How to File a Personal Injury Claim: A General Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

How to File a Personal Injury Claim: A General Guide

When you've been injured in an accident, the situation can be overwhelming. What a person does in the first few hours and days can be important, not just for their health, but for protecting their potential legal rights down the road. This can be viewed as laying the foundation for a potential personal injury claim.

Critical First Actions After an Injury

The clock starts ticking the moment an accident happens. Navigating this high-stress time with a clear head and a few key priorities may make a difference. Let's walk through some general steps one might consider.

Prioritize Your Health and Seek Medical Care

Above all else, it is important to take care of yourself. Seeking a medical evaluation right away is a common first step, even if you think you’re “fine.” Some serious issues like internal bleeding, concussions, or whiplash may not always show obvious symptoms immediately.

Going to a doctor or the emergency room accomplishes two things. First and most importantly, it allows you to get the treatment you may need to start healing. Second, it creates an official medical record—a paper trail that could link your injuries to the incident. This documentation can be a cornerstone of a future claim.

Formally Report the Incident

Next, you may need to get an official report on the books. How this is done depends on where and how you were injured.

- Vehicle Collisions: In many cases, people call the police. An officer may come to the scene, interview those involved, and file a formal accident report. This objective, third-party account can be valuable. For a deeper dive, check out our guide on what to do after a car accident.

- Incidents on Someone Else's Property: If you slip and fall in a store or restaurant, you might want to find a manager or supervisor immediately. They may need to create an internal incident report. It could be beneficial to ensure one is filed before you leave.

- Workplace Injuries: Informing your direct supervisor as soon as you can is a typical requirement. Many companies have a specific protocol for reporting on-the-job injuries, so it can be helpful to follow it.

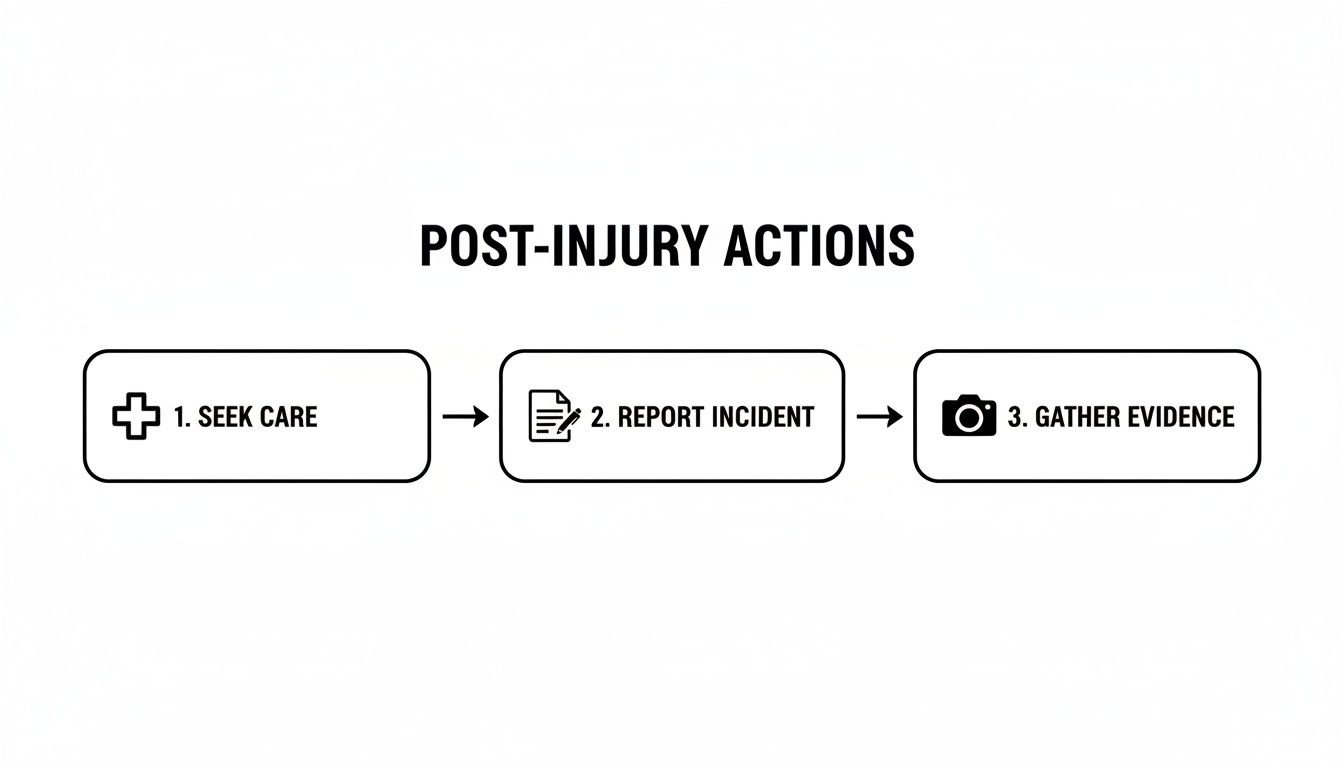

This flowchart breaks down a simple, potential sequence of events.

As you can see, it all starts with your well-being, then moves to official reporting and gathering the initial facts.

Preserve Initial Details and Information

While the incident is still fresh in your mind, it can be helpful to start collecting as much information as you can. Your smartphone can be a useful tool here.

Taking clear photos of everything—the accident scene, your injuries, any property damage, and anything that might have contributed to the accident, like a wet floor or a pothole—can capture crucial details that are easy to forget or that get cleaned up later.

If anyone saw what happened, getting their name and phone number could be useful. An independent witness can provide an unbiased account of the events. It's also a smart move to jot down your own version of what happened as soon as you’re able, while the details are still sharp.

You're not alone in this. In 2023, a staggering 62 million Americans—that's about one in five people—needed medical care for an injury. With medical costs constantly on the rise, it’s no surprise that many of these incidents lead to personal injury claims.

Building Your Case with Strong Documentation

When you've been hurt in an accident, a personal injury claim is built on proof. It is like telling a story backed by solid facts. This isn't just about having a few receipts in a shoebox; it's about methodically gathering every piece of paper that paints a clear picture of how the incident affected your health, your wallet, and your life.

Every document can add another layer to your story. The first report from the ER shows the immediate damage. The ongoing notes from your physical therapist track the road to recovery. Each bill—from the ambulance to the pharmacy—adds up to show the financial cost.

Getting this right can be critical. The U.S. personal injury law market is a massive $50 billion industry annually. With the CDC reporting 39.5 million injury-related treatments each year, knowing how to properly document a claim from day one can be a significant advantage. It puts you in a more informed position.

Your Medical Records are the Foundation

At the heart of many injury claims, you'll find the medical records. These documents can be a powerful tool because they officially connect your injuries to the accident. They can create a timeline that may be difficult to dispute.

You’ll want to collect everything. This can include paramedic reports from the scene, hospital admission paperwork, detailed notes from every doctor's appointment, and even physical therapy logs. These aren't just details; they're evidence of your commitment to getting better and the challenges you're facing along the way. For a step-by-step guide, see our post on how to get medical records, which explains a general request process.

Tracking the Financial Fallout

The impact of an injury goes way beyond the doctor’s office. It can hit your bank account, sometimes in unexpected ways. Documenting every one of these financial losses can be just as important as tracking your medical treatment.

This is where you show the economic toll of the accident. Consider gathering:

- Proof of Lost Wages: Pay stubs from before and after the accident can be helpful. A letter from your HR department confirming your missed time and pay rate could also work.

- Property Damage Records: If your car or other property was damaged, getting multiple repair estimates from trusted shops can be a good idea.

- Out-of-Pocket Receipts: This is a big one. Keep every receipt for prescriptions, crutches, bandages, and even the gas and parking fees for trips to the doctor. It can all add up.

A simple daily journal can be powerful evidence. Jotting down your pain levels, the everyday tasks you can no longer do, and the emotional stress this is causing helps tell the human side of the story—the part that numbers alone can't capture.

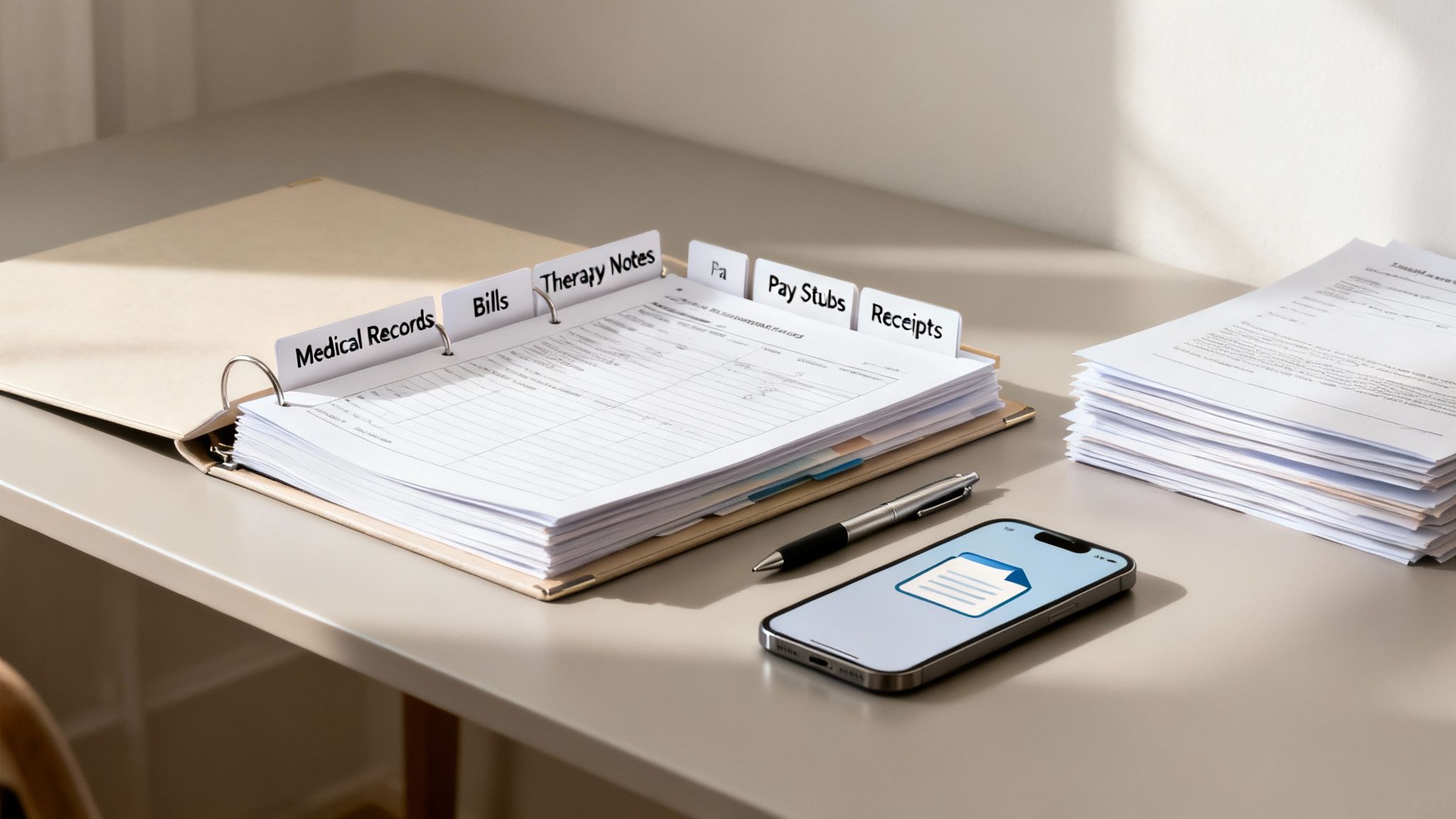

Staying Organized is Your Secret Weapon

As the paperwork starts to pile up, staying organized is very helpful. A messy file can lead to confusion, missed deadlines, and a weaker presentation. Whether you're a paper-and-pen person or you live in the cloud, you need a system.

A simple binder with dividers labeled "Medical Bills," "Lost Wages," and "Insurance Letters" can be a lifesaver. If you prefer digital, create a main folder on your computer with subfolders for each category. Scan your receipts as you get them and save important emails. This one habit can make the entire process feel less overwhelming and keeps you prepared for what comes next.

To make things even clearer, here's a checklist of the essential documents you might need to gather.

Essential Documents for Your Personal Injury Claim File

| Medical Evidence | ER reports, hospital records, doctor's notes, physical therapy logs, diagnostic imaging (X-rays, MRIs) | To prove the extent of your injuries and link them directly to the accident. |

| Financial Losses | Medical bills, pharmacy receipts, pay stubs, letter from employer, property damage estimates | To quantify all economic damages, including medical costs and lost income. |

| Incident-Related Proof | Police report, photos/videos of the scene and injuries, witness contact information, incident reports | To establish how the accident happened and who was at fault. |

| Personal Impact | A daily journal detailing pain and suffering, notes on missed events, photos of your recovery process | To document the non-economic damages, like pain, suffering, and loss of enjoyment of life. |

Having these documents organized and ready will not only strengthen your claim but may also give you peace of mind during a stressful time.

Kicking Off Your Claim and Dealing with the Insurance Company

Once you've got your initial evidence in order, it's time to officially open a claim with the at-fault party's insurance company. This is a crucial step. You are formally putting the insurer on notice that you are seeking compensation for the harm you’ve suffered.

This first contact is generally straightforward—you'll provide the basic details of the incident, like the date, location, and who was involved. Think of it as starting the formal claims process.

So, Who Is This Insurance Adjuster?

Shortly after you report the incident, your case may be handed off to a claims adjuster. This person works for the insurance company. Their job is to investigate your claim, determine fault from their perspective, and decide what your claim is worth from their point of view. They will be your main point of contact.

The adjuster will begin building their own file on the incident. They will ask you for things like the police report, your medical records, and proof of your lost wages. Their mission is to evaluate the claim's validity and, ultimately, how much they might have to pay out.

Keep this in mind: The adjuster's loyalty is to their employer, the insurance company. Their goal is to close the claim in a way that serves the company's interests.

This does not mean they are automatically your enemy, but this dynamic can color every conversation you have. Being organized, prepared, and very clear in your communication from the get-go can be your best approach.

How to Talk to the Adjuster

When you get on the phone with an adjuster, a good approach is to be clear, accurate, and stick to the facts. Answer their questions directly, but don't volunteer extra information or guess about things you aren't sure of. This is not the time for speculation.

For instance, if they ask about your injuries, talk about what your doctors have diagnosed and how you feel. It can be wise to avoid trying to predict your long-term prognosis. Critically, avoid casual phrases like "I'm fine" or "I feel a lot better." The full extent of some injuries may not show up for days or even weeks, and those simple words could be used against you later.

Here are a few practical tips for these early conversations:

- Have Your File Ready: Before you pick up the phone, have your notes, the claim number, and key dates right in front of you.

- Just the Facts: If you don't know the answer to a question, it's perfectly fine—and smart—to say, "I don't know."

- Document Everything: Keep a simple log of every call. Note the date, the adjuster's name, and a quick summary of what you talked about. This can be invaluable down the road.

The Recorded Statement: Should You Give One?

One of the first things an adjuster will likely request is a recorded statement. This is a formal, recorded interview where they ask you to describe the accident and your injuries in your own words. You should think carefully about this, as you are often not legally required to provide one.

Why do they want it? From their perspective, it locks in your story early on. Any small inconsistency between what you say in the recording and what you say later can be used to question your credibility. Before agreeing to a recorded statement, it is important to understand what you're getting into and be prepared to give a completely factual, consistent account.

Navigating this process correctly can be beneficial. The data shows that 70% of claimants end up receiving compensation, either through a settlement or a court award. With roughly 400,000 of these claims filed in the U.S. every year, these initial conversations are a key moment. You can dig into more liability insurance statistics on Feather Insurance to see the bigger picture.

Navigating the Investigation and Negotiation Process

Once your claim is officially filed, the landscape shifts. Now, the insurance company starts its own deep dive into the incident, which is a normal part of the process. You can expect them to look into the details.

An adjuster will be assigned to your case, and their job is to gather all the evidence—the police report, your medical bills and records, photos you took at the scene, and any statements from witnesses. They are trying to piece together two things: who they think is at fault and how much your claim is worth from their perspective.

What Happens During the Insurer's Investigation

Think of the insurance adjuster as building a case file. They're looking for consistency across all the documents and information they have. They want to see if the story adds up.

For instance, they may comb through your medical records to make sure every treatment you received is clearly linked to the accident. They'll also lean heavily on the police report to see what the officer concluded about who caused the crash. Everything you've told them up to this point may be cross-referenced with this new evidence, so consistency is key.

This is why those early conversations with an adjuster are so critical. If you're looking for more insight on how to handle those calls, we have some practical tips on how to deal with insurance adjusters in another one of our guides.

This investigation can feel slow, especially if a case has a lot of moving parts. But once the insurer feels they have a solid handle on things, the focus often moves from fact-finding to negotiation.

Crafting the Demand Letter

The negotiation phase can kick off when you send a demand letter. This is a document that formally outlines your entire case from your perspective. It is your opening argument, and it needs to be persuasive.

A strong demand letter isn't just a number on a page. It methodically breaks down your claim:

- The Story: A clear, step-by-step explanation of how the accident happened and why the other person is at fault.

- Your Injuries: A detailed summary of every injury you suffered, backed up by your medical documentation.

- The Costs: An itemized list of all your damages. This means medical bills, lost income from missing work, property damage, and any other money you've had to spend.

- The Demand: The specific dollar amount you are seeking to settle the case.

Putting together a compelling letter is a skill. For a solid starting point, you can check out a winning personal injury demand letter template to see how these are structured.

The Back-and-Forth of Settlement Negotiations

Do not be surprised if the insurance company does not immediately agree to your demand. It is common for them to come back with a counter-offer that is lower than what you asked for.

This is where negotiation starts. It is a give-and-take, with both sides making arguments to support their numbers. The adjuster might push back on certain medical treatments or argue that you weren't out of work as long as you claim.

It can be helpful to think of this as a structured conversation. Every offer and counter-offer is just one more step toward finding a middle ground. The key is to be patient but firm.

When you get that first low offer, it can be easy to get discouraged or feel pressured to accept. Take a breath and evaluate it carefully. Does it truly cover all of your past, present, and future costs?

You have to think bigger than just the bills you have in hand right now. A fair settlement could account for:

- All current medical expenses.

- The estimated cost of any future medical care or physical therapy.

- Every dollar of lost income.

- Compensation for the non-financial impact, like your pain and suffering.

This is often a challenging part of the claim process. It's a delicate dance, but the goal is to reach a fair settlement that reflects the full and true impact this injury has had on your life.

Reaching a Settlement or Taking the Next Step

For many personal injury claims, the back-and-forth negotiation eventually leads to a settlement agreement. This is the finish line for most cases—a formal deal where you accept a specific sum of money. In return, you agree to drop the case and give up any right to sue for that incident in the future.

Making the call to accept a settlement is a huge decision, and it’s one you can't undo. Once you sign on the dotted line, the case is officially over. That's why it's so critical to step back and weigh any offer carefully before you say yes.

What’s Actually in a Settlement Agreement?

A settlement is far more than a simple handshake. It's a legally binding contract, and its most important piece is usually the release of liability form. Signing this document means you are legally releasing the at-fault party and their insurer from any and all future claims tied to your accident.

This is a full and final stop. If that old injury flares up five years down the road and requires another surgery, you cannot go back and ask for more money. The settlement is the final word.

How to Size Up a Settlement Offer

Getting that first settlement offer can feel like a massive weight has been lifted. But you have to look at it with a cool head. An amount that sounds like a lot of money at first might barely cover your costs when you start adding everything up.

When an offer comes in, you and your attorney may need to stack it up against the full extent of your damages. This isn't just about the bills you have in hand today.

It’s a bigger picture that includes:

- All Medical Bills: This is everything from the first ambulance ride to projected costs for future physical therapy, specialist visits, or even surgeries you might need later on.

- Total Lost Wages: Think beyond the paychecks you've already missed. If your injuries will affect your ability to work or earn at the same level in the future, that has to be factored in.

- Pain and Suffering: This is the human cost. It’s compensation for the physical pain, the emotional trauma, and the way the injury has fundamentally changed your day-to-day life.

A good question to ask is whether the offer truly accounts for the long-term impact. A fast settlement might feel good now, but if it doesn't cover unforeseen medical issues, you could be left paying out-of-pocket for years to come.

Getting the true value of a claim means looking at the total picture—not just the immediate financial hit, but the ripple effect the accident has had on a person's entire life.

What Happens When You Can’t Agree on a Number?

Sometimes, no matter how hard everyone tries, you and the insurance company just can't see eye-to-eye on what's fair. When negotiations hit a wall and a reasonable settlement isn't happening, your claim may be ready to move to the next level.

The next move is often filing a lawsuit. This doesn't mean you're immediately heading to a dramatic courtroom showdown. It simply takes the dispute out of the insurance company's hands and puts it into the formal court system. In fact, filing a lawsuit can prompt the other side to get serious about settling, and many cases are resolved long before a trial date is ever set.

Looking at Other Ways to Settle the Dispute

Even after a lawsuit is on the books, you're not locked into a trial. There are other, less formal ways to resolve the case. These are broadly known as Alternative Dispute Resolution (ADR), and they're designed to be more collaborative and less adversarial than court.

In personal injury cases, two common forms of ADR are:

- Mediation: Think of a mediator as a neutral referee. This person doesn't take sides or make decisions. Instead, they guide a structured conversation between you and the other party, helping you find common ground and work toward a settlement you can both agree to. It’s entirely voluntary.

- Arbitration: This is a step up in formality. An arbitrator (or a panel of them) acts more like a judge. They'll hear arguments and review evidence from both sides before making a decision. Depending on what was agreed to beforehand, that decision can be binding—meaning it's final—or non-binding.

These alternatives can be a faster and less expensive route to a resolution, giving you one more chance to close out the case without the stress and uncertainty of a trial.

Navigating the Personal Injury Claim Process: Common Questions

When you're dealing with an injury, the last thing you want is to be bogged down by confusing legal jargon. The path to a settlement can seem intimidating, so let's clear up a few of the most common questions people have.

How Long Does a Personal Injury Claim Take?

This is the million-dollar question, and the honest answer is: it depends. There’s no standard timeline because every single case is unique. A straightforward case with minor injuries and clear fault might wrap up in a few months.

However, if you're looking at serious injuries that require long-term treatment, or if the insurance company is fighting hard on who's to blame, the process can stretch out much longer. The key factors are often the severity of your injuries and how much disagreement there is over the facts.

What is a Statute of Limitations?

Think of the statute of limitations as a legal countdown clock. It's a state law that sets a strict deadline for filing a lawsuit after you've been injured. This deadline can be different for different types of cases, but it is critical.

If this deadline is missed, you may lose your right to sue, no matter how strong your case is. A court will almost certainly dismiss it. This is one of the first things an attorney will check because it's a make-or-break issue for any claim.

Do All Personal Injury Claims Go to Court?

No. In fact, it's quite rare. The vast majority of personal injury cases—well over 90%—are settled out of court through negotiations.

Filing a lawsuit doesn't mean you're headed for a trial, either. Often, that step is just a procedural move to show the other side you're serious. It can be the very thing that jumpstarts stalled talks and pushes the case toward a fair settlement. For a good overview of the entire process, you can explore what a personal injury claim entails and how it works.

What Kinds of Damages Can Be Recovered?

In legal terms, "damages" are the losses you've suffered because of your injury. The goal is to get compensation that helps make you whole again. These losses typically fall into two main buckets:

- Economic Damages: These are the straightforward, calculable costs. We're talking about medical bills (past and future), lost wages from being out of work, and even the loss of your future ability to earn a living.

- Non-Economic Damages: This category is for the losses that don't have a price tag. It’s compensation for your physical pain, emotional distress, and the impact the injury has had on your ability to enjoy your life.

The core idea behind damages is to secure compensation that helps restore you, as much as possible, to the position you were in before the accident ever happened.

Getting a handle on these basic concepts is a great first step. It allows you to walk into a conversation with an attorney ready to ask the right questions about your specific situation.

Navigating the complexities of a personal injury claim requires experience and dedicated advocacy. The team at Bell Law is committed to helping you understand your options. To discuss your case with an experienced attorney, contact us for a consultation at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.