Navigating Oregon State Disability Benefits An Essential Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Navigating Oregon State Disability Benefits An Essential Guide

When an illness or injury prevents you from working, a common question is, "What now?" Finding the right support system is a critical first step. For residents of Oregon, the answer isn't a single program but a network of both federal and state-level options, each designed for different situations.

Your Guide to Disability Benefits in Oregon

Trying to understand disability benefits can feel overwhelming, like being handed a map to a new country with no legend. This guide is designed to be that legend. It walks through the main support systems available to Oregonians, from federal programs run by the Social Security Administration to state-specific options like Paid Leave Oregon and Workers' Compensation.

Think of it like a mechanic's toolbox—you wouldn't use a wrench to hammer a nail. Each program is a different tool designed for a specific job. This guide breaks down what each program does, who runs it, and where the funding originates. This general information can help you begin to see which path might be relevant to your situation.

A High-Level Overview of Key Programs

To get our bearings, let's look at the main players. At the federal level, you have Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). At the state level in Oregon, Paid Leave Oregon and Workers' Compensation cover more specific, often shorter-term, needs.

The appropriate program for an individual often hinges on the answers to a few key questions:

- Is the disability long-term? Does the condition prevent work for at least a year, or is it a temporary setback?

- What is the applicant's work history? Have they paid into Social Security through their paychecks over the years?

- What is the applicant's financial picture? Do they have very limited income and assets?

- How did the disability happen? Was it a direct result of an injury or illness sustained on the job?

Knowing the distinctions between these programs is the first real step toward clarity. Each one operates with its own rulebook, application process, and definition of who qualifies.

To make this easier, here's a quick comparison table that lays out the programs side-by-side. This snapshot provides a simple framework before we get into the details of each one.

Oregon Disability Programs at a Glance

This table provides a high-level comparison of the main benefit programs available to Oregon residents, clarifying their purpose and administration.

| Social Security Disability Insurance (SSDI) | Provides income to individuals who are unable to work long-term due to a disability and have a sufficient work history. | Social Security Administration (Federal) | Social Security taxes (FICA) paid by workers and employers. |

| Supplemental Security Income (SSI) | Offers financial assistance to disabled adults and children who have limited income and resources, regardless of work history. | Social Security Administration (Federal) | General tax revenues. |

| Paid Leave Oregon | Provides paid time off for family, medical, and safe leave for Oregon workers, including for a personal serious health condition. | Oregon Employment Department (State) | Contributions from employees and large employers. |

| Workers' Compensation | Covers medical costs and lost wages for employees who are injured or become ill as a direct result of their job. | Private insurers or self-insured employers, regulated by the Oregon Workers' Compensation Division (State). | Employer-paid insurance premiums. |

This overview helps illustrate that while all these programs offer support, they are designed for very different circumstances. Now, let's explore what each one means in more detail.

SSDI and SSI: The Two Main Federal Disability Programs

If an individual in Oregon is unable to work for the long term because of a health condition, their first point of exploration may be the two major federal disability programs. Both are run by the Social Security Administration (SSA), but they’re built for very different situations. They can be thought of as two different doors to getting help.

The programs are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). While they both use the same medical standards to determine disability, understanding how they differ financially is a critical first step.

SSDI: An Insurance-Based Program

One way to think about Social Security Disability Insurance (SSDI) is as an insurance program that individuals may have paid into during their working life. The FICA taxes taken out of paychecks are a form of premium.

By working and paying those taxes, a person earns what the SSA calls "work credits." These credits are a key to SSDI benefits. How many are needed depends on the person's age when the disability began, but the bottom line is that SSDI is for people with a sufficient work history who are now unable to work.

To qualify, an applicant must pass two general tests. The first is the work history test—did the person earn enough work credits to be "insured"?

The second test is medical. The SSA has a strict definition of disability: an applicant must have a medical condition that keeps them from doing any significant work and is expected to last for at least 12 straight months or to be terminal.

This brings up a crucial term: Substantial Gainful Activity (SGA). It's the SSA's technical way of asking, "Is the person earning a significant amount of money?" If an individual's monthly earnings are over a certain limit, the SSA may determine they are not disabled, regardless of their medical records. For 2025, that limit is $1,620 per month for most people.

In short, SSDI asks two main questions: Did the applicant work and pay into the system? And does their health condition now prevent them from working and earning a substantial living?

The SSDI payment amount is not based on the severity of a disability, but on the applicant's average lifetime earnings before they stopped working. In Oregon, the average monthly SSDI benefit for a new recipient is around $1,691.39, but an actual amount could be higher or lower.

SSI: A Financial Safety Net

On the other hand, Supplemental Security Income (SSI) is not an insurance program. It's a needs-based safety net funded by general tax dollars, not by Social Security taxes. It’s designed for disabled adults and children who have very little income and few, if any, assets.

Since SSI is not connected to a work history, there's no work credit requirement. This makes it a potential option for people who have not worked much—or at all—and therefore do not qualify for SSDI.

Eligibility for SSI comes down to a strict financial review. The SSA will look at an applicant's income and what they call "countable resources"—things like cash, money in the bank, stocks, or property. To qualify, an individual's resources must be below $2,000 for an individual or $3,000 for a couple. The SSA does not count everything. The house an applicant lives in and one car are often exempt.

The monthly SSI payment is a set federal amount, though it can be lowered if an individual has other sources of income. It is also possible for some people to qualify for both SSDI and SSI at the same time, known as "concurrent benefits."

You can learn more about Supplemental Security Income (SSI) and its unique rules on our site. Having a general handle on both of these federal programs is the foundation for navigating disability options in Oregon.

The Social Security Disability Application Process for Oregonians

For an Oregonian who can no longer work due to a medical condition, applying for federal disability benefits can feel like starting a long and complicated journey. It’s a process with multiple stages, and knowing the roadmap from the start can be beneficial. It can be viewed as a step-by-step path, starting with an application and sometimes moving through appeals and even a hearing.

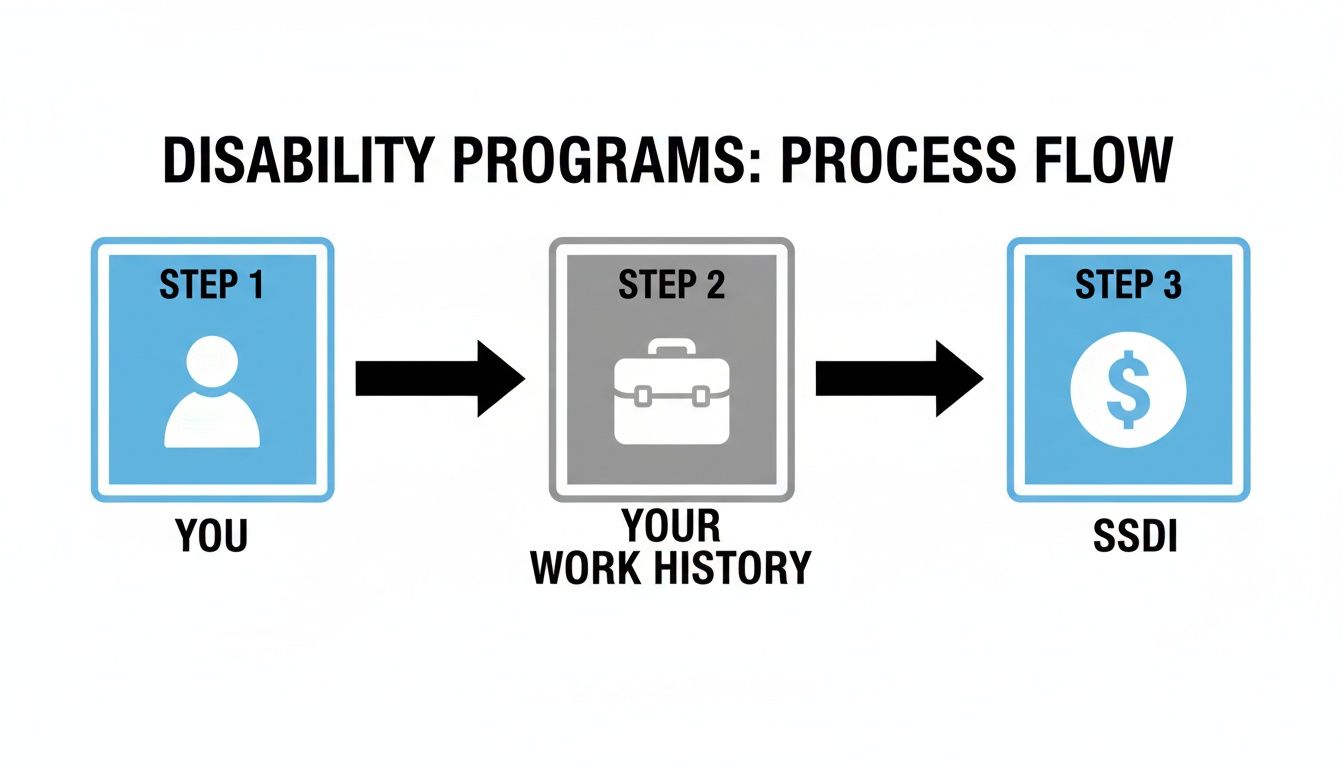

This whole system is built on a foundational idea: an applicant's work history is directly tied to their eligibility for certain federal programs, like SSDI. Before the government even looks at medical records, they need to see if the applicant has paid into the system.

This is why understanding one's own work contributions is the very first piece of the puzzle.

The Initial Application Stage

The journey starts when an application is submitted to the Social Security Administration (SSA). There are several options: it can be done online, by phone, or by scheduling an appointment at a local SSA office. This first step involves gathering extensive information about the medical condition, treatments received, past jobs, and how the disability impacts daily life.

Once the SSA gets the application, they first check the non-medical requirements. For SSDI, that means confirming there are enough work credits. For SSI, they'll look at income and resources. After that's cleared, the file is handed over to a state-level agency called Oregon's Disability Determination Services (DDS). These are the individuals who handle the medical side, reviewing all the records to see if the condition is severe enough to meet the SSA's strict definition of disability.

Reconsideration and Appeals

It is not uncommon for initial applications to be denied. If this happens, the next step is called a reconsideration. This is the first chance to appeal, and it means asking the DDS to take another look at the case. A different examiner and medical consultant will review the entire file, including any new medical evidence submitted since the initial application.

If the reconsideration also results in a denial, there are more options. The next step is to request a hearing with an Administrative Law Judge (ALJ). This is a significant step because the case moves from the state DDS system to a federal hearing office. At the hearing, the applicant can tell their story, and their attorney can present new evidence and testimony to the judge.

The Social Security disability process can often be a marathon, not a sprint. A denial at the start isn't the end of the road; it's just the beginning of the appeals process, where there will be more chances to make the case.

A Look at Oregon's Timelines and Approval Rates

While every case is unique, looking at state-level data can offer a general idea of what to expect. Oregon's numbers have often been better than the national average.

- Oregon’s initial SSDI approval rate is reported at 45.1%, a bit higher than the national average of 39.5%.

- At the hearing level, Oregon's approval rate is reported at 67.4%, also above the national figure of 57.7%.

- In a recent period, the wait time for a hearing in the Portland office was about 10.6 months, with a 69.2% approval rate reported.

These numbers show that many people who are denied at first may eventually get approved, especially once they get to a hearing.

Why Documentation and Persistence Are Important

Throughout this entire process, solid medical documentation is essential. This includes consistent doctor visits, detailed notes from specialists, and objective medical evidence like MRIs, blood work, and X-rays. This paperwork is the bedrock of a claim.

Because the process can have many steps and long waiting periods, persistence can be valuable. The system is built with multiple layers of review to give every case a fair shot. For those just starting out, it can be a good idea to learn the ropes. You can get a much deeper look at the initial steps by checking out our guide on how to apply for SSDI benefits.

A Look at Paid Leave Oregon

Federal programs like SSDI are built for long-term, career-ending disabilities. But what happens when an individual needs to step away from work for a few weeks or months? That’s where Paid Leave Oregon comes in, offering a powerful state-level resource for more immediate, temporary needs.

It can be viewed as a financial bridge. It's not a permanent disability plan, but rather a temporary support system that provides partial wage replacement. It allows a person to handle a serious health crisis or care for a loved one without the stress of losing their entire income.

Who Qualifies for Paid Leave Oregon?

Eligibility for this program isn't about proving a long-term disability or having limited assets. Instead, it's tied directly to an individual's recent work and earnings in Oregon.

Most employees are covered, whether full-time, part-time, or even working multiple jobs. The program is funded by contributions from both employees and larger employers, creating a shared resource pool for Oregon's entire workforce.

What Kinds of Leave Does It Cover?

Paid Leave Oregon is designed to provide support through a wide range of life events. An individual can generally apply for one of three main types of leave.

- Medical Leave: This covers an individual's own serious health condition. It could be for recovering from a major surgery, managing a flare-up of a chronic illness, or going through intensive medical treatments.

- Family Leave: This is for when an individual needs to care for a family member with their own serious health issue. It also covers bonding with a new child—whether through birth, adoption, or foster care—or managing needs related to a family member's military deployment.

- Safe Leave: This crucial protection is available for survivors of domestic violence, sexual assault, stalking, or harassment. It provides the time and financial stability needed to seek medical attention, get legal help, or even relocate to a safer place.

Paid Leave Oregon acknowledges that a "disability" isn't always personal. The need to care for a sick parent or a child can be just as disruptive to a person's ability to work, and this program is built with that reality in mind.

For those curious about how these kinds of programs work elsewhere, it's interesting to explore the origins and global variations of paid leave to see different models in action.

How Much Time and Pay Can an Individual Expect?

In most cases, eligible employees can take up to 12 weeks of paid leave within a 12-month benefit year. For certain conditions related to pregnancy, an additional two weeks may be available, bringing the potential total to 14 weeks.

The payment received is not a full wage replacement. It's calculated based on average earnings over the past year. The system is designed to give lower-wage workers a higher percentage of their average weekly pay, ensuring that the program provides meaningful support to those who need it most. This structure makes Paid Leave Oregon a vital piece of the broader network of Oregon state disability benefits, filling a critical gap for temporary work interruptions.

How Workers' Compensation Works for Job-Related Disabilities

When an injury or illness is a direct result of a job, a completely different support system comes into play. Oregon's workers' compensation program is not a social safety net like SSDI; it's a specific type of insurance that employers are legally required to carry.

This system is built for one purpose: to assist people with work-related health conditions. It's a dedicated path for on-the-job injuries, designed to cover medical treatment and replace some lost wages while an individual heals. It all operates under its own unique set of rules managed by Oregon's Workers' Compensation Division.

Temporary Disability Benefits During Recovery

If a work injury prevents someone from doing their job for a period of time, a couple of temporary benefits can act as a financial bridge. These can be thought of as a lifeline while a person is actively getting treatment.

- Temporary Total Disability (TTD): This is for when a doctor confirms a person is completely unable to work for a period of time. TTD benefits step in to pay a portion of the wages they are losing.

- Temporary Partial Disability (TPD): Sometimes an individual can go back to work, but not at full capacity. They may be on light duty or working fewer hours. If that modified work pays less than their regular job, TPD can make up some of the difference.

It's important to understand these benefits are not meant to be a permanent fix. They are there to provide stability until the medical condition stabilizes—a point doctors call being "medically stationary."

Benefits for Lasting Impairments

What happens when a doctor determines a condition has improved as much as it's going to? If the injury has left the person with a permanent impairment that impacts their ability to function, the focus shifts to long-term benefits.

A common benefit in this situation is Permanent Partial Disability (PPD). This is a monetary award designed to compensate an individual for the permanent loss of use or function of a body part caused by their work injury.

The size of a PPD award is not arbitrary. It is calculated based on a detailed medical assessment that assigns a rating to the level of impairment according to state guidelines. Anyone facing this situation can get a better sense of the entire journey by reading our detailed guide on the workers' comp claim process.

The world of PPD benefits in Oregon has seen its share of changes. A major reform in 1990 significantly increased benefit amounts, and another in 1996 pushed them to historic highs—in some cases, more than doubling the awards.

To give an idea of the scale, one recent reporting period saw nearly $45 million paid out in monthly awards for death and permanent disability claims. This history highlights the state's ongoing effort to balance robust support for injured workers with the economic realities of the system, directly shaping the Oregon state disability benefits available today.

Disability Benefits for Oregon Public Employees

If an individual works for the state, a local government, or a public school in Oregon, their disability benefits come from a different system. This specialized system is called the Oregon Public Employees Retirement System, or PERS, and it operates entirely separately from federal Social Security and other state programs.

The roots of this system run deep. When PERS was established back in 1945, disability provisions were included from the start. Over the years, the program has evolved, with major reforms in the 1950s to expand coverage for police and firefighters. This long history shows a continued commitment to supporting the state’s public workforce. A full breakdown of these changes can be seen in this history of Oregon PERS timeline.

Eligibility and Time in Service

Here’s where PERS really differs from federal programs. Instead of looking at an entire work history, PERS disability benefits are closely tied to a person's specific service time as a public employee. The number of years they have contributed to the retirement system is often a very important factor in whether they qualify.

PERS generally sorts disability claims into two categories:

- Non-Duty Disability: This is for an illness or injury that is not related to the job.

- Duty-Related Disability: This applies to a condition that was caused or made worse by work duties.

The eligibility rules—including how many years of service are needed—can be different for each type.

PERS can be thought of as a combined retirement and disability plan designed just for public employees. The rules are custom-built for the public sector, creating a unique support system that a private-sector employee would not have access to.

How PERS Works with Other Benefits

It's crucial to understand how PERS benefits fit in with other programs. For example, if a disability is job-related, a PERS claim will likely need to be coordinated with a workers' compensation claim. The two systems are designed to interact, but navigating the specific rules of that interaction can be complex.

Ultimately, a PERS disability benefit is a form of retirement. If a claim is approved, the recipient will receive a monthly payment calculated from their final average salary and their years of service. It’s a system designed to provide a stable, long-term income for career public servants who can no longer work, making it a vital piece of the oregon state disability benefits puzzle for this specific group.

Frequently Asked Questions About Oregon Disability Benefits

When you're trying to figure out disability benefits in Oregon, it’s completely normal to have questions. The system can feel complex, and you may be wondering how all the different programs work, where to even begin, and what to expect. Let’s address some of the most common questions people have.

Can I Get More Than One Type of Disability Benefit at the Same Time?

Yes, it's possible in some circumstances, but this is where things get complex. The different programs have rules that can affect eligibility for other benefits.

For instance, receiving workers' compensation benefits can sometimes lower the amount an individual receives from Social Security Disability (SSDI). This reduction is called an "offset." The government has a complex formula to ensure an individual does not receive more than a certain percentage of their pre-disability earnings.

The same applies to a needs-based program like Supplemental Security Income (SSI). Since SSI is designed for people with very limited income and resources, getting payments from another source could make a person ineligible or reduce their monthly SSI check. It is important to understand how each program interacts with the others.

I Can't Work. What’s the Very First Thing I Should Do?

Before considering applications, an important first step is to get consistent medical treatment. Medical records are the bedrock of any disability claim, no matter which program is applied for.

It can be helpful to talk openly with a doctor about how a condition limits the ability to work. Making sure every symptom, limitation, and treatment is documented creates an official paper trail that can support a case. Once that is underway, the next step is to figure out which path may be the most relevant.

- Is it a long-term problem? If a doctor expects an individual will be out of work for at least a year, it may be time to look at federal programs like SSDI or SSI.

- Is this a temporary situation? For shorter-term leave (like recovering from surgery or a serious illness), Paid Leave Oregon might be the best fit.

- Did it happen at work? If an injury or illness is a direct result of a job, it is necessary to start with a workers' compensation claim.

How Long Will I Wait for a Decision?

This is a big question, and the answer really depends on the program. For state-level benefits like Paid Leave Oregon or workers' comp, a decision might come in a matter of weeks. They are designed to be much faster.

The federal Social Security disability system, on the other hand, can be a marathon, not a sprint. Just getting an initial decision on an SSDI or SSI application can take several months. If an application is denied—which happens to many people initially—and an appeal must be filed, the whole process can easily stretch out for a year or longer, especially if it proceeds to a hearing before a judge.

To give a real-world idea, recent data showed that the average wait time for a hearing at the Portland Social Security office was about 10.6 months.

When dealing with a long wait and a loss of income, other financial pressures don't just disappear. It can be smart to know all your rights. For example, learning how to stop wage garnishment in Oregon can be a critical piece of information for protecting the money you do have. Staying informed on issues like this helps you keep your finances stable while you focus on your health.

Navigating the legal side of disability benefits can be tough. Having someone in your corner who knows the system inside and out can be the key to pursuing the benefits you may be entitled to. If you have questions or need help with your claim, the team at Bell Law is ready to listen. Contact us today to talk about your case.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.