: This is the most common reason for a long delay. If the other driver denies they were at fault or, worse, tries to blame you, the insurance company will dig in its heels. This kicks off an in-depth investigation that can involve hiring accident reconstruction experts and taking formal statements from everyone involved.

- Severe or Catastrophic Injuries: If you’ve suffered a serious injury that requires surgery, long-term rehab, or future medical care, your claim will naturally take longer. It is absolutely critical to wait until you’ve reached MMI before settling. You only get one shot, and you need to know the full, long-term cost of your injuries.

- Insurance Company Delay Tactics: Unfortunately, some insurance companies intentionally drag their feet. They might ignore your calls, ask for documents you’ve already sent, or make a ridiculously low offer, hoping the financial pressure forces you to give up. Knowing how to effectively deal with insurance adjusters is a crucial skill in fighting back against these tactics.

Key Insight: The severity of your injuries is directly tied to your settlement timeline. A case involving a permanent disability will require life care plans and expert testimony, which can add a year or more to the process compared to a simple whiplash claim.

The time it takes for initial vehicle inspection timelines and damage assessments can also affect how quickly things move forward.

While every case is unique, most are resolved before ever seeing a courtroom. In fact, only about 3% of personal injury cases in the U.S. go to trial. For the vast majority that settle, the process typically takes 6 to 9 months after medical treatment is finished, assuming liability is clear.

Factors Impacting Your Settlement Timeline

This table breaks down how the same factors can either fast-track your settlement or bring it to a grinding halt. Seeing the contrast makes it clear why no two cases are exactly alike.

| Liability | The other driver was cited for running a red light, and multiple witnesses confirm it. | Both drivers claim they had a green light, and there are no independent witnesses. |

| Injuries | You suffered whiplash and completed physical therapy in three months. | You sustained a back injury requiring surgery and a year of recovery. |

| Insurer | The adjuster is responsive and makes a reasonable first offer. | The adjuster is unresponsive and uses tactics to stall the claim. |

| Damages | Property damage is minimal and easily documented. | The case involves significant lost income and future medical costs. |

Ultimately, the combination of these elements—clear fault, the extent of your injuries, and the insurer’s attitude—will shape your claim’s journey from start to finish.

Understanding Timelines Through Real-World Scenarios

Sometimes the best way to understand the legal process is to see how it plays out for real people. All the stages and factors we've discussed can feel a bit abstract until you put them into context.

So, let's walk through three different, but very common, scenarios. Each story is unique, highlighting how a few key details can drastically change the answer to the question, "how long will my car accident claim take to settle?"

Case Study 1: The Straightforward Fender-Bender

First, meet Sarah. She was stopped at a red light when another car rear-ended her at a relatively low speed. The other driver was apologetic, admitted fault on the spot, and the police officer who arrived on the scene issued them a ticket. That’s a huge head start.

Sarah felt sore the next day and went to urgent care, where she was diagnosed with mild whiplash. Her treatment plan was clear: six weeks of physical therapy.

This case had all the right ingredients for a speedy resolution:

- Undisputed Liability: The police report and the at-fault driver's admission made it an open-and-shut case.

- Minor Injuries: Sarah’s injury had a predictable recovery time.

- Clear Damages: Her medical bills and the estimate for her car's bumper were easy to add up.

Once Sarah finished her PT, her lawyer gathered her records, totaled up the damages, and sent a demand letter to the insurance company. After a couple of quick phone calls, they reached a fair settlement.

Total Timeline from Accident to Settlement Check: 5 Months. Sarah’s experience is a perfect example of how clear fault and a short, defined medical recovery can wrap things up in well under a year.

Case Study 2: The Moderate Injury with Complications

Now, let's look at David's situation. He was driving through an intersection on a green light when another driver blew through a red light, T-boning his car. David’s arm was broken in the crash, requiring surgery to insert a plate and screws.

Right away, there was a snag. The other driver claimed their light was yellow, not red, creating an initial dispute over who was at fault. On top of that, David's recovery was much more involved. After surgery, he needed months of occupational therapy to get back the full use of his hand and had to miss four months of his construction job.

David’s timeline was longer for a few key reasons:

Liability Dispute: It took a little while to track down traffic camera footage that definitively proved the other driver ran the red light.

Serious Injury: David couldn't even begin to talk about a settlement until his doctors declared he had reached Maximum Medical Improvement (MMI), which didn't happen until nine months post-accident.

Complex Damages: The claim wasn't just for a few doctor's visits. It included a costly surgery, extensive therapy, and significant lost wages—all of which needed careful documentation.

Because the final number was much bigger, the insurance adjuster dug in their heels. The negotiation phase dragged on for over two months before a fair offer was finally put on the table.

Total Timeline from Accident to Settlement Check: 13 Months. David’s case shows how a more serious injury, coupled with even a minor argument over fault, can easily push a claim's timeline past the one-year mark.

Case Study 3: The Severe Injury and Disputed Fault

Finally, consider Maria. She was just a passenger in a multi-car pileup on the freeway. The crash left her with a severe back injury that resulted in chronic pain and required multiple, ongoing procedures. To make a terrible situation worse, the two other drivers involved were busy pointing fingers at each other.

This case had just about every roadblock you can imagine.

The investigation into who caused the wreck was a massive undertaking, requiring depositions from multiple drivers and witnesses to piece it all together. Maria's own medical journey was far from over; her doctors couldn't give a final prognosis for more than a year.

The insurance companies for both potentially at-fault drivers made insultingly low offers, each hoping the other would be forced to pay. With negotiations completely stalled, Maria's attorney had to file a lawsuit to get them to take the claim seriously. While the case ultimately settled before going to trial, the litigation process itself added a significant amount of time.

Total Timeline from Accident to Settlement Check: 22 Months. This difficult scenario is a powerful reminder of how catastrophic injuries, especially when combined with a complex fight over liability, almost always result in a timeline stretching beyond 18 months and often require filing a lawsuit to achieve justice.

Critical Oregon Legal Deadlines You Cannot Afford to Miss

When you're trying to settle a car accident claim, few things are as unforgiving as a legal deadline. These aren't just suggestions; they are absolute cutoffs. For anyone in Oregon, getting these dates right is everything. Miss one, and you could lose your right to compensation for good.

The big one is called the statute of limitations. It’s the legal stopwatch that starts ticking the moment an accident happens, and it dictates how long you have to file a lawsuit.

The Oregon Statute of Limitations

The specific deadline you're up against depends on the type of claim you have. Each one is strict, and there's no room for error.

- Personal Injury Claims: If you were injured in a car wreck, Oregon law generally gives you two years from the date of the crash to file a lawsuit. If that window closes, it doesn't matter how strong your case is—the court will almost certainly throw it out.

- Wrongful Death Claims: In the heartbreaking event that an accident leads to a death, the family typically has three years from the date of the injury that caused the death to file a wrongful death suit.

It's important to understand that these deadlines are for filing a lawsuit, not just talking to the insurance company. Why does this matter? Because your ability to sue is your biggest bargaining chip. The insurer knows you can take them to court, and that's what keeps them at the negotiating table.

Crucial Takeaway: Think of the statute of limitations as your ultimate leverage. Even if your goal is to settle, preserving your right to sue is the most powerful tool you have. Once that deadline passes, the insurance company holds all the cards.

Other Important Time Limits to Know

Beyond the major deadline for a lawsuit, you also have to keep an eye on timelines related to your own insurance policy.

One of the first you'll encounter involves your Personal Injury Protection (PIP) benefits. In Oregon, you usually have to notify your own insurance company of your intent to use your PIP coverage within one year of the accident. This is the coverage that pays for your initial medical bills and lost wages, so acting quickly is essential.

The details of the Oregon personal injury statute of limitations can get tricky. For example, if your claim is against a city or state government entity, the deadlines can be much shorter and have more complex rules.

This isn't an area for guesswork, especially when the consequences are so high. The smartest thing you can do to protect your claim is to speak with an experienced Oregon personal injury lawyer right away. We make sure every deadline is tracked and every requirement is met, so you can focus on healing while we handle the fight.

Answering Your Top Questions About Claim Timelines

Even when you understand the basic roadmap of a claim, a lot of questions pop up along the way. The whole process can feel a bit overwhelming, and it's completely normal to wonder what you can do to move things along or what to make of the insurance company's actions. Let's tackle some of the most common questions we hear from our clients to give you a clearer picture.

Can I Do Anything to Speed Up My Car Accident Settlement?

Yes, absolutely. While you can't control the insurance adjuster or the legal system, you have more power than you think. The key is to be organized and proactive from day one.

Think of it this way: the more organized you are, the fewer excuses you give an insurance company to drag its feet. Here’s what you can do to keep the momentum going:

- Get Medical Care Immediately: Don't wait. See a doctor right after the crash and follow their treatment plan precisely. This creates a rock-solid, documented link between the accident and your injuries.

- Become a Record Keeper: Start a file and put everything in it—the police report, photos you took at the scene, the other driver's info, and names and numbers for any witnesses.

- Track Every Penny: Keep a running log of all your related expenses. This includes medical bills, pharmacy receipts, and a simple calendar marking the days you couldn't work.

- Be Responsive: When your lawyer needs a document or a quick signature, try to get it back to them as soon as you can. Your speedy cooperation helps us keep the pressure on.

Of course, one of the biggest moves you can make is hiring an experienced attorney early on. A good lawyer knows the insurance company's playbook, handles all the communication, and makes sure every deadline is met, which is critical to a smooth and efficient process.

Why Would the Insurance Company Delay My Claim?

It's a frustrating but common part of the process. Insurance companies are businesses, and delaying a claim is often a calculated business strategy. At the end of the day, an adjuster's primary role is to protect their company’s profits by minimizing payouts. Delays are one of their most effective tools.

This tactic is sometimes called the "delay, deny, defend" strategy. They might ask you for documents you've already sent, make a ridiculously low offer just to see if you'll bite, or simply go silent for a while.

The goal is to wear you down. They know that as your medical bills and living expenses pile up, the financial pressure builds. The hope is that you'll get desperate enough to accept a lowball offer that is nowhere near what your case is actually worth.

This is exactly where having a tenacious lawyer in your corner makes all the difference. We see these tactics for what they are—a cynical game—and we know how to apply the legal pressure needed to shut them down. It sends a clear signal that you won't be pushed around and are prepared to fight for a fair result.

Should I Take the First Settlement Offer I Receive?

In almost every single case, the answer is no. That first offer is rarely the best one. Think of it as a starting point for negotiations—a lowball figure sent to test the waters and see if you’ll close your case quickly and for cheap.

It is crucial to wait until you’ve reached what’s called Maximum Medical Improvement (MMI). That’s the point when your doctor says your condition is stable and they have a clear idea of your long-term prognosis. Only then can you and your attorney truly grasp the full value of your claim, including:

- The total cost of all your medical care to date.

- The estimated expense of any future treatment you’ll need.

- Every dollar of income you lost while recovering.

- The true measure of your pain and suffering.

If you accept an offer too early, you sign away your right to ask for more money later. If it turns out your injury is more serious than you first realized, you'll be stuck paying for those future costs out of your own pocket.

If I File a Lawsuit Does That Mean I Have to Go to Trial?

Filing a lawsuit is a huge step, but it almost never means you’ll end up in front of a jury. The statistics are really clear on this: over 95% of personal injury cases settle before they ever reach a trial.

It’s best to think of filing a lawsuit as turning up the heat in the negotiation process. It’s a formal, powerful move that shows the insurance company you are serious and not backing down. More often than not, this is the exact motivation they need to come to the table with a much more reasonable offer to avoid the risk and expense of a trial.

Once the suit is filed, a phase called "discovery" begins, where each side gets to formally request evidence from the other. This process tends to expose the real strengths and weaknesses of a case, which often paves the way for a fair settlement long before anyone sets foot in a courtroom. Your attorney will continue negotiating for you every step of the way.

Navigating the aftermath of a car accident is challenging, but you don't have to do it alone. If you have questions about your claim or need guidance on what to do next, the experienced team at Bell Law is here to help. Contact us today for a free, no-obligation consultation to protect your rights and get the support you deserve.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.