What Is a Typical Rear End Settlement in Oregon?

"I was satisfied once John Bell took over my case."

"Communication was always timely."

What Is a Typical Rear End Settlement in Oregon?

When people inquire, "What's a typical rear-end settlement in Oregon?" they are often hoping for a simple number. While understandable, there is no single "typical" amount.

Think of it less like a price tag and more like building a house. You can't price the house until you know the cost of the foundation, the framing, the plumbing, and all the finishes. A settlement works in a similar way; its final value is built, piece by piece, from the specific damages documented. Every case is unique because every person's injuries, financial losses, and life disruptions are different.

What Goes Into a Rear-End Settlement?

A settlement is a detailed accounting of the various ways an accident has impacted a person's life, both financially and personally. The process involves identifying, documenting, and then putting a value on each of those impacts.

It helps to break these damages down into a few core categories. This is how lawyers and insurance adjusters often begin to build the framework for a settlement negotiation.

The Building Blocks of a Claim

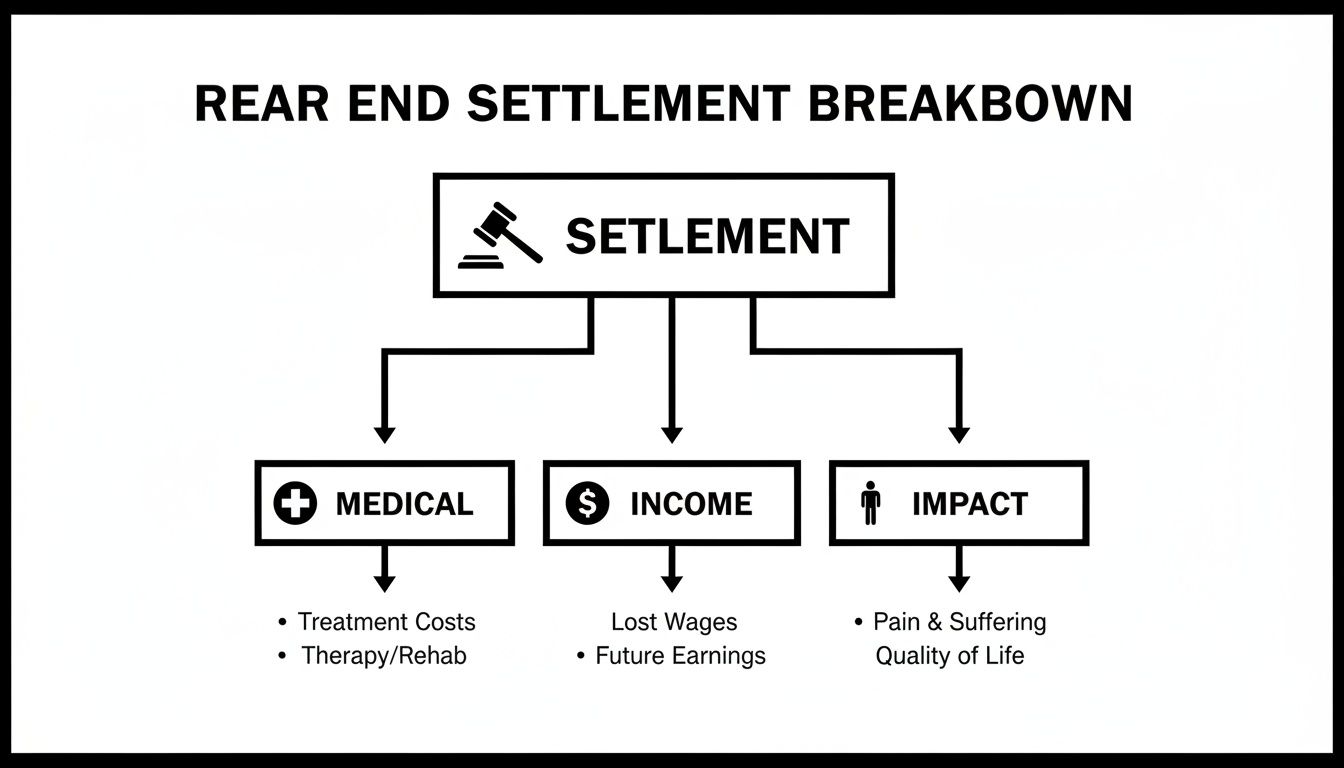

In general, any settlement negotiation may boil down to three main areas. Each one adds a layer to the final number.

- Medical Bills & Recovery: This is often the most straightforward part. It can cover everything from the ambulance ride and ER visit to surgery, physical therapy, chiropractic care, medications, and even medical care that may be needed in the future.

- Lost Wages & Earning Capacity: If injuries kept someone out of work, this part of the claim can cover the income lost. It may also address a long-term or permanent change in ability to earn what was earned before the crash.

- Pain & Suffering (The Human Cost): This is the component that accounts for the non-financial toll. It's intended to provide compensation for the physical pain, emotional distress, and the general disruption the accident has caused in daily life.

The purpose of a settlement is to help make a person "whole" again—at least from a financial standpoint. It's a process of adding up not just the documented bills, but also the personal hardships that don't come with an invoice.

These three elements can be the foundation of a personal injury claim. How much value is assigned to each one depends entirely on solid documentation and the specifics of the situation. For example, a minor whiplash case that resolves in six weeks will look very different from an accident that results in a spinal surgery and months of missed work. Once these individual pieces are understood, it becomes clearer how a final settlement figure comes together.

How a Rear-End Collision Claim Value Is Built

Think of a settlement as a puzzle. Each piece represents a different way the accident has affected a life, and only by putting them all together can the full picture of the claim's potential value be seen. Understanding these pieces is the first step toward figuring out what a typical rear-end settlement might look like in a given situation.

The process often starts by taking a hard look at every single loss suffered. These losses generally fall into two buckets: the ones with clear price tags (economic damages) and the ones that are deeply personal (non-economic damages).

The Foundation: Economic Damages

Economic damages are the tangible, out-of-pocket costs incurred because of the crash. These are often the most straightforward parts of a claim because they can be proven with receipts, bills, and pay stubs.

These are the core financial losses that may be looked at:

- Medical Expenses: This is more than just the emergency room bill. It can cover everything from the ambulance ride and hospital stay to follow-up surgeries, physical therapy, chiropractic adjustments, and prescription drugs. It may also be necessary to account for any medical care that might be needed in the future.

- Lost Wages: If injuries kept someone out of work, this is the income missed. It can include not just a base salary or hourly pay, but also any lost overtime, commissions, or bonuses that might have been earned.

- Loss of Earning Capacity: Sometimes, an injury is severe enough to permanently impact a person's ability to do their job or earn what they used to. This part of a claim can address that long-term financial hit.

- Property Damage: This is generally the cost to get a car fixed or, if it was totaled, to replace it. It can also include any other personal items that were damaged in the crash, like a laptop or phone.

These hard numbers form the financial bedrock of a case. Getting all this paperwork in order is critical. To get a rough idea of how these figures start to add up, some people find it helpful to use a general car accident compensation calculator to see the different inputs.

The Human Element: Non-Economic Damages

While economic damages cover the numbers, non-economic damages are meant to compensate for the very real human cost of the collision. These are the impacts that don't have a neat invoice attached to them. Putting a dollar value on them is more of an art than a science, as it’s about translating suffering into a financial figure.

Non-economic damages are the legal system’s way of acknowledging that the true harm from an accident goes far beyond the bills. It’s about the pain, the fear, and the disruption to a person's life.

This category is designed to compensate for things like:

- Pain and Suffering: This accounts for the actual physical pain injuries have caused, both in the immediate aftermath and during the long process of recovery.

- Emotional Distress: A car crash can be a traumatic event. It is not uncommon for people to deal with anxiety, depression, a new fear of driving, or even post-traumatic stress disorder (PTSD).

- Loss of Enjoyment of Life: This is about what the accident took away. Was someone an avid hiker who can no longer hit the trails? A grandparent who can't pick up their grandkids? This can compensate for the loss of hobbies and daily joys that make life worth living.

This chart helps visualize how these crucial components—medical bills, lost income, and the personal impact—come together to form the basis of a settlement.

As you can see, a final settlement number isn't pulled out of thin air. It’s built, piece by piece, by carefully documenting both the black-and-white financial costs and the deeply personal, human toll of the collision. Only by combining both can a figure be reached that truly reflects the total impact the accident had on a life, which becomes the starting point for any negotiation.

Key Factors That Shape Your Settlement Amount

While medical bills and lost wages lay the groundwork for a settlement, several other factors can influence the final number. Think of these as the variables in the equation—they can change the outcome of a claim. Understanding what they are can provide a clearer picture of what to expect during negotiations.

One of the first hurdles can be proving liability. This just means figuring out who was legally responsible for the crash. There's a common belief that the rear driver is always at fault in a rear-end collision. While often true, it's not a guarantee.

What if the front driver’s brake lights weren't working? Or what if they suddenly and unexpectedly slammed on their brakes or even reversed? In those situations, liability can become less clear. Pinning down exactly who was at fault is an essential first step.

Oregon’s Comparative Negligence Rule

In Oregon, there is a system called modified comparative negligence. It's a way of dealing with situations where more than one person might be partially to blame for an accident.

Imagine the total fault for the crash is a pie. A court or insurance companies might slice up that pie and assign a percentage to each driver. If a person were found to be, say, 10% responsible, their final settlement could be reduced by that 10%.

Under Oregon law (ORS 31.600), an individual can still receive compensation as long as they are not more at fault than the other party. The cutoff is 50%. If a person is found to be 51% or more to blame, they may not be able to recover anything.

This is a key reason why even a seemingly simple rear-end case may need a close look. Any fault assigned could directly reduce a settlement check.

The Impact of Insurance Policy Limits

Another major real-world factor is insurance policy limits. Every driver has an insurance policy, and every policy has a maximum amount it will pay for an accident. It's a hard cap.

Think of it as a bucket of money. Once the bucket is empty, it's empty. If the at-fault driver only has a $25,000 liability limit, that is the most their insurance company will pay out, even if the medical bills are double that.

This is a significant reason why having one's own Underinsured Motorist (UIM) coverage can be so critical. Those policy limits create a ceiling on the negotiation, and it's something everyone may have to work within.

Addressing Pre-Existing Conditions

Insurance adjusters may dig into past medical records, looking for pre-existing conditions. This is any injury or health issue a person had before the crash. Their goal can be to argue that the pain isn't from the accident, but from an old problem.

Having a pre-existing condition doesn't automatically negate a claim, but it may need to be handled carefully. The key is often to prove that the crash made an old condition worse or caused an entirely new injury. After all, the severity of an injury is a major driver of value; for example, properly distinguishing between a sprain and a break can completely change the diagnosis, treatment plan, and settlement.

This is where a doctor's reports are crucial. Clear medical evidence may be needed to show a direct link between the collision and new or worsened symptoms. Together, all these factors—fault, policy limits, and prior health—can create a unique puzzle for every claim, making it far more than just a simple math problem.

Navigating the Settlement Process and Timeline

For those wondering what a typical rear end settlement process looks like, it's best to think of it as a marathon, not a sprint. The path from the crash to the final check involves several key stages, and knowing what to expect can make a world of difference.

The whole thing kicks off the moment the accident is reported. For a solid primer on this crucial first step, it’s worth understanding how to effectively file an auto insurance claim. This is where the insurance companies start their investigation, gathering police reports, photos, witness accounts, and initial medical records to piece together what happened.

Reaching Maximum Medical Improvement

One of the most critical milestones in this journey is reaching what's known as Maximum Medical Improvement (MMI). This is a term that is frequently used, and it's essential to understand.

MMI is simply the point where a doctor says a patient's condition has stabilized and isn't likely to get any better, even with more treatment. This doesn't mean the person is 100% healed or back to their old self. It just means there is now a clearer picture of their long-term medical outlook.

Why is this so important? Because until MMI is reached, it can be difficult to fully calculate the total cost of the injuries—both what has already been spent and what may be needed in the future. Settling before this point can be a gamble because significant future costs could be left out.

The Negotiation and Resolution Phase

Once MMI has been reached and all damages have been tallied (medical bills, lost wages, pain and suffering), the back-and-forth can begin. This may start with a formal demand letter sent to the insurance company, laying out the facts and the requested compensation.

The insurance adjuster will review the demand and will often come back with a lower counteroffer. This is where the negotiation dance starts. For a more detailed look at these interactions, you can get a good overview of the general https://www.belllawoffices.com/car-accident-settlement-process/.

If a fair number can be agreed upon, the settlement is finalized. If not, options like mediation or filing a lawsuit might be considered. Each of these steps, of course, adds to the overall timeline.

The settlement timeline is driven by the need for complete information. Rushing the process before medical outcomes are clear can leave significant gaps in the valuation of a claim. Patience and thoroughness are key.

Understanding the Expected Timeline

So, how long does all this actually take? These cases rarely wrap up in a few weeks. The reality is that the timeline can stretch from several months to a couple of years, depending on the complexity of the case.

Recent industry data suggests that many car accident injury settlements are finalized between 12 and 36 months after the crash.

- Simple cases with minor injuries might settle in 6–12 months.

- Moderate cases can take 12–24 months.

- Complex cases with severe injuries or liability disputes can extend beyond that.

The bottom line is that a quick settlement is not always the best settlement. Getting it right takes time.

Understanding General Settlement Ranges by Injury

Everyone wants to know the magic number—the "typical" rear-end settlement. The truth is, there isn't one. Instead, it’s more helpful to think in terms of ranges, because the settlement value is directly tied to how seriously a person was hurt.

Think of it this way: a minor fender-bender with a sore neck is in a completely different ballpark than a crash that requires surgery. The more an injury turns a life upside down, the higher the potential settlement value.

Minor Soft-Tissue Injuries

This is the most common category and can involve injuries like whiplash, muscle strains, or sprains. The key factor here is a relatively quick and full recovery, often within a few weeks or months.

The settlement is often about making a person whole again financially. It may cover things like the emergency room visit, a few follow-ups with a doctor or chiropractor, and maybe a few days of lost wages. The focus is on covering those direct costs and compensating for the short-term pain and hassle.

Moderate Injuries

This is where the math can get more complicated. Moderate injuries have a much bigger impact on daily life and can include things like:

- Herniated Discs: These can cause nagging, chronic pain and may require long-term physical therapy or even steroid injections to manage.

- Bone Fractures: A broken arm or leg isn't just about the initial pain; it involves a long recovery that can keep a person out of work for a while.

- Concussions: Even a "mild" traumatic brain injury can leave someone with persistent headaches, brain fog, and dizziness for months.

Because these injuries require more medical treatment and may cause more missed work, the settlement has to account for that. This is also where "pain and suffering" can become a much more significant part of the equation. We dive deeper into that in our guide on how much pain and suffering is worth.

The value of a claim is a story told by medical records. The more treatment needed, the longer the recovery, and the more a life is disrupted, the more there is to account for in a settlement.

Severe and Catastrophic Injuries

These are the most tragic cases, involving life-altering harm. This includes spinal cord injuries, severe traumatic brain injuries (TBIs), or any injury that results in a permanent disability.

Here, the settlement isn't just about past medical bills. It must project a lifetime of future costs, including ongoing medical care, loss of the ability to ever work again, and the profound, permanent changes to quality of life. Valuing these cases is an incredibly detailed process that may require bringing in medical and economic experts to paint a clear picture of the future.

Industry data from 2025 gives us a clearer picture of these ranges. Typical rear-end collision settlement values often fall into these brackets: minor cases may land between $1,000 and $25,000, moderate injuries in the $25,000–$100,000 range, and severe cases can exceed $1,000,000. If you want more context on how these patterns play out elsewhere, you can read about typical rear-end collision settlement ranges in California.

When to Consider Speaking with a Personal Injury Attorney

Making the call to hire an attorney after a rear-end collision is a personal one. For a simple fender-bender with no injuries, many people can handle the claim themselves directly with the insurance company.

But what happens when things get complicated? It's not always black and white. Knowing when to ask for help can make a huge difference in how a claim is resolved.

When Injuries Are Significant

The single biggest factor is the severity of the injuries. If someone walked away with more than just a few scrapes and some muscle soreness, the stakes are instantly higher.

When looking at ongoing medical needs—like physical therapy, trips to specialists, or even surgery—figuring out the value of a typical rear end settlement becomes much more complex. It's not just calculating past bills; it involves trying to predict the future.

An experienced attorney knows how to account for those future medical costs to ensure a person doesn't settle for less than they need for a full recovery. They look at the big picture, which can be tough to do when just focused on getting better.

When Fault Is Disputed

It’s a common misconception that the rear driver is always at fault. While often the case, it is not guaranteed. What if the other driver claims the person in front slammed on their brakes for no reason, or that their brake lights were out? Suddenly, the situation becomes about defending one's actions.

When liability is questioned, the focus shifts from how much a claim is worth to who is responsible. An attorney’s job can become one of an investigator—they may dig for evidence like witness statements, police reports, or nearby traffic camera footage to reconstruct what really happened.

Navigating Oregon’s comparative fault rules on one's own can be a nightmare. A lawyer can clarify how even a small percentage of fault could reduce a settlement and will fight to protect a client's right to fair compensation.

When the Insurance Offer Seems Low

That first offer from the insurance company can be a real eye-opener, and not in a good way. It’s important to remember that the adjuster works for the insurance company, and their job is to close the claim for as little as possible.

If their offer barely covers the medical bills and doesn't even touch the lost wages, that's a major red flag. It may be time to get a professional opinion.

One might want to think about getting legal advice if:

- The insurance adjuster is dragging their feet, ignoring calls, or giving the runaround.

- The injuries are complex (like a concussion or spinal injury) and the long-term impact isn't clear yet.

- There is a feeling of being rushed or pressured into signing a settlement agreement.

Think of an attorney as an advocate. They can step in to handle the back-and-forth with the insurance company and all the legal paperwork. This frees up the individual to focus on what actually matters: their health and recovery.

Common Questions About Rear-End Collision Claims

When dealing with the fallout from a car accident, many questions can run through a person's mind. Here is some general information about common questions that arise during the settlement process.

Should I Take the First Settlement Offer?

The at-fault driver's insurance company may present a settlement offer pretty quickly. They might be hoping the injured party will take fast cash before knowing what their claim is really worth.

However, those initial offers are often based on an incomplete picture—perhaps just the initial ER bill and the car repair estimate. Before considering acceptance, it's important to have a complete understanding of all losses. This means all medical bills, any future treatment needed, and every dollar of lost income. Once an offer is accepted, the case is closed, and it's not possible to go back for more if another surgery is needed later.

How Is a Number Put on Pain and Suffering?

This is a very common question. There are no receipts for sleepless nights, chronic pain, or the frustration of not being able to pick up one's kids. That's what "pain and suffering" damages are for—to compensate for the very real, but non-financial, impact the crash has had on a life.

There isn't a magic formula, but one common starting point is the "multiplier method." This involves taking the total of concrete economic damages (like medical bills and lost wages) and multiplying it by a number, typically between 1.5 and 5. A higher multiplier may be used for more severe injuries, longer recovery times, and a greater disruption to daily life. It’s not an exact science, but it provides a reasonable baseline to start negotiations.

What if I Already Had a Bad Back (or Other Pre-Existing Condition)?

This is a source of anxiety for many people, but it doesn't have to be. Having a pre-existing condition does not automatically sink a claim. The insurance company may try to use it to lower the settlement, but the law does address this.

The legal concept at play is that the at-fault driver is responsible for making a condition worse. Perhaps someone had a manageable old back injury that the crash turned into a debilitating, surgical problem. The claim focuses on that aggravation of the prior injury. This is where a doctor's records become critical—it's necessary to clearly show a "before and after" picture of the person's health to isolate the harm the collision caused.

The core idea is simple: the person who caused the crash may be responsible for the new harm they created. That includes taking a stable, manageable condition and making it an active, painful problem.

How Long Do I Have to File a Claim in Oregon?

Time is a critical factor after an accident. Every state has a deadline for filing a personal injury lawsuit, known as the statute of limitations. In Oregon, an individual generally has just two years from the date of the accident to file.

If that two-year window is missed, the legal right to pursue compensation in court may be lost forever. It’s a harsh deadline, which is why it can be important to get legal advice and start the process well before time runs out.

At Bell Law, we understand how overwhelming this process can be. If you’re trying to make sense of your situation, our team is here to provide information and protect your rights. We’re committed to helping Oregonians seek the compensation they deserve. To get a clear picture of your options, visit us at belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.