Uninsured driver in accident: Your Guide to Coverage and Next Steps

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Uninsured driver in accident: Your Guide to Coverage and Next Steps

When the driver who hits you doesn't have insurance, your own policy can become a critical resource. One potential route to getting bills paid may be through your own Uninsured Motorist (UM) coverage. This type of coverage is designed for these situations—to cover medical costs and other damages when an at-fault driver has no insurance.

What an Uninsured Driver Accident Means for You

Any car wreck can be a major challenge. When you discover the other driver is uninsured, the situation can become more complex. Suddenly, there may not be an at-fault driver's insurance company to file a claim against, leaving you to wonder how you will cover your medical bills and car repairs.

This guide is here to provide general information for Oregon drivers navigating the aftermath of a crash with an uninsured motorist. While no two accidents are the same, knowing some basic steps may provide some clarity. We'll look at why your own insurance policy is so critical and how it can act as a safety net in these situations.

The Growing Risk on Oregon Roads

You might be surprised by the number of drivers on the road without insurance. It’s a nationwide issue, but the consequences are felt on local roads, from the streets of Portland down to Medford.

A recent study from the Insurance Research Council (IRC) estimated that 15.4% of drivers across the country were uninsured in 2023. That’s more than one in every seven drivers on the road. It's a statistic that highlights a potential risk for every responsible, insured person. You can find more information on the latest uninsured motorist rates.

This information underscores the importance of being prepared. Carrying the right insurance isn’t just about following the law; it's about protecting yourself and your family from the financial fallout that can result from someone else's actions.

Your First Line of Defense: Your Own Policy

If you are involved in a collision with an uninsured driver in Oregon, your own auto insurance policy can be a powerful tool. Two specific parts of your coverage are particularly relevant:

- Personal Injury Protection (PIP): This is mandatory coverage in Oregon. PIP is no-fault coverage that can pay for initial medical bills and a portion of lost wages, regardless of who caused the crash.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is the coverage that can step in when the at-fault driver has no insurance. It's designed to cover your losses when the other person has no insurance (uninsured) or not enough insurance (underinsured) to pay for all of your damages.

Handling an uninsured driver claim involves a shift in focus. Instead of interacting with the other driver's insurance company, you will likely be working with your own. The process involves documenting everything, promptly notifying your insurer, and understanding the limits and rules of your own policy. We'll break down these steps to provide a general roadmap.

Protecting Your Rights at the Accident Scene

The minutes right after a car crash can be a blur of confusion and adrenaline. It can be tough to think straight, and you might not even realize you're hurt. But what you do in this critical window—especially when the other driver has no insurance—can impact your ability to recover financially and physically.

Your first priority should be safety. If you can, get the cars out of traffic. Then check on everyone involved—your passengers, yourself, and the people in the other car. If there’s any question about injuries, even a slight one, call 911 immediately.

Always Seek a Medical Evaluation

Seeking a medical evaluation right away is important, even if you think you're fine. The shock of a crash can mask serious injuries like whiplash, concussions, or even internal bleeding that might not show symptoms for hours or days.

Delaying medical care presents a risk to your health, and it can also create an opportunity for insurance companies to argue that your injuries are not from the crash. When a doctor documents your condition on the same day as the accident, it creates a direct link that may be more difficult to dispute later. It is important to follow through on all appointments, prescriptions, and therapy sessions. That paper trail is a crucial part of your record.

Gather the Facts at the Scene

While you wait for the police, and only if you’re able, start gathering information. What you collect at the scene is the raw, unfiltered story of what happened. Having these details is a cornerstone of knowing what to do after a car accident in Oregon.

Your goal is to swap basic info with the other driver. It is often helpful to remain calm and stick to the facts—avoid apologizing or discussing who was at fault.

Here’s a checklist:

- Driver's Info: Their full name, address, phone number, and driver's license number.

- Vehicle Info: The make, model, color, and license plate of their car.

- Witnesses: If anyone saw what happened, politely ask for their name and number. An independent witness can be very helpful.

When they inform you they don't have insurance, you will know to turn to your own uninsured motorist (UM) coverage to handle this, so the information you gather is for your own insurance company.

Your Smartphone Is a Valuable Tool for Evidence

Your phone is an evidence-gathering machine. Use it. Take many photos and videos from every possible angle. This visual proof can speak volumes.

A picture can be worth a thousand words. Photos capture the immediate aftermath—the position of the cars, the extent of the damage, and the road conditions—in a way that words alone may not.

Be sure to capture:

- Damage to both cars (close-ups and wide shots).

- The overall scene, including skid marks, debris, traffic signals, and weather conditions.

- Any visible injuries, like bruises or cuts.

- The other driver’s license plate.

This collection of images creates an objective record of the scene.

Get a Police Report, No Matter What

In Oregon, you are required to file a report if the crash causes an injury or more than $2,500 in damage to any single vehicle. However, even for a minor collision, it is a good practice to call the police and get an official report filed when the other driver is uninsured.

The police report is an impartial summary created by a trained officer. They will document the scene, note what each driver and witness said, and may issue a ticket or give their initial assessment of fault. This report adds a layer of official credibility to your story when you file a claim with your own insurance company. It is one of the strongest pieces of evidence you can have.

What Happens When You Use Your Own Policy After an Uninsured Motorist Crash?

Discovering that the driver who hit you has no insurance can be a sinking feeling. Without their insurance to pay for your injuries and car repairs, what are your options?

The answer may be in your own auto policy. This is the exact situation your own auto policy is designed to handle.

Instead of dealing with the other driver's insurance company, the focus shifts to yours. Your first step is to notify your own insurer about the accident and the other driver's lack of insurance. This gets the ball rolling on a claim under your own policy.

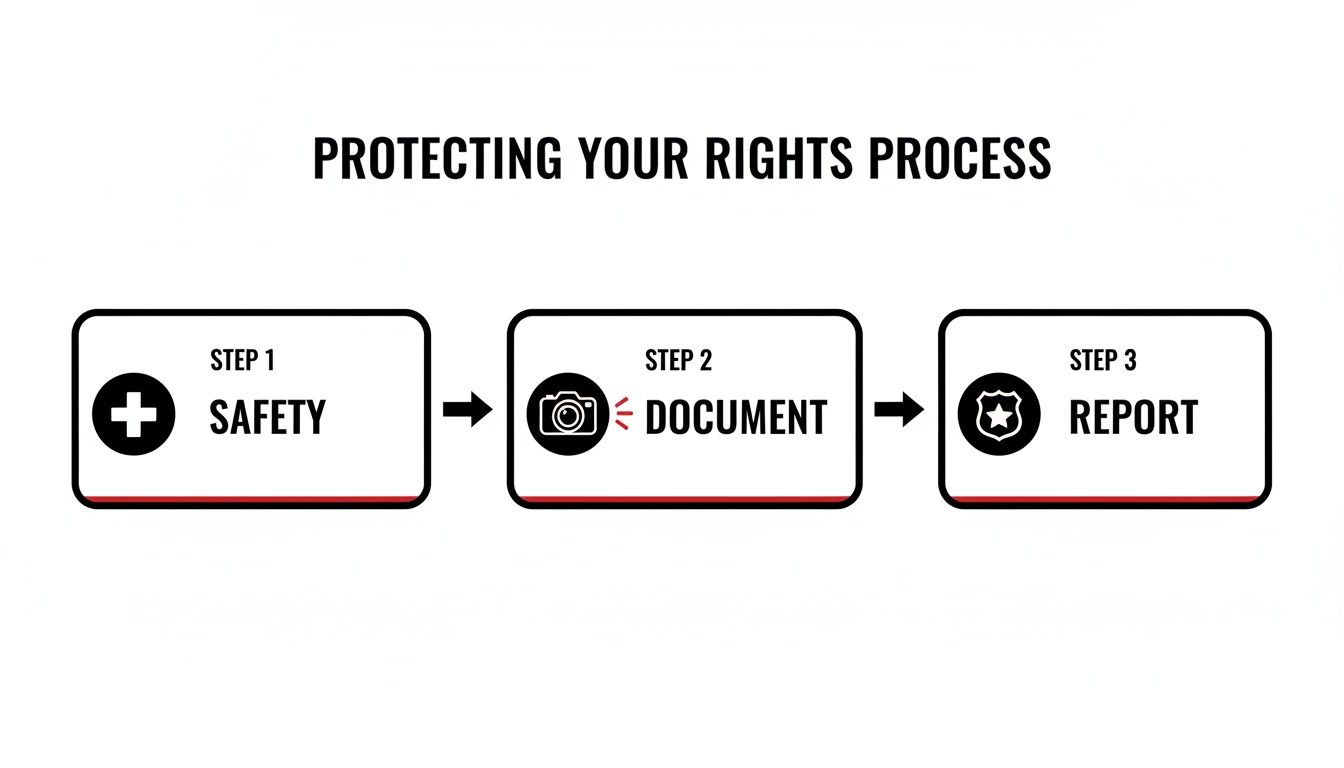

The core process remains the same: secure your safety, document everything, and report the crash. These steps are always important, but they become absolutely critical when you're dealing with an uninsured driver.

This simple flow—Safety, Documentation, Reporting—is your roadmap. It helps build a solid foundation for the insurance claim that comes next.

Your own auto policy likely contains a few different types of coverage. Let's break down the key players in an uninsured motorist situation in Oregon.

Understanding Your Oregon Auto Insurance Coverage

This table breaks down the typical coverages on an Oregon auto policy and explains their specific role when the at-fault driver is uninsured.

| Personal Injury Protection (PIP) | Your initial medical bills and a portion of lost wages, regardless of who is at fault. | This may be your first line of defense. It can pay for immediate medical needs without waiting to determine fault, helping you get the care you need right away. |

| Uninsured Motorist (UM) | Your damages (medical bills, lost wages, pain and suffering) when the at-fault driver has no insurance. | This coverage can stand in for the at-fault driver's missing liability insurance. You make a claim against your own UM policy to cover your losses. |

| Underinsured Motorist (UIM) | The difference between your damages and the at-fault driver's low policy limits. | This may come into play if the at-fault driver has insurance, but not enough to cover all your damages. Your UIM coverage can potentially bridge that gap. |

| Collision Coverage | Damage to your own vehicle from a collision, regardless of fault. | If you have collision coverage, you can use it to repair your vehicle, subject to your deductible. Your insurer may try to recover that deductible from the uninsured driver later. |

Having these coverages in place is one of the best ways to protect yourself financially from the choices of other drivers.

Your First Line of Defense: Oregon PIP Coverage

In Oregon, every auto policy is required to have Personal Injury Protection (PIP). It can be thought of as your medical safety net. It's "no-fault," which means it can cover your initial medical bills and some lost wages right away, no matter who caused the crash.

This is a significant benefit. You don't have to wait for a long investigation to conclude before you can see a doctor. PIP can help ensure you get the treatment you need while the rest of the claim gets sorted out.

The Heavy Hitter: Uninsured Motorist (UM) Coverage

While PIP takes care of immediate medical bills, Uninsured Motorist (UM) coverage is what can tackle the bigger picture. In essence, your UM coverage steps into the shoes of the insurance policy the at-fault driver was supposed to have.

Depending on your specific policy, UM coverage can help pay for a wide range of losses, including:

- Medical bills that go beyond your PIP limits, including things like surgery or physical therapy.

- Future medical care if your injuries require long-term treatment.

- Lost wages and loss of future earning capacity if you can't work.

- Pain and suffering and other non-economic damages that impact your quality of life.

Figuring out exactly how your UM policy works is crucial.

Key Takeaway: An Uninsured Motorist claim is different. You aren't pursuing a claim with a stranger's insurance company; you're making a claim with your own insurer, explaining that another driver was at fault but couldn't pay for the harm they caused.

Policy Limits and Underinsured Motorist (UIM) Coverage

The amount of money available through your UM coverage is capped by your policy limits. It is vital to know what those limits are. Spending a few minutes understanding insurance policy limits before an accident happens can save a world of financial stress later.

A close cousin to UM coverage is Underinsured Motorist (UIM) protection. This applies when the other driver does have insurance, but their policy limits are too low to cover all your bills. Once their insurance pays out its maximum, your UIM coverage may kick in to cover the rest, up to your own policy limit.

To proceed with either a UM or UIM claim, you'll need to demonstrate two things to your insurer: that the other driver was at fault, and the full extent of your damages. This means gathering all your medical records, pay stubs, and any other evidence that tells the complete story of your losses.

The Option of Filing a Lawsuit Against the Driver

While using your own Uninsured Motorist (UM) coverage is a common path after being hit by an uninsured driver, it's not the only option. You also have the right to file a personal injury lawsuit directly against the person who hit you. This takes the matter out of the insurance world and into the courtroom.

In a lawsuit, you are taking formal legal action to prove the other driver was negligent and is responsible for your injuries and all the associated costs. It is a different arena from dealing with an insurance adjuster, with its own rules, procedures, and standards of proof.

But winning the case is only half the battle. A practical question to ask is: even if I win, can I actually collect the money?

The Practical Challenge of Collecting a Judgment

The reason a driver may not have insurance is often because they cannot afford it. This is a significant hurdle you may face if you decide to sue.

When you win a lawsuit, a judge issues a judgment in your favor. This is a formal court order declaring that the defendant legally owes you a specific amount of money. The problem is, a driver who cannot pay for a basic liability policy likely does not have a savings account or valuable assets available to pay that judgment.

You could spend months—or even years—in litigation, win a significant verdict, and end up with a piece of paper. It is a tough reality to face.

A judgment is the court's official word that someone owes you money. It is not, however, a check in your hand. The burden of actually collecting that money often falls on the person who won the judgment.

Before heading down this road, it's critical to have a realistic consideration of whether the at-fault driver has any ability to pay.

Potential Methods for Collecting a Judgment

Even if the driver seems to have no assets, there are a few legal tools that can sometimes be used to enforce a judgment. None of them are quick or easy, and their success depends entirely on the defendant's financial situation.

A few collection methods include:

- Wage Garnishment: A court order can force the defendant's employer to take money directly out of their paycheck and send it to you. State and federal laws cap how much can be taken, so this can be a very slow process.

- Property Liens: If the person owns a house or land, a lien can be placed on it. This does not get you paid immediately, but it means if they ever sell or refinance the property, your judgment would need to be paid off from the proceeds. This only works, of course, if they own property with equity.

- Bank Account Levy: This is a court order to seize funds straight from the defendant's bank account. But it is only successful if there is money in the account on the day the levy is executed.

Each of these strategies requires more legal work and court filings long after you've won your case. They offer no guarantees.

Time Limits for Filing a Lawsuit in Oregon

If you are considering a lawsuit, you cannot wait. Oregon has a strict statute of limitations, which is a legal deadline for filing a personal injury case. If you miss that window, your right to sue may be lost forever, no matter how strong your case is.

The specific deadlines can be complex, so it's worth getting familiar with the Oregon personal injury statute of limitations.

Understanding these timelines is crucial as you weigh your next steps. An attorney can help you evaluate whether a lawsuit makes sense in your situation and help ensure you don't forfeit your rights by missing a critical deadline.

How a Car Accident Attorney Can Help Navigate Your Claim

When an uninsured driver causes a crash, the road to compensation can feel complicated and unfair. It is natural to think that filing a claim with your own insurance company would be simple, but that is not always the case. This is where consulting a legal professional can make a difference.

A car accident attorney can take over the heavy lifting. They can handle intricate details and paperwork, letting you pour your energy into what truly matters: your recovery. They can act as your dedicated representative, managing communications so you don’t have to.

They can bring order to the chaos by organizing the facts, building a clear narrative for your claim, and making sure every deadline is met.

Managing Communications and Your Claim

One of the biggest reliefs for many people is having an attorney take over all the calls and emails with the insurance company. Even when it is your own insurer you are dealing with for a UM claim, their goals and yours might not align. Their priority is to protect their bottom line, and adjusters are trained to minimize payouts.

Your lawyer acts as a crucial buffer. They can ensure that every piece of information given to the insurer is accurate, complete, and framed to fully support your claim. This step can head off misunderstandings or misinterpretations that could undermine an otherwise valid claim.

Building a Comprehensive Case for Damages

Proving the full extent of your losses after an uninsured driver in accident is about much more than just the initial medical bills. An attorney knows how to present the complete picture of what an accident has cost you.

This involves meticulously gathering and organizing evidence, which often includes:

- Medical Documentation: Collecting every record from doctors, hospitals, specialists, and physical therapists to build a clear timeline of your injuries and treatment.

- Economic Losses: Calculating not just the wages you've already lost, but also projecting your future loss of earning capacity if your injuries will have a lasting impact on your career.

- Future Medical Needs: Consulting with medical experts to determine the costs of future surgeries, long-term therapy, or essential medical devices.

- Non-Economic Damages: Documenting the very real, but less tangible, impact on your life—the pain, suffering, and emotional distress that are a huge part of your ordeal.

It is about building a strong case that shows the true, full scope of everything you have been through.

An attorney's job is to tell your complete story through documented evidence. They assemble the medical records, financial statements, and expert opinions needed to demonstrate the full impact the accident has had on your life.

Negotiating with Insurance Providers

Once all the evidence is in place, negotiations can begin. An experienced attorney has seen many of the tactics insurance adjusters use to downplay injuries or dispute costs. They come to the table prepared, arguing from a position of strength backed by solid proof.

Just having a lawyer on your side signals to the insurance company that you are serious about getting a fair settlement based on the policy you paid for. The process involves negotiation, strategic counter-offers, and a detailed defense of your claim, all supported by the evidence that has been collected.

Protecting You from Critical Mistakes

The claims process can have many potential missteps, especially after an accident with an uninsured driver. An attorney can help you by managing the strict deadlines, from the state’s statute of limitations to the specific deadlines buried in your own insurance policy for filing a UM claim.

They can also protect you from the temptation of a quick, lowball settlement. Insurers may present an early offer before you know the full extent of your injuries or what future medical care you will need. An attorney can properly evaluate that offer against the potential value of your claim, helping you avoid accepting a few thousand dollars now when you might need a much larger amount for care down the road.

Common Questions About Uninsured Driver Accidents

Getting hit by someone without insurance brings a wave of questions and stress. It is a frustrating and unfair situation to be in. Let's walk through some of the most common questions from Oregon drivers facing this issue.

What Happens if I Was Partially at Fault for the Accident in Oregon?

It is not uncommon for an accident to be seen as having shared responsibility. Oregon law has a specific way of handling this.

The state operates under what’s called modified comparative negligence. In simple terms, this means you may still recover money for your injuries even if you were partially to blame. However, your final compensation could be reduced by your percentage of fault. For example, if you're found to be 20% at fault, your total award may be cut by 20%.

There's a critical threshold: if you're found to be more than 50% at fault, you may be barred from recovering anything from the other driver. This same logic can be applied by your own insurance company when you make a UM claim, so it is a crucial factor.

Will My Insurance Rates Go Up if I File a UM Claim?

This is a top concern for many people. You pay for this coverage, so why should you be penalized for using it when someone else caused the crash?

Oregon law offers some consumer protection in this area. Your insurance company is generally prohibited from increasing your rates or dropping your policy for an accident that wasn't your fault. Since an uninsured motorist (UM) claim is, by definition, for a crash caused by the other driver, filing one should not trigger a rate hike on its own.

That said, insurance pricing is complex, and many factors can affect premiums over time. Reviewing your policy documents or speaking with your insurance agent can provide clarity on how your specific insurer handles UM claims.

What Is the Statute of Limitations for an Uninsured Motorist Claim?

This is a legal detail that cannot be ignored. A statute of limitations is a hard deadline for filing a lawsuit. If it is missed, you could lose your right to pursue compensation forever.

In Oregon, the general deadline for a personal injury lawsuit after a car crash is two years from the date you were injured. It is a very strict deadline.

However, the situation can be tricky. Your UM claim is based on your insurance policy, which is a contract. That contract might have its own internal deadlines for filing a claim or demanding arbitration that could be shorter than the two-year legal deadline. It is important to be aware of both to protect your rights.

What if the Uninsured Driver Was Driving Someone Else's Car?

This scenario adds another layer of complexity. If you find out the driver was uninsured but the car belongs to someone else, the focus can shift.

In Oregon, insurance generally follows the car, not the driver. So, the investigation will pivot to a few key questions:

- Was the vehicle itself insured? If the car's owner has a policy, that could become the primary source for your claim.

- Did the driver have permission to be using the car? Most policies cover the owner and anyone they give permission to drive their vehicle.

If the owner’s policy is active and covers the incident, you could file a claim against it directly. This might allow you to avoid using your own UM coverage entirely. It often becomes a puzzle of untangling different policies to see which one applies, showing how a simple crash can get complicated fast.

Trying to piece everything together after a crash with an uninsured driver is tough. If you have questions about your specific situation, the team at Bell Law is here to help you find your footing. We help Oregonians understand their rights and figure out the best path forward. To see how we can help, please visit us at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.