Expert Guide to Your Pedestrian Accident Claim

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Expert Guide to Your Pedestrian Accident Claim

When you've been hit by a car as a pedestrian, pursuing a claim is the formal way to get compensation for everything you've gone through. The process centers on proving the driver was negligent and carefully documenting all your losses—from the initial emergency room visit to ongoing physical therapy and the pain you've had to endure. It's about building a strong case to present to their insurance company.

Your First Moves After a Pedestrian Accident

The moments after being struck by a vehicle are a blur of chaos and adrenaline. It's disorienting. Your first instinct might be shock or just a desperate need to get up and out of the road. But the choices you make right here, in these first few minutes, can make or break your potential claim. Your health and the evidence are what matter most.

Even if you think you can stand up, don't. Stay where you are (if it's safe), take a moment, and call 911. This isn't just for medical help; it's to get law enforcement on the scene. That official police report becomes a cornerstone of your claim, providing a neutral, third-party narrative of what happened.

Document the Scene with Your Phone

If you're able to, pull out your smartphone and start taking pictures while you wait. Your memory of the details will fade, but photos and videos won't. Don't just snap one or two quick pics; be thorough. Get shots from every possible angle.

An insurance adjuster is going to pore over every detail later, so give them plenty to see:

- The Vehicle: Get clear photos of the car that hit you. Capture its license plate, make, and model. Zoom in on any damage, like a dented hood or a cracked windshield.

- The Big Picture: Take wide-angle shots of the entire scene—the intersection, the crosswalk, traffic lights, and any nearby street signs (like speed limits or walk signals).

- The Conditions: Was it raining, making the road slick? Was the sun low in the sky, creating a blinding glare? Capture these details.

- Your Injuries: It might be difficult, but take photos of any cuts, scrapes, bruises, or torn clothing. This initial proof is incredibly important.

This collection of images helps piece together exactly how the accident occurred. It's your best defense against the driver or their insurance company trying to shift the blame onto you. These first steps are critical in any collision, and you can find more in-depth advice in our guide on what to do after a car accident.

Exchange Information and Find Witnesses

You'll need to get the driver's details, but keep the conversation short and to the point. Stick to the facts. The absolute last thing you want to do is apologize or say anything that could be misinterpreted as admitting fault. A simple "I'm sorry" can be used against you down the road.

Make sure you get this information from the driver:

- Full Name and Contact Information

- Driver's License Number

- Insurance Company Name and Policy Number

- Vehicle License Plate Number

Crucial Tip: Look around for witnesses. People often stop to help, but they leave just as quickly. Before they scatter, ask anyone who saw what happened for their name and phone number. A statement from an impartial observer can completely shut down a driver's attempt to change their story.

Seek Immediate Medical Evaluation

This is the one step you absolutely cannot skip, even if you think you’re okay. The adrenaline pumping through your body after an accident is a powerful painkiller. It can easily mask serious issues like a concussion, soft tissue damage, or even internal bleeding.

Going straight to an emergency room or an urgent care clinic does two critical things. First, it ensures you get the care you need. Second, it creates an official medical record that connects your injuries directly to the accident.

If you wait a few days to see a doctor, the insurance company will jump on that. They'll argue that you couldn't have been that hurt if you waited. Don't give them that opening. Your medical records are the foundation of your claim and the proof of what you've endured. Without them, you’re handing the insurer a reason to devalue or deny your claim entirely.

Gathering Your Ammunition: Building a Rock-Solid Claim File

Once you've handled your immediate medical needs, your next mission is to build the foundation for your pedestrian accident claim. This isn't just about collecting a few receipts; it’s about systematically putting together a file that tells the complete, undeniable story of what happened and how it has affected your life.

Remember, the insurance company's job is to pay out as little as possible. A disorganized case file gives them all the openings they need to poke holes in your claim. A well-documented, meticulously organized file, on the other hand, leaves them very little room to argue. You essentially become the lead investigator on your own behalf, and every piece of evidence you gather adds strength to your position.

Get Organized from Day One

Your first practical step is to create one central place for every single thing related to your accident. This could be an old-school accordion file, a simple three-ring binder, or a dedicated folder on your laptop. The method isn't as important as your commitment to using it consistently.

Start by gathering what you likely already have on hand:

- The police report exchange form or case number the officer gave you.

- Names and phone numbers of any witnesses.

- Any photos or notes you took at the scene.

- Discharge papers from the ER or urgent care clinic.

This file is a living document. It will grow as you move through your recovery and the claims process. Every receipt for a prescription, every explanation of benefits from your health insurance, every note from a doctor—it all goes in the file.

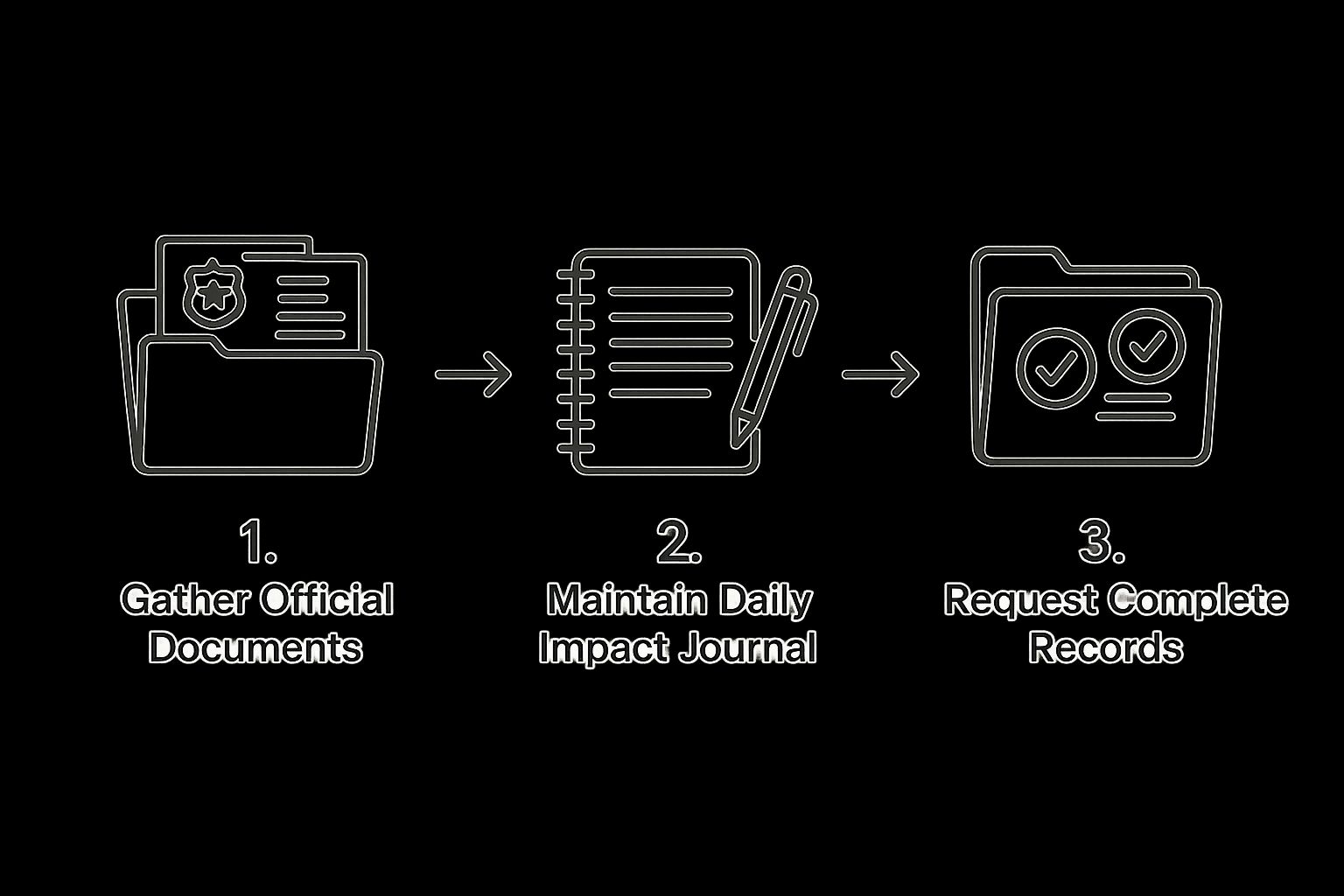

The infographic below gives you a clear visual roadmap for this process, from gathering initial documents to making formal requests for official records.

Think of it this way: your personal notes, official reports, and medical bills all work together to create a powerful and complete picture of your ordeal.

Here’s a quick checklist to help you stay organized and ensure you're collecting everything you need to build a compelling claim.

Essential Documentation Checklist for Your Claim

| Full Police Report | Contains the officer's official narrative, diagrams, witness info, and initial assessment of fault. | Request it from the responding police department or law enforcement agency, usually 7-10 days after the accident. |

| All Medical Records | Provides the official diagnosis, treatment plan, and prognosis. This is the core evidence of your injuries. | Formally request records from every provider you've seen (hospital, surgeon, physical therapist, etc.). |

| Medical Bills & Receipts | Itemizes every single cost associated with your treatment, from the ambulance ride to prescription co-pays. | Keep every bill, invoice, and receipt you receive. Organize them by provider and date. |

| Proof of Lost Wages | Documents the income you've lost because you were unable to work. | Get a letter from your HR department or employer detailing your pay rate and missed hours. Keep pay stubs from before and after the accident. |

| Daily Impact Journal | Chronicles your day-to-day pain, limitations, and emotional distress, proving your "pain and suffering." | Keep a simple notebook or a digital document. Write in it daily, starting immediately after the accident. |

| Photos and Videos | Visual evidence of the scene, your injuries, property damage (like a broken phone), and your recovery process. | Use your smartphone to document everything. Take photos of your injuries as they heal. |

| Witness Contact Info | Provides third-party accounts that can corroborate your version of events. | Gather names, phone numbers, and email addresses at the scene. Follow up with them later if needed. |

This table serves as your master list. By methodically checking off each item, you build a fortress of evidence around your claim that an insurance adjuster simply can't ignore.

The Power of a Daily Impact Journal

Official documents are great for proving the hard facts, but they're terrible at explaining the human cost of an accident. They don't show the daily pain, the frustration of not being able to do simple tasks, or the emotional toll it takes. That’s where a journal becomes your most underrated—and powerful—tool.

An adjuster can argue about a medical bill, but it's much harder for them to dispute a consistent, detailed, and honest account of your daily struggles. Your journal is what translates the cold, hard data of your claim into a compelling human story.

Starting the day after the crash, just take a few minutes each evening to write down how you’re feeling and how the injuries are impacting you. Be specific.

- Describe Your Pain: Don't just say "my shoulder hurts." Is it a dull ache or a sharp, stabbing pain? On a scale of 1 to 10, what was it today?

- List Your Limitations: What couldn't you do? "I tried to lift a gallon of milk and had to stop." or "It took me 15 minutes to get my shirt on this morning."

- Note the Emotional Toll: Are you having nightmares? Do you feel a surge of anxiety every time you have to cross a street? Write it down.

This simple log provides irrefutable evidence of your pain and suffering, which is a major component of your final settlement.

Making It Official: Requesting Key Records

While your personal notes are crucial, the backbone of your claim will always be the official documents. You’ll need to formally request two main things: the full police report and your complete medical records.

The full police report is more detailed than the slip you got at the scene. It includes the officer’s diagram, their narrative of events, and any witness statements they took. You can usually get a copy from the police department that responded to the call about a week or two after the incident.

Getting your medical records is a bit more involved but absolutely essential. You need a complete file from every single provider you’ve seen for your injuries—the hospital, your family doctor, any specialists, physical therapists, and so on. These records are the ultimate proof of your injuries and treatment. For a step-by-step guide, you can review our article on how to get medical records. It walks you through the exact process to make sure you get everything you need to substantiate your claim.

Proving Fault Under Oregon's Negligence Laws

After an accident, the single most important legal concept you'll face is negligence. To have a successful claim, it’s not enough to show that a driver hit you. You have to prove they failed to use reasonable care, and that specific failure is what caused your injuries.

In legal terms, this is called breaching a "duty of care." Every driver on the road has a fundamental responsibility to operate their vehicle safely and avoid harming others. When they don't, that's a breach. This could be something obvious, like running a red light, or something subtler, like a moment of distraction.

Some of the most common ways drivers are negligent in pedestrian accidents include:

- Distracted Driving: Texting, messing with the GPS, or just not paying attention to the road.

- Failing to Yield: Blowing through a crosswalk when a pedestrian clearly has the right-of-way.

- Speeding: Exceeding the speed limit or simply driving too fast for the weather or traffic conditions.

- Ignoring Traffic Signals: Running red lights and stop signs is a classic, and dangerous, example.

- Driving Under the Influence: Getting behind the wheel while impaired by alcohol or drugs.

How Speed Changes Everything

A driver's speed is more than just a number on a police report; it's a critical piece of the puzzle that dramatically affects both who is at fault and how severe the injuries are. When a driver is speeding through a neighborhood, they're drastically cutting down their reaction time and multiplying the force of impact.

The statistics are sobering. According to a study by MoneyGeek, the link between speed and injury severity is undeniable.

Research shows 1 in 3 pedestrians hit by a car going 25 mph are severely injured. At 35 mph, that jumps to a staggering 1 in 10 pedestrians being killed.

These numbers are exactly why an adjuster or jury will look so closely at how fast the driver was going.

Understanding Oregon's Comparative Negligence Rule

This is one of the most important things to understand about any personal injury claim in Oregon. The state follows a "modified comparative negligence" rule, as laid out in ORS 31.600. This law is a way of handling accidents where both parties might share some of the blame.

Here's the bottom line: you can still get compensation even if you were partially at fault, but only if your share of the blame is 50% or less. If a jury decides you were 51% or more responsible for the accident, you recover nothing. If your fault is 50% or less, your total compensation is just reduced by your percentage of fault.

Let’s see it in action:

Imagine you crossed the street mid-block (jaywalking) when you were hit by a speeding driver. A jury finds your total damages—medical bills, lost wages, pain and suffering—are $100,000. They also decide the driver was 80% at fault for speeding, but you were 20% at fault for crossing outside the crosswalk. Your award of $100,000 would be reduced by your 20%, so you would receive $80,000.

Insurance adjusters are masters at using this rule to their benefit. They will probe for any detail that can shift blame onto you. Were you wearing dark clothes? Were you looking at your phone? Every answer matters.

Using Evidence to Establish Liability

Because of the comparative negligence rule, your story alone isn't enough. You need to build a case with solid evidence that pins the majority of the blame squarely on the driver.

Here’s the kind of proof that makes a real difference:

- Surveillance Footage: Video from a nearby business, traffic light, or even a Ring doorbell can be a game-changer. It provides a completely unbiased view of what happened.

- Witness Statements: A good Samaritan who saw the driver texting or can confirm you were waiting at the corner before crossing provides powerful, independent backup for your version of events.

- The Police Report: The responding officer's report is a crucial starting point. It includes their initial assessment of fault, any tickets they issued, and a diagram of the accident scene.

- Accident Reconstruction Analysis: For more serious or complex accidents, an expert can be hired to reconstruct the crash. By analyzing skid marks, vehicle damage, and other physical evidence, they can scientifically determine things like speed and point of impact.

What's My Claim Really Worth? Calculating the Full Value

When you’re hurt in a pedestrian accident, the first things you see are the most obvious costs—the ambulance bill, the emergency room charges, the pharmacy receipts. It’s easy to get tunnel vision and think that's the extent of it. But if you only focus on the bills piling up on your kitchen table, you're missing the bigger picture and potentially leaving a lot of money on the table.

To get the settlement you truly deserve, you have to account for the total impact the accident has had on your life. This isn't just about the here and now; it's about every single loss you've suffered and will continue to suffer, both financially and personally. In the legal world, we break these down into two key categories.

The Black-and-White Costs: Economic Damages

First, let's talk about economic damages. These are the straightforward, calculable losses. Think of them as anything you can prove with a receipt, an invoice, or a pay stub. They’re the "hard numbers" of your claim.

Your economic damages will almost certainly include:

- Medical Bills (Past and Future): This is everything from the initial ambulance ride and hospital stay to any surgeries, specialist appointments, and physical therapy. Crucially, it also includes the cost of future medical care your doctor anticipates, like another surgery down the road or long-term medication.

- Lost Wages: This is the income you lost because you couldn't work. We calculate this based on your pay rate and the exact amount of time you were out.

- Loss of Earning Capacity: This is a big one that often gets overlooked. If your injuries are severe enough that you can’t return to your old job or have to take a lower-paying position, you can claim the difference in what you would have earned over your lifetime.

The Human Cost: Non-Economic Damages

The second part of your claim is often the largest: non-economic damages. These are the intangible losses—the very real human cost of what happened to you. There’s no receipt for pain, but its impact on your life is undeniable and deserves to be compensated.

An insurance adjuster can add up your medical bills in minutes, but they have no way to quantify your suffering. That's why your story, backed by journals and witness accounts, is so powerful. It gives weight to the true, human cost of the crash.

Non-economic damages cover things like:

- Pain and Suffering: This accounts for the physical pain, chronic discomfort, and emotional distress you've gone through since the accident.

- Emotional Anguish: This includes the very real trauma of the event, which can manifest as anxiety, depression, fear of crossing the street, or even PTSD.

- Loss of Enjoyment of Life: You can no longer go for your daily run. You can't kneel on the floor to play with your kids. The hobbies that once brought you joy are now impossible. This loss has immense value.

Digging Deeper: Don't Overlook the Hidden Losses

A truly comprehensive claim requires you to think beyond the obvious. For instance, when calculating lost wages, don't just stop at your base salary. Did the injury cause you to miss out on a promotion you were on track for? Did you lose out on overtime pay or performance bonuses you usually count on? Those are absolutely part of your economic damages.

The same goes for the ripple effects on your everyday life. If you can no longer do your own yard work or clean your house and have to hire someone, that's a recoverable expense. The cost of gas and parking for all those trips to doctor’s appointments adds up quickly and should be part of your claim.

These "small" costs are critical pieces of the puzzle. On a global scale, the financial toll is staggering. The economic impact of road traffic crashes is estimated to cost most countries 3% of their GDP each year. You can review the global road traffic injury findings from the World Health Organization to see just how massive these costs are.

By meticulously documenting every single loss—from the largest hospital bill to the smallest co-pay—you build a demand that reflects the complete and honest cost of the driver's negligence. This is how you ensure the settlement you receive is genuinely fair and covers everything you’ve been forced to endure.

Negotiating With Insurance Adjusters

Sooner than you think, you’ll get a call from the at-fault driver's insurance adjuster. They almost always sound friendly and concerned, but make no mistake—this is a strategy. Their one and only job is to protect their company’s profits, which means paying you as little as possible.

This is a high-stakes conversation, and you're stepping into their arena. The goal of this first call is simple: provide the bare minimum and avoid saying anything that can be twisted and used against you. Keep it brief. Keep it factual.

Navigating the First Contact

When the adjuster calls, stick to the absolute essentials. You can confirm your name and the date and location of the accident. That’s it.

The second they start asking detailed questions about your injuries, how you feel, or what happened right before the collision, it’s time to politely but firmly end the call. A common trap is the request for a recorded statement. You should always decline this request until you’ve spoken with an attorney.

Adjusters are masters at asking leading questions. They might ask something like, "So you were a little distracted right before you stepped into the street?" Or even a simple, "How are you feeling today?" If you say "I'm doing okay," they'll note it down as evidence that your injuries aren't that serious. It's a minefield, so it's smart to learn more about how to deal with insurance adjusters before that phone rings.

Drafting a Powerful Demand Letter

Once you’ve finished your medical treatment, it's time to send the insurance company a formal demand letter. This isn't just a note asking for money. It's a comprehensive, evidence-based argument that methodically lays out every single dollar your claim is worth.

Your letter needs to tell the full story, backed by all the proof you’ve gathered. It absolutely must include:

- A clear account of how the accident happened, proving the driver was negligent.

- A detailed description of all your injuries, the treatments you received, and your road to recovery.

- An itemized list of your economic damages (every medical bill, lost wages, etc.).

- A strong justification for your non-economic damages, better known as pain and suffering.

You have to attach copies of everything—the police report, all medical records and bills, and pay stubs showing lost income. Presenting a meticulously organized package shows the adjuster you mean business.

Key Insight: Always demand more than the absolute minimum you'd be willing to accept. This is a negotiation. Starting with a well-supported, higher number gives you the necessary room to bargain without being forced to settle for less than you deserve.

Responding to the Inevitable Lowball Offer

Get ready for it: the adjuster's first settlement offer will almost certainly be insulting. Don't let it get to you. This is a standard tactic designed to see if you're desperate enough to take a quick, cheap payout. It's just part of the game.

Your job is to respond with a calm, professional counteroffer. Don't just throw out another number; explain exactly why their offer is unacceptable by pointing back to your evidence.

For example: "Your offer of $15,000 completely ignores the $10,000 in future physical therapy recommended by my doctor, which was documented in the records I sent. It also fails to adequately compensate for the three months of chronic pain I detailed in my journal."

This kind of fact-based response forces them to negotiate on the merits of your case, not just try to bully you. Be prepared for a few rounds of this. Stay patient, stay firm, and let your evidence do the talking.

Your Top Questions About Oregon Pedestrian Claims, Answered

After a pedestrian accident, your head is probably swimming with questions. It’s a stressful, uncertain time, and worrying about the legal side of things is the last thing you need while you're trying to heal. Let’s clear up some of the most common concerns we hear from people in your situation.

How Long Do I Have to File a Claim?

This is one of the most critical questions, and the answer is unforgiving. Oregon law gives you a strict window to take legal action, known as the statute of limitations. For most pedestrian accidents, you have just two years from the date you were injured to file a lawsuit.

If you let that deadline pass, you lose your right to seek compensation through the courts—permanently. It doesn't matter how strong your case is.

A Word of Caution: Two years can fly by. Building a solid case takes time—we have to investigate, gather evidence, and track down witnesses. The sooner you start the process, the stronger your position will be when it's time to negotiate or go to court.

What if I Was Partially at Fault? Do I Still Have a Case?

It’s a common worry, but the answer in Oregon is often yes. Our state uses what’s called a modified comparative negligence rule. In simple terms, this means you can still get compensation as long as you weren't mostly to blame for the accident.

The key number here is 51%. As long as your share of the fault is less than 51%, you can still recover damages. Your final award is just reduced by your percentage of fault.

Let's say a jury decides your total damages are $50,000, but they find you were 10% at fault because you were looking at your phone while crossing. Your award would be reduced by $5,000, so you’d receive $45,000. You can bet the insurance adjuster will do everything they can to pin more blame on you, which is why having a strong advocate is so important.

How Much Does a Personal Injury Attorney Cost?

The thought of legal bills is enough to make anyone anxious, especially when medical costs are piling up. The good news is that nearly all personal injury lawyers in Oregon, including us, work on a contingency fee basis.

This means there are no upfront costs or hourly fees for you. We only get paid if we win your case, either through a settlement or a court verdict. Our fee is a pre-agreed percentage of what we recover for you. If we don’t win, you don’t owe us a dime for our time. It's a system that gives everyone access to justice, regardless of their financial situation.

What’s a Typical Pedestrian Accident Settlement Amount?

There’s really no such thing as a "typical" settlement, because no two accidents are the same. The value of your claim depends entirely on the unique details of what happened to you.

Several key factors come into play:

- The Severity of Your Injuries: This is the biggest driver of value. A broken bone is valued differently than a permanent spinal cord injury.

- Total Medical Bills: We look at everything—past, current, and what you’ll need for the future.

- Lost Wages: How much income did you lose while recovering? Will your ability to earn a living be affected long-term?

- How Your Life Has Changed: We also account for your pain, suffering, and the loss of your ability to enjoy life as you did before.

A case with minor injuries might settle for a few thousand dollars, while a catastrophic injury case could be worth a great deal more. Understanding the broader trends in this field can be complex, and some find resources on Personal Injury Law Marketing insightful for a behind-the-scenes look. The only way to get a real sense of what your specific case might be worth is to have an experienced attorney review all the evidence.

To help you keep track, here's a quick look at some of the most important rules and deadlines in Oregon.

Key Oregon Deadlines and Insurance Rules

Navigating the rules after an accident can be confusing. This table breaks down some of the most important timelines and insurance requirements you'll face.

| Statute of Limitations | 2 years from the date of injury. | Miss this deadline, and you lose your right to sue for compensation. This is non-negotiable. |

| PIP Claim | Must be filed with your own auto insurer within 1 year. | Your Personal Injury Protection (PIP) covers initial medical bills and lost wages, regardless of fault. |

| Notice to Government | 180 days if a government entity is at fault. | A much shorter deadline for filing a "tort claim notice" if a city bus or government vehicle hit you. |

| Comparative Fault Rule | You must be less than 51% at fault. | If your fault is 51% or more, you cannot recover any damages from the other party. |

These deadlines are strict and missing one can be devastating to your claim. It’s always best to act quickly to protect your rights.

At Bell Law, we've seen firsthand the physical, emotional, and financial chaos a pedestrian accident causes. Our team is here to help Oregonians cut through the confusion, stand up to the insurance companies, and fight for the full compensation they deserve. If you have questions about your case, contact us for a free consultation.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.