Understanding Social Security Attorney Fees

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Understanding Social Security Attorney Fees

Let's get right to the question that's probably on your mind: What's this going to cost?

The good news is, you don't need a dime to hire a Social Security disability lawyer. Almost every attorney in this field works on a contingency fee basis. Think of it as a "no win, no pay" guarantee. You pay nothing upfront, and your attorney only collects a fee if they successfully win your case and secure you an award of past-due benefits.

This structure is designed to help you, not hurt you.

How Social Security Attorney Fees Actually Work

The entire fee arrangement is regulated by federal law, so there are no surprises. It’s set up to make sure that anyone who needs a lawyer can get one, regardless of their financial situation.

It also means your attorney’s goal is perfectly aligned with yours—getting your claim approved. The fee itself isn't paid out of your pocket; it's taken directly from your "back pay." That’s the lump-sum payment of benefits that built up during the months (or years) you were waiting for the Social Security Administration (SSA) to approve your case.

Understanding the Fee Cap

The SSA puts a strict ceiling on what an attorney can charge to protect claimants. By law, the fee is limited to 25% of your past-due benefits or $9,200, whichever is less.

This cap is a critical safeguard. Let’s look at how it works in the real world:

- Scenario 1: Say your back pay award is $10,000. In this case, 25% is $2,500. Since that's much less than the cap, $2,500 would be the attorney's fee.

- Scenario 2: Now imagine your back pay is $40,000. Here, 25% would be $10,000. Because this is more than the $9,200 cap, the attorney’s fee is automatically reduced to $9,200.

No matter how large your back pay award is, the fee will never exceed that statutory limit.

The Real Work of an Attorney

Hiring a lawyer is about much more than just filling out forms. A good attorney builds a rock-solid case for you. This means digging deep to gather the right medical evidence, handling all communications with the SSA, and representing you in front of a judge if a hearing is necessary.

A huge part of this work involves a detailed analysis of your work history and financial records to build the strongest argument for your benefits. This complex work is vital for a successful claim, and some are even using AI for financial analysis to help make sense of all the data.

The contingency fee model is what makes expert legal help accessible. It removes the financial roadblock, letting you focus on your health while your attorney focuses on securing the benefits you rightfully deserve.

Deciding to hire legal help is a big step. Our guide on hiring a lawyer for SSI claims can give you even more information to help you feel confident in your choice.

How Your Attorney Gets Paid: The Contingency Fee Model

You’ve probably seen the ads: "no win, no pay." This isn't just a catchy phrase; it's the foundation of how Social Security disability attorneys work. It’s called a contingency fee model, and it’s a system designed to give you access to expert legal help without any upfront cost or financial risk.

Let's be real—when you're out of work and dealing with a serious health condition, the last thing you can afford is a hefty legal bill. The contingency model gets rid of that barrier. You get a skilled professional in your corner from day one, and you don't pay them a dime out of your own pocket.

This setup does more than just remove the financial stress. It creates a true partnership. Your attorney’s success is directly linked to yours. They only get paid if they win your case and secure the past-due benefits you’re owed. That's a powerful motivator to fight for the best possible result for you.

What This Means for You in Practice

The biggest advantage is obvious: you pay nothing upfront. This peace of mind is invaluable. But like any agreement, it's good to understand both sides of the coin.

- Pro: Your Goals Are Aligned. Your attorney is incentivized to get you the largest back pay award possible, because their fee is a percentage of that amount. When you win, they win.

- Pro: Access to an Expert. This model lets you hire a top-notch attorney you couldn't otherwise afford, giving you a fair shot against a huge government bureaucracy.

- Con: The Percentage. In rare cases with a very large back pay award, the 25% fee might end up being more than an hourly rate would have been. Thankfully, the federal fee cap is in place to protect you from excessively high fees.

For most people, the contingency model is a lifeline. It lets you focus on your health while your attorney handles the legal fight, without the constant worry of racking up legal bills.

A contingency fee agreement puts you and your attorney on the same team. Their paycheck is contingent on proving your disability and winning the benefits you deserve.

Watch Out for Case Expenses

Here’s a crucial detail to get straight with any attorney: the difference between their fee and case expenses. They are not the same thing.

While the attorney's fee for their time and expertise is contingent on winning, building a strong case often involves some hard costs.

These are the real-world expenses needed to gather evidence for your claim:

- Fees charged by your doctors and hospitals for copies of your medical records.

- Costs for getting special reports or opinions from medical experts.

- Administrative costs like postage and copying.

These expenses are separate from the attorney’s 25% fee. Usually, the law firm will cover these costs for you as the case progresses. Then, if you win, they are reimbursed out of the settlement after their main fee is calculated. Make sure this is spelled out clearly in your written fee agreement before you sign anything, so there are no surprises down the road.

How the SSA Fee Cap Protects You

The Social Security Administration's (SSA) fee cap is much more than just a number—it’s a powerful financial safeguard designed to protect you, the claimant. Think of it as a safety net woven directly into the system. Its entire purpose is to prevent excessive social security attorney fees and keep the process fair for people who are often in a very tough spot.

This legal limit means that even if 25% of your back pay adds up to a huge sum, your attorney can't charge you a penny more than the federally mandated maximum. That gives you a critical layer of financial security and predictability. The cap ensures the lion's share of your hard-won benefits goes where it belongs: to you. It’s a core principle of how the entire disability system is supposed to work.

The History and Purpose of the Cap

The fee cap wasn't just pulled out of thin air. It has evolved over the years, reflecting an ongoing effort to balance fair pay for attorneys with strong protection for the people they represent. Understanding this history shows you just how important it is. It was created to solve a real-world problem and has been adjusted over time to keep up with economic shifts.

This balance is absolutely crucial. Attorneys put in a ton of work, sometimes for years, and they need to be compensated for that. But at the same time, claimants like you have to be shielded from fees that would eat up an unreasonable chunk of your past-due benefits. The cap is the mechanism that keeps everything in equilibrium.

The fee cap is essentially a consumer protection law built right into the Social Security system. It puts a hard ceiling on legal costs, giving you peace of mind that the SSA itself is looking out for your financial interests.

How Inflation Affects the Fee Cap

Now, here’s where it gets a bit more complicated. While the cap offers great protection, its adjustments haven't always kept pace with inflation. This creates a tricky dynamic for both claimants and attorneys.

Historically, the fee cap for SSDI claims has lagged behind the cost of living, which can have a real impact on the legal landscape. For instance, the $4,000 cap set way back in 1991 would be worth over $8,100 today. Similarly, the $6,000 cap from 2009 is equivalent to just over $7,700 in today's dollars. As you can discover more insights about these fee cap trends, this gap highlights the economic pressures at play.

But even with these economic realities, the fee cap remains your ultimate protection against runaway legal costs. It's the final word, ensuring the system serves its primary mission: providing financial support to those who can no longer work.

Calculating Your Potential Attorney Fee

Hearing about fee structures is one thing, but seeing how the numbers actually crunch makes all the difference. The formula for Social Security attorney fees is always based on a simple rule: your attorney receives the lesser of two amounts.

It's either 25% of your back pay or the current federal cap, whichever is lower. Let's walk through a couple of real-world scenarios so you can get a feel for how this works and estimate what you might expect. No guesswork involved.

Scenario 1: The 25 Percent Rule Applies

Let's say your claim is approved, and the Social Security Administration (SSA) calculates that you're owed $15,000 in past-due benefits. This lump sum is often called "back pay."

Here’s the breakdown:

- First, we calculate 25% of your back pay: $15,000 x 0.25 = $3,750.

- Next, we compare that number to the federal fee cap, which is $9,200 as of late 2024.

- The outcome? Since $3,750 is less than $9,200, the attorney's fee is exactly $3,750.

This is the most common situation we see. The percentage determines the fee because it doesn’t hit that maximum ceiling.

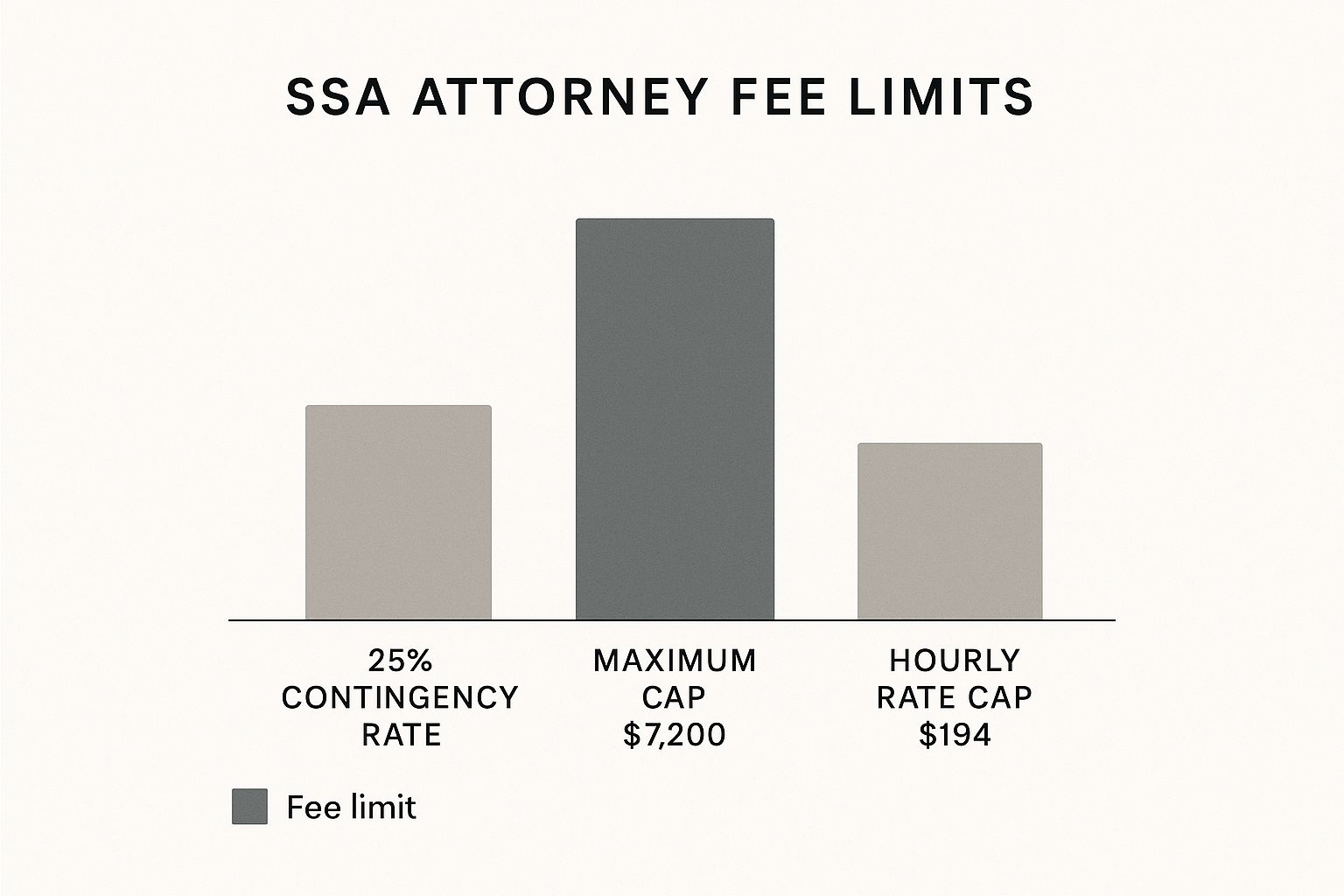

The infographic below really helps visualize the fee limits set by the Social Security Administration.

As you can see, the cap acts as a critical safety net, keeping attorney costs predictable and under control.

Scenario 2: The Federal Cap Kicks In

Now, imagine your case was more complex and took longer to win, leading to a much larger back pay award. Let's say you're awarded $50,000 in past-due benefits. The math plays out a bit differently here.

- First, we take 25% of your back pay: $50,000 x 0.25 = $12,500.

- Then, we compare that to the $9,200 federal fee cap.

- The outcome? In this case, $12,500 is more than the cap. The attorney's fee is legally capped at $9,200, not a penny more.

This is a perfect example of how the fee cap protects you. It stops fees from spiraling on claims with substantial back pay, making sure the lion's share of your award lands in your pocket.

To get a clearer picture of how these two scenarios compare, check out the table below. It shows how the final fee changes based on the size of the back pay award.

Sample Attorney Fee Calculations

| $10,000 | $2,500 | $9,200 | $2,500 |

| $25,000 | $6,250 | $9,200 | $6,250 |

| $36,800 | $9,200 | $9,200 | $9,200 |

| $60,000 | $15,000 | $9,200 | $9,200 |

This table clearly illustrates the tipping point—once 25% of the back pay exceeds $9,200, the cap takes over and the fee stays fixed.

Your back pay award is a vital lifeline, so it’s important to understand how back pay works for SSI and what to expect. Knowing these rules upfront empowers you to move forward with confidence, knowing there’s a fair and transparent system in place.

What Happens to Fees if Your Case Goes to Federal Court?

So, you've gone through every level of the Social Security appeal process. You've been denied at the initial stage, reconsideration, by the administrative law judge, and even by the Appeals Council. For many, this is the end of the road. But it doesn't have to be.

The final step is to file a lawsuit against the Social Security Administration (SSA) in federal court. This is a whole new ballgame, and it completely changes how your Social Security attorney fees are handled. The contingency fee agreement you signed for the administrative process typically ends here. Federal court is a different animal, requiring a different approach to fees.

The Equal Access to Justice Act (EAJA) Steps In

When your claim moves to federal court, a federal law called the Equal Access to Justice Act (EAJA) comes into play. You can think of it as a fairness law. It’s designed to level the playing field between individuals and the U.S. government.

Under EAJA, if the court finds that the SSA’s decision to deny your benefits wasn't "substantially justified"—meaning their position wasn't reasonable—the government itself can be ordered to pay your attorney's fees. This is a massive deal. It means you can challenge an unfair denial in court without having to worry about footing the bill for a federal lawsuit. It also gives attorneys the confidence to take on these tough, lengthy cases.

How EAJA Fees and Your Back Pay Work Together

This is where things get interesting. Let's say your attorney wins your case in federal court, the case gets sent back to the SSA, and you're finally awarded benefits and a large sum of back pay. Does your lawyer get to collect their contingency fee and the EAJA fees from the government?

Absolutely not. The law has a built-in protection to prevent this kind of "double-dipping."

When an attorney is awarded fees under both the Social Security Act (your contingency fee) and EAJA, they have to give the smaller of the two awards to you. It's that simple.

The rule is straightforward: The attorney keeps the larger of the two fee awards, and the smaller amount is refunded directly to you. This system ensures you get to keep as much of your back pay as possible while still making sure your lawyer is fairly paid for the monumental effort of a federal case.

The goal is to make you whole again. As you can learn more about EAJA data and its application directly from the SSA, this fee-shifting statute is a powerful tool for justice. It works hand-in-hand with the standard contingency fee model to cover all stages of a complex disability claim.

This final stage of the disability journey is undeniably complex. If you're facing a tough fight, our guide on how to appeal a disability denial can help you understand every step of the process.

Answering Your Top Questions About Attorney Fees

When you're thinking about hiring a lawyer, the cost is almost always the first thing on your mind. It’s completely normal to have questions. Let's walk through some of the most common concerns people have about social security attorney fees so you can feel confident moving forward.

These are the straightforward answers you need to make a smart decision about getting help with your disability claim.

Are There Any Upfront Costs or Hidden Fees?

For the vast majority of Social Security disability cases, the answer is a simple, resounding no. Attorneys work on a contingency fee basis, which is just a formal way of saying they don't get paid unless you do. You won't owe a dime in legal fees to get started.

That said, you should always ask about case expenses. These are the hard costs involved in building a strong claim—things like paying for copies of your medical records or getting a written opinion from a doctor. Your attorney typically fronts these costs, but they are usually reimbursed out of the back pay award after their own fee is taken out. Just make sure this is clearly spelled out in your written agreement.

What Happens If I Lose My Disability Case?

If your claim is denied, you owe your attorney no fee for their time and effort. It’s that simple. This is the bedrock of the "no win, no pay" model. Because their payment is tied directly to winning you an award of past-due benefits, a loss means they don't get paid for their legal work.

This whole system is designed to take the financial risk off your shoulders. The only potential cost you might have is repaying those case expenses we just talked about, but even that depends on your specific agreement. It’s a key detail to confirm before signing anything.

The contingency system ensures you can pursue a valid claim without the fear of ending up with a large legal bill if the outcome isn't successful. Your financial risk is kept to an absolute minimum.

How Does My Attorney Actually Get Paid?

You don't have to worry about cutting a check or figuring out payment logistics. The Social Security Administration (SSA) manages the entire process to make sure everything is done by the book.

After your claim is approved, the SSA calculates your back pay. From there, they will:

Set aside the attorney's approved fee directly from that total award.

Pay your attorney directly.

Send the rest of your back pay—the remaining balance—straight to you.

It's a streamlined process designed to protect you and ensure your attorney is paid correctly according to federal law.

Is Hiring a Disability Attorney Worth the Fee?

Every situation is different, of course, but the numbers don't lie. Data consistently shows that people who hire legal representation are approved for benefits at a much higher rate than those who go it alone.

A good disability attorney lives and breathes the SSA's complex rules. They know what kind of medical evidence is needed, how to present it persuasively, and how to effectively argue your case in front of a judge. For most people, that expertise is a sound investment in their future financial security and their own peace of mind.

Navigating a Social Security Disability claim in Oregon can feel overwhelming, but you don't have to face it by yourself. The experienced team at Bell Law is here to guide you through every step, ensuring your rights are protected. For a free consultation to discuss your case, contact us today at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.