What Is Premises Liability Law Explained

"I was satisfied once John Bell took over my case."

"Communication was always timely."

What Is Premises Liability Law Explained

At its heart, premises liability law is pretty simple: property owners have a responsibility to keep people safe on their property. It’s the legal reason a grocery store manager rushes to put up a “wet floor” sign after a spill. This area of personal injury law ensures that if you get hurt because of a dangerous condition, the person in control of that property can be held responsible.

What's a Property Owner's Real Responsibility?

When we talk about premises liability, we're talking about a legal duty. A property owner or a tenant leasing the space has a responsibility to maintain a reasonably safe environment for anyone who comes onto the property. If they fail in that duty and someone is injured by a hazard—think a rickety staircase, an unlit parking lot, or a patch of black ice on the walkway—they can be held accountable.

This responsibility goes beyond just accidental slips and falls. The law is evolving, and courts are now more frequently holding property owners liable for criminal acts that happen on their property, like muggings or assaults. If the crime was foreseeable and the owner didn't provide adequate security (like working locks or proper lighting), they may be on the hook.

This expansion gets to the core of the law's purpose: to push property owners to be proactive about finding and fixing dangers before someone gets hurt.

The central idea is that the person or entity in control of a property is in the best position to discover and fix potential hazards. This gives them a clear legal obligation to protect visitors from unreasonable risk.

Why This Law Matters in Your Everyday Life

You might not think about it, but premises liability law affects you all the time. It sets the standard of safety you can expect whether you're shopping, visiting a friend, or even just walking through a public park.

This legal protection applies almost everywhere you go, including:

- Commercial properties like grocery stores, shopping malls, and restaurants.

- Private homes and apartment complexes.

- Public spaces like parks, government buildings, and parking garages.

Ultimately, premises liability law is a foundational part of public safety. It establishes a clear and enforceable expectation that owners must put the well-being of their visitors first.

Understanding a Property Owner’s Duty of Care

At the heart of every premises liability case is a legal concept called the duty of care. This isn't some rigid, universal rule. Instead, it’s a flexible obligation that shifts depending on why someone is on a piece of property. The best way to think about it is as a sliding scale of responsibility. The property owner’s legal duty to keep someone safe from harm goes up or down based on that person's status as a visitor.

Getting a handle on this concept is the first step in figuring out if you have a valid claim. A shopkeeper, for example, owes a much higher level of care to a paying customer than you might owe to a friend visiting your home. And the duty owed to a trespasser is different altogether.

This hierarchy is the framework courts use to evaluate these kinds of injury claims. Let's break down how this duty is established.

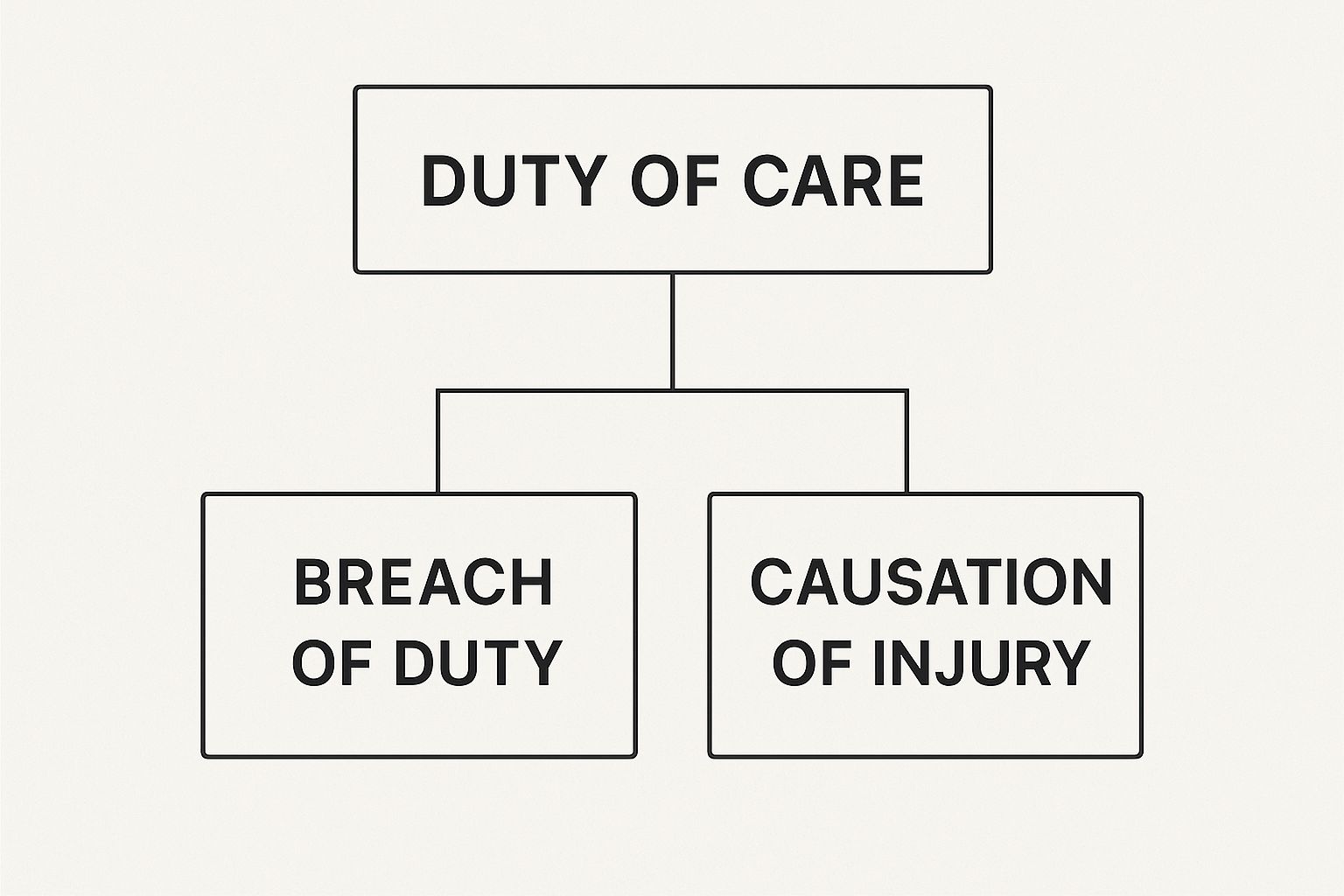

As you can see, everything flows from that initial duty of care. If a property owner doesn't legally owe you a duty in the first place, the other parts of a claim simply can't exist. So, let’s look at the three main types of visitors that determine the level of that duty.

The Three Categories of Visitors

Oregon law, like the law in most states, sorts visitors into three distinct groups. Each group is owed a specific level of care from the property owner.

- Invitees: This is the category with the highest level of protection. An invitee is someone invited onto the property for the owner's financial or business benefit. Think of shoppers in a retail store, diners in a restaurant, or clients visiting an office. For invitees, the owner has a duty to actively inspect the premises for hidden dangers, repair them, and post clear warnings about any hazards that can’t be fixed right away.

- Licensees: A licensee is essentially a social guest—a friend you invite over for a barbecue or a family member stopping by. The property owner's duty here is to warn the licensee of any known dangers. They don't have to go searching for unknown problems, but if they know a handrail is loose, they have to give their guest a heads-up.

- Trespassers: A trespasser is someone who enters a property without any permission. In general, property owners owe almost no duty to protect a trespasser from getting hurt. The main rule is that the owner can't intentionally or recklessly injure them.

The most important thing to remember is this: your reason for being on the property directly determines the owner's legal obligation to ensure your safety. An injury that happens while you're shopping is treated very differently by the law than one that occurs when you're cutting across someone's private yard.

Common Accidents That Lead to Liability Claims

When you hear "premises liability," the classic "slip and fall" accident probably comes to mind. It's a textbook example for a reason—many injuries happen this way, often highlighting something as simple as the need for proper anti-slip floor mats.

But the world of premises liability is much bigger than just a wet floor. At its core, any injury caused by a property owner's failure to keep their space reasonably safe can be grounds for a claim. These incidents show the direct line between an owner's neglect and a visitor's injury.

A property owner’s responsibility isn't just about fixing obvious problems; it's about anticipating and preventing foreseeable dangers before they can harm someone. An unaddressed hazard is a potential lawsuit waiting to happen.

Everyday Scenarios That Cause Serious Injuries

Beyond a simple puddle, countless other hazards lead to serious injuries and valid legal claims. These accidents can happen anywhere—from a sprawling big-box store to a quiet residential backyard—and the consequences can be life-altering.

Here are a few common examples that paint a clearer picture:

- Falling Merchandise: You’re walking through a warehouse store when a poorly stacked pallet of heavy boxes suddenly topples over, striking you. This is a clear-cut case where the store’s failure to secure its inventory directly caused harm.

- Swimming Pool Accidents: A child tragically wanders into a neighbor’s unfenced pool. The lack of a legally required safety barrier, like a fence with a self-latching gate, created an obvious and preventable danger.

- Dog Bites: You're visiting a friend when their dog, which they know has a history of aggression, bites you without warning. The owner's failure to restrain the animal or at least warn you of the risk could make them liable for your injuries.

- Inadequate Security: Someone is assaulted in a dimly lit apartment complex parking garage where the security cameras have been broken for weeks. Here, the property owner’s failure to provide basic safety measures like adequate lighting and working cameras could be seen as negligence.

Each of these situations shows how an owner's carelessness can lead to very real physical and emotional trauma, forming the foundation of a premises liability claim.

How to Prove Negligence in a Premises Liability Case

Winning a premises liability case is about more than just showing you were hurt on someone else’s property. The entire claim hinges on your ability to prove the property owner was negligent. In legal terms, this means they failed to use reasonable care to keep their property safe, and that failure led directly to your injury. Honestly, this is often the toughest hurdle to clear.

To build a strong case, you have to establish four specific elements. Think of them like four legs on a chair—if even one is missing, the whole thing comes crashing down. These pieces must connect logically to tell the full story of how the owner’s carelessness caused your harm.

The Four Elements of a Negligence Claim

Let's walk through the four points you must prove, using a common scenario to make it clear: a tenant tripping on a broken stair in their apartment building.

Duty of Care: First, you have to show the property owner actually owed you a legal duty to keep you safe. In our example, a landlord absolutely has a duty to maintain safe common areas like stairwells for their tenants. The law sees tenants as invitees, who are owed the highest duty of care.

Breach of Duty: Next, you need to prove the owner failed in that duty. This means showing they knew about the hazard—or reasonably should have known—and did nothing about it. If other tenants had complained about that wobbly stair for weeks and the landlord never sent someone to fix it, that’s a clear breach.

Causation: This is the crucial link. You must connect the owner's failure directly to your injury. The evidence needs to demonstrate that the broken stair itself was the direct cause of your fall and the injuries that followed, not something else.

Damages: Finally, you must show you suffered actual, measurable harm. This isn't just about the injury itself, but the financial and personal impact. Evidence of damages includes things like medical bills, lost income from being unable to work, and even compensation for your pain and suffering.

Proving all four elements is non-negotiable. Bureau of Justice statistics reveal that only about 39% of premises liability cases that go to court succeed, which really highlights how high the bar is set. To win, you must draw an undeniable line from the owner's breached duty to your specific injuries.

Evidence is the lifeblood of any premises liability claim. You need solid documentation, from photos of the hazardous condition taken right after the incident to every single medical record.

For property owners, keeping meticulous records is just as critical. A good guide to an incident management system can be invaluable for ensuring every event is properly documented, protecting all parties involved. Given how much is at stake, many people find that hiring a personal injury attorney is the best way to navigate these complex requirements and build the strongest case possible.

How Insurance Plays a Role in Liability Claims

When an accident happens on someone else's property, the conversation almost always turns to insurance. Think of it as the financial backstop for every premises liability claim. Without it, property owners could face financial ruin from a single lawsuit.

For homeowners, this safety net usually comes from their standard home insurance policies. For businesses, a Commercial General Liability (CGL) policy serves the same purpose. These policies are designed to handle the heavy lifting of a claim, covering everything from the owner's legal defense fees to the injured person's medical bills and any final settlement.

The Financial Motivation for a Safe Property

Insurance isn't just about paying for mistakes after they happen. It actively encourages property owners to keep their spaces safe. Insurance companies reward owners who take proactive safety measures with lower premiums. On the flip side, a history of claims can cause premiums to skyrocket, or even make it impossible to get coverage at all.

This creates a powerful financial incentive to prevent accidents before they occur. It's not just a legal duty; it's smart business.

The stakes are enormous. The global liability insurance market is projected to hit $524.66 billion by 2034. Despite this, a shocking 40% of small businesses are rolling the dice with no insurance at all. This is incredibly risky, especially when you consider that up to 53% of them face lawsuits each year. (For more on these numbers, check out the liability insurance statistics on feather-insurance.com).

At the end of the day, insurance does more than just cover accidents. It builds a financial ecosystem that rewards prevention. A safe property isn't just a responsible one—it's an insurable and financially sound one.

Once a claim is filed, navigating the process with an insurance company can feel like a maze. Knowing how to negotiate an insurance settlement is crucial for everyone involved to reach a fair resolution.

Common Questions About Premises Liability

When you're dealing with an injury, the legal side of things can feel overwhelming. People often have very specific questions about how premises liability works in the real world. Here are some straightforward answers to the questions we hear most often.

How Long Do I Have to File a Premises Liability Claim?

Every state sets a hard deadline for filing a personal injury lawsuit, and this is known as the statute of limitations. For most premises liability cases, you typically have about two to three years from the date you were injured to file your claim.

This deadline is absolutely critical. If you miss it, even by a single day, the court will almost certainly refuse to hear your case. It’s also why moving quickly is so important—it helps preserve crucial evidence like security camera footage or the memories of witnesses before they fade or disappear.

What if I Was Partially at Fault for My Own Injury?

Even if you think you might have been partially to blame, you can often still recover compensation for your injuries. Most states, including Oregon, use a system called comparative negligence.

This just means your final settlement is reduced by whatever percentage of fault is assigned to you. For example, if a jury decides you were 20% responsible for the accident, your total compensation would simply be reduced by 20%.

Be aware, though, that some states have a stricter "modified" rule. In those places, if you are found to be 50% or more at fault, you could be completely barred from receiving any compensation.

Can I Sue a Government Entity for an Injury on Public Property?

Yes, but it's a completely different ballgame. Suing a city for an injury in a public park or a state agency for a slip and fall in a government building involves much stricter rules and far shorter deadlines.

You usually have to file a formal “notice of claim” with the government entity very quickly—sometimes in as little as 90 days after the incident. For more answers to common questions, check out our personal injury FAQs.

A “wet floor” sign doesn’t automatically get a property owner off the hook. A court will still look at whether the warning was truly adequate. Was the sign easy to see? Could the owner have done more to fix the underlying danger instead of just posting a sign?

If you’ve been hurt on someone else's property and feel lost about what to do next, the team at Bell Law is here to help. We walk Oregon residents through every step of the process, making sure you get the expert legal guidance and personal support you need.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.