How to Negotiate Insurance Settlement Successfully

"I was satisfied once John Bell took over my case."

"Communication was always timely."

How to Negotiate Insurance Settlement Successfully

A successful insurance negotiation doesn't start when you pick up the phone to talk to an adjuster. It starts the second the incident happens. The real key to getting a fair settlement is building an undeniable case before you ever start talking numbers. Think of it this way: your preparation is your power. It's the only tool you have to counter the inevitable lowball offers.

Build Your Case Before You Negotiate

The strength of your entire negotiation hinges on the evidence you gather from day one. An insurance adjuster’s primary role is to protect the company's bottom line by minimizing payouts. They are trained to find any weakness, any undocumented claim, to justify a lower offer. Your job is to leave them no room for doubt.

You need to become the lead detective on your own case. Every photo, every receipt, and every note is a piece of the puzzle. This isn't just about proving what happened; it's about painting a complete and vivid picture of your losses—one that is simply too well-documented to dispute.

Document Everything at the Scene

If you're in a car accident, your first job after making sure everyone is safe is to start documenting. Your memory is not as reliable as you think, especially after a stressful event.

- Photos and Videos are Gold: Snap pictures of everything from every possible angle. Get wide shots of the intersection, and then zoom in on the damage to all vehicles, skid marks on the road, and any damaged property.

- Exchange the Essentials: Get the full name, address, phone number, and insurance information from every single driver involved. Don't be shy.

- Talk to Witnesses: Did anyone see what happened? If so, get their name and number. An independent witness statement is one of the most powerful things you can have.

- Jot Down the Details: While it’s fresh in your mind, write down the time, date, location, weather conditions, and a quick summary of how the accident unfolded.

Taking these steps immediately is critical. You're preserving the facts before they can get twisted or forgotten. Understanding the full https://www.belllawoffices.com/car-accident-settlement-process/ helps clarify why this initial groundwork is so crucial for your claim's ultimate success.

Prioritize Immediate Medical Attention

Even if you feel okay, go see a doctor. Seriously. Some of the worst injuries, like whiplash or internal bleeding, don't show symptoms for hours or even days. If you wait to get checked out, the insurance company will jump at the chance to argue your injuries aren't related to the accident.

A documented medical visit creates a direct, time-stamped link between the incident and your physical harm. This is non-negotiable for any personal injury claim.

From there, follow your doctor's treatment plan to the letter. Keep a meticulous record of every appointment, every prescription, and every physical therapy session. This medical file will become the backbone of your claim, proving both the extent of your injuries and the costs associated with them.

Organize Your Evidence Like a Pro

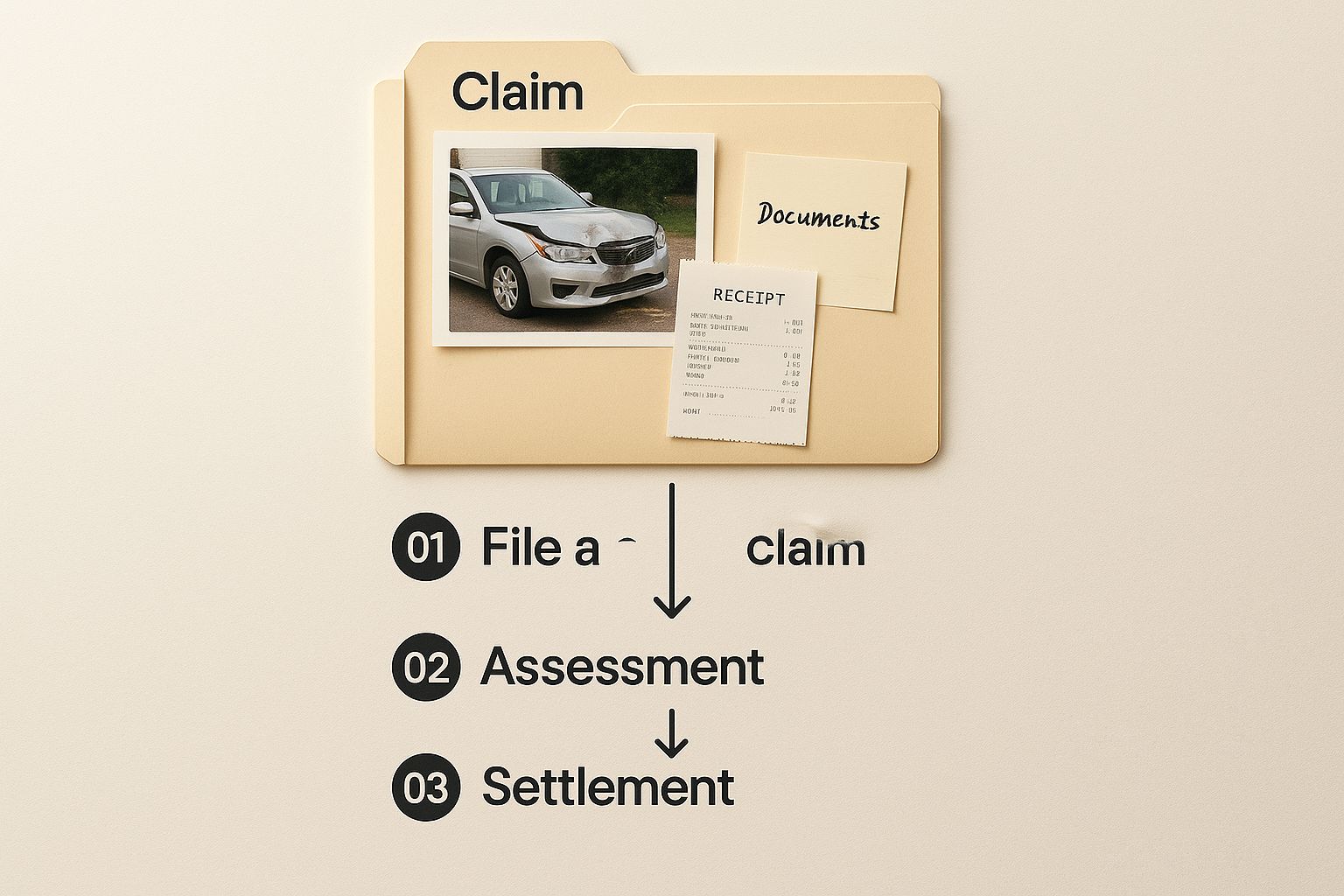

All this great documentation is useless if you can't find it. Create a dedicated folder—either a physical one or a digital one on your computer—and put everything related to the incident in it.

This evidence file should contain:

- The official police or incident report

- All the photos and videos you took

- Every medical record, bill, and prescription receipt

- Proof of lost wages from your employer

- Repair estimates for your vehicle or property

- A running log of every conversation you have with the insurance company

Historically, the strength of a claim has a direct and massive impact on the settlement. Well-supported cases settle for much fairer amounts than claims built on spotty evidence. In fact, studies on accident litigation have shown settlement rates as high as 86%, with the outcome almost always hinging on the quality of the case presented. Using tools like legal research AI can also help you efficiently uncover important precedents that strengthen your position even further.

Calculate the Full Value of Your Claim

Before you even think about picking up the phone to talk to an adjuster, you need a number. Not just any number, but a solid, well-documented valuation of your claim. If you go into a negotiation blind, you’re setting yourself up to accept whatever lowball offer they slide across the table.

Remember, the insurance adjuster has a number, too. Theirs is calculated to protect their company's bottom line, not to fully compensate you for your losses.

Your job is to build a detailed, justifiable claim value that you can defend with evidence. This figure becomes your anchor. It gives you the confidence to push back on an unfair offer because you'll have the facts to back it up. A strong claim valuation is built on two key components: economic and non-economic damages.

Tallying Your Economic Damages

Let’s start with the easy part: the hard costs. Economic damages are all the tangible, out-of-pocket financial losses you’ve suffered because of the accident. These are the black-and-white figures you can prove with a paper trail. Don't underestimate this step; organization is everything.

You need to track every single penny.

- Medical Bills: This isn't just the big stuff like the emergency room visit or surgery. It's every co-pay, prescription, physical therapy session, and even the cost of gas for driving to and from your doctor’s appointments.

- Lost Wages: Get a letter from your HR department detailing your pay rate and the exact amount of time you missed from work. This includes sick days and vacation time you had to burn.

- Property Damage: For a vehicle accident, this is the mechanic’s repair estimate. If your car was totaled, it’s the fair market value right before the crash.

- Other Out-of-Pocket Costs: Did you need to hire a dog walker because you couldn't manage? Pay for a cleaning service? These are real, compensable losses directly tied to your injury.

The key is to present your financial losses in a way that’s impossible for an adjuster to ignore.

As you can see, keeping everything organized—receipts, photos, notes—makes your claim much stronger and easier for an adjuster to process. For claims with complex medical histories, using AI tools for medical record analysis can be a huge help in pulling all the necessary details together to show the full picture.

Putting a Number on Pain and Suffering

This is where things get a bit more subjective, but it's often the most significant part of a settlement. Non-economic damages, better known as pain and suffering, are meant to compensate you for the human toll of the injury. This covers the physical pain, emotional trauma, anxiety, and the loss of enjoyment in your life.

Obviously, there's no receipt for suffering. So how do you calculate it? The standard industry approach is the "multiplier method."

The multiplier method works by taking your total economic damages—specifically your medical bills—and multiplying them by a number between 1.5 and 5. The more severe, painful, and life-altering your injuries are, the higher the multiplier you can justify.

A sprained wrist that heals completely in six weeks might justify a 1.5x multiplier. But a severe back injury that required surgery and leaves you with permanent pain and limitations? That's when you start arguing for a 4x or 5x multiplier. Be honest and realistic about how the injury has truly impacted your life.

To help you get organized, here's a look at how these two types of damages break down.

Calculating Economic vs. Non-Economic Damages

| Economic | Tangible financial losses with a clear dollar value. | Medical bills, pharmacy receipts, pay stubs, car repair estimates. |

| Non-Economic | Intangible, non-financial impacts like pain and emotional distress. | Personal journal, photos of injuries, statements from friends/family. |

Calculating both types of damages accurately is crucial for building a demand that reflects the true cost of your accident.

Determining Your Settlement Range

Now it’s time to put it all together. The basic formula looks like this:

Total Economic Damages + (Total Medical Costs x Multiplier) = Your Target Settlement Value

This final number isn't your opening offer—it's the top end of your realistic settlement range. Your initial demand to the insurance company should be at or slightly above this figure. Why? Because it gives you room to negotiate.

Just as important, you need to decide on your "walk-away" number. This is the absolute minimum you would accept before deciding to take further action. Knowing this range is your power during the https://www.belllawoffices.com/personal-injury-claims-process/ and ensures you don’t get talked into accepting less than your claim is worth.

Writing a Demand Letter That Gets Results

This is it. Your demand letter is the official kickoff to settlement talks. It’s far more than just a letter; it’s the first time you’ll lay out your entire case for the insurance adjuster.

If your letter is vague, disorganized, or reads like an angry rant, you're setting yourself up for a quick, lowball offer. A powerful, well-structured demand letter, on the other hand, immediately signals that you're serious. It commands respect and sets the stage for a real negotiation.

Think of it as your opening argument. You’re systematically laying out the facts, presenting your evidence, and explaining exactly why their insured is on the hook for your losses. The goal is to make it logically impossible for the adjuster to justify anything less than a fair number. It shows them you're organized, you've done your homework, and you're ready to back up the value of your claim.

First, Tell the Story of What Happened

You need to start with a clear, straightforward summary of the facts. This isn't the time to vent or assign blame; it's for a simple, chronological account of the incident.

Stick to the objective details: the date, time, location, and a step-by-step rundown of how things unfolded.

For example, instead of, "Your client's reckless driving nearly got me killed," try this:

"On October 26, 2023, around 3:15 PM, I was driving my Toyota Camry eastbound on Main Street. I had a green light at the Oak Avenue intersection. At that time, your insured, driving a blue Ford F-150, failed to stop for their red light and collided with the passenger side of my vehicle."

See the difference? This professional tone establishes you as credible and reasonable right from the start. Keep this narrative section tight and to the point. The adjuster has a stack of files on their desk and will appreciate you getting right to it.

Next, Pinpoint Exactly Why They Are at Fault

After you've outlined what happened, you have to connect the dots and state clearly why their insured is legally responsible. This is where you bring in the evidence you've been gathering.

If the police report assigns fault, mention it. If you have witness statements that back up your story, refer to them.

Did the other driver break a specific traffic law? Call it out. For instance: "As noted in the official police report (Case #12345), your insured was cited for a violation of state traffic code §56-5-2120, Failure to Obey a Traffic Control Device." That one sentence takes it from "my word against theirs" to a clear legal violation, making your liability argument incredibly strong.

Then, Detail Every Single Dollar of Your Damages

This is the heart of your letter and where all that meticulous documentation pays off. You need to provide a complete, itemized breakdown of everything you've lost—both the tangible and the intangible.

Start with your economic damages (the ones with a clear price tag). Don't just throw out a total; show them the math.

- Medical Bills: List every single provider and what they charged.

- Mercy Hospital Emergency Room: $3,500

- Dr. Smith's Office Visits (4): $850

- Westside Physical Therapy (12 sessions): $1,200

- Lost Income: Show exactly how you calculated this figure. Get a letter from your HR department to back it up.

- 80 hours of missed work at $25/hour = $2,000

- Property Damage: Include the final repair invoice or the "total loss" valuation for your vehicle.

Next up are your non-economic damages. This is your chance to explain the very real human cost of the injury. Describe the physical pain, the sleepless nights, the anxiety, and how this whole ordeal has turned your daily life upside down. Talk about the hobbies you can no longer enjoy or the simple daily tasks that are now a struggle.

"A well-supported demand letter doesn't just ask for money—it tells a story backed by facts. Each receipt and medical record is a chapter in that story, building a case that is too compelling to ignore."

Finally, you make your demand. State a specific dollar amount that covers the total of your economic and non-economic damages. Remember, this figure should be at the high end of your acceptable settlement range to give you some wiggle room for negotiation.

Wrap up the letter professionally. State that you look forward to their prompt response and are open to discussing a reasonable settlement. This confident but cooperative closing positions you perfectly for the conversation to come.

How to Talk to the Insurance Adjuster

After you send your demand letter, the next step is a phone call from an insurance adjuster. This is where all your careful preparation gets put to the test. It's vital to go into this conversation with your eyes wide open.

Remember, the adjuster works for the insurance company. They are trained negotiators whose primary goal is to protect their employer's bottom line by minimizing your payout. Your goal is to be polite and professional, but firm.

Set the Ground Rules Early

From the very first call, you need to control the conversation. The adjuster will likely sound friendly, even empathetic, but this is a business negotiation, not a casual chat. Stay focused on the facts you’ve documented.

Their first call is almost always a fishing expedition. They’ll ask open-ended questions like, "So, how are you feeling today?" This seems innocent, but it’s a trap. A simple "I'm doing fine, thanks" can be twisted and used against you later to argue that your injuries weren't serious.

Instead, stick to neutral, factual answers. Try something like, "I'm continuing to follow my doctor's treatment plan," or "I'm still in the process of recovering." This answers their question without giving them ammunition.

What You Should Never Say

Certain phrases can torpedo your claim before you even get to a real negotiation. The adjuster is listening for any opening to devalue your case. Avoiding these common mistakes is absolutely critical.

- Never Admit Fault: Don't apologize or say anything that could be interpreted as accepting blame. Even a simple, "I'm so sorry this happened," can be spun as an admission of fault.

- Avoid Speculation: If you don't know something for sure, don't guess. It's perfectly fine to say, "I don't have that information in front of me," or "I'd have to check my records."

- Don't Downplay Your Injuries: Never say things like, "It's just a little whiplash," or "I'm not hurt that bad." Let your documented medical records do the talking.

Crucial Tip: Politely refuse any request to give a recorded statement until you've consulted with an attorney. These recordings are designed to lock you into a story and find inconsistencies later on.

Stick to the Facts and Your Documentation

The evidence you’ve gathered is your greatest asset. When the adjuster starts asking about your medical bills or lost time from work, don't rely on your memory. Refer directly to your organized file.

For example, if they ask about your costs, you can say, "According to my records, my medical bills total $5,550 to date, and my documented lost wages are $2,000." This approach demonstrates that you're meticulous and that your demand is based on hard data, not just feelings.

This data-driven approach shifts the conversation from a subjective argument to a straightforward business discussion about documented losses. An adjuster who sees you are prepared is more likely to take your claim seriously.

The reality is, most cases never see a courtroom. In fact, research shows that around 97% of litigated insurance claims are settled before a verdict. A good settlement, however, hinges on having solid proof. For more on this, you can read the full analysis on Insurance Thought Leadership.

Handling Common Adjuster Tactics

Adjusters have a playbook of common strategies designed to get you to accept less than you deserve. If you can spot these tactics, you can counter them.

- The Quick, Lowball Offer: They might offer a small check right away, sometimes just days after the accident. They're hoping you'll take the easy money before you understand the full extent of your injuries and expenses. Politely decline and explain you're still assessing your total damages.

- Digging for Unrelated Info: You only need to provide information directly relevant to the accident. If they ask for your entire medical history from the last ten years, you have the right to refuse.

- Stalling and Delays: Sometimes, the best tactic for them is to do nothing at all. They might go silent for weeks, hoping you'll get frustrated and take whatever they're offering. Be patient, but persistent with written follow-ups.

If you feel like you're being stonewalled or that the adjuster isn't negotiating in good faith, it might be time to bring in a professional. Understanding when you might need a lawyer for your auto accident case can level the playing field and protect your rights.

Mastering the Art of the Counteroffer

https://www.youtube.com/embed/kxO-D34twyk

When the first settlement offer lands in your inbox, it's a strange feeling. There's a bit of relief that things are moving, but it’s often followed by a wave of disappointment. The number is almost never what you calculated or feel you deserve.

Don't panic. This is part of the game. The insurance adjuster’s initial offer is just a starting point—they’re testing the waters to see if you’ll get nervous and accept a lowball amount. Now, the real negotiation begins.

Analyze the Adjuster's Offer

Before firing back with a new number, you need to dissect their offer. Your first move should be to ask the adjuster for a detailed, written breakdown explaining exactly how they arrived at their figure. This puts the ball in their court to justify the number and, more importantly, reveals where they’ve cut corners.

Did they completely ignore your pain and suffering? Maybe they used a lower hourly rate to calculate your lost wages. You’ll often find they've drastically minimized or even dismissed non-economic damages because those are subjective and easier for them to undervalue. These weak spots are the foundation of your counterargument.

Craft a Strategic Written Counteroffer

Always, always, always put your counteroffer in writing. A phone call is too casual and leaves no paper trail. You want a professional, firm, and evidence-based letter that methodically dismantles their position.

Don't just name a price. Your letter needs to tell the story of why their offer falls short by systematically connecting their proposal back to your documented losses.

Here’s a good way to structure it:

- Acknowledge Their Offer: Start by politely acknowledging you received their offer, then pivot immediately to explaining why it’s not acceptable.

- Reiterate Your Strongest Points: Briefly restate the core facts of your claim. Remind them of the other party's clear liability and the severity of your injuries and other damages.

- Target the Weaknesses: Go after the specific points where their offer was deficient. If they lowballed your physical therapy, point them directly to those bills. If they ignored your pain and suffering, reference your journal entries detailing the impact on your daily life.

- Present Your New Demand: Clearly state your counteroffer. This number should be a step down from your initial demand letter, but still comfortably above the absolute minimum you’d accept. This leaves you room to negotiate further.

A powerful counteroffer isn’t just a number; it's a narrative backed by evidence. It links every single dollar you’re asking for to a specific, documented expense, loss, or piece of your suffering, making your demand incredibly hard to dismiss.

Navigate the Back-and-Forth

Patience is your greatest asset here. The adjuster may use stalling tactics or try to pressure you into a quick decision. Don’t let them rattle you. If they respond with another offer that’s still too low, you just repeat the process: send another written counter, once again justifying your position with the facts.

Each exchange should feel like a step closer to a fair number within your settlement range. It’s a bit of a dance, but you should never give up ground without getting something in return. If you want to sharpen your skills, some great general advice on how to negotiate contracts and win deals can be incredibly helpful.

Remember that negotiation is a process, not a single event. The key is to stay firm, remain professional, and always, always bring the conversation back to the evidence you’ve worked so hard to gather.

Common Sticking Points in Insurance Negotiations

As you get deeper into settlement talks, you're bound to hit a few roadblocks. It's just the nature of the beast. An adjuster might throw out a term you don't understand, or you'll reach a point where the conversation just stalls.

Being prepared for these common hurdles is half the battle. Think of this as your field guide for those moments when the path forward gets murky. Knowing what to expect keeps you in control and prevents you from making a costly mistake under pressure.

How Long Should This Whole Process Take?

This is the million-dollar question, and unfortunately, there's no single answer. A straightforward car damage claim might wrap up in a few weeks. A complex injury case? That could easily stretch out for more than a year.

The most critical factor, by far, is reaching Maximum Medical Improvement (MMI). This is a term you absolutely need to know.

MMI is the point when your doctor says you’ve healed as much as you’re going to. Settling before you hit MMI is one of the biggest mistakes you can make. If you accept a check and then find out you need another surgery six months later, you can't go back and ask for more money. It’s a done deal. The insurance company's own backlog and the specific details of your case will also play a big role in the timeline.

What if Their "Final Offer" Is a Joke?

It’s incredibly frustrating to hit a wall with an adjuster who refuses to budge on a lowball offer. It can feel like the end of the line, but trust me, you still have options.

Your first move should be to draft one last, formal counteroffer. Don't just name a number. Lay out your case again, piece by piece, and connect your evidence directly to your financial losses. Methodically show them exactly why their offer doesn't make you whole.

If they still won't play ball, it's time to escalate.

- File a State Complaint: If you genuinely believe the insurance company is acting in bad faith, you can file a complaint with your state's department of insurance. This gets a regulator's eyes on your case.

- Try Mediation: This brings in a neutral third-party mediator to help you and the insurer find some common ground. It's a structured negotiation without the formality (and cost) of a courtroom.

- File a Lawsuit: Sometimes, just the act of filing a lawsuit is the wake-up call the insurance company needs. Their legal team gets involved, and suddenly, they're often willing to make a more serious offer to avoid going to court. This is your ultimate trump card.

Never assume a "final offer" is truly final. More often than not, it's a tactic designed to see if you'll give up. Proving you're willing to take the next step is your strongest negotiating tool.

Will I Have to Pay Taxes on My Settlement?

For the most part, you won't, but the devil is in the details. The IRS is generally not interested in compensation you receive for physical injuries or the money used to pay your medical bills. That means the chunk of your settlement covering hospital stays, doctor visits, and property repair is typically tax-free.

However, some parts of a settlement can be considered taxable income.

- Lost Wages: If you're compensated for time missed from work, that portion is usually taxed just like your regular paycheck would be.

- Emotional Distress: Money for emotional distress can be taxable if it isn't directly tied to a physical injury.

- Punitive Damages: These are meant to punish the at-fault party and are pretty rare in most claims. If you do receive them, however, they are almost always taxable.

The tax rules can get tricky, so it's always a smart idea to run your settlement by a tax professional. A quick consultation can save you from a nasty surprise when tax season rolls around.

Trying to manage an insurance claim while you're focused on getting better is a heavy burden. At Bell Law, our experienced Oregon personal injury attorneys live and breathe this stuff. We're here to take on the fight for you, from meticulously building your case to going head-to-head with adjusters to get the fair settlement you deserve. If you're stuck in a tough negotiation, contact us for a free consultation to protect your rights.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.