How to Apply for SSDI Benefits A Practical Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

How to Apply for SSDI Benefits A Practical Guide

Applying for Social Security Disability Insurance (SSDI) in Oregon is a detailed process, and it all starts with figuring out if you even qualify. Before you dive into the mountain of paperwork, you need to be sure you meet the two core requirements set by the Social Security Administration (SSA): your work history and your medical condition.

If you don't tick both boxes, your application won't go far. Let's break down exactly what they're looking for.

Confirming Your SSDI Eligibility

Before you invest your time and energy into an application, it’s critical to understand the two main pillars of SSDI eligibility. Think of them as two separate gates you have to pass through. Missing just one will lead to a denial, no matter how severe your disability is.

The Work History Requirement

SSDI isn't a handout; it's an insurance program you've paid into through FICA taxes from your paychecks. To be eligible, you need to be "insured," which means you've worked long enough and recently enough. The SSA tracks this with a system of work credits.

You can earn up to four credits each year, and the number you need depends on your age when your disability began.

- For younger workers (under 24): You might only need 6 credits earned in the 3-year period before your disability started.

- For most workers (over 31): The general rule is you need at least 20 credits earned in the 10 years right before you became disabled.

Let's look at a real-world example. A 45-year-old construction worker from Portland who's been steadily employed for the last 20 years will almost certainly have enough credits. But what about a 30-year-old who only worked part-time for a few years? Even with a serious medical condition, they might not meet the recent work test. This is a common stumbling block, and you can get a better handle on the specifics by reviewing this guide on https://www.belllawoffices.com/am-i-eligible-for-social-security-disability-benefits/.

The Medical Condition Requirement

Just having a doctor's diagnosis isn't enough to get approved. The SSA has a very strict definition of "disability." Your condition must be severe enough to prevent you from engaging in what they call "Substantial Gainful Activity" (SGA). In simple terms, this means your medical issues prevent you from earning more than a certain amount of money each month.

The SSA must find that your medically determinable impairment is expected to last for a continuous period of at least 12 months or result in death. Short-term or partial disabilities do not qualify for SSDI benefits.

This is a really important point. Being unable to do your old job is not the same as being unable to do any job. Imagine a surgeon who develops a hand tremor and can no longer operate. The SSA will then look at whether they could perform other work, like being a medical consultant. If they can still earn above the SGA limit in another role, their claim will likely be denied.

Here’s a quick table to help you keep these two key requirements straight.

Quick SSDI Eligibility Checklist

| Work History | You've earned enough "work credits" by paying FICA taxes. | This is based on how long and how recently you worked. |

| Medical Condition | Your impairment prevents you from earning above the SGA limit. | It's not about your old job; it's about your ability to do any substantial work. |

| Duration of Condition | Your disability has lasted or is expected to last at least 12 months. | Short-term conditions are not covered by SSDI. |

Meeting these criteria is the first and most important step.

As you move through the process and discuss your private medical history with professionals, remember to protect your information. If you're having remote consultations, using one of the many HIPAA compliant video conferencing platforms is a smart way to ensure your sensitive data stays secure.

Gathering Your Essential Documents

Think of your SSDI application as a legal case. You're the main witness, and your documents are the evidence that will prove your claim. Honestly, a well-organized file is probably the single most powerful tool you have in this entire process.

It does more than just make the paperwork easier. A complete and orderly file sends a clear message to the Disability Determination Services (DDS) examiner reviewing your case: you are serious and your claim is credible.

This isn’t just about grabbing a few recent doctor's notes. I’ve seen time and again that success often comes down to the depth and quality of the documentation. Going in prepared can dramatically cut down on the frustrating back-and-forth with the Social Security Administration (SSA) and help you avoid the simple mistakes that lead to long delays.

So, before you even think about filling out a single form, your first job is to become an archivist of your own life.

Compiling Your Medical Evidence

This is the absolute core of your application. While every medical record helps, some pieces of evidence carry far more weight with the SSA than others. Your main focus should be on gathering objective medical evidence—the kind of proof that doesn't just rely on what you say, but what tests, scans, and specialists have confirmed.

The goal here is to paint a clear, undeniable picture of your condition and how it has impacted your ability to live and work.

- Diagnostic Imaging and Lab Results: This is your hard evidence. Think MRIs, CT scans, X-rays, and any relevant blood work. These provide concrete, visual proof of your medical condition.

- Specialist Consultation Notes: Reports from specialists like neurologists, orthopedic surgeons, cardiologists, or psychiatrists are crucial. They demonstrate that you've sought advanced care and offer an expert's assessment of your condition.

- Hospitalization and ER Records: Always include admission and discharge summaries. These records are incredibly powerful because they document acute episodes and the true severity of your symptoms.

- Physical or Occupational Therapy Notes: Don't overlook these. These reports often include functional assessments that spell out your physical limitations in practical, measurable terms.

A detailed opinion from your treating physician can be a game-changer. Ask your doctor for a written statement that explains your diagnosis, prognosis, and—most importantly—your specific functional limitations. A letter simply stating "my patient can't work" is far less helpful than one detailing that you cannot lift more than 10 pounds or stand for more than 15 minutes at a time.

Gathering Non-Medical Information

Your medical history is only one side of the coin. The SSA also needs a complete picture of your personal life and work history to process your claim correctly and figure out your potential benefit amount. It's easy to gloss over these details, but missing information here can stop your application in its tracks just as fast as a missing medical record.

Here’s a quick checklist of the non-medical info you’ll need to pull together:

Personal Identification: Your original birth certificate (or other proof of age) and proof of U.S. citizenship or lawful alien status.

Marriage and Family Information: If it applies to you, have marriage certificates, divorce decrees, and birth certificates for any minor children ready.

Complete Work History: This one is a big deal. You must document your jobs for the last 15 years. For each one, be prepared to list your job title, dates of employment, pay rate, and a detailed description of your day-to-day duties.

Financial Details: Have your bank account information (both routing and account numbers) handy so the SSA can set up direct deposit for your benefits.

Organizing Your Documentation for Success

Once you have everything, please don't just toss it all in a box. Getting organized now will save you so much stress later. Many people I've worked with find that a simple accordion file with labeled tabs for each category (e.g., "MRIs," "Work History," "Personal IDs") works wonders.

Another great option is to go digital. Create a secure folder on your computer, scan every single document, and give each file a clear, descriptive name like "Dr_Smith_Consult_Note_June_2024.pdf." This makes uploading documents to the SSA's online portal a breeze and helps you keep track of exactly what you've sent.

Taking the time for this prep work now not only makes the next steps smoother but also helps you get a clearer picture of your own case as you see all the evidence in one place and better understand how to qualify for Social Security.

Navigating the SSDI Application Forms

Alright, you’ve gathered your documents, and now it’s time to face the paperwork. At first glance, the SSDI application can feel like a mountain of forms, and frankly, it's easy to get lost in the jargon. But think of it less as a single submission and more as telling your story through a few key documents.

How you fill these out can make or break your claim. The language is intentionally precise and legalistic, but if you understand what each form is asking for, you can give the Social Security Administration (SSA) examiners exactly what they need to approve your case. Let’s walk through the most important ones.

The Main Application for Benefits

This is the big one—the foundation of your claim. It’s where you’ll put all that personal and work history information you’ve already collected. A lot of it is basic stuff, like your Social Security number and bank details for direct deposit.

Where you really need to slow down and be deliberate is the section about your work history. This isn't just a resume. The SSA needs a detailed breakdown of the jobs you’ve held over the past 15 years.

Don’t just write "Cashier" or "Construction Worker." You have to paint a picture of what you actually did.

- Physical Tasks: How much did you lift, stand, walk, or sit? Be specific. "Regularly lifted boxes weighing up to 50 pounds" is much stronger than "some lifting."

- Mental Tasks: Did your job involve complex problem-solving? Following detailed instructions? Working under tight deadlines?

- Skills & Tools: Mention any specialized equipment you operated or skills you used.

This level of detail is critical. The SSA will use this information to decide if your medical condition truly prevents you from doing any of your past work.

The Adult Disability Report (Form SSA-3368)

If there’s one document that can make or break your case, it’s this one. The Adult Disability Report is where you connect the dots between your medical diagnosis and your real-world limitations. Honesty and extreme detail are your best friends here.

Saying "I have back pain" won't cut it. That's a diagnosis, not a limitation. You have to show the examiner how that pain impacts your ability to function day-to-day. A great way to do this is to walk them through a typical day in your life.

Take something as simple as grocery shopping. A vague answer gets you nowhere.

- Weak Answer: "My back pain makes shopping hard."

- Powerful Answer: "Because of my degenerative disc disease, I can only stand and walk for about 10 minutes before the pain in my lower back becomes sharp and debilitating. I can’t carry a basket and have to lean on the shopping cart for support. By the time I get home, I have to lie down for at least an hour."

Apply that same logic to everything you do—getting dressed, cooking a meal, cleaning the house, even interacting with friends. This creates a vivid, consistent, and credible picture of your limitations for the Disability Determination Services (DDS) examiner reviewing your file.

Expert Insight: The information on Form SSA-3368 is what the SSA uses to create your "Residual Functional Capacity" (RFC) assessment. This is their official take on what you can still do despite your condition. A detailed, consistent report from you is the best tool you have to ensure that RFC is accurate.

The Authorization to Disclose Information (Form SSA-827)

This one is pretty straightforward, but a mistake here can cause serious delays. Form SSA-827 is the medical release that gives the SSA your permission to request records directly from your doctors, hospitals, and clinics.

Your only job here is to be thorough. List every single medical provider who has treated you for your condition. If you forget to include the specialist who holds the most critical evidence, the SSA might never see it.

When you're filling it out, remember to:

- Be Comprehensive: List every doctor, therapist, hospital, and clinic you can remember.

- Check Your Details: Double-check that all names, addresses, and phone numbers are correct.

- Sign and Date It: An unsigned form will stop your application in its tracks.

Taking the time to complete these forms with care and detail is your best strategy for getting an approval on your first try. I know it's a daunting process, especially when you're not feeling well, but this initial effort can save you months, or even years, of appeals down the road.

Getting Your Application Filed and What to Expect Next

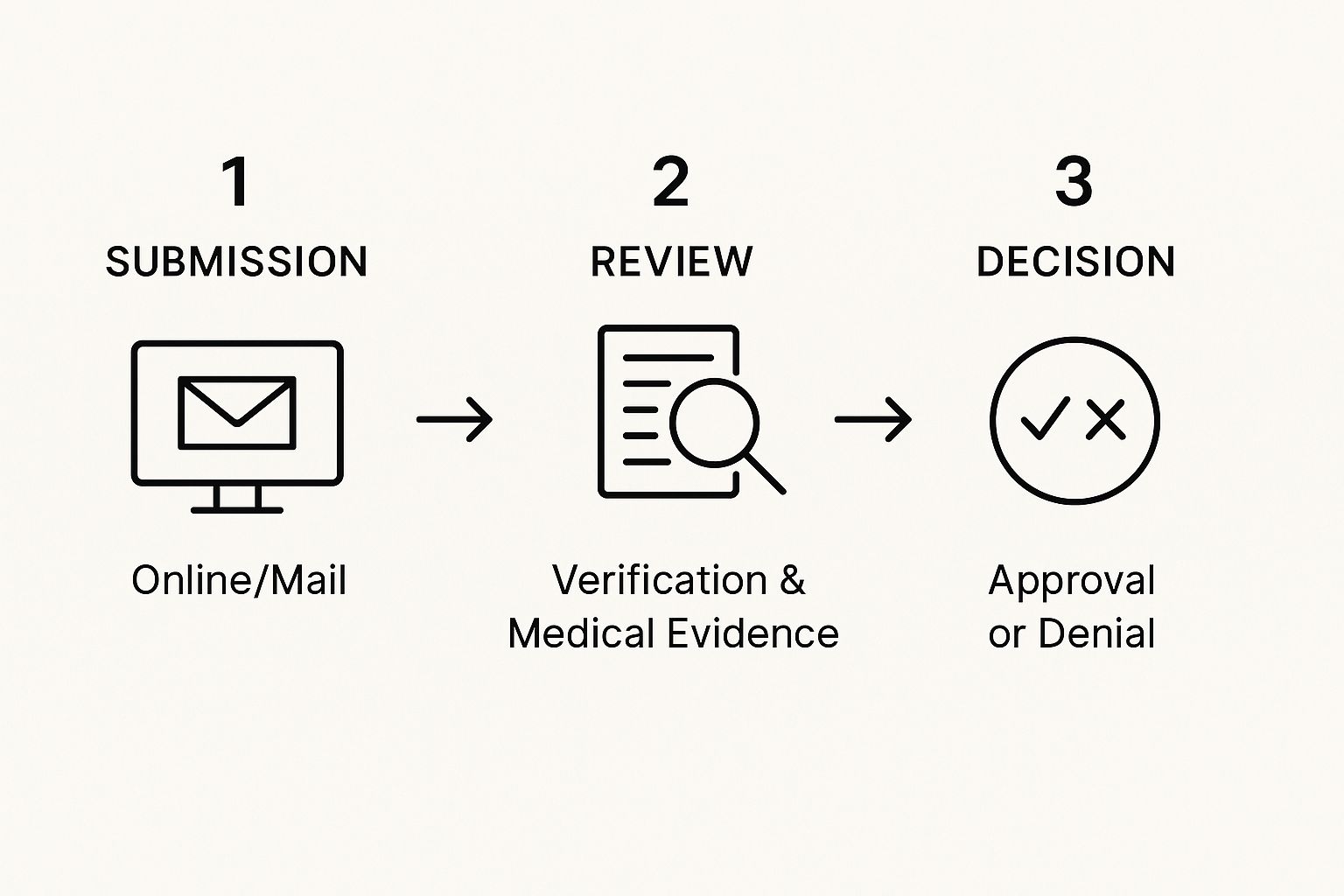

You've done the hard work of gathering your records and filling out all the paperwork. Now comes the moment of truth: submitting your application. Knowing how to file and understanding what happens behind the scenes can make the long wait ahead a little more manageable.

You have a few different ways to get your application into the Social Security Administration's hands. While there’s no single "right" way for everyone, one method is usually the most straightforward.

How to Submit Your SSDI Application

Choosing the best way to file can make a real difference in how smoothly things go. Let's look at the options.

- Online: This is almost always the best bet. You can work on the application whenever you have the time and energy, save your progress as you go, and upload your documents directly. The biggest plus is the online portal, which lets you check your claim's status anytime.

- By Phone: You can also call the SSA's national toll-free number to get things started. The representative will walk you through the application over the phone. Be prepared for potentially long hold times, and remember you'll still have to mail in your supporting documents.

- In Person: Scheduling an appointment at your local Oregon SSA office is another option. This can be helpful if you feel you need face-to-face help, but it’s typically the slowest route. Getting an appointment can take time, and so can the manual processing.

For most folks I work with, filing online is the clear winner. It puts you in the driver's seat and gives you a direct line of sight into where your application stands.

Deciding how to submit your application is the first step in the post-filing process. Each method has its own set of advantages and disadvantages, which can impact your experience.

SSDI Application Submission Methods Compared

| Online | Apply 24/7 at your own pace; easily save progress; direct document upload; clear status tracking. | Requires internet access and some comfort with technology. |

| By Phone | Guided assistance from an SSA representative; good if you don't have internet access. | Potentially long wait times; still requires mailing documents; can be hard to schedule. |

| In Person | Face-to-face help for complex questions; staff can clarify forms. | Slowest method; requires scheduling an appointment; travel may be difficult. |

Ultimately, the online portal provides the most control and transparency, which is a huge benefit during what can be a very long and uncertain waiting period.

Expert Tip: Think of the online portal as your personal dashboard for your claim. It’s not just for submitting—you can use it to track status updates and see important notices from the SSA. This is far better than waiting by the mailbox or sitting on hold.

The Hand-Off to Disability Determination Services

Once you hit "submit," your application begins its journey. The local SSA office first does a quick check to make sure you have enough work credits to qualify technically. As long as that checks out, they don't hold onto it.

Your file is then sent over to a state agency called Disability Determination Services (DDS). This is where the real medical review happens. The DDS is responsible for digging into your health records and figuring out if your condition truly prevents you from working.

As you can see, once your application is in, it goes through a deep dive into your medical history. This is the core of the evaluation.

What Really Happens During the DDS Review

At DDS, your case lands on the desk of a disability examiner who works with a medical consultant. Their job is to build a complete medical file that proves (or disproves) your claim.

They'll use the Form SSA-827 you signed to request every medical record from the doctors, hospitals, and clinics you listed. This is why having accurate contact information for your providers is non-negotiable. A typo in a clinic's phone number can stall your case for weeks.

Sometimes, the records you provided just aren't enough for the examiner to make a call. If that happens, DDS might schedule you for a Consultative Examination (CE). The SSA pays for this appointment with an independent doctor.

The goal of a CE is to get a current, unbiased look at your condition or to fill in specific gaps in your medical history. It might feel like one more thing to do, but it’s a crucial opportunity to add more evidence to your file. Whatever you do, don't miss this appointment—it's one of the fastest ways to get your claim denied.

Getting through the DDS review takes time. You should expect to wait anywhere from three to five months for that first decision. During this waiting game, keep going to your doctor's appointments and follow their treatment plan. If the SSA sends you a letter, respond immediately. Patience is key, but so is staying on top of your case.

The Decision: What to Do After You Get the Letter from Social Security

After what feels like an eternity, the envelope from the Social Security Administration (SSA) finally shows up in your mailbox. Your heart probably pounds a little as you open it. This letter will dictate everything that comes next, so whether it's good news or bad, you need a plan.

If you're approved, it's a huge weight off your shoulders. But even an approval comes with its own set of steps and things to understand. If it's a denial, don't panic. It’s frustrating and disheartening, I know, but it is far from the end of the line. Most people get denied at first.

Let's walk through both scenarios.

You Got Approved! Now What?

An approval letter is a massive victory. This document, officially called an "award letter," is dense with critical information, so read it carefully.

It will tell you your exact monthly benefit amount, which is calculated from your average earnings over your working life. The letter also breaks down any back pay you're entitled to. This is the money owed to you from the date the SSA determined your disability began, minus a mandatory five-month waiting period.

Your first check (or direct deposit) should arrive the month after your claim is approved. Make sure the SSA has your correct bank information to avoid any delays.

One thing to keep in mind is that your benefits aren't necessarily for life. The SSA performs periodic check-ins called a Continuing Disability Review (CDR) to confirm you're still medically eligible. These can happen every three to seven years, depending on your condition and if it's expected to improve.

The single best thing you can do to protect your benefits is to continue your medical treatment. Consistent doctor visits and up-to-date records are your strongest defense when the SSA conducts a review.

Your Application Was Denied. Don't Give Up.

Getting a denial letter is incredibly common. In fact, most people who apply for SSDI are denied the first time around. The most important takeaway here is this: you have the right to appeal, but you are on a strict timeline.

A denial doesn't mean you have a bad case. More often than not, it just means the first person who reviewed your file didn't feel the evidence was strong enough. The appeals process exists for this exact reason—it gives you a chance to strengthen your case and present it to someone new.

You're not alone in this. SSDI statistics from sources like disabilityadvice.org show that millions of Americans rely on these benefits. This just underscores how important it is to keep fighting for the support you need when you can no longer work.

The Four Levels of a Disability Appeal

If you decide to challenge the denial, you'll enter a formal, four-stage appeals process. For each step, you have a non-negotiable 60-day deadline from the date on your denial letter to file your appeal. Miss it, and you have to start all over.

- Reconsideration: This is the first stop. Your entire file gets handed to a completely different examiner at the DDS for a second look. While you don't have to submit new evidence, this is the perfect opportunity to add any new medical records or test results that strengthen your claim.

- Hearing by an Administrative Law Judge (ALJ): If the reconsideration is also a "no," you can request a hearing with a judge. This is where most people win their cases. It's your chance to speak directly to an Administrative Law Judge—someone who had nothing to do with the first two denials—and explain your situation in person or over video.

- Appeals Council Review: If the ALJ's decision doesn't go your way, you can ask the Appeals Council to review it. They aren't re-trying your case; they're looking for mistakes. They check to see if the judge made a legal or procedural error. The Council can agree with the judge, overturn the decision, or send your case back for another hearing.

- Federal Court Review: Your last resort is to file a lawsuit against the Social Security Administration in U.S. District Court. This is a serious legal step that moves your case out of the SSA's hands and into the federal court system.

The appeals process can feel like a maze, which is why knowing how to appeal a disability denial is so crucial. Especially once you get to the hearing stage, having a lawyer who knows this system inside and out can make all the difference. They can help gather the right evidence, prepare you for the judge's questions, and build the strongest possible argument for your case.

Common Questions About the SSDI Process

Even with a roadmap, the SSDI journey can feel like navigating a maze. It’s packed with specific rules and timelines that often don’t make intuitive sense. Getting straight answers to the most common questions can make a world of difference, helping you stay on track and easing some of the stress that naturally comes with this process.

Let's dive into some of the questions that come up time and time again. Knowing the answers can help you make better decisions, whether you're just starting your application or thinking about an appeal.

Can I Work While Applying for SSDI Benefits?

The short answer is yes, but you have to be incredibly careful. The Social Security Administration (SSA) has a very strict income limit they call Substantial Gainful Activity, or SGA. If what you earn from working goes over this specific dollar amount in a month, the SSA will almost always determine you aren't disabled by their definition.

That SGA limit changes most years, so you have to stay on top of the current number. It is absolutely critical that you report every bit of work and all your earnings to the SSA. Earning even a little over the limit is one of the quickest ways to get a technical denial, no matter how strong your medical records are.

What Is the Difference Between SSDI and SSI?

This is easily one of the biggest points of confusion. While the SSA runs both programs, they're two completely different animals.

- SSDI (Social Security Disability Insurance) is a benefit you've earned. Think of it like an insurance policy you paid into with every paycheck through Social Security taxes. Your eligibility and benefit amount are directly tied to your work history.

- SSI (Supplemental Security Income) is a needs-based program. It’s designed to help people who are disabled, blind, or over age 65 and have very little income or resources, whether they've ever worked or not.

You can sometimes qualify for both programs at the same time (they call this being "concurrent"), but they're still separate with their own rules. At its core, SSDI is insurance, and SSI is a safety net.

The key distinction lies in how you qualify. SSDI is all about your work credits, while SSI is based on your current financial need.

How Long Does It Take to Get a Decision?

This is where you’ll need a lot of patience. On average, you can expect to wait three to five months for an initial decision on your application. But remember, that’s just an average, and your personal timeline could easily be longer.

What causes delays? Lots of things. If the Disability Determination Services (DDS) office has a tough time getting your medical records, or if they schedule you for a Consultative Examination (CE), that will add time. And if your claim is denied and you have to appeal, the whole process can unfortunately stretch to over a year, sometimes much longer.

Should I Hire a Lawyer to Help with My Application?

You’re not required to have a lawyer, especially for the initial application, but getting an experienced professional on your side can be a huge advantage. This is particularly true if you have a complicated case or if you're facing an appeal after a denial.

Most disability lawyers work on a contingency fee. That means you don't pay anything upfront—they only get paid if you win your case. By law, their fee is capped at a percentage of the back pay you're awarded. A good attorney knows exactly what the SSA is looking for, will handle the deadlines and evidence, and can represent you at a hearing, which can dramatically increase your odds of success.

Trying to make sense of an SSDI claim can be overwhelming, but you shouldn't have to figure it all out on your own. The team at Bell Law is here to guide Oregon residents through every part of the process, from filling out that first form to representing you at a hearing. If you're fighting to get the benefits you've earned, visit us at https://www.belllawoffices.com to see how we can help.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.