Rear End Collision Settlement: Oregon Guide to Settlement Factors

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Rear End Collision Settlement: Oregon Guide to Settlement Factors

When you hear the term rear-end collision settlement, it can be a lot to take in with all the legal jargon. At its core, it is a formal agreement to resolve an injury claim without going to court. The at-fault driver's insurance company agrees to pay a sum of money, and in return, the claim is closed for good.

This payment is intended to cover the ways the crash has resulted in costs, from medical bills and vehicle repairs to less tangible impacts, such as pain and suffering.

Understanding a Rear End Collision Settlement in Oregon

After a wreck, figuring out how to get back on your feet financially can feel overwhelming. A settlement is the legal term for a negotiated solution. Instead of a judge and jury making a decision, the involved parties come to a mutual agreement.

The purpose of a settlement is to provide compensation for losses—what are often referred to as "damages." These damages are the essential pieces that form the foundation of a personal injury claim.

The Building Blocks of Your Claim

A claim can be thought of as a puzzle. Each piece represents a different part of a person's life that was disrupted by the accident. To see the full picture of how much the crash truly cost, every single piece should be on the table.

Here's a breakdown of the core components of a claim, which are the different types of damages for which compensation may be sought.

The table below summarizes the key categories that can build the value of a case.

Key Components of a Rear End Collision Claim

| Medical Expenses | Costs related to injuries, from the ambulance ride and ER visit to surgery, physical therapy, and even anticipated future treatments. |

| Lost Income | Wages that could not be earned because of being out of work recovering. It can also include loss of future earning capacity if injuries are permanent. |

| Property Damage | The cost to repair or replace a car and any personal items that were damaged in the crash, like a laptop or phone. |

| Pain and Suffering | Compensation for non-economic impacts, such as physical pain, emotional trauma, anxiety, and the general loss of enjoyment of life. |

Each of these categories is a part of building a settlement demand.

A settlement is a final resolution. Once the agreement is signed and payment is accepted, the claim is officially closed. It is generally not possible to go back and ask for more money later, even if new medical issues arise.

Why These Components Matter in Oregon

Getting a handle on these foundational elements is an important step for anyone navigating the claims process in Oregon. Every medical bill, repair estimate, and pay stub can serve as evidence to support the value of a claim.

It’s no surprise this is such a common issue. Rear-end collisions are incredibly frequent, accounting for a reported 27.8% of all car accidents in the U.S., which makes them the single most common type of crash. You can see more about the latest traffic accident trends on the Mesriani Law blog.

By understanding what a settlement is and what it's made of, you can be better equipped to start the journey toward financial recovery after being hit from behind.

Key Factors That Influence Your Settlement Value

It’s a common question: "What is my case worth?" The answer is that no two accidents are exactly alike, so no two settlements are, either. Several key ingredients come together to determine the final value of a claim.

Getting a clear picture of these factors is a step toward understanding what a fair rear end collision settlement might look like. It all comes down to methodically documenting the ways an accident has impacted a person's life, from the obvious bills to the less tangible personal struggles.

Documenting Medical Expenses Both Now and in the Future

The most concrete part of many settlement calculations is the stack of medical bills. These costs are far more than just the initial ER visit. They can cover the entire arc of recovery.

- Immediate Care: This bucket includes everything from the ambulance ride and emergency room treatment to the diagnostic scans like X-rays and MRIs that first identified the injuries.

- Ongoing Treatment: Whiplash and other common rear-end injuries may not heal overnight. This could involve weeks or months of physical therapy, chiropractic care, follow-ups with specialists, and the cost of prescription medications.

- Future Medical Needs: For severe injuries, the road to recovery can be long. A settlement may need to account for the medical care that could be required down the road, whether it's a future surgery, long-term physical therapy, or even permanent care.

Keeping meticulous records is critical.

Lost Wages and Diminished Earning Capacity

An accident’s financial toll can go well beyond medical costs. If someone is too hurt to work, the paychecks missed during recovery are a major part of a settlement. This is often called lost wages.

But what if the injury has a lasting impact on a career? That’s where a concept called diminished earning capacity comes in. This addresses the long-term financial hit someone might take if they can no longer perform their old job or have to switch to a lower-paying field because of permanent physical limitations.

The Cost of Property Damage

Of course, one of the most immediate consequences of a rear-end crash is the damage to the car. The cost to get the vehicle repaired—or to replace it if it's totaled—is a core component of a claim.

This isn’t just about a crumpled bumper. It includes all the detailed bodywork and mechanical repairs needed to make the car whole again. Even knowing how to remove scratches from a car bumper shows the level of detail that goes into assessing the full scope of property damage.

Every receipt, from a prescription co-pay to a car rental invoice, can serve as a piece of evidence. Together, they help paint a complete financial picture of the accident's aftermath.

Valuing Pain and Suffering

Some of the deepest impacts of a car accident don't come with a neat invoice. Pain and suffering—also known as non-economic damages—is the legal term for compensating for the physical pain and emotional trauma endured.

This is where things can get more subjective. Calculating this value isn't about plugging numbers into a spreadsheet. Instead, it involves looking at:

- The severity and permanence of the injuries.

- The level of physical pain experienced.

- The emotional and psychological fallout, like anxiety, stress, or PTSD.

- How the injury has impacted daily life and ability to enjoy hobbies.

Because it’s not based on receipts, putting a number on pain and suffering requires a careful evaluation of how the crash affected a person's quality of life.

Oregon's Rule of Comparative Fault

Finally, it is important to discuss how Oregon law assigns responsibility. The state uses a modified comparative fault rule, which is a crucial concept to understand. In simple terms, it means a final settlement can be reduced by a person's percentage of fault in the accident.

There's a sharp cutoff. Under Oregon law, if an individual is found to be 51% or more at fault, they may lose the right to recover any money from the other driver. This rule makes it important to have the crash investigated to clearly establish who was responsible.

How Insurance Companies Approach Settlement Offers

When a settlement offer arrives after a rear-end collision, it can bring a sense of relief. But it's helpful to understand where that number comes from. Insurance companies are businesses, and they approach settlements with a system—one that's built around data and financial efficiency.

The initial figure presented is not just a number pulled from a hat. It's the output of a specific calculation, often run through specialized software. An adjuster will plug in the hard numbers from a claim—documented medical bills, lost wages, the estimate for car repairs—and the software uses its internal formulas to generate a suggested settlement range.

The Formulas Behind the First Offer

So, how do they put a price tag on something like "pain and suffering"? While it seems personal and subjective, insurers often try to quantify it using a formula. One common starting point is the multiplier method.

This can be thought of as a general guideline. An adjuster takes the total hard costs (what they call "economic damages" like medical bills and lost income) and multiplies that sum by a number, which may be somewhere between 1.5 and 5. The specific multiplier they choose can hinge on a few key things:

- Injury Severity: A minor whiplash case that resolves quickly might get a 1.5x multiplier. A more significant injury, like a herniated disc needing surgery, could command a much higher one.

- Recovery Time: A long, grueling recovery process may push the multiplier up.

- Impact on Your Life: The extent to which an injury has disrupted a person's world can be a factor. If someone can no longer work, play with their kids, or enjoy their hobbies, that may justify a higher multiplier.

For example, if medical bills and lost wages add up to $10,000, and the adjuster applies a multiplier of 2, they would calculate pain and suffering at $20,000. Add that to the hard costs, and the total settlement value becomes $30,000. This formula gives the insurer a consistent starting point, but it can miss the real, human story of an accident.

Why the First Offer Is Just a Starting Point

It is helpful to think of the first offer as an opening bid in a negotiation, not the final word. These initial numbers are based only on the information the insurance company has on hand, which is often an incomplete picture. They may not know the full story of potential future medical care or the true depth of suffering.

The insurer's first offer is their initial assessment based on the data they have. It’s a baseline—a place to begin the real conversation once the full evidence and the human side of the experience are presented.

The adjuster's job is to resolve the claim for an amount their company deems reasonable. Knowing this business reality can be powerful. It shifts the perspective from a simple "take it or leave it" choice to the start of a real negotiation. A guide on how to negotiate an insurance settlement offers a more detailed look at the strategies involved. Being ready for this back-and-forth can empower individuals to handle their settlement discussions with confidence.

Navigating the Settlement Process Step by Step

From the moment of impact to a final rear-end collision settlement, the journey can feel overwhelming. Knowing the typical stages of the process can bring much-needed clarity during a stressful time.

It can be viewed as a four-part journey: responding to the immediate crisis, carefully building the case, negotiating with the insurer, and finally, reaching a resolution. Each step has its own priorities, and paying close attention to the details is key to ensuring a settlement reflects everything that has happened.

Let's walk through what can be expected.

Stage 1: The Immediate Aftermath

Actions taken in the first hours and days after a crash can set the foundation for the entire claim. The priorities are often centered around safety, health, and getting the official facts down on paper.

Key actions to consider right away include:

- Seeking Medical Attention: This is important, even if you think you're okay. Injuries like whiplash can take days to show symptoms, and a medical record created right after the accident is powerful evidence.

- Reporting the Accident: It is often a good idea to call the police. An official accident report is an objective, third-party account of what happened, and it’s a document insurance companies may take seriously.

- Gathering Information: Swapping insurance and contact details with the other driver is a standard step. If there were any witnesses, getting their names and phone numbers before they leave the scene can be helpful.

- Notifying Your Insurer: You may need to let your own insurance company know about the accident, regardless of who was at fault.

Stage 2: Documenting and Building Your Claim

Once the immediate crisis has been handled, the focus shifts to a more deliberate task: gathering every piece of evidence related to the crash's impact on your life. This is where the factual backbone of the claim is built.

This is all about meticulous record-keeping. Every medical bill, pay stub, and repair receipt tells a part of the story. The goal is to create a comprehensive file that leaves no doubt about the extent of the losses.

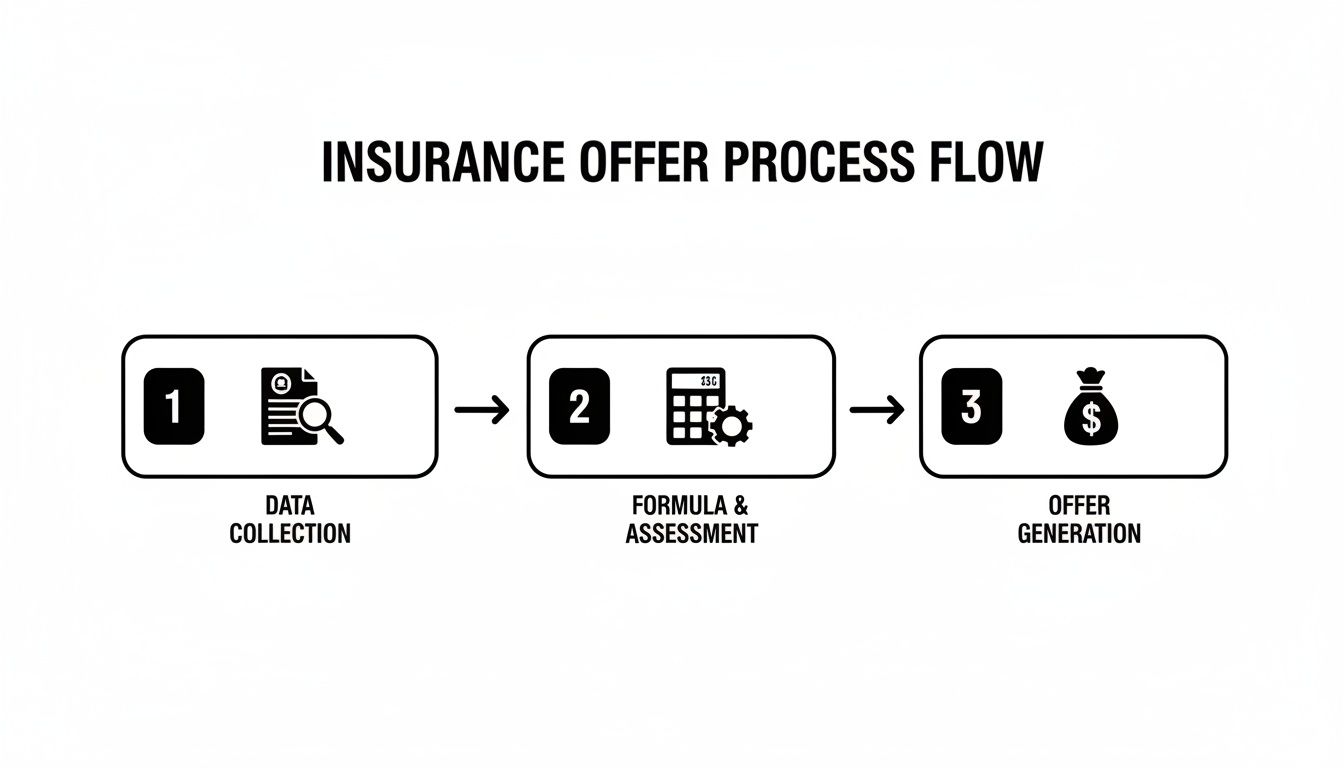

The infographic below shows a simplified version of how an insurance company takes all this information and turns it into a settlement offer.

As can be seen, the quality and completeness of the documentation can directly influence the outcome.

Stage 3: The Negotiation Phase

After all the documents have been collected and there is a clear number for total damages, it’s time to negotiate. This is essentially a structured conversation between you (or your attorney) and the at-fault driver's insurance adjuster.

It can kick off when a demand letter is sent. This is a formal document that lays out the facts, details the injuries and financial losses, and states the total compensation being sought. The insurer will review it and come back with an initial offer—which is often lower than the demand.

Do not be discouraged by a low first offer. This can be a standard tactic. The initial offer is just a starting point for the discussion, not the final word.

What follows is a period of back-and-forth, with counter-offers and discussions aimed at finding a number both sides can agree on. You can learn more about what to expect during these talks by reading our guide to the car accident settlement process.

Stage 4: Resolution and Finalizing the Settlement

This is the final stage, which begins once you and the insurer have agreed on a settlement amount. With a number locked in, the process moves toward making it official.

You'll be asked to sign a release agreement. This is a critical, legally binding contract where you agree to accept the settlement money in exchange for giving up your right to any further claims against the at-fault party. Once that's signed and processed, the settlement check is cut, and your claim is officially closed.

To give you a clearer picture, here’s a simplified breakdown of the entire journey.

Typical Stages in a Rear End Collision Claim

| 1. Post-Accident | Seek medical care, report the crash, gather evidence at the scene, and notify your insurer. |

| 2. Treatment & Documentation | Follow all medical advice, attend appointments, and collect all bills, receipts, and pay stubs. |

| 3. Claim Submission | Compile all documents into a demand package and send it to the at-fault driver's insurer. |

| 4. Negotiation | The insurance adjuster reviews your demand and makes an initial offer, beginning the back-and-forth. |

| 5. Agreement & Resolution | A settlement amount is agreed upon, a release is signed, and the final payment is issued. |

While this table outlines the general flow, remember that every case has its own unique timeline and complexities.

Common Mistakes That Can Wreck Your Rear-End Collision Claim

After getting hit from behind, it can be easy to make a wrong move. The weeks and months following a crash are stressful and confusing, and a simple misstep could jeopardize a settlement. Think of the claims process as a path with a few well-hidden traps—knowing where they are is key to avoiding them.

Let's walk through some of the most common pitfalls people may fall into. While this is just general information, being aware of these issues can help protect your rights and keep you on the right track from day one.

Mistake #1: Jumping at the First Settlement Offer

The insurance adjuster might call pretty quickly with a settlement offer. It can be tempting. You may want this whole ordeal to be over, and having a check in hand sounds like a solution. But it is important to ask: how can they possibly know the full extent of the injuries just days or weeks after the crash?

The simple answer is, they may not be able to. That first offer is often a low number calculated before anyone understands what the recovery will truly look like. It may not account for potential future surgeries, ongoing physical therapy, or the full impact the injury will have on the ability to work and live your life.

An insurer's first offer may not be their best offer. It can be an opening offer. It's the start of the negotiation, not the finish line.

Taking that first check means signing away your rights to any future compensation for this accident. Once you accept, the case is closed for good. While a minor fender-bender might settle for a few thousand dollars, a serious injury case could be worth substantially more. It's helpful to understand the potential range of outcomes, which can vary widely as explained in this overview of car accident settlement amounts from Best Lawyers.

Mistake #2: Giving a Recorded Statement to the Other Driver's Insurer

Soon after the collision, you might get a call from the at-fault driver's insurance adjuster. They may be friendly, sound concerned, and ask if you can give a quick recorded statement about what happened. It can sound harmless, but it can be a minefield.

Insurance adjusters are trained professionals whose job is to minimize payouts for their company. They may know which questions to ask to get you to say something that could be twisted later. An innocent "I'm feeling a bit better today" could be used to argue injuries aren't serious. A moment of confusion about speeds or distances could be used to pin partial blame on you. You are generally under no legal obligation to provide a recorded statement to the other party's insurance company. It can be a tool they use, not one that benefits you.

Mistake #3: Sending Mixed Signals About Your Injuries

Consistency is everything when you're describing your injuries. What you tell your doctor, what you tell the insurance adjuster, and what you tell your attorney should all paint the same picture.

Imagine telling your orthopedic surgeon that your back pain is a constant, stabbing "8 out of 10", but a week later telling the adjuster you're "doing okay" because you don't want to sound like you're complaining. That can be a red flag for the insurance company. They may use that discrepancy to argue that you're exaggerating your pain and that your claim isn't credible.

To keep your story straight and protect your claim, it's helpful to remember these key points:

- Be Brutally Honest with Your Doctors: Give them the full, unvarnished truth at every single appointment. Don't downplay your pain or skip mentioning a symptom because it seems minor.

- Keep a Pain Journal: Jotting down daily notes about your pain levels and physical limitations creates a powerful, consistent record.

- Don't "Tough It Out": It’s natural to want to put on a brave face, but minimizing your injuries to an adjuster could hurt your case in the long run.

A clear, unwavering account of what you're going through builds credibility. It can remove doubt about the impact this collision has had on your life, which is fundamental to securing a fair settlement.

Frequently Asked Questions About Oregon Collision Claims

After a wreck, it's natural to have a lot of questions. Even after you get a handle on the basics of a rear-end collision settlement, you might still be wondering about specific deadlines, insurance problems, and the legal process itself.

This section tackles some of the most common questions we hear from people dealing with a collision claim in Oregon. Think of it as a starting point to help you get your bearings—not legal advice for your specific case, but solid, general information.

How Long Do I Have to File a Claim in Oregon?

Every state has a legal deadline for filing a personal injury lawsuit, and Oregon is no exception. This deadline is called the statute of limitations, and it’s one of the most important factors in an entire claim.

If this window is missed, the right to ask the court system for compensation can be lost. The exact timeframe can shift depending on the details of the crash, so it's critical to understand which deadline applies.

What if the Other Driver Doesn't Have Enough Insurance?

This is a scary but surprisingly common scenario: the driver who hit you is at fault, but their insurance policy isn't large enough to cover all your medical bills and other losses. When this happens, a potential solution might be found in your own auto insurance policy.

This is exactly what certain types of coverage are designed for.

- Underinsured Motorist (UIM) Coverage: This is an add-on to your own policy that can kick in to cover the gap when the at-fault driver's insurance runs out.

- Uninsured Motorist (UM) Coverage: This part of your policy may help if the at-fault driver has no insurance at all.

Whether you can use this coverage, and how much is available, depends entirely on the policy you chose for yourself. It’s always a good idea to review your policy documents and see exactly what protections you have.

Do I Have to Go to Court to Get a Settlement?

It’s a huge misconception that every injury claim turns into a dramatic courtroom battle. The reality is that the vast majority of these cases are resolved through a settlement agreement long before a trial is ever on the table.

A settlement is simply a negotiated agreement between you and the insurance company. The whole process is built around negotiation, with both sides working toward a compensation figure they can agree on. While the possibility of a trial can provide leverage, most claims end with a signed settlement.

A settlement is the result of a successful negotiation. It is a formal agreement that resolves the claim without the need for a court to decide the outcome.

Reaching a settlement gives everyone more control over the outcome and avoids the time, cost, and stress of going to trial. The road to a rear-end collision settlement is almost always paved with discussion and compromise, not a gavel.

How Is Pain and Suffering Calculated in a Settlement?

Pain and suffering is what’s known as a non-economic damage. That’s a technical way of saying it’s compensation for harms that don't come with a neat price tag, like a hospital bill or a mechanic's invoice.

It’s meant to cover the real-life human cost: the physical pain, the emotional trauma, the anxiety, and the simple loss of being able to enjoy your life the way you used to. Because you can’t put a dollar amount on those things, calculating pain and suffering is one of the most challenging parts of any settlement.

Insurance adjusters and attorneys may use a few methods to try and land on a number. They’re not using a simple formula, but instead look at a combination of factors:

- How severe and permanent are the injuries?

- What was the total cost of all related medical care?

- How long and difficult was the recovery process?

- What was the overall impact on the person's day-to-day life?

Because this is so subjective, the value of pain and suffering is often a major point of contention during negotiations. It forces everyone to look past the spreadsheets and focus on how the accident truly affected a person’s life.

Understanding the ins and outs of a rear-end collision settlement is your first step toward protecting your rights and getting your life back on track. If you have more questions or need help with your specific situation here in Oregon, the team at Bell Law is ready to listen. Contact us today for a consultation to discuss your case and find out how we can help.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.