What Is Temporary Total Disability in Oregon Explained

"I was satisfied once John Bell took over my case."

"Communication was always timely."

What Is Temporary Total Disability in Oregon Explained

When a work injury leaves you unable to earn a paycheck, the financial stress can be as overwhelming as the physical pain. This is where Temporary Total Disability (TTD) may come in. It's a type of workers' compensation benefit that can act as a financial lifeline, replacing a portion of lost wages while an individual is temporarily unable to work at all due to a covered injury.

Think of it this way: income is the bridge that helps cover monthly expenses. A serious injury can damage that bridge. TTD benefits can be the support beams that allow an individual to focus on getting better without the immediate worry of a complete loss of income.

Decoding Temporary Total Disability Benefits

TTD is a core component of the broader workers' compensation benefits system, which is a form of insurance that may cover medical care and lost wages for employees hurt on the job.

Breaking Down the Key Terms

To get a handle on what TTD means, it can be helpful to look at each word in its name, as they have specific meanings in this context.

- Temporary: This indicates the condition isn't considered permanent. The general expectation is that with treatment and time, the individual may be able to return to work.

- Total: This is a crucial part. It generally means a doctor has officially stated that the injury prevents the person from performing any kind of work, including light-duty or modified tasks.

- Disability: This simply refers to the fact that a medical professional has certified the injury is limiting an individual's ability to work.

Putting it all together, TTD is for the specific period when a doctor places an individual on a "no work" status to focus solely on recovery.

At its heart, TTD provides a financial safety net. It allows an individual to concentrate on medical care without the crushing weight of a zero-income household, which is fundamental to how the workers' compensation system is designed to function.

To help quickly grasp the main ideas, this table breaks down the core components of TTD.

TTD Core Concepts at a Glance

| Wage Replacement | An individual may receive a portion (often two-thirds) of their average weekly wage. | This is the direct financial support that may be received while out of work. |

| Medical Authorization | Eligibility is often determined by an authorized doctor's orders. | The doctor's note stating an individual cannot work is a key trigger for TTD benefits. |

| Temporary Status | Benefits are not permanent; they generally end when an individual can return to work. | This distinguishes TTD from permanent disability benefits. |

| No Work Capacity | The individual is considered completely unable to perform any job duties. | This separates TTD from partial disability, where someone might work in a limited role. |

This table provides a snapshot, but it's also helpful to see how TTD fits into the larger system.

How TTD Fits Into the Bigger Picture

TTD is just one of several types of disability payments. It is important not to confuse it with others, like Temporary Partial Disability (TPD). TPD might apply if an individual can go back to work with restrictions—perhaps fewer hours or lighter tasks—but is earning less than before the injury. TTD is for situations where the individual cannot work at all.

On a broader scale, companies often track safety metrics related to lost workdays, like the DART Rate (Days Away, Restricted, or Transferred). This gives them a way to measure the impact of workplace injuries. A useful DART Rate Calculator can show how these incidents are tallied.

Understanding TTD is an important first step in navigating the workers' comp system after an injury. Knowing your rights and what to expect can make a difference during a difficult time.

How Do You Qualify for TTD Benefits?

Figuring out if you may qualify for Temporary Total Disability (TTD) benefits involves a couple of key questions.

First, did the injury happen at work or because of work? Second, has a doctor officially taken you off work completely because of that injury? If both of those conditions are met, it is a step in the right direction.

The Work-Related Injury Requirement

This is the foundation of any workers' compensation claim. A common legal phrase is that the injury must "arise out of and in the course of employment." It sounds a bit formal, but the idea is straightforward.

- "In the course of employment" is all about the when and where. Was the individual on the clock, at the job site, or somewhere they were required to be for their job when the injury happened?

- "Arising out of employment" looks at the why. Was the injury caused by a risk connected to the job? This relates to the specific tasks performed every day.

A roofer falling off a ladder is a common example of a work-related injury. But some situations can be less clear. What about a repetitive strain injury that builds up over months, or an accident that happens while driving to a client meeting? Each case is often looked at individually, based on its specific details and state laws.

The Doctor's Orders: Medical Certification

This is the second, non-negotiable piece of the puzzle. An individual cannot just feel unable to work; their authorized treating physician generally has to make it official. The physician must provide clear, written documentation stating that the individual is completely unable to perform any work while they recover.

This doctor's note is what puts the "total" in Temporary Total Disability. It’s the official signal to the insurance carrier that wage replacement benefits may be needed because the individual is medically sidelined.

A doctor's certification isn't just a suggestion—it's critical evidence that can confirm an inability to work. Without that medical order taking an individual off duty, TTD benefits may not start.

Keep in mind, this is often not a one-and-done deal. The doctor will likely re-evaluate the condition at follow-up appointments. As the condition improves, the doctor might change the work status, which would then affect benefits.

Tying It All Together: Injury, Doctor, and Benefits

So, how do these two requirements work together? It’s a logical progression. A work-related injury gets the ball rolling, but it’s the medical documentation that truly unlocks potential eligibility for TTD.

Here's the step-by-step connection:

The Injury: An individual gets hurt in an incident connected to their job.

Medical Care: They see an authorized doctor for treatment.

Doctor's Evaluation: The physician assesses the injury and how it impacts the ability to function.

The "No Work" Order: If the injury is severe enough, the doctor formally takes the individual off all work duties.

Eligibility Unlocked: This medical order, combined with the accepted work injury, creates the basis for a TTD claim.

This two-part system is designed to ensure TTD benefits go to people who genuinely cannot work at all while they focus on getting better.

How TTD Benefit Payments Are Calculated

When an injury keeps someone from working, a common question is, "How will I pay my bills?" Understanding how replacement income gets calculated is crucial, and it all revolves around a specific, state-regulated formula.

The starting block for this process is a number called the Average Weekly Wage (AWW). It can be thought of as a financial snapshot of what an individual was typically earning before getting hurt. This AWW figure is the foundation for everything else.

Determining Your Average Weekly Wage

To find the AWW, the insurance company will look back at a pay history for a set period leading up to the injury. The idea is to get an accurate picture of the regular weekly income.

It’s not just about a base salary or hourly pay. The calculation often includes other earnings that were part of regular compensation. Things like:

- Overtime hours consistently worked

- Bonuses received

- Sales commissions

The specific rules for how far back to look and exactly what income counts can be complicated, but once that AWW number is determined, the rest of the math can begin.

The Standard TTD Benefit Formula

Once the AWW is established, the insurance company applies a set percentage to it to determine the weekly benefit amount. In many places, including Oregon, that rate is two-thirds (or 66.67%) of the AWW.

This means a TTD check will not fully replace an old paycheck. Instead, it’s a substantial portion designed to help cover living expenses while a doctor has the individual off work.

The basic formula is: Average Weekly Wage (AWW) x 66.67% = Your Weekly TTD Benefit. This is the core calculation that provides financial support during recovery.

For example, if an AWW was calculated to be $900, the benefit would be $900 multiplied by 0.6667, which comes out to about $600 per week. While that's the general rule, a couple of other key factors come into play.

State Maximum and Minimum Benefit Levels

To keep the system balanced, states set both a ceiling and a floor for TTD payments. These maximum and minimum benefit levels are usually updated each year to keep up with economic shifts.

- Maximum Benefit: This is the absolute highest amount anyone can receive per week, no matter how high their AWW was. It's a cap that helps manage the overall costs of the workers' compensation system.

- Minimum Benefit: This is a safety net. It ensures that even lower-wage workers receive a base level of support.

So, if 66.67% of an AWW is more than the state maximum, the payment gets reduced to that maximum amount. On the flip side, if the calculated benefit is less than the state minimum, it may be bumped up to that floor.

These rates aren't set in stone forever. For example, it’s common for states to adjust benefits based on wage growth. To see this in action, you can look at how California's 2026 temporary disability rates are set to increase to help benefits keep better pace with the rising cost of living. This just shows how workers' compensation systems may adapt over time.

How Long Do TTD Benefits Last?

One of the first questions on an injured worker's mind might be, "How long will these checks keep coming?" It’s a completely valid concern. When someone can't work, financial stability is everything. The key thing to remember is that Temporary Total Disability (TTD) benefits are, by their very nature, temporary. They are designed to bridge a specific gap in time, and their duration is tied directly to medical recovery.

There's no set number of weeks or months. The timeline is dictated by milestones in the healing process, as documented by the treating physician. Think of TTD as a support system meant to carry an individual from the day of injury until they are medically cleared to get back to work in some form.

The Turning Point: Maximum Medical Improvement

A critical moment in any TTD claim is when an individual reaches what's called Maximum Medical Improvement (MMI). This isn't a legal term decided by a lawyer or insurance adjuster; it’s a medical judgment made by a doctor.

MMI means the work-related injury or illness has stabilized. In the doctor's expert opinion, the condition is not expected to get significantly better, even with more treatment. The individual has essentially reached a plateau in their recovery.

Reaching Maximum Medical Improvement is the most common reason TTD benefits end. It signals a move out of the active healing phase and into managing a stable, long-term condition.

Once MMI is reached, the focus of the workers' comp claim often shifts. The conversation may move from temporary support to evaluating if there is any permanent impairment or figuring out long-term capacity to work. This marks the end of the "total" disability period.

Other Reasons TTD Payments Can Stop

While reaching MMI is a major factor, it's not the only thing that can end TTD benefits. Because these payments are tied to the ability to work, they can stop for a few other common reasons.

Here are some other triggers that can conclude TTD payments:

- A Full Return to Work: The doctor clears the individual to go back to their old job with no restrictions.

- A Return to Modified Duty: The physician says the individual can work, but with specific limitations (like no lifting more than 20 pounds). If an employer offers a job that fits those restrictions, TTD often stops.

- Refusing a Suitable Job Offer: If a doctor releases an individual to light or modified duty and the employer makes a valid job offer within those limits, turning it down can jeopardize benefits.

The bottom line is that TTD is for the time an individual is medically certified as completely unable to work due to the injury.

What to Expect for Recovery Time

So, how long does TTD actually last? It can vary dramatically based on the injury, the part of the body affected, and even the industry of work. While every case is different, national data gives us a general idea.

A 2023 analysis of temporary disability duration looked at nearly 273,000 claims and found the average time off work was 94 days. But that average hides a lot of variation. For example, construction workers were out for an average of 116 days. The injury itself is the biggest factor—injuries to the nervous system averaged 264 days of recovery, while sprains were closer to 53 days.

To give you a clearer picture, here’s a look at how different factors can influence recovery timelines.

General Factors That May Influence Recovery Time

| Industry | Construction & Utilities: 116 | Higher-risk jobs may involve more severe injuries, leading to longer recovery. |

| Injury Type | Nervous System: 264 | Complex injuries involving nerves or the spine may require extensive healing time. |

| Injury Type | Sprains: 53 | Soft-tissue injuries, while painful, generally have a shorter recovery path. |

| Body Part | Head/Neck: 140+ | Injuries to critical areas like the head and neck are treated with caution. |

| Body Part | Lower Back: 100+ | Back injuries can be complex and may require significant time for rehabilitation. |

These numbers help set realistic expectations, but remember, they are just averages. Each personal recovery journey is unique. The doctor's medical opinion is what truly guides how long TTD benefits may be received while an individual focuses on getting better.

Navigating the Workers' Compensation Claim Process

When you get hurt on the job, the road ahead can feel uncertain. Understanding the actual steps involved in a workers' comp claim can make a difference, turning a confusing process into a more manageable one. It all starts the moment an injury happens.

Think of it like a roadmap. From the initial paperwork to the insurance company's decision, there are clear stages. Let's walk through what one can generally expect when filing for temporary total disability benefits.

The First Steps After an Injury

What you do right after a work injury is critical. The first priority is health—get the medical attention you need right away.

Just as important is telling your employer about the injury. This should be done as soon as possible. Every state has deadlines for reporting, and missing that window could jeopardize a claim. This official report is what kicks off the whole workers' compensation process.

Filing the Claim and the Insurer Review

Once you've notified your employer, you'll need to formally file the claim. This usually means filling out specific paperwork, like Oregon's Form 801, the "Report of Job Injury or Illness." This form gives the insurer the core details of your injury.

After you submit the claim, the insurance company gets to work. They will launch an investigation, looking at your report, the first medical records, and what your employer has to say. Their goal is to see if your injury qualifies under workers' comp rules. Based on this review, they will accept the claim, deny it, or sometimes delay a decision if they need more information.

The single best thing you can do for your claim is to keep meticulous records. A folder with every doctor's note, email, and pay stub can be a powerful tool.

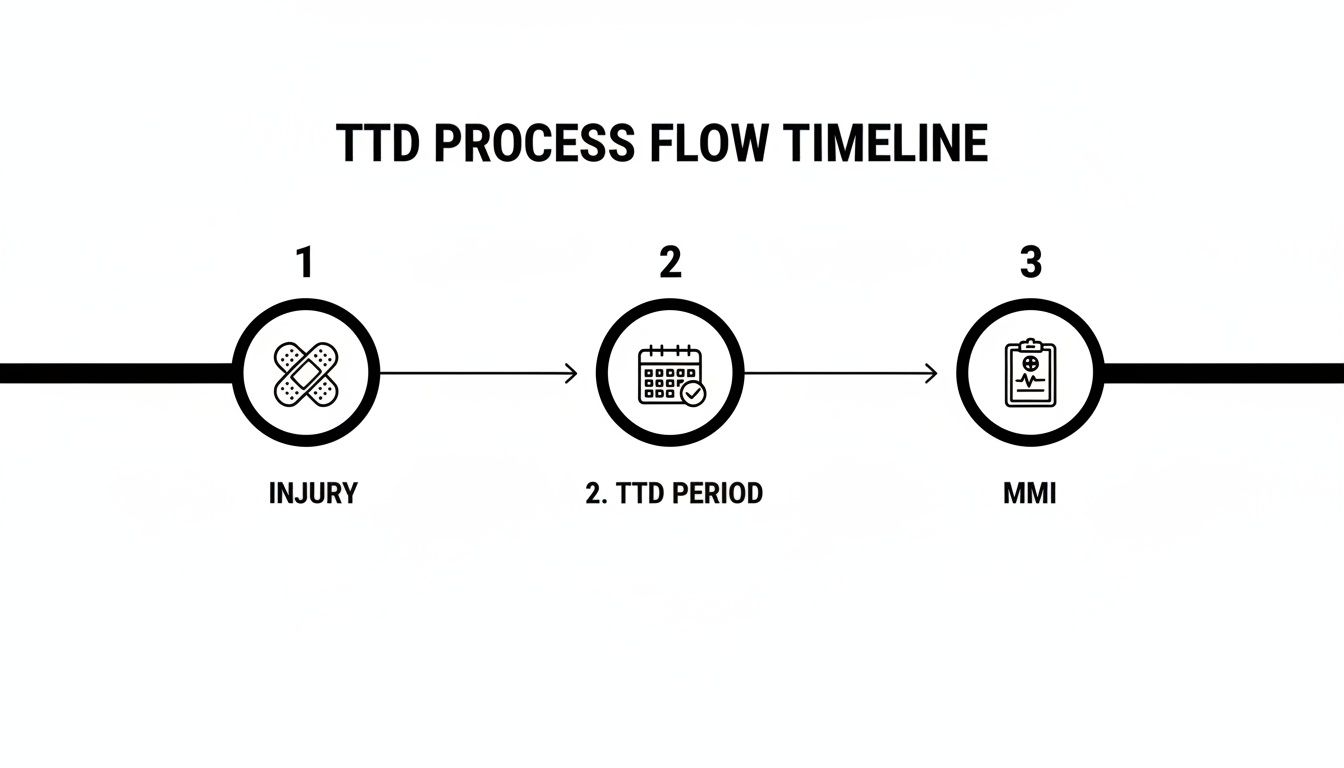

This timeline gives you a bird's-eye view of the process, from the day you're injured until TTD benefits conclude.

As you can see, the TTD period starts after your injury and ends once a doctor says you've reached Maximum Medical Improvement (MMI), which is the point where your condition is not expected to improve further.

Receiving a Decision and Next Steps

The insurer will eventually send a formal letter with their decision. If they accept the claim and your doctor has taken you off work, you may start receiving temporary total disability payments. For a deeper dive into this part of the journey, our guide on the workers' comp claim process breaks it down even further.

If you get a denial letter, it isn't always the final word. The letter will explain why they denied the claim, and you have the right to appeal that decision. Just be aware that the appeals process comes with its own set of deadlines and procedural steps.

While you're recovering, you might also need medical equipment to help you get by. Services offering local medical equipment rentals can be a great resource for things like crutches, wheelchairs, or other rehabilitative aids you might need at home.

When You Might Consider Speaking with an Attorney

Many workers' compensation claims are fairly straightforward. An individual gets hurt, files a claim, and receives benefits without a hitch. But what happens when things get complicated? It's not always easy to know when a simple claim has turned into something more.

The point here isn't to say everyone needs a lawyer for a work injury. But recognizing a few key red flags can help an individual decide if it's time to get some professional backup to protect their rights.

Your Claim Has Been Denied

Getting a denial letter in the mail can be frustrating and scary, but it’s not necessarily the final word. Insurance companies deny claims for all sorts of reasons—perhaps they question if the injury really happened at work, or maybe they’re disputing the medical records.

Whatever the reason, a denial officially kicks off a formal appeals process. Suddenly, you may be up against deadlines, complex legal paperwork, and specific rules of procedure. This is the point where things can get overwhelming fast.

Disagreements Arise Over Your Benefits

Even with an accepted claim, trouble can still arise. Often, a dispute is over the money—the temporary total disability benefits someone is counting on to pay bills while unable to work.

Common sticking points include:

- Incorrect Wage Calculations: TTD benefits are based on an Average Weekly Wage (AWW). If the insurer didn't include overtime, bonuses, or a second job in that calculation, the weekly check may be smaller than it should be.

- Late or Stopped Payments: When the checks suddenly stop coming or are consistently late without explanation, it can throw an entire financial life into chaos.

These aren't just simple math errors; they often involve digging through payroll stubs and understanding the fine print of state regulations.

When an insurance company starts questioning the core of a claim—whether it's the doctor's treatment plan or how benefits are calculated—an individual is no longer just filling out forms. It has become a situation that requires evidence, negotiation, and a deep understanding of the process.

Navigating Complex Medical Issues

The medical side of a workers' comp claim is where many battles are fought. An individual's recovery and benefits are completely tied to what the doctors say, and when opinions differ, the claim can stall out.

For example, an individual might feel pressured to go back to work before their own doctor says they're ready. The insurer could also refuse to approve a specific treatment a doctor recommends. A common step is for an insurer to send someone to an Independent Medical Examination (IME) with a doctor they picked. If that doctor's report contradicts the individual's own physician's, a major conflict may arise that could threaten benefits.

For a deeper dive into these kinds of challenges, our overview of when to hire a workers' comp lawyer offers more detail.

Your Injury Is Severe or Has Long-Term Implications

If an injury is career-altering—one that may leave an individual with permanent limitations or make it impossible to go back to their old job—the stakes are incredibly high. This isn't just about temporary wage replacement anymore.

These serious cases open up conversations about permanent disability benefits, job retraining (vocational rehabilitation), or negotiating a final lump-sum settlement. Each path involves complex medical reports, impairment ratings, and a clear-eyed view of future medical needs and financial stability. The decisions made here can have an impact for years to come.

Answering Your Oregon TTD Questions

When you’re dealing with a work injury, it's natural to have a lot of questions. Let's walk through some of the most common things people ask about Temporary Total Disability (TTD) benefits here in Oregon.

What if I Was Injured While Working off-Site?

This is a great question, and the answer often comes down to whether the injury happened in the "course and scope" of employment. That legal phrase just means an individual was doing something their job required, even if they weren't physically at their normal workplace.

For instance, if someone gets into a car accident while driving to a mandatory client meeting, that is likely considered a work-related injury. The deciding factor is the direct connection between the activity and job duties. Every situation is unique, so the specific details really matter.

What Happens if My Boss Offers Me Light-Duty Work?

This is a critical point that can directly affect TTD payments. If your doctor says you can go back to work with certain restrictions, your employer might offer you a modified or "light-duty" job that fits within those limitations.

If you accept a suitable light-duty position, your TTD benefits will typically stop because you're no longer "totally" disabled. On the flip side, refusing a valid offer for modified work that meets your medical restrictions can get your benefits suspended.

Now, if you take that light-duty job but earn less than you did before your injury, you might be eligible for another benefit called Temporary Partial Disability (TPD), which is designed to cover a portion of that wage gap.

How Is TTD Different from Social Security Disability?

It’s easy to mix these two up, but they are completely separate programs. Think of them as operating in two different worlds with their own rulebooks and funding.

Here’s a quick breakdown to clear things up:

| Temporary Total Disability (TTD) | This is a state workers' compensation benefit for injuries that happen on the job. | It’s designed for a temporary recovery period when you’re completely unable to do your job. |

| Social Security Disability (SSDI) | This is a federal program for people with severe medical conditions. | It's for long-term situations where a condition is expected to last at least a year or is terminal, preventing any significant work. |

The simplest way to think about it is that TTD is a short-term wage replacement for a work-related injury. SSDI is a long-term federal benefit for a severe disability, and it doesn't matter if it was work-related or not.

At Bell Law, we know how overwhelming a work injury can be. If your claim was denied or you just need to understand your rights, our team is here to help you find clarity. Contact us for a consultation to discuss your Oregon workers' compensation case by visiting our website.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.