Injury at Work Claims in Oregon | Protect Your Rights

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Injury at Work Claims in Oregon | Protect Your Rights

When you get hurt on the job, the first few hours are absolutely critical. What you do—or don't do—can set the tone for your entire workers' compensation claim. Your top priorities are simple but non-negotiable: get medical help and tell your employer.

What to Do in the First 24 Hours After a Work Injury

It’s easy to feel disoriented and overwhelmed right after an accident. Pain and shock make it tough to think straight. But the steps you take right away are probably the most important ones you'll make, as they create the official record that your entire case will be built on.

Even if you think it's "just a tweak" or a minor sprain, don't brush it off. Adrenaline is a powerful painkiller and can easily trick you into thinking you’re okay when you're not. That’s why getting a medical evaluation right away is a must.

Get to a Doctor—Immediately

Your health comes first, period. Head to an urgent care clinic, the ER, or your company-approved doctor as soon as you can. If you wait, you give the insurance company a perfect excuse to argue that your injury wasn't that bad or, worse, that you got hurt somewhere else.

When you speak with the doctor, be crystal clear about how the injury happened and what you’re feeling. Every single detail matters because it becomes part of your official medical record, which is the most powerful evidence you'll have.

A huge mistake I see people make is telling a doctor, "I'm not sure how it happened," or trying to tough it out by downplaying the pain. You have to be specific. "I felt a sharp, shooting pain down my left leg while lifting a 50-pound box at work." That direct link is what we need to build a strong claim.

Officially Report the Injury

Once you’ve been seen by a doctor, you need to report the injury to your employer. Don't put this off. Oregon has strict reporting deadlines, and missing them can mean losing your right to file a claim altogether.

Find your direct supervisor, manager, or someone in HR and tell them what happened. I always advise clients to follow up that conversation with something in writing, even if it’s a quick email. This creates a paper trail with a date and time.

Make sure your report includes these key details:

- When and where: The exact date, time, and location of the accident.

- What happened: A simple, factual account of the events.

- What hurts: List every part of your body that was injured or is in pain.

- Who saw it: If anyone witnessed the incident, get their names.

Create an "Injury File" and Document Everything

Memories fade, but documents don't lie. Start a folder—physical or digital—and keep everything related to your injury in one place. We're talking medical reports, bills, receipts for prescriptions, and any emails or letters from your employer or the insurance company.

This is also the time to start a log of any time you miss from work. Track every single hour. This documentation is crucial for calculating lost wage benefits. It's natural to worry about your finances during this period. For more details on this, you can learn more about if you get paid if you are injured at work and what your options are.

To help you stay on track during those chaotic first moments, here's a quick checklist of what to do.

Immediate Action Checklist After a Work Injury

This checklist breaks down the most important actions to take right after a workplace injury. Following these steps helps ensure your health is prioritized and your legal rights are protected from the very beginning.

| Seek Medical Attention | Your health is the priority. It also creates an official medical record linking the injury to your work. | Immediately after the incident. |

| Report to Your Supervisor | This starts the official claim process. Failing to report in time can disqualify your claim. | As soon as possible, right after getting medical care. |

| Follow Up in Writing | Creates a time-stamped paper trail that proves you reported the incident. | Within 24 hours of the verbal report. |

| Identify Witnesses | Coworkers can confirm how the accident happened, strengthening your case. | On the day of the injury, while memories are fresh. |

| Take Photos (If Possible) | A picture of the scene, your injury, or the faulty equipment can be powerful evidence. | Safely and as soon as possible after the incident. |

| Start a Documentation File | Keeps all crucial records (medical bills, notes, reports) organized and accessible. | Day 1. Don't wait. |

Sticking to this checklist can make a huge difference in the outcome of your claim. It’s all about creating a clear, undeniable record from the very start.

How to Officially File Your Oregon Claim

Once you've dealt with the immediate aftermath of a workplace accident, your attention needs to turn to the official paperwork. This is a critical juncture where, believe me, a lot of otherwise valid injury at work claims get tripped up by simple, avoidable mistakes. Getting through Oregon’s workers' compensation system is all about precision, and it starts with two fundamental forms.

The first and most important document you'll handle is Form 801, the 'Report of Job Injury or Illness.' Think of this as your official account of what happened. Your employer should give you this form right away, but if they don't, you can always download it directly from the Oregon Workers' Compensation Division website.

Getting Form 801 Right

Filling out Form 801 with painstaking accuracy isn't just a suggestion—it's absolutely essential. Every single box, from how the incident occurred to which body parts were injured, needs to be filled out with complete honesty and as much detail as you can possibly recall. Insurance adjusters are trained to spot vague descriptions or missing information, and it immediately raises red flags.

For example, don't just write "hurt back at work." That's a classic mistake. A much stronger description is: "While lifting a 50-pound box from a pallet onto a shelf at 10:15 AM in the main warehouse, I felt a sudden, sharp pain shoot down my lower back and into my left leg." When it comes to this form, specificity is your greatest ally.

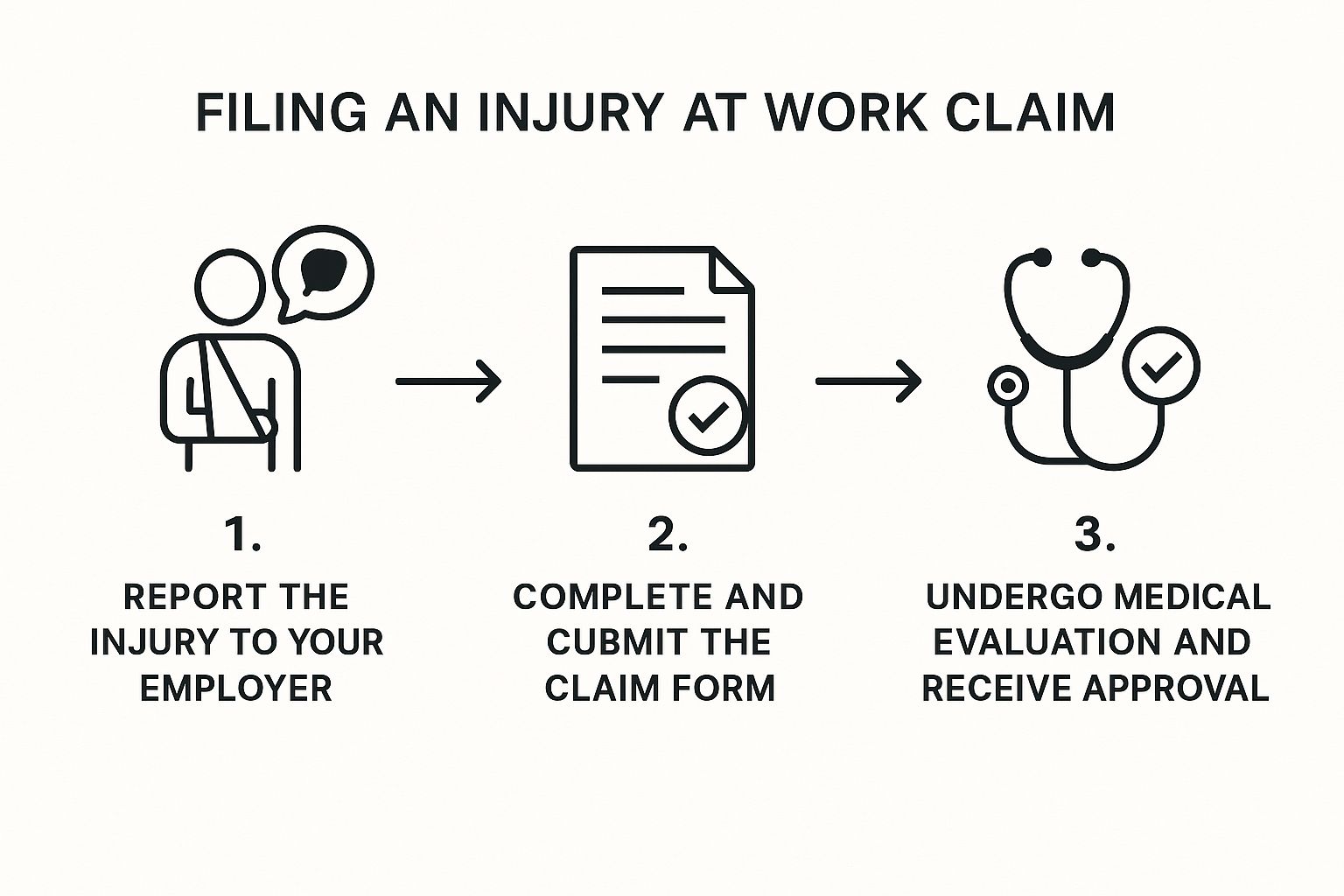

This chart breaks down the essential flow of the process, from the moment you report the injury to getting that crucial medical evaluation.

As you can see, each step builds on the last. A successful claim depends on getting this sequence right.

After you've filled out and signed your part of Form 801, give it directly to your employer. Make sure to keep a copy for yourself before you hand it over. By law, they have five days to complete their section and send it to their workers' comp insurance carrier.

A word of caution: Do not let your employer try to talk you out of filing this form. It is your absolute right to file a claim, and it's their legal duty to process it. Any attempt to discourage you is a serious violation of Oregon law.

Your Doctor's Role and the Power of Form 827

While you handle Form 801, your doctor has an equally vital job. They are responsible for completing and submitting Form 827, the 'Worker's and Physician's Report for Workers' Compensation Claims.' This document is your doctor’s medical testimony, and it carries enormous weight in your case.

Form 827 is what officially connects your injury to the incident you described. It provides the insurance company with the hard medical evidence, detailing:

- The specific medical diagnosis of your injury.

- A causal link, which is the doctor's professional opinion that your work activities caused the condition.

- Your current work status—whether you can return to full duty, need modified work, or must stay off work completely.

- A proposed treatment plan for your recovery.

Your doctor has to submit this form within 72 hours of your first treatment for the injury. It’s always a good idea to call their office and politely confirm it's been sent. A delayed Form 827 can stall your entire claim.

Oregon Filing Deadlines You Absolutely Cannot Miss

In the world of Oregon workers' comp, the clock is always ticking. Missing a deadline can get your claim denied outright, no matter how legitimate your injury is. You have to take these timelines seriously.

- Telling Your Employer: You should report your injury immediately, but you legally have up to 90 days from the date of the accident. Waiting is a terrible idea, though. Report it the same day if possible.

- Filing Your Claim: Submitting Form 801 to your employer is what "files" your claim. This must also happen within that same 90-day window.

- Occupational Disease Claims: For conditions that develop over time, like hearing loss or carpal tunnel, the rules are different. You have one year to file from the date you first discovered the condition and knew it was work-related.

These deadlines are set in stone. Procrastination is the single biggest threat to your ability to get the benefits you need for your injury at work. Treat these dates as final and act quickly.

Gathering Evidence to Build a Strong Claim

Once the initial paperwork is in, the real work begins: proving your injury at work claim. Let's be frank—insurance companies are businesses, and their adjusters are trained to scrutinize every detail before paying out. A claim backed by a mountain of clear, organized evidence is simply much harder for them to fight.

Think of this phase as building your case. You need to gather every piece of information that tells the complete story of your injury and how it has turned your life upside down. Taking charge of this process yourself can make all the difference in the world.

Create Your Master Medical File

Your medical records are the absolute foundation of your claim. They are the undeniable proof. I always tell my clients to become the curator of their own medical story, keeping everything in one, easy-to-access place.

This "master file" is non-negotiable. It should contain:

- Doctor’s Notes and Reports: Every single consultation, diagnosis, and progress note.

- Treatment Plans: The official outlines for your physical therapy, medications, and any recommended procedures.

- Medical Bills and Invoices: A running tally of every charge you've incurred.

- Prescription Receipts: Proof of every medication you've filled.

A great way to understand how all these pieces fit together is by learning about creating accurate medical chronology reports for demand letters. This process essentially turns a stack of documents into a compelling timeline that an insurance adjuster can't ignore.

Document Every Financial Loss

Workers' comp isn't just about covering doctor's visits; it’s meant to replace your lost income. But you won't see a dime of it without hard proof. Don't try to remember everything later—document it as it happens.

Your financial evidence really comes down to two things:

Lost Wages: Pull together your pay stubs from before the injury to establish your normal earnings. From there, keep a simple log of every single day or hour of work you're forced to miss.

Out-of-Pocket Expenses: This is more than just co-pays. Track your mileage driving to appointments, the cost of parking at the clinic, and any money you spend on things like braces or crutches. You'd be amazed at how quickly these add up.

Here's a pro tip: No expense is too small to document. That $5 parking fee might seem like nothing, but after twenty trips to physical therapy, that’s $100 you’re entitled to get back.

The Power of Personal Documentation

Some of the most powerful evidence you have won't come from a doctor's office. It will come from you. Your personal experience provides the human element that sterile medical reports just can't capture.

This is where you paint the real picture of your daily struggle.

- A Personal Injury Journal: Every day or two, just jot down a few notes. How was the pain today? What couldn't you do that you normally would? This creates a real-time record of your recovery journey that is incredibly hard to dispute.

- Photos and Videos: Visuals are persuasive. Snap some photos of your injuries right after they happen and as they heal. If you can do it safely, get pictures of the accident scene, especially any faulty equipment or unsafe conditions that caused the incident.

Secure Statements from Witnesses

Did anyone see the accident? Their account could be gold. A coworker who can back up your version of events is an incredibly powerful asset, especially if there's any question about who was at fault.

Don't wait. Memories get fuzzy fast.

Talk to any witnesses as soon as you can. Simply ask them to write down what they saw in their own words and sign it. This simple statement can be a game-changer if your employer's story starts to shift. Make sure you get their full name and a good phone number.

What to Expect After You've Filed Your Claim

Filing your claim is a huge step, but now comes the hard part for many people: the waiting game. Your paperwork is officially with the insurance company, and their internal process has just begun. Knowing what's happening behind the scenes can take a lot of the anxiety out of the next couple of months and help you prepare for what’s ahead.

Once the insurer gets your claim, they launch their own investigation. Their job is to verify every detail and decide if your injury legally qualifies for compensation under Oregon's rules. This is far from a rubber-stamp approval. An adjuster will be actively digging into your medical records, the report from your employer, and any other evidence you've provided.

The 60-Day Clock and the Insurer’s Investigation

Oregon law is clear on one thing: insurers can't leave you hanging forever. They have a strict 60-day deadline from the day your employer was notified of your claim to either accept or deny it. This clock is your protection against your claim getting lost in a pile on someone's desk.

So, what are they doing during these 60 days? The adjuster is typically:

- Scrutinizing the initial medical chart notes and the Form 827 from your doctor.

- Calling your employer to hear their side of the story.

- Sometimes, they might want to interview you or any witnesses you mentioned.

You’ll likely get letters or calls asking for more information or for your signature on forms that let them access more of your medical history. It's really important to respond to these requests as quickly as you can. Any delay on your part can slow things down.

It’s completely normal to feel like you're under a microscope during this investigation. Just remember this is how the system works. Be consistent, be honest, and keep your own records of every conversation. The insurer is building a file on your case—you want to make sure it's packed with clear, supportive facts.

The "Independent" Medical Examination (IME)

One of the most nerve-wracking things an insurer can request is an Independent Medical Examination, or IME. If the adjuster is questioning your diagnosis, what caused the injury, or the treatment plan from your doctor, they have the right to send you to a doctor they choose for a second opinion.

Let's be blunt: there's nothing "independent" about an IME. This doctor is hired and paid for by the insurance company. Their role is to give the insurer a medical opinion, which often—surprise, surprise—conflicts with what your own doctor says. You have to go to this appointment. If you don't, your claim will almost certainly be denied.

Here’s what to expect at the IME:

- The doctor will ask you to recount, in detail, how the injury happened.

- They will review your medical past.

- They will conduct a physical exam.

Your only job is to be straightforward and truthful. Don't exaggerate your symptoms, but absolutely do not downplay your pain or limitations. Just describe what you're feeling and experiencing as accurately as possible.

What About Your Benefits in the Meantime?

While you're waiting for that final accept or deny decision, you may be able to receive some initial benefits. The most important one is Temporary Disability (TD) payments. These are meant to replace some of your lost income if your doctor has taken you off work or put you on light-duty restrictions that your boss can't accommodate.

TD payments are calculated at about two-thirds of your average weekly wage. Just as importantly, the insurer must pay for all reasonable and necessary medical care for your injury, even while your claim is pending. This is a crucial protection. Workplace safety has gotten better, but injuries are still a fact of life—work-related medically consulted injuries still hit around 4.07 million in the U.S. in 2023. You can read more about the national workplace safety statistics and trends to see the bigger picture. Getting the right care right away is non-negotiable.

What To Do When Your Claim Is Denied

Getting that denial letter for your injury at work claim can feel like a punch to the gut. It’s frustrating, and it’s easy to feel like you’ve hit a dead end. But I’m here to tell you it is absolutely not the end of the road.

In my experience, a denial in Oregon is often just the insurer's opening move. It's the start of the formal legal process, and you have every right to fight back. The first thing you need to do is understand exactly why they said no.

Common Reasons Insurers Deny Claims

An insurance company’s denial letter isn't personal; it's a business decision. They’ve reviewed your file and are looking for any reason to challenge the claim's validity.

Most of the time, the reasoning falls into one of a few common categories:

- You Missed a Deadline: They might argue you didn't report the injury to your boss or file the official claim within the strict legal timeframes.

- It Wasn't "Work-Related": A classic argument is that your injury happened outside of work or is just a flare-up of a pre-existing condition, not a new workplace incident.

- Not Enough Medical Proof: The adjuster might look at your doctor's report and decide it doesn't strongly connect your diagnosis to the specific work event.

- The Story Doesn't Add Up: If there are inconsistencies between what you reported, what your employer said, and what the medical records show, it can raise a red flag and trigger a denial.

Knowing their specific argument is everything—it maps out the entire strategy for your appeal. Your job now is to directly counter their reason with stronger, more compelling evidence.

A denial is the insurer's way of saying, "Prove it." They're challenging you to build a case. The good news is, you don't have to build it alone.

Kicking Off Your Appeal in Oregon

Once that denial letter is in your hands, a new clock starts ticking—and it’s a short one. You have just 60 days from the date on that letter to file an appeal with the Oregon Workers' Compensation Board.

Let me be clear: missing this deadline is devastating. You will lose your right to challenge their decision, and the case is over.

The appeal officially starts when you request a hearing. This is a crucial legal step that takes your case out of the insurance adjuster’s hands and puts it into the state’s dispute resolution system. The playing field starts to level out, but the rules get a lot more complicated.

You're about to enter a world of legal discovery, depositions, and potentially a formal hearing in front of a judge. For a deeper dive into this process, you can learn more about what to expect when your workers' comp claim is denied and how to prepare for the road ahead.

What the Appeals Process Actually Looks Like

After you request a hearing, the "discovery" phase begins. This is basically a formal information swap. The insurance company's lawyer will almost certainly request your entire medical history. They'll also likely schedule your deposition—a formal interview, under oath, where they will grill you on the details of the accident, your injuries, and your past medical care.

Many cases actually get resolved before ever seeing a judge, through a process called mediation. This is a structured negotiation where a neutral professional helps you and the insurer’s attorney try to find a middle ground and reach a settlement. It's a great opportunity to resolve the claim without the stress and uncertainty of a full hearing.

If you can't reach an agreement in mediation, your case moves on to a formal hearing. Think of it as a mini-trial. An Administrative Law Judge (ALJ) listens to testimony from both sides, reviews all the evidence, and then makes a final, legally binding decision on your claim.

The Right Time to Call an Attorney

If you haven't brought in an attorney yet, the moment you receive a denial letter is the time to make the call. The appeals process is a legal fight, plain and simple. The insurance company will have a team of experienced lawyers working to defend that denial, and you shouldn't face them on your own.

A skilled workers' compensation attorney manages every piece of your appeal. They'll handle the filings, navigate the discovery process, represent you in mediation, and fight for you at the hearing. They know exactly what evidence is needed to dismantle the insurer's arguments and build the strongest possible case to get you the benefits you deserve.

Navigating the Rough Patches in Your Claim

Even when you follow all the rules, a workers' comp claim can throw you a curveball. Real-world questions and worries inevitably crop up, and it's easy to feel lost about your rights and what to do next. Let's walk through some of the most common hurdles I see injured workers face and get you some clear, practical answers.

One of the first things people worry about is their job. It's a completely valid fear, but you should know that Oregon law has your back.

"Can They Fire Me for Filing a Claim?"

The answer is a hard no. Your employer is legally forbidden from firing you, demoting you, harassing you, or punishing you in any way just because you filed a workers' compensation claim. That's called retaliation, and it’s a serious violation of state law that could land your employer in a separate, high-stakes lawsuit.

If you think you're facing retaliation—maybe your hours get slashed right after you file, you're suddenly moved to a dead-end task, or you're hit with bogus disciplinary actions—start documenting everything. Keep a detailed log of every incident. This is a time when you absolutely need to get legal advice immediately.

"What if My Boss Doesn't Have Insurance?"

In Oregon, it's the law: just about every employer has to carry workers' comp insurance. Skipping out on this is a major offense. But if you find out your employer broke the law and is uninsured, you aren't out of luck.

You can file your claim directly with the state's Worker Benefit Fund. This fund is a safety net, created specifically to pay benefits to injured employees of non-compliant employers. The state will handle your claim and then go after your employer to get all the money back, plus penalties.

You are not penalized for your employer's failure to follow the law. The system is designed to make sure you get the medical treatment and wage replacement benefits you deserve, no matter what.

"Do I Have to See the Company Doctor?"

This is a classic point of confusion. For your very first medical visit right after the injury, your employer can—and often will—send you to a specific clinic or doctor they work with. That's usually allowed.

But here’s the critical part: after that initial visit, you have the right to choose your own doctor to manage your ongoing care. This is a huge deal. It means you can be treated by a medical professional you actually know and trust. To make the change, you just have to notify the insurance company in writing who your new attending physician is. Getting these details right is one of the key reasons people turn to an experienced Oregon workers' compensation lawyer for help.

"Settlement vs. Award: What's the Difference?"

As your claim moves forward, you'll start hearing these two words thrown around. They are not interchangeable, and knowing what each one means is vital before you sign on any dotted line.

- Award: Think of this as a final judgment. An award is a decision handed down by a judge after a formal hearing, ordering the insurance company to provide you with specific benefits. It’s not a negotiation; it’s a ruling.

- Settlement: In Oregon, this is usually called a Claim Disposition Agreement, or CDA. It’s a voluntary deal between you and the insurer where you agree to close out all or part of your claim in exchange for a lump-sum payment.

A settlement is almost always final. Once you sign that CDA, you can't reopen that part of your claim later, even if your medical condition gets much worse. You're trading future benefits for a one-time payout. It’s a massive decision, and frankly, one you should never make without having an attorney review the offer to make sure it's fair and you're not giving up too much.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.