Workers Comp Disability Rating Explained: Know Your Benefits

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Workers Comp Disability Rating Explained: Know Your Benefits

So, what exactly is a workers' comp disability rating? In simple terms, it’s a percentage that represents the permanent impact your work injury has left on your body. It's a number that translates your long-term physical limitations into a value used to calculate your final compensation.

This rating is only given by a doctor after you’ve reached what’s called Maximum Medical Improvement (MMI), which is a critical turning point in your case.

Decoding Your Workers' Comp Disability Rating

When you're first injured at work, everything is about getting better. But once the surgeries, physical therapy, and other treatments are done, the focus shifts. Now, we have to figure out the long-term effects of that injury, and that’s where the disability rating comes in. It’s the official medical verdict on how much function you've permanently lost.

Think about a carpenter who badly injures their shoulder. After months of treatment, they’re better, but they can no longer lift their arm above their head without pain and weakness. The disability rating is what puts a number on that loss—maybe it’s a 10% permanent impairment to the shoulder. That percentage isn't just pulled out of thin air; it’s the result of a specific medical evaluation designed to be as objective as possible.

The Role of Maximum Medical Improvement (MMI)

You won’t get a disability rating until you hit a key milestone in your recovery: Maximum Medical Improvement (MMI). MMI is the point where your doctor says your condition is as good as it’s going to get.

It’s important to understand that MMI doesn’t mean you’re 100% cured or pain-free. It just means that from a medical standpoint, your condition has stabilized and isn't expected to get any better, even with more treatment.

Once you’ve reached MMI, the doctor performs a final exam. They’ll look at all your medical records, test your strength and range of motion, and assess any functional limitations you still have. This in-depth evaluation forms the basis for your final disability rating percentage, which is then plugged into a formula to calculate your permanent disability award.

Why This Rating Is So Important

Your disability rating is the crucial link between your medical outcome and your financial recovery. Simply put, a higher rating means the injury had a more significant permanent impact, which generally leads to a larger financial settlement.

This single percentage is one of the most powerful factors in your entire workers' compensation claim. It directly affects the benefits you receive to help you manage your future after a serious injury. That's why it's so vital to understand how it's determined and what you can do to make sure your rating is fair and accurate.

Understanding Permanent Disability Benefits

After your doctor determines your workers' comp disability rating, that percentage becomes the key to unlocking your permanent disability benefits. These payments are meant to compensate you for how the injury will affect you for the rest of your life. They generally fall into two buckets, depending on how severe the injury is.

The first, and most common, is Permanent Partial Disability (PPD). This is for when your injury causes a permanent physical loss, but it doesn't mean you can never work again. Your PPD payment is calculated based on that specific rating percentage.

The second category is for much more serious situations: Permanent Total Disability (PTD). PTD benefits are for catastrophic, life-changing injuries that are so severe they prevent you from ever returning to any kind of sustainable work.

What is Permanent Partial Disability, Really?

Think of PPD as compensation for a specific, lasting loss. Imagine a construction worker who hurts their back and can no longer lift anything over 20 pounds. That’s a permanent limitation. They might be able to find a different job, but their physical abilities and even their earning potential have been permanently changed.

Their PPD rating is the system’s way of acknowledging that loss. It recognizes that while they can still work, they aren't the same person physically they were before the accident. The benefit is financial compensation for that specific, partial loss of function.

A workers' comp disability rating is a medical assessment of your functional loss. A Permanent Partial Disability award is the legal determination that turns that rating into financial compensation.

This is a critical distinction. The goal of PPD isn't to replace every dollar you might lose in the future, but to compensate you for the impairment itself.

The Rarity of Permanent Total Disability

Getting a Permanent Total Disability designation is a much higher mountain to climb. It means an injury is so profound that the worker can't realistically hold down any job. We're not just talking about being unable to do your old job; we're talking about being unable to do any job at all.

For example, an electrician who suffers a severe spinal cord injury that leads to paralysis has had their life fundamentally altered. An injury like that makes it impossible to participate in the workforce in any meaningful way, which is why they would be eligible for PTD benefits. These payments typically last for life, offering long-term financial stability.

Because PTD signifies a complete and total loss of earning capacity, it's reserved for only the most severe cases. Most injuries, even very serious ones, end up with a PPD rating. The numbers back this up—most impairment ratings are actually on the lower end of the scale. The average whole-body impairment rating is about 6.5%. Digging into the data, you'll find that roughly 50% of all claims get a rating of 4% or less, and 95% of claims fall below a 20% rating. This confirms that the vast majority of recognized permanent disabilities are considered partial.

Knowing Which Category You Fall Into

Figuring out the difference between PPD and PTD is essential for navigating your claim and planning for your future. It's the medical evidence in your file that will ultimately decide which path your claim takes. If you’re unsure about your own case, it’s good to know the basic requirements. For more details, you can read our guide on determining your eligibility for workers compensation.

An experienced attorney can look at your medical records and help clarify whether your injury is more likely to be classified as a partial or a total disability. Getting that clarity is the first step toward securing the full benefits you deserve.

How Doctors Calculate Your Impairment Rating

When it's time to determine your workers comp disability rating, a doctor can’t just pull a number out of thin air. It’s not a gut feeling or a subjective judgment call. The entire process is a structured medical assessment guided by a very specific rulebook, all to make sure the outcome is as objective and consistent as possible.

To do this, physicians turn to a crucial document: the American Medical Association's (AMA) Guides to the Evaluation of Permanent Impairment. Think of it like a highly detailed instruction manual for the human body. The guide gives doctors the exact criteria needed to measure the long-term effects of your injury, ensuring two people with similar injuries receive comparable ratings, no matter which doctor does the evaluation.

The Foundation: Reaching Maximum Medical Improvement

Before any rating can even be considered, you have to hit a critical milestone known as Maximum Medical Improvement (MMI). A doctor simply will not assign a permanent rating until your condition is considered medically stationary.

Reaching MMI means your recovery has plateaued. It’s the point where, medically speaking, your condition isn't expected to get any better, even with more treatment. This doesn’t mean you’re 100% healed or pain-free; it just signals the end of the active healing phase. You can learn more about this in our article on what MMI means in a workers comp case.

Once you’re at MMI, the doctor can finally perform the comprehensive exam needed to assess the permanent limitations left behind by your work injury.

The Evaluation Process, Step-by-Step

The rating evaluation is a meticulous process. It’s a deep dive that combines hands-on physical tests with a thorough review of your entire medical journey since the injury occurred.

Here’s a breakdown of what that evaluation looks like:

- Reviewing Your History: The doctor will comb through every document tied to your injury—from the first ER report and surgeon’s notes to physical therapy logs and imaging results like MRIs.

- The Physical Exam: This is where the doctor gets hands-on, carefully measuring your range of motion, testing your muscle strength, checking reflexes, and pinpointing areas of sensory loss or pain.

- Assessing Your Function: You’ll likely be asked to perform specific tasks or movements. This isn’t just a test; it allows the doctor to see with their own eyes how the injury impacts your ability to perform daily activities.

- Applying the AMA Guides: Finally, the doctor takes all of that information and cross-references it with the AMA Guides. The guide provides exact charts and criteria to convert your specific functional loss into a precise percentage of impairment for the affected body part.

For instance, the AMA Guides might have a specific chart showing that a certain loss of motion in your knee equates to a 15% impairment of the leg. The doctor's job is to take an accurate measurement and apply the correct value from the guide.

What About an Independent Medical Examination?

It’s very common for the insurance company to request an Independent Medical Examination (IME). This is basically a second opinion from a doctor who hasn’t been involved in your treatment. While the name says "independent," it's crucial to remember this doctor is selected and paid for by the insurer.

The goal of the IME is for the insurance company to get another expert’s take on your condition, your MMI status, and, most importantly, your impairment rating. Don't be surprised if the IME doctor comes back with a lower workers comp disability rating than your own treating physician.

When the two ratings don’t match, it creates a dispute. This is a common fork in the road where having an experienced attorney becomes essential to fight for the rating that truly reflects your permanent limitations.

How Your Rating Translates Into Benefit Payments

So, what does that workers' comp disability rating actually do? It’s not just a number on a medical chart. Think of it as the single most important variable in the equation that determines your permanent disability benefits. Once that percentage is finalized, it gets plugged into a state-specific formula to convert your physical impairment into a dollar amount.

Getting a handle on this formula is key. It gives you the power to look at a settlement offer from an insurance company and know whether you're being treated fairly. While the fine print changes from state to state, the basic building blocks of the calculation are surprisingly consistent.

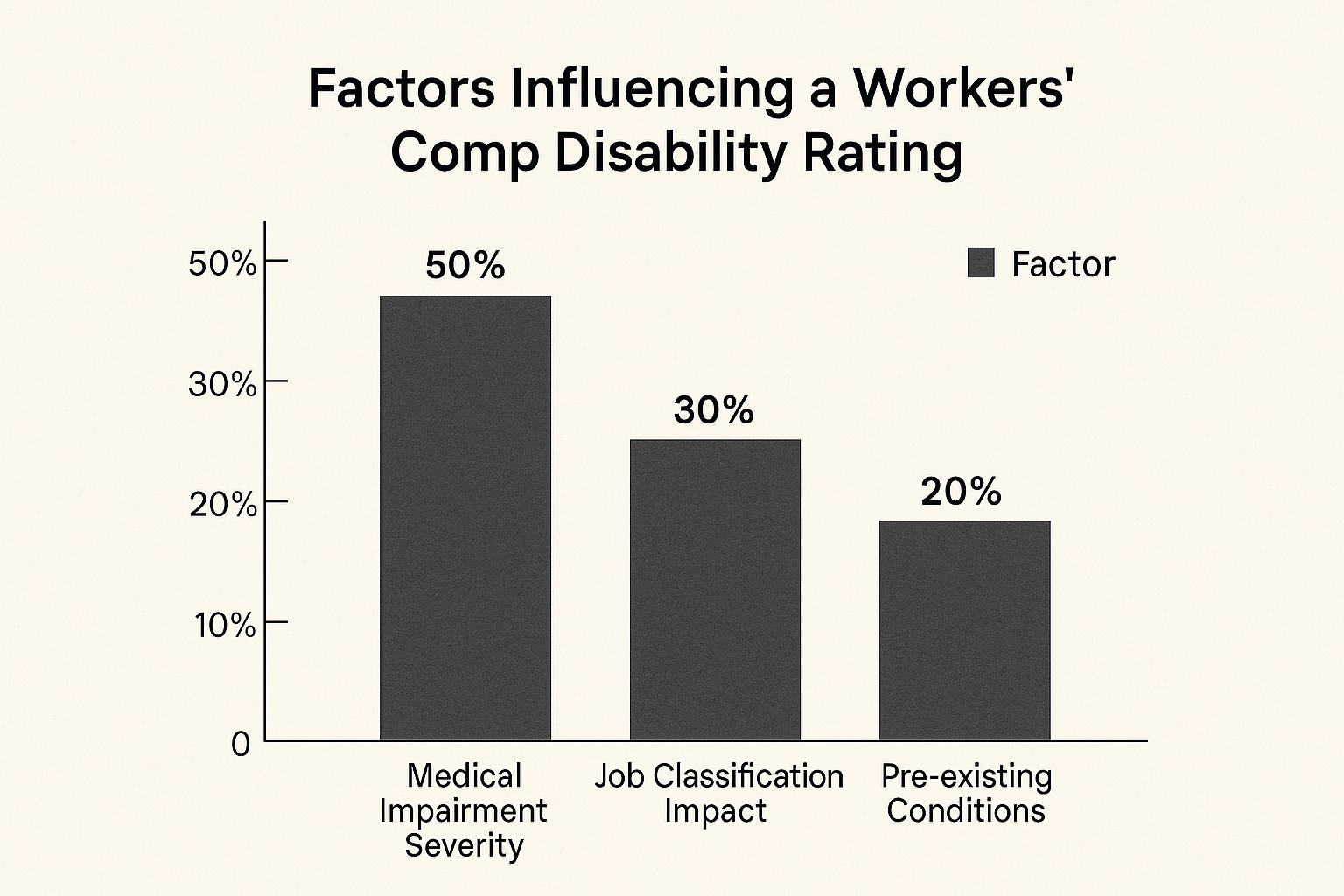

This image breaks down the main factors that go into determining your final rating, which is the starting point for the whole process.

As you can see, the severity of your injury is the biggest piece of the pie. But things like your specific job duties and even pre-existing conditions can also influence the final number.

The Core Formula for PPD Benefits

When it comes to Permanent Partial Disability (PPD) claims, states rely on a pretty standard formula to figure out your payment. It's a simple multiplication problem, really—just three key numbers that, when combined, give you the total benefit.

Let's pull back the curtain on this critical equation:

Your Impairment Rating Percentage: This is the percent the doctor assigns once you've reached Maximum Medical Improvement (MMI).

Weeks of Compensation: Every state has a "schedule" that assigns a certain number of weeks to each body part. For example, a state might decide a back injury is worth up to 300 weeks, while a hand injury is capped at 200 weeks.

Your Compensation Rate: This is usually two-thirds (66.7%) of your average weekly wage (AWW) before your injury, but it's capped at a maximum amount set by state law.

Here’s the basic formula boiled down:

(Impairment Rating %) x (Weeks Assigned to Body Part) x (Your Compensation Rate) = Your PPD Award

This framework ensures the final payout reflects how badly you were hurt, where you were hurt, and how much you were earning.

A Practical Example of the Calculation

Let's make this real. Seeing the formula in action with a hypothetical scenario helps connect all the dots.

Meet Sarah, a warehouse worker in Oregon who suffered a serious arm injury. Before she got hurt, her average weekly wage was $900. After months of treatment, she reaches MMI, and her doctor gives her a 15% permanent impairment rating for the arm.

Here’s how Oregon’s system would handle it:

- The state schedule values an arm at a maximum of 240 weeks.

- Sarah’s compensation rate is two-thirds of her wage: ($900 x 2/3) = $600 per week.

Now, we just plug everything into the formula:

- 15% (Impairment Rating) x 240 (Weeks for an Arm) = 36 Weeks of benefits

- 36 Weeks x $600 (Compensation Rate) = $21,600

So, Sarah's total PPD award for her arm injury comes out to $21,600. Suddenly, the process doesn't seem so mysterious. You can see exactly how the doctor's rating turns into a final settlement figure.

State-by-State Variations Matter—A Lot

This is incredibly important to understand: the value of an injury can change drastically just by crossing a state line. Every state writes its own rulebook and sets its own benefit schedules. The result? Massive differences in what you might receive for the very same injury.

To put this in perspective, let’s look at how wildly different the compensation can be for losing an index finger.

Example State-by-State PPD Benefits for Loss of an Index Finger

| Oregon | 50 weeks | $79,759 |

| National Average | (Varies) | $11,343 |

| Massachusetts | 29 weeks | $2,065 |

The numbers are staggering. As detailed in a public health policy analysis, workers' compensation disability ratings in the U.S. are anything but uniform.

The fact that Oregon offers nearly $80,000 for an injury that might only get you $2,000 in Massachusetts shows why knowing your local laws isn’t just helpful—it’s absolutely essential.

What to Do When You Disagree With Your Rating

Getting your final workers comp disability rating should feel like the end of a long, difficult journey. But what happens when you look at that number and your heart sinks? It’s incredibly frustrating when a rating just doesn’t seem to match the reality of what you're living with every day.

The good news is that the first rating isn't always the last word. You have the right to challenge a number that seems too low. This is a pivotal moment, and knowing how to appeal is the first step toward getting the fair compensation you truly deserve.

It all starts by officially notifying the insurance company and your state’s workers' compensation board that you dispute the rating. This simple but critical action protects your rights and gets the appeal process started.

Your Most Powerful Tool: A Second Opinion

The single most important part of any rating dispute is getting a second medical opinion. While your treating doctor provided the initial rating, you are entitled to have another, independent doctor evaluate your condition. Think of it as getting a fresh set of expert eyes on your case.

This isn't just another check-up. The new doctor will perform their own detailed examination, comb through your medical records, and calculate their own impairment rating using the AMA Guides.

A second opinion can completely change the game for your claim:

- It creates a counter-argument. If the second doctor gives you a higher rating, you now have a direct medical conflict with the first opinion, which immediately gives your dispute weight.

- It strengthens your case. A more favorable rating from another qualified physician is powerful evidence to bring to the negotiating table or a formal hearing.

- It gives you peace of mind. A second opinion can validate your gut feeling that the initial rating was wrong and confirm the real-world challenges you're facing.

When the two ratings don't match, the insurance company can’t just ignore it. It signals that there’s a genuine disagreement that needs to be properly resolved.

Escalating Your Dispute Formally

If getting that second opinion doesn’t lead to a resolution with the insurance adjuster, it’s time to file a formal dispute. This moves your case out of the realm of informal disagreement and into a legal proceeding.

One common next step is mediation. This is a more relaxed process where a neutral third party helps you and the insurer try to find a middle ground on the rating. A mediator doesn't issue a ruling but guides the conversation toward a compromise.

If mediation isn't an option or doesn't work, you'll likely head to a formal hearing before a workers' compensation judge. This is basically a mini-trial for your claim. Both sides will present their evidence—including the conflicting medical reports—and the judge will decide which rating is more credible.

At this stage, the strength of your medical evidence is everything. The judge will carefully examine how each doctor justified their rating, how well they applied the AMA Guides, and the overall thoroughness of their evaluation.

Why Legal Counsel Is Invaluable

Trying to navigate a rating dispute on your own is tough. The system has its own set of rules, and you can be sure the insurance company will have lawyers working to defend the lower rating. This is exactly why bringing in an experienced workers' compensation attorney is so crucial.

A great lawyer does much more than just file paperwork. They will:

- Help you find a respected doctor for your second opinion.

- Gather all the medical evidence needed to build a convincing case.

- Handle all the back-and-forth with the insurance company and its attorneys.

- Represent you effectively in mediation or at your hearing.

- Negotiate firmly to get you the highest possible rating and settlement.

Knowing your rights is key. For a bigger picture, you can explore our guide on what workers' compensation benefits you may be entitled to. An attorney can help you understand these benefits and make sure your appeal has the best possible chance of success.

Your Top Questions About Disability Ratings, Answered

Going through a workers' comp claim can feel like learning a new language, and the final disability rating is often the most confusing part. Let’s clear up some of the most common questions that pop up when you're nearing the end of your claim.

Can My Disability Rating Change Later On?

Generally, your permanent disability rating is set in stone once your doctor says you've reached Maximum Medical Improvement (MMI). MMI basically means your condition is as good as it’s going to get and has stabilized.

However, life happens. If your original work injury gets significantly worse down the road, you might have an opportunity to reopen your case and get your rating re-evaluated. This isn't a simple process, though. You'll need strong new medical evidence and, frankly, the help of a good attorney to prove the worsening is directly tied to that initial injury.

What’s the Difference Between an "Impairment Rating" and a "Disability Rating"?

People often use these terms interchangeably, but they mean very different things. It’s a crucial distinction.

Here’s a simple way to think about it:

- An impairment rating is a cold, hard medical number. It’s the percentage a doctor assigns based on your loss of function according to the AMA Guides. For example, the doctor might determine you have a 10% impairment of your lower back.

- A disability rating is the legal and financial consequence of that impairment. It takes the doctor's impairment number and adds in real-world factors—like your age, what you do for a living, and your education—to figure out how the injury impacts your ability to earn a living.

So, while the impairment rating is the starting point, the disability rating is what truly determines your final award.

Does Getting a PPD Rating Mean I Can Never Work Again?

Absolutely not. This is one of the biggest misconceptions out there. A Permanent Partial Disability (PPD) rating simply acknowledges that you have a permanent loss of function. It does not mean you're considered incapable of working.

Many, many people with PPD ratings get right back to their old jobs, sometimes with a few modifications. If you can’t go back to your exact role, the PPD award is there to compensate you for the hit to your overall earning power as you find a new line of work.

Trying to make sense of your rating or figure out your next steps can be overwhelming. The team at Bell Law is here to make sure injured workers in Oregon get the fair compensation they're entitled to. Reach out to us for a free consultation to talk about your situation. You can find out more at belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.