Injured at Work What to Do in Oregon

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Injured at Work What to Do in Oregon

When you get hurt on the job, everything can feel chaotic and overwhelming. In those first few moments, it’s easy to get flustered. But what you do right away is absolutely critical for both your physical recovery and your ability to get the benefits you're entitled to.

Your focus should be on three things: getting medical help, telling your boss what happened, and starting the documentation process. Getting these steps right from the very beginning sets a strong foundation for your entire workers' compensation claim.

Your First Moves After a Workplace Injury

Let's break down exactly what you need to do, step by step, to protect yourself after a work injury.

Get Medical Care Immediately

Before you worry about paperwork or talking to HR, take care of your health. Nothing is more important.

If it’s a serious injury, call 911 or get to an emergency room right away. For injuries that aren't life-threatening, you still need to see a doctor. Tell your employer you’ve been hurt and need medical attention. In Oregon, you generally have the right to choose your own doctor after that first visit, which is a crucial right to exercise.

Whatever you do, don't downplay your injuries. Tell the medical staff everything you're feeling, even if it seems minor. Every symptom you report creates an official record, and this initial medical report is one of the most important pieces of evidence in your workers' compensation case.

Notify Your Supervisor Right Away

As soon as you are physically able, tell your supervisor what happened. While a verbal heads-up is a good start, always follow up in writing—an email or text message works—to create a time-stamped record.

A prompt report isn't just a good idea; it's a legal necessity. If you wait too long, the insurance company might argue that your injury didn't actually happen at work. Don't give them that opening.

Reporting the injury officially kicks off the entire workers' comp process.

Start the Official Paperwork

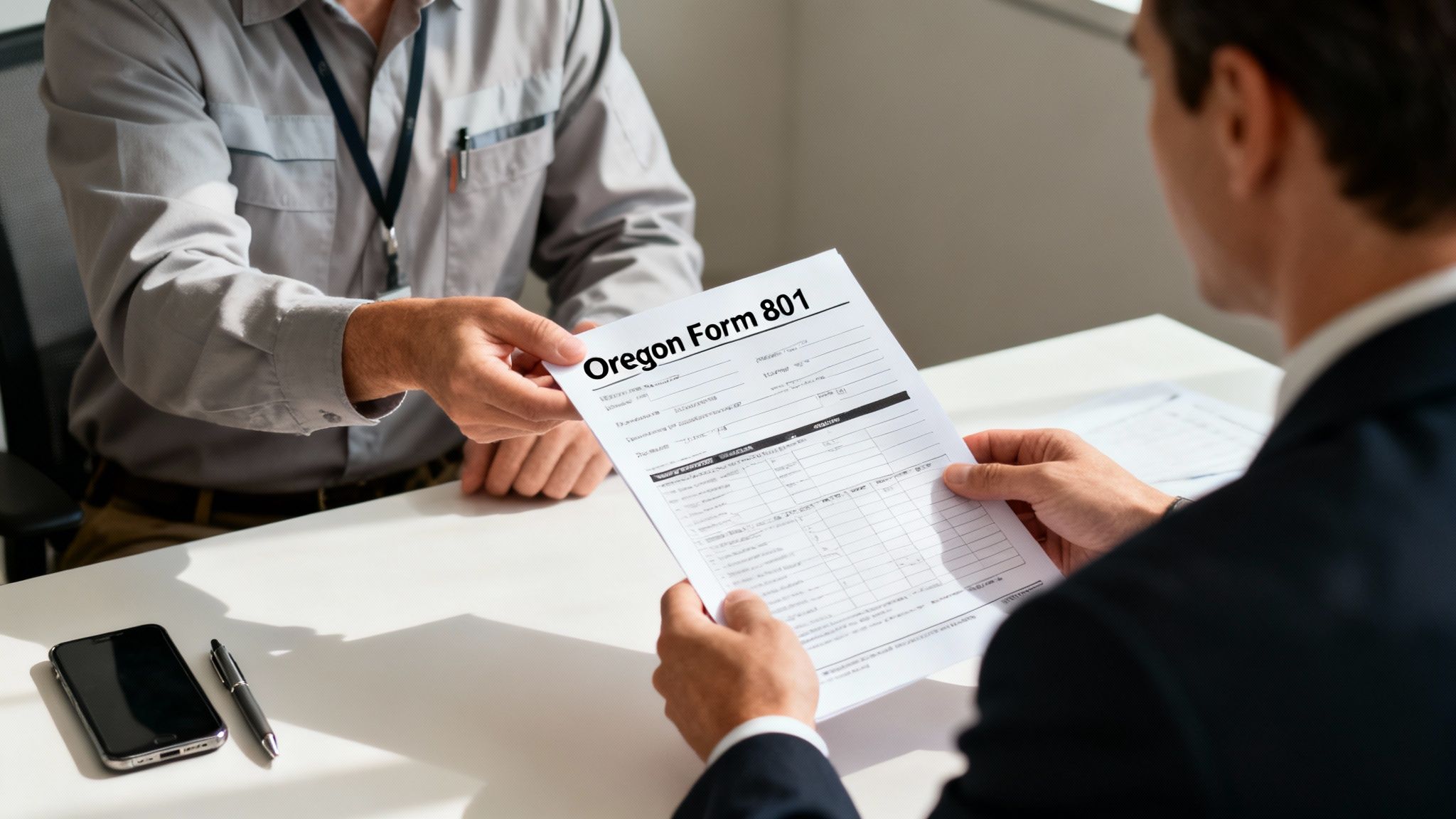

Your employer is required to give you a Form 801, which is the official "Report of Job Injury or Illness" in Oregon. This is your chance to tell your side of the story in an official capacity.

Be as accurate and detailed as you can. If you're not sure about a specific detail, it's better to say you're unsure than to guess. This form becomes a key piece of evidence, so take your time and get it right.

To give you a quick reference, here’s a simple checklist of what to prioritize in the immediate aftermath of an injury.

Immediate Action Checklist After a Work Injury

| Seek Medical Care | Your health is the top priority, and it creates the first official record of your injury. | Never downplay your symptoms. Be completely honest with the doctors. |

| Notify Your Supervisor | This officially starts the claim process and protects your rights. | Tell them verbally first, but always follow up with a written message (email/text). |

| Complete Form 801 | This is your official, written account of the incident for the claim. | Fill it out carefully and accurately. Don't guess on details you're unsure of. |

These initial actions are the bedrock of a successful workers' compensation claim.

Workplace injuries are far from rare. In 2023, U.S. employers in the private sector reported around 2.6 million nonfatal injuries and illnesses. Of those, a staggering 946,500 were serious enough to cause people to miss work. These numbers show just how important it is to know your rights and take the correct steps.

Part of protecting yourself is also learning about your specific injury. For example, if you've hurt your shoulder, it's helpful to understand and manage common injuries like a rotator cuff. By getting medical care, reporting the incident, and starting the paperwork, you put yourself in the best possible position for a fair recovery.

How to Officially Report Your Injury

Once you’ve received immediate medical attention, your next priority is establishing a formal record of the accident. A quick chat with your boss helps, but a written notice is what really safeguards your rights.

Putting the incident in writing creates the backbone of your workers’ compensation claim, so don’t skip it. This step stops anyone from later denying they knew about what happened or disputing the facts.

Who To Notify And What To Say

Always report your injury to someone with decision-making authority—your direct supervisor, a manager, or a Human Resources representative. Mentioning it to a coworker won’t cut it if you need to prove you gave notice.

Speak plainly and stick to what you know. Avoid guessing about fault or filling in gaps with “I think” or “maybe.”

• Your Full Name and Job Title

• Exact Date and Time of Injury (or when symptoms first appeared)

• Precise Location (for example, “main loading dock, north end”)

• Brief, Objective Description of what happened and which body parts were affected

• Names of Witnesses who saw the incident

Sending these details in an email or text message adds a time-stamped trail that’s hard to contest.

Navigating Oregon Form 801

The official starting point in Oregon is Form 801, known as the Report of Job Injury or Illness. Your employer must give you this form—if they hesitate, you can download a copy from the Oregon Workers’ Compensation Division website.

Accuracy matters because insurers will pore over every word. Take your time filling out each field.

Let’s break down two common situations:

• Sudden Accident:

“On June 5, 2024, at approximately 10:15 AM, I slipped on a puddle near aisle 4, landing hard on my lower back and right hip.”

• Gradual Injury:

“Beginning in March 2024, I noticed increasing numbness and sharp pain in my right wrist after daily typing tasks, which has progressively worsened.”

Your goal is to be truthful and precise. Do not guess or add details you are unsure of. What you write on this form will be compared against your medical records and witness statements.

Completing Form 801 isn’t optional—it officially notifies your employer, who then must forward it to their insurer. That action triggers their legal duty to process your claim, so take the time to do it correctly.

Building Your Case by Documenting Everything

When you're fighting for a workers' compensation claim, memories aren't enough. You need proof. Days start to blur together after an injury, conversations get hazy, and crucial details can slip away. That's why the single most powerful thing you can do is become your own best advocate by meticulously documenting every single thing.

Think of it this way: your notes, photos, and records are your personal proof. They're your defense when an insurance adjuster tries to downplay your injury or your employer gets the timeline of events wrong. Every little note you jot down reinforces the hard facts of your case.

Start Your Evidence Trail Immediately

Don't wait. The best time to start gathering evidence is right after the incident happens, while your memory is sharp and the scene is exactly as it was. It's easy to think a detail is too small to matter, but you’d be surprised how often those "minor" details become critical pieces of evidence down the road.

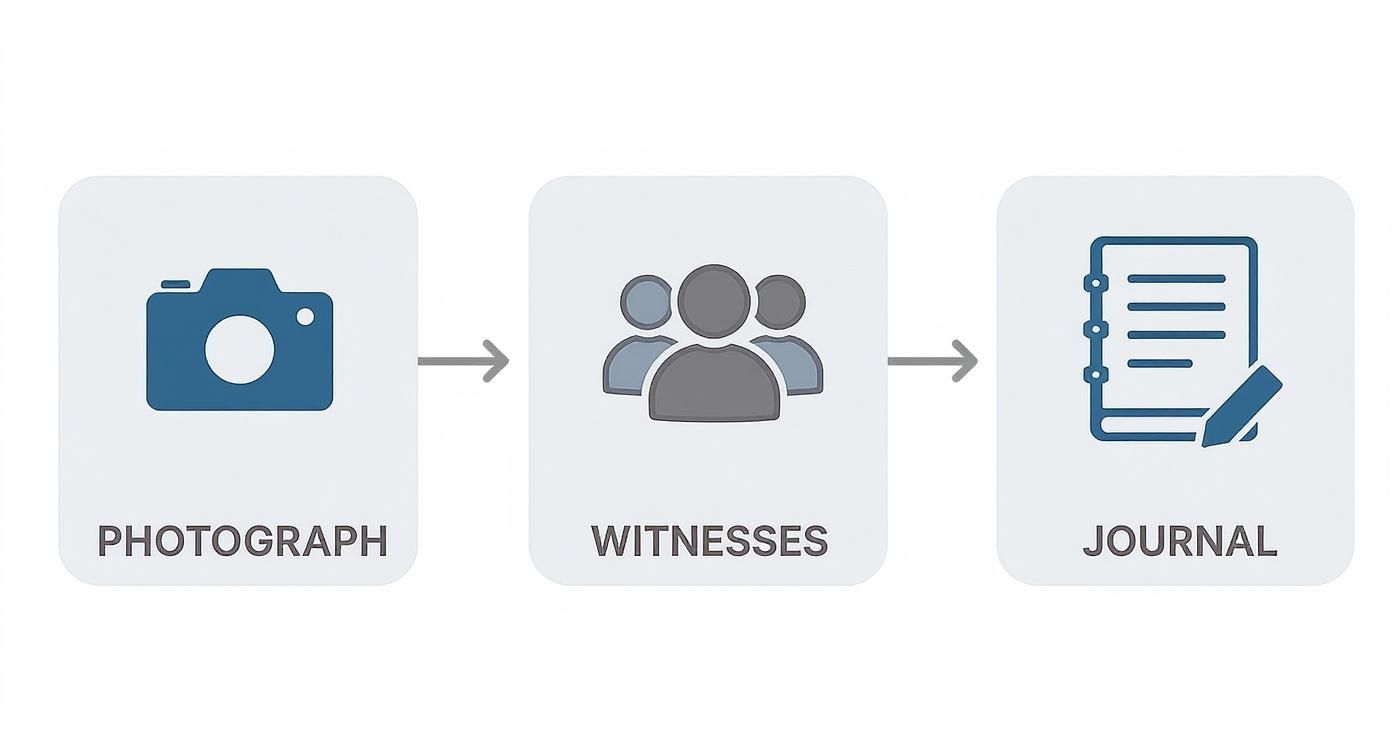

Right away, focus on grabbing three key things:

- Photographic Evidence: Pull out your phone and start taking pictures. Snap photos of where the accident happened, what caused it (like a puddle on the floor or that piece of broken equipment), and any visible injuries you have. Photos with a time and date stamp are hard to argue with.

- Witness Information: Did anyone see it happen? Get their full name, phone number, and email. A coworker’s story backing you up can be incredibly valuable when it’s your word against the company's.

- A Personal Journal: This is your most important tool, bar none. A simple notebook or even a notes app on your phone can become the backbone of your entire claim.

Keep a Detailed Injury and Communication Log

Your journal is where you'll create a consistent, daily record of what you're going through. The entries don't need to be long essays, but they absolutely must be specific. Tracking these details paints a clear, undeniable picture of how this injury is affecting your day-to-day life.

For instance, a good journal entry looks something like this:

July 15, 2024: Woke up with that sharp, shooting pain again in my lower back—felt like an 8/10. Literally couldn't bend over to tie my own shoes. Got a call from Jane at the insurance company around 11:30 AM; she just said the claim is still "under review." Dr. Smith’s office called later to schedule my follow-up for next Tuesday.

Just look at what that one short entry accomplishes. It documents your pain level, a specific physical limitation, and a key conversation with the insurer. As these entries pile up, they create a powerful narrative that an insurance adjuster can't just brush aside. It also makes it so much easier to give your doctor and attorney the accurate information they need.

This log you create perfectly complements your formal medical files. For a deeper dive into getting those official documents, you can learn how to get your medical records in Oregon from our guide. When you combine your own detailed notes with the official reports, you present the strongest possible case for the benefits you rightfully deserve.

Filing Your Oregon Workers' Compensation Claim

Once you've reported your injury and started a log of what happened, it's time to officially file your claim. This is where things get more formal, with specific paperwork and deadlines that can make or break your case. Making a simple mistake here can unfortunately jeopardize the benefits you're entitled to, so it’s crucial to get it right.

The most important piece of paper in this process is the Worker's and Physician's Report for Workers' Compensation Claim, officially known as Form 827. Think of this as the starting gun for your claim. You and your attending physician both need to fill it out and sign it, which officially puts the insurance company on notice that you're seeking benefits.

Your doctor's role here is absolutely critical. They'll handle the medical side of the form, giving their professional opinion on your diagnosis and, most importantly, linking it back to your work. This medical evidence is the bedrock of your claim, so be completely honest and thorough with your doctor. Don't downplay your symptoms or leave out details about how the injury happened.

The Claim Process and Critical Deadlines

The moment that Form 827 is submitted, a clock starts ticking for the insurance company. They have exactly 60 days to make a decision: accept or deny your claim. In that time, they'll launch an investigation. This usually means digging into your medical records, interviewing you, talking to your employer, and maybe even speaking with witnesses.

It’s essential that you cooperate with their investigation, but you need to be smart about it. Keep your answers factual and stick to what you know. Never guess or speculate on details you can't recall perfectly.

Keep in mind, while the insurer is verifying your claim, they're also actively looking for reasons to deny it. A single statement that contradicts your earlier report can be a huge red flag. This is where your personal log becomes invaluable—stick to the facts you’ve already written down.

Oregon Workers' Compensation Key Deadlines

While the insurer has their 60-day window, you have your own set of critical deadlines to meet. Missing even one of these can permanently bar you from receiving benefits, so it's non-negotiable to pay close attention to the calendar.

This table breaks down the most important timelines you need to know to protect your rights.

| Report Your Injury | Immediately, but no later than 90 days from the date of injury. | Your claim can be denied for late reporting. |

| File a Claim (Form 827) | Within 1 year of the date of injury. | You will lose your right to file a claim. |

| Appeal a Denial | Within 60 days of receiving the denial letter. | The insurer's denial becomes final. |

| Report New/Omitted Condition | Within 5 years from the date of first claim closure. | You may not be able to get treatment for related conditions. |

Staying on top of these dates is one of the most proactive things you can do for your claim. If you're ever unsure, don't wait—seek clarification immediately.

Navigating Insurer Investigations

During their investigation, don't be surprised if the insurer asks you to attend an Independent Medical Examination (IME). The name is a bit misleading. This exam is with a doctor hand-picked and paid for by the insurance company.

The whole point of an IME is for the insurer to get a second opinion on your injury. This doctor isn't there to treat you; their only job is to examine you and write a report for the insurance company. That report will either back up what your doctor has said or give the insurer ammunition to deny your claim.

You absolutely must go to any scheduled IME. Simply not showing up is often reason enough for them to deny your claim. When you're there, be polite and honest, but never forget that this doctor isn't working for you. Their findings will heavily influence the insurer's final decision. For a deeper dive into handling these communications and legal steps, you can find more on our page dedicated to workplace injury claims.

Every job carries some level of risk. And while workplace safety has come a long way, the numbers show there's still work to be done. In 2023 alone, the U.S. reported 5,283 fatal workplace injuries. This sobering statistic, highlighted in the AFL-CIO's latest report, is a stark reminder of why following every safety and reporting procedure is so critically important when an accident happens.

When Should You Call a Work Injury Attorney?

After an injury at work, many people second-guess themselves. They worry that calling a lawyer seems too aggressive or might cause trouble with their employer. But let’s be clear: getting legal advice isn’t about picking a fight. It’s about protecting yourself.

Think about it this way: the insurance company has a whole team of adjusters and lawyers whose job is to protect their bottom line. Calling an attorney simply levels the playing field.

If your injury is minor, your employer is supportive, and the claim process is smooth, you might be fine on your own. But the moment you feel things getting complicated, professional guidance becomes critical.

Red Flags That Signal You Need Legal Help

There are some clear signs that you need to get a lawyer involved right away. If any of these things happen to you, don’t hesitate. The insurance company already has its experts working on your case; you deserve to have one on your side, too.

- Your claim gets denied. A denial letter can feel like a final verdict, but it’s not. It is, however, a flashing red light that you need an experienced attorney to navigate the appeals process for you.

- The insurer questions your medical care. Is the insurance company refusing to approve the surgery your doctor prescribed? Are they denying physical therapy or medication? A lawyer can step in and fight for the treatment you need to recover.

- You’re feeling pressure from your employer. If you’re being pushed to come back to work before you’re healed, or if you feel like you're being punished for filing a claim, you need legal protection.

- The settlement offer is suspiciously low. Insurers often start with a lowball offer, hoping you’re stressed enough to take it. An attorney knows how to accurately value your claim and negotiate for a truly fair settlement.

So many injured workers make the mistake of trying to handle a complex dispute themselves. Insurance adjusters are trained negotiators, and their primary goal is to minimize how much the company pays out. An experienced attorney recognizes their tactics and knows exactly how to push back.

The financial impact of a serious work injury is staggering. In the U.S., companies face an estimated $58.78 billion in costs each year from medical bills and lost wages. The most common causes, like overexertion and falls, account for over $24 billion of that total. It’s no wonder insurers fight so hard to control their costs on every single claim.

An Attorney Fights for Your Future

Dealing with the aftermath of a work injury is overwhelming. A good workers' comp lawyer takes that weight off your shoulders. They manage the endless paperwork, handle all communications with the insurance company, and build a solid case backed by medical evidence.

Their entire job is to make sure you aren’t taken advantage of when you’re most vulnerable. They will work to get your medical bills paid, recover your lost wages, and secure compensation for any permanent impairment you’ve suffered.

For a deeper dive, our guide on when to hire a workers' comp lawyer offers even more insight. Making that call isn’t an admission of defeat; it’s a powerful step toward protecting your health and your family’s financial stability.

Common Questions About Oregon Work Injuries

Getting hurt on the job throws your life into chaos. Beyond the physical pain, you're suddenly facing a confusing and intimidating system. I've spent years helping Oregon workers navigate this process, and I’ve found that the same questions come up time and time again. Let’s tackle some of the most pressing ones head-on.

Can My Boss Fire Me for Filing a Claim?

Absolutely not. Let me be clear: it is illegal in Oregon for an employer to retaliate against you for filing a workers' compensation claim or even just reporting a work-related injury. This protection covers firing, demotion, cutting your hours, or any other form of discrimination.

If you start feeling like your job is on the line right after you report your injury, that's a massive red flag. Keep a detailed log of any changes in how you're treated at work. An employer's retaliatory actions could lead to a wrongful termination case, which is a separate legal battle you might need to fight.

Do I Have to See the Company Doctor?

This is a tricky one, and the answer is "it depends." For your very first visit, especially in an emergency, you might have to see a provider your employer sends you to. But—and this is a big but—after that initial treatment, Oregon law gives you the right to choose your own attending physician.

Don't underestimate how critical this choice is. Your attending physician is the captain of your ship. They manage your care, set your work restrictions, and write the medical reports that form the backbone of your claim. Choosing a doctor you trust, one who has your best interests at heart, is vital for both your physical recovery and the financial outcome of your case.

A classic insurance company tactic is to pressure you into seeing doctors who are known for being conservative—often meaning they downplay injuries to save the insurer money. Stand your ground. Insisting on your right to choose your own doctor is one of the most powerful moves you can make.

What Benefits Am I Entitled To?

When you get hurt at work, you're not just asking for a handout. You're owed specific benefits under the law. Knowing what they are helps you make sure you’re getting everything you deserve.

- Medical Treatment: This covers all reasonable and necessary medical care for your injury. Think doctor visits, surgery, prescriptions, physical therapy—the works.

- Time Loss Payments: If your doctor says you can't work, or if your employer can't accommodate the light-duty restrictions your doctor assigns, you are entitled to temporary disability payments. These are designed to replace a portion of the wages you're losing.

- Permanent Disability Awards: If your injury unfortunately leaves you with a permanent impairment, you may receive a monetary award. The amount is calculated based on the severity of that long-term impairment.

What Should I Do If My Claim Is Denied?

First, don't panic. A denial letter feels like a final verdict, but it's really just the insurance company's opening move. You have the right to appeal, but the clock is ticking. In Oregon, you have a strict 60-day deadline from the date on the denial letter to file your appeal.

This is the moment when the stakes get incredibly high. Trying to handle an appeal on your own is a huge gamble. The process is loaded with complex legal procedures and deadlines. A denial is the insurer's way of saying they're ready for a fight, and you need to show them you're ready, too, by getting an experienced advocate in your corner right away.

When you're up against a denied claim or just trying to make sense of this overwhelming system, you shouldn't have to go it alone. The team at Bell Law is here to protect your rights and fight for the full benefits you're owed. For a no-cost, no-obligation consultation, visit us at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.