Navigating Rear End Collision Settlements in Oregon

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Navigating Rear End Collision Settlements in Oregon

When you're dealing with the aftermath of a car wreck, you’ll hear the word “settlement” a lot. But what does that actually mean?

A rear-end collision settlement is a formal agreement that resolves an injury claim without going to a full trial. It's a negotiated outcome intended to provide financial compensation for losses that may include medical bills, missed paychecks (lost income), and the cost of vehicle repairs.

Understanding how these settlements work is an important first step in the process.

What Is a Rear End Collision Settlement

A rear-end collision settlement can be thought of as a private contract between an injured person and the at-fault driver's insurance company. Instead of having a judge or jury decide the value of a case, the two sides may agree on a specific dollar amount to officially close the claim.

This isn't just about the obvious costs. A settlement is meant to cover the various impacts the crash had on a person's life, from tangible bills to more personal, less quantifiable harm.

It’s a structured negotiation. The goal is to find common ground on the total financial toll of the accident. This approach allows parties to avoid the potential stress, costs, and unpredictability of a trial.

Why Settlements Are Common

Rear-end crashes are one of the most common types of collisions on the road. In many of these cases, determining fault can be relatively straightforward. Because of this, both sides—the insurance company and the person who was hurt—may find it makes more sense to negotiate a settlement instead of pursuing litigation.

There can be practical advantages to settling:

- Finality: Once an agreement is signed, the matter is concluded. This provides a definite outcome and allows the parties to move on.

- Efficiency: The negotiation process is often faster and less expensive than a drawn-out court battle.

- Control: The involved parties have a direct say in the final number, rather than leaving the outcome to a third party.

A settlement is not just about paying bills; it is about acknowledging the full scope of an accident’s impact on an individual's life, including their physical recovery, financial stability, and overall well-being.

The Foundation of a Claim

At its core, a strong rear-end collision settlement is based on proving the direct link between the crash and the damages suffered. A claim is built on organized, compelling documentation that tells the story of the accident and its consequences.

This includes medical records that outline injuries, pay stubs that show how much income was lost, and repair shop estimates for the vehicle. Each document is a building block, helping to construct a complete picture of the disruption the collision caused.

How Settlement Values Are Calculated

Figuring out what a fair rear-end collision settlement might look like is more complex than adding up a stack of receipts. It’s a process that attempts to put a dollar figure on every way the crash has affected a person's life—from the obvious medical bills to the deeply personal, human toll it takes.

To get to a final number, losses, or "damages," are often sorted into two main categories. Understanding these two categories can help you see how a settlement offer is constructed.

A settlement is made up of different types of compensation, known as damages. The table below breaks down the two main categories that are considered when calculating the value of a claim.

Components of a Rear End Collision Settlement

| Economic Damages | These are the direct, measurable financial losses suffered. They have a clear paper trail. | Medical bills, lost wages, vehicle repair costs, prescription costs, transportation to appointments. |

| Non-Economic Damages | These are the intangible, non-financial losses that affect quality of life. | Pain and suffering, emotional distress (anxiety, PTSD), loss of enjoyment of life, disfigurement. |

Both types of damages can be crucial for ensuring a person receives full and fair compensation for everything they've been through.

Economic Damages: The Tangible Costs

The most straightforward part of any settlement calculation involves what are called economic damages. These are the specific, provable financial losses incurred because of the accident. They form the concrete foundation of a claim, built with receipts, invoices, and pay stubs.

Common examples include:

- Medical Bills: Costs related to treatment, from the ambulance ride and ER visit to future surgeries or ongoing physical therapy.

- Lost Wages: Income that couldn't be earned because of recovery. This can be supported by pay stubs or a statement from an employer.

- Property Damage: The cost to repair a car or, if it's totaled, its replacement value. This may also cover personal items inside the car that were damaged.

- Other Out-of-Pocket Expenses: Other money spent because of the wreck, like paying for rides to doctor's appointments or hiring someone for household help.

These costs create the baseline for a negotiation. Each dollar amount should be supported by documentation.

According to some sources, the economic toll of motor vehicle accidents can be substantial. For example, some national estimates place the average auto liability claim for a bodily injury in 2022 at $26,501, and property damage claims averaged $6,551. These numbers provide a general financial snapshot for these kinds of cases.

Non-Economic Damages: The Human Impact

Beyond the stack of bills are non-economic damages. This is where the very real, but intangible, personal losses that don’t come with a price tag are accounted for. These losses can have a profound impact on a person’s life, and valuing them correctly is an important part of a negotiation.

Non-economic damages are the legal system’s way of acknowledging that the real cost of an injury isn't just about the medical bills. It’s about the pain, the stress, and the life you can't live the same way you did before.

There's no simple formula for this. Instead, calculating these damages requires taking a hard, honest look at how the injuries have affected someone's life.

Key areas include:

- Pain and Suffering: This covers the physical pain and discomfort endured from the moment of impact and what a person may face in the future.

- Emotional Distress: This can be anything from anxiety about getting back in a car to PTSD, depression, or sleep loss caused by the traumatic event.

- Loss of Enjoyment of Life: This addresses an inability to do the things that once brought joy, whether it's playing with kids, hiking, or engaging in a favorite hobby.

Since you can't get a receipt for suffering, proving these damages requires a different approach. Personal journals detailing daily struggles, testimony from friends and family, and expert medical opinions can be used to paint a clear picture of the true human cost. To get a deeper look at this crucial component, you can learn more about how much pain and suffering is worth in our detailed guide.

By carefully assessing both the tangible and intangible losses, a case for a comprehensive settlement that reflects everything a person has been through can be built.

What's a Typical Rear-End Accident Settlement in Oregon?

When you’ve been in a rear-end collision, one of the first questions is often, "What is my case worth?" It’s a completely natural and practical thing to wonder. While no one can predict an exact number—because every case has its own unique set of facts—we can look at general settlement ranges for informational purposes.

The scope of the damage often dictates the cost. It’s the same with injury claims; the settlement value is directly tied to the severity of the harm suffered.

Settlements for Minor Injuries

Many rear-end collisions result in what the insurance industry calls "minor" injuries. This could include soft-tissue issues like whiplash, muscle strains, and sprains. But it is important to note that "minor" doesn't mean painless or insignificant. These injuries can cause real pain and disrupt daily life for a period of time.

For these types of claims, the settlement often focuses on covering immediate and obvious costs:

- An ER or urgent care visit right after the crash.

- A course of physical therapy or chiropractic treatments.

- Wages lost from missing a few days or weeks of work.

- An amount for the pain and inconvenience.

Because the treatment is often short-term with an expectation of a full recovery, these settlements tend to be on the lower end. The most important thing here is to have a paper trail—every doctor's visit and every therapy session needs to be documented to show the real impact of the injury.

Settlements for Moderate Injuries

Sometimes, the impact is harder, and the injuries are more serious than a simple strain. A "moderate" injury might be a herniated disc that needs steroid injections, a concussion that causes headaches and dizziness for months, or a simple broken bone. These injuries can have a much bigger impact on a person's life and finances.

A settlement's value is built on the story your medical records tell. The more extensive and well-documented the treatment is, the stronger the claim for fair compensation may be, as long as it's all clearly linked back to the crash.

In these cases, the settlement needs to account for a wider range of damages:

- Extended Medical Care: This could mean seeing specialists, getting diagnostic imaging like MRIs, and undergoing longer-term physical therapy.

- Greater Lost Wages: When recovery takes several months, the lost income can add up.

- Higher Pain and Suffering: A longer, more painful recovery journey can justify a higher value for non-economic damages.

These claims demand careful and thorough record-keeping. With more money on the line, the insurance company may scrutinize the connection between the accident and ongoing medical needs, so every detail matters.

Settlements for Severe and Permanent Injuries

In the most serious cases, a rear-end collision can be a life-altering event. When a crash causes a traumatic brain injury (TBI), spinal cord damage, or an injury that requires major surgery and leaves a person with a permanent impairment, the entire settlement conversation changes. The focus shifts from looking backward at past bills to looking forward and calculating the lifelong consequences.

Calculating a settlement for a severe injury is a complex process that must account for:

- Future Medical Expenses: This isn't a guess. It's a carefully calculated projection of potential future surgeries, medications, in-home care, and therapy.

- Loss of Earning Capacity: If someone can't go back to their old job—or can't work at all—this calculation covers the income lost over their working life.

- Permanent Impairment and Disfigurement: This compensates for permanent physical limitations, scarring, or other visible changes.

- Profound Loss of Enjoyment of Life: This acknowledges the real, human cost of not being able to do the things one once loved.

Looking at national data, these tiers are reflected in settlement outcomes. While many rear-end claims across the U.S. resolve for amounts between $15,000 and $50,000, cases involving severe, lifelong injuries can surpass $100,000. If you're curious about the broader trends, you can explore some of these national estimates for rear end collisions. Ultimately, these figures all point to the same truth: the documented facts of an injury are the foundation of a settlement.

What Factors Actually Determine Your Settlement Amount?

When trying to figure out what a fair settlement looks like, it’s about more than just the initial diagnosis. A whole host of factors come into play, each one capable of shifting the final number. Think of it less like a simple calculation and more like building a case. The final value isn't just about what happened—it's about what can be proven.

Every successful settlement is built on a solid foundation of evidence. From the details buried in medical charts to the specifics of Oregon law, each piece of the puzzle matters. Getting a handle on these key variables is an important step toward understanding what a claim may be worth.

Your Medical Records are the Bedrock of Your Claim

Consistent, detailed medical documentation is one of the most important parts of a personal injury claim. Insurance adjusters are trained to look for reasons to downplay injuries, and a messy or incomplete medical history can present an opportunity for them to do so.

They look for a clear, uninterrupted story that connects the crash directly to the injuries and every treatment received since. Any gaps in treatment or long delays before seeing a doctor can be used by an adjuster to argue that the injuries weren't that bad or that something else must have caused them after the accident.

A medical file should tell the whole story, including:

- The Initial Visit: Records from the ER or urgent care right after the crash are crucial.

- The Game Plan: Notes from doctors detailing recommended treatments, medications, and referrals to specialists.

- The Follow-Up: Progress reports that show how someone is healing (or not healing) over time.

- Expert Opinions: For serious injuries, reports from specialists explaining the long-term impact can be invaluable.

Think of your medical records as the official logbook of your recovery. Every bill, every doctor’s note, and every physical therapy report is a piece of evidence that validates your pain, suffering, and financial losses.

Without this paper trail, it can become one person's word against the insurance company’s.

How Oregon’s “Comparative Fault” Rule Can Affect Your Payout

Oregon law acknowledges that accidents aren't always black and white. Sometimes, more than one person shares a piece of the blame. This is handled through a legal principle called modified comparative fault.

In plain English, it means a final settlement can be reduced by a person's percentage of fault. Here’s how it breaks down:

- If a person is found to be 50% or less to blame for the accident, they can still get compensation. Their total award, however, will be cut by their share of the fault. For example, if a person is found 10% at fault in a $100,000 case, their payout would be reduced to $90,000.

- The critical part: if a person is found to be 51% or more at fault, Oregon law says they get nothing.

This rule highlights why it's so important to prove the other driver was the one primarily responsible. Even seemingly minor details, like whether one of your brake lights was out, can become a major point of contention and potentially reduce what you can recover.

Other Key Pieces of the Puzzle

Beyond medical records and fault, a few other practical realities have a huge impact on the final number. These elements often dictate the upper limit of what’s even possible in a settlement negotiation.

Three other crucial factors are:

How Clear Liability Is: The more straightforward it is to prove who caused the crash, the better. In many rear-end collisions, the driver in the back is presumed to be at fault, but there are exceptions. Strong evidence like a police report, witness statements, and photos of the scene can shut down arguments before they start.

Insurance Policy Limits: This is a big one. The at-fault driver's insurance policy has a maximum amount it will pay out. No matter how devastating the injuries are, their insurance company won’t pay a penny more than that policy limit. Figuring out that limit early on is key to setting realistic expectations.

The Strength of Your Evidence: At the end of the day, it all comes down to how well-organized and convincing a case is. A claim that is neatly packaged with clear proof of all financial losses and non-economic damages is more likely to result in a fair and efficient settlement.

The Settlement Process Timeline and Common Pitfalls to Avoid

If you've been in a rear-end collision, navigating the settlement process can feel confusing, and it's easy to take a wrong turn. But the path from the crash to a final settlement does follow a general course, and knowing the landmarks—and the traps—is a good way to protect your interests.

The journey starts the moment the collision happens, with crucial first steps like gathering evidence and getting medical attention. Everything you do in those early hours and days lays the groundwork for the entire claim. From there, you’ll be dealing with insurance companies, collecting paperwork, and eventually, negotiating a number. Each step is built on the last, and trying to rush things can seriously hurt a case.

For a deeper dive into the entire journey, check out our complete guide on the car accident settlement process.

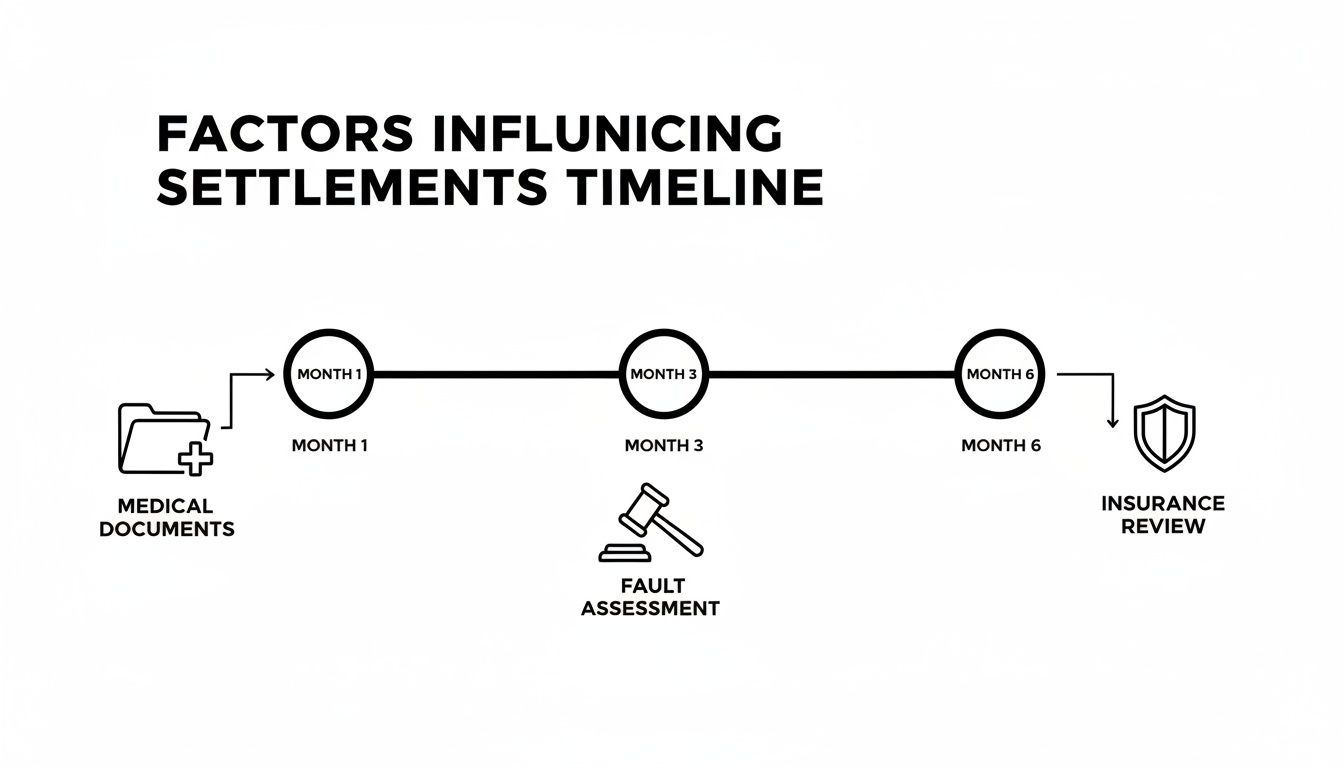

Mapping the Key Stages of a Settlement

There's no magic number for how long a settlement takes. A simple case might wrap up in a few months, but more complex claims, especially those involving serious injuries, can take much longer to resolve properly. It's a marathon, not a sprint.

Here’s a look at the typical stages you can expect:

- Immediate Aftermath: This is all about the first 24-48 hours. Report the accident, see a doctor (even if you feel fine), and start collecting basic evidence like photos and witness contacts.

- Treatment and Recovery: As you heal, the main job is to follow your doctor’s orders. At the same time, medical records and bills are gathered. This phase isn't over until you reach Maximum Medical Improvement (MMI)—that’s the point where your doctor says you’re as recovered as you’re going to be.

- Building Your Case: Once the full extent of damages is known, a "demand package" is assembled. This is a detailed letter and a thick stack of supporting documents that is sent to the at-fault driver's insurance company.

- Negotiation: The insurance adjuster will review the demand and come back with an initial offer. This kicks off a back-and-forth negotiation that can take several rounds before an agreement that fully compensates for your losses is reached.

This process is a sequence of critical steps that have to be managed carefully over time.

As you can see, it's not a single event but a methodical process that unfolds over several months.

Don't Fall for the Early Offer Trap

One of the biggest mistakes a person can make is accepting the first offer the insurance company makes. It’s a classic tactic. An adjuster might call soon after the accident, sound incredibly helpful, and offer a check that might seem like a lot of money at the time. They may be hoping you'll take it and sign away your rights before you understand what your claim is really worth.

The first offer is rarely the best offer. Think of it as the opening bid in a negotiation, not the final price. It is frequently a low amount made before anyone knows the true, long-term impact of the injuries.

Taking that quick money is a huge gamble. Injuries like whiplash or a herniated disc often don't show their full effects for days or even weeks. If you settle too early, you forfeit your right to any more compensation—even if you later need surgery, can't work for months, or develop chronic pain.

Patience can be your best weapon. Don't be surprised if a case takes time. Some studies of traffic accident claims have found that a significant percentage of rear-end collision cases were still unresolved more than two years after the crash. This suggests that getting a fair outcome can mean playing the long game.

Knowing what every client should know in the first 24 hours of their personal injury case can make a difference. Those initial steps set the stage for everything that follows and help you avoid these common pitfalls from the very beginning.

The Role of Legal Representation in Your Claim

After a rear-end collision, trying to manage an injury claim on your own can feel overwhelming. While some people with very minor claims might handle them solo, the process can quickly become complicated, especially if the injuries are serious or the other driver tries to shift the blame. This is the point where many people decide to seek legal counsel.

An attorney can act as an advocate—someone who steps in to manage technical and procedural headaches. Their involvement can change the dynamic of the claim, helping to ensure that every communication, piece of evidence, and negotiation is handled with professional precision.

Managing Communications and Negotiations

One of the most immediate benefits of hiring a lawyer is that they can take over all communications with insurance companies. This means you no longer have to field calls from adjusters or worry about saying the right thing; your attorney can handle it all.

Insurance adjusters are trained negotiators whose goal is to minimize the payout for their company. Having an experienced representative who knows their playbook can be an advantage. A good lawyer builds a case methodically, based on hard facts and documented evidence, to pursue a settlement that covers all damages. If you want a closer look at what goes on behind the scenes, this guide explains how to negotiate an insurance settlement.

Gathering Evidence and Calculating Damages

Building a solid claim for a rear-end collision settlement involves much more than just forwarding medical bills to the insurance company. A legal team can be crucial for gathering and organizing all the documentation needed to paint a complete picture of how the accident has affected a person's life.

This process typically includes:

- Collecting and organizing all medical records to show a clear timeline of injuries, treatments, and the recovery process.

- Obtaining expert opinions from medical specialists or accident reconstructionists to strengthen a case when necessary.

- Documenting lost wages and, if applicable, calculating the long-term impact on future earning capacity.

- Compiling all critical evidence, such as police reports, witness statements, and photos from the accident scene.

An attorney’s job is to translate a personal experience—the pain, the financial stress, the disruption—into the structured language that the legal and insurance systems understand. They can weave complex information into a compelling story backed by solid proof, ensuring no part of the damages gets overlooked.

Understanding Oregon's Legal Framework

This is where local expertise really matters. Navigating Oregon’s specific laws is another key area where an attorney can make a significant difference. A lawyer who practices in the state will have an understanding of state-specific rules, like the statute of limitations for filing a personal injury claim and the nuances of Oregon’s comparative fault system.

This specialized knowledge helps ensure that critical deadlines aren't missed and that a claim is positioned correctly within local legal standards. If you're considering getting legal help, it can be useful to see what the first steps look like; for a deep dive into how firms onboard clients, check out a complete guide to law firm client intake. Understanding this process can take a lot of the mystery out of hiring a lawyer for a rear-end collision claim.

Frequently Asked Questions About Rear-End Collision Settlements

After a rear-end crash, it's completely normal to have a ton of questions. Let's walk through some of the most common ones.

How Long Do I Have to File a Claim in Oregon?

This is an important question, and the clock starts ticking right away. Oregon law has a deadline for filing a personal injury lawsuit, known as the statute of limitations. For most car accident injury claims, there is a two-year window from the date of the crash.

Be aware that this isn't a one-size-fits-all rule. The timeline can get tricky depending on the specifics, like if a government vehicle was involved. Missing this deadline can be critical; if you do, you could lose your right to seek compensation in court. It is always best to confirm the exact timeline for your unique situation with a legal professional.

Is a Settlement from a Rear-End Collision Taxable?

Generally, the IRS does not consider the portion of a settlement that compensates you for physical injuries and medical bills to be taxable income.

However, it can be more complicated for other parts of the settlement. Any money received for lost wages or punitive damages (which are rare) might be taxed. Because tax rules can be complex and often depend on how the settlement agreement is worded, it can be a smart move to talk with a tax professional.

Understanding the financial implications of a settlement is just as important as the negotiation itself. A clear picture of potential tax obligations ensures there are no surprises after the claim is resolved.

What Should I Do If the Other Driver’s Insurance Company Contacts Me?

It is common to get a call from the at-fault driver's insurance adjuster soon after an accident. They will likely ask for a recorded statement or ask you to sign a broad medical release form.

It is wise to proceed with caution. While you will need to provide some basic facts about the accident, you are not required to give a recorded statement, especially not right away.

If you do speak with them, stick to the facts. Be concise and do not guess or speculate about who was at fault or how badly you're hurt—you may not know the full extent of your injuries yet. Understanding your rights when dealing with an insurance company is a crucial part of protecting your claim.

If you have more questions about a rear-end collision claim, the team at Bell Law is here to help. Contact us for a consultation to discuss your situation and learn more about your options by visiting our official Bell Law Offices website.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.