Social Security Disability Requirements Explained

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Social Security Disability Requirements Explained

To figure out if you meet the social security disability requirements, you need to look at two distinct but equally important parts of your life: your health and your work history. Think of it as a two-sided coin. On one side, you have a medical condition that’s severe enough to stop you from working. On the other, you have a work history that shows you’ve paid into the Social Security system.

The Social Security Administration (SSA) looks at both sides. You have to satisfy both criteria—it’s not one or the other. This ensures that the benefits are there for people who truly need them and have a record of contributing to the system.

The Two Pillars of Disability Eligibility

Getting approved for Social Security Disability Insurance (SSDI) isn't about checking a single box. It's about building a strong case that rests on two foundational pillars. The SSA has very strict guidelines, and your claim needs to show that both your medical situation and your work history fit squarely within them. Getting a handle on these two pillars is your first, most important step.

This system is a financial lifeline for millions. As of April 2025, it provides support to 7.2 million disabled workers and their families, with the average monthly benefit hovering around $1,537. To get this support, you have to prove two things: that your medical condition will keep you out of work for at least a year, and that you’ve worked and paid into the system long enough to be "insured."

To help clarify this, let's break down these two core requirements.

The Two Pillars of SSDI Eligibility at a Glance

| Medical | Your health condition is so severe it prevents you from doing any meaningful work. | Medical records, doctor's notes, lab results, and proof that the condition will last at least 12 months. |

| Non-Medical | You have worked and paid Social Security taxes long enough to be covered. | "Work credits" earned based on your yearly income. The number you need depends on your age. |

Both of these pillars are non-negotiable. You can't have one without the other and expect to be approved. Now, let’s look a little closer at each one.

The Medical Pillar: Your Health Condition

The first pillar is all about your health. The SSA needs to see clear, objective evidence that your physical or mental condition is severe enough to prevent you from performing what they call Substantial Gainful Activity (SGA).

It's not enough to just have a diagnosis. The real question is: How does that diagnosis actually limit your ability to hold down a job and earn a living?

Your claim will be judged on a few key things:

- Severity: Does your condition get in the way of basic work-related tasks like walking, sitting, lifting, or concentrating?

- Duration: Has your impairment already lasted for at least 12 months, or is it expected to last that long? Or, is it terminal?

- Medical Evidence: Is your application backed up by solid records from doctors, specialists, and other "acceptable medical sources"?

The strength of your medical evidence is often the deciding factor in a disability claim. Without detailed, consistent documentation from healthcare professionals, even the most legitimate claims can be denied.

The Non-Medical Pillar: Your Work History

The second pillar has nothing to do with your health and everything to do with your work history. This is where "work credits" come into play. You earn these credits automatically as you work and pay Social Security taxes.

To qualify, you need to have earned enough of them. How many you need depends on how old you were when your disability began. This requirement makes sure that SSDI benefits go to people who have a history of contributing to the very system they need help from.

The SSA actually uses two different tests to check your work history: a "recent work test" and a "duration of work test." You have to pass both. We'll get into the nitty-gritty of how credits are calculated later on, but for now, just know that your employment file is every bit as critical as your medical file.

If you're wondering how your own situation stacks up, take a closer look at our guide on determining if you are eligible for benefits.

Meeting Your Work History Requirements

Before the Social Security Administration (SSA) even glances at a single medical record, they have to check off a different box first: your work history. Think of it like a two-gate system. Your medical condition is behind the second gate, but you can't even get to it unless your work history unlocks the first one. This initial step boils down to one simple thing: work credits.

Work credits are basically the currency of the Social Security system. You earn them by working and paying your Social Security taxes. The dollar amount needed for a credit inches up a bit each year, but for 2025, you'll earn one credit for every $1,760 you make, up to a maximum of four credits per year. These credits are the bedrock of your eligibility, proving you’ve paid into the system you now need help from.

To see if you have enough credits, the SSA uses two separate tests. You have to pass them both.

The Recent Work Test

First, the SSA needs to know you've been working recently. This is called the "recent work test," and it's designed to look at your employment in the years just before your disability started. It prevents a scenario where someone who worked 20 years ago, but hasn't been in the workforce since, tries to file a claim.

The rules for this test change based on how old you were when your disability began:

- Age 31 or older: You generally need to have earned 20 credits (which is about five years of work) within the 10-year period right before your disability hit.

- Between ages 24 and 31: The rule is a bit different. You must have worked at least half the time from when you turned 21 to when you became disabled.

- Under age 24: You’ll typically need 6 credits (roughly 1.5 years of work) earned in the 3-year window ending when your disability started.

This test is all about ensuring that benefits go to people who were actively paying into the system not too long ago.

The Duration of Work Test

Passing the recent work test gets you halfway there, but it's not enough on its own. You also have to pass the "duration of work test." This second check looks at your entire career to make sure you've worked long enough overall. While the first test proves your recent connection to the workforce, this one proves you have a substantial history of working over your lifetime.

Just like the recent work test, the number of credits you need here also depends on your age. The older you are, the more credits you’ll need to have accumulated.

Key Takeaway: The SSA is looking for both recent work and a solid long-term work history. Having one without the other just won't cut it for meeting the technical side of SSDI eligibility.

Here’s a quick look at the total credits you might need, depending on your age:

| Before age 28 | 6 credits (1.5 years of work) |

| Age 30 | 8 credits (2 years of work) |

| Age 42 | 20 credits (5 years of work) |

| Age 50 | 28 credits (7 years of work) |

| Age 62 or older | 40 credits (10 years of work) |

It’s so important to understand how the SSA looks at your work history. A lot of people get completely wrapped up in their medical diagnosis, only to find out their claim was denied on a technicality before a single medical file was ever opened. To get a better handle on this, you can learn more about how to qualify for Social Security and make sure your work record is up to snuff.

Proving You Meet the Medical Criteria

Once you’ve cleared the non-medical hurdles, your claim gets to the main event: your medical condition. This is where the vast majority of disability claims are either won or lost. To make a decision, the Social Security Administration (SSA) uses a very strict, 5-step evaluation process.

Think of this process as a series of gates. If your claim gets stopped at any one of them, it will be denied. You have to pass through all five, in order, for your application to be approved. It's a rigid system, but it's how the SSA ensures every single case is judged by the same set of standards.

Step 1: Are You Working Above the Limit?

The very first question the SSA asks has nothing to do with your diagnosis. Instead, they want to know: are you currently working and earning what they consider to be a significant income? This is measured against a specific dollar amount known as Substantial Gainful Activity (SGA), and the number usually changes each year.

If your monthly earnings are more than the SGA limit, the SSA will automatically conclude that you aren't disabled, no matter what your medical records say. Your claim stops right there. If you're not working or your earnings fall below the SGA threshold, your claim moves on to the next gate.

Step 2: Is Your Condition Medically Severe?

Next up, the SSA looks at whether your impairment is "severe." This isn't just a casual term; it has a specific legal meaning in their world. A condition is only considered severe if it significantly limits your ability to perform basic work-related tasks like sitting, standing, walking, lifting, concentrating, or remembering instructions for at least 12 consecutive months.

This is where your medical records become everything. A simple diagnosis on paper isn’t enough. The evidence has to clearly demonstrate how your condition functionally cripples your ability to work. If the SSA decides your impairment is "not severe," your claim is denied.

The SSA is far less interested in the name of your condition and much more interested in its impact. The question they're always trying to answer is: How does this specific impairment stop you from functioning in a work environment?

Step 3: Does Your Condition Meet a Listing?

At step three, the SSA pulls out its official list of impairments, often called the "Blue Book." This manual contains a massive list of medical conditions that the administration already considers severe enough to prevent someone from working.

Each condition in the Blue Book has a very specific set of criteria you must meet. For instance, a listing for a back problem might require exact findings on an MRI, documented nerve root compression, and specific limitations in your range of motion. You have to check every box.

If your condition perfectly matches or is medically equal to a listing, your claim will be approved on the spot. But be warned: most claims don't, and they have to proceed to the final two, more subjective steps. You can learn more about what qualifies for disability benefits in our detailed guide.

Step 4: Can You Do Your Past Work?

If your condition doesn't meet a Blue Book listing, the SSA then has to figure out your Residual Functional Capacity (RFC). This is just a formal way of saying they create a detailed breakdown of what you can still do, despite your limitations.

Using your RFC, they look back at your work history from the last 15 years. They analyze the physical and mental demands of your old jobs and compare them to your current abilities. If they decide you can still perform any of that past work, your claim will be denied.

Step 5: Can You Do Any Other Work?

If you can't go back to your old jobs, you've made it to the final step. Here, the SSA takes everything into account—your RFC, age, education, and past work experience—to decide if there is any other type of work you could do that exists in the national economy.

For example, let's say your past work was in heavy construction, but your RFC says you can only do sedentary (sit-down) jobs. The SSA will then look to see if there are any unskilled, sedentary jobs you could pivot to. If they find that such jobs exist and you could do them, your claim will be denied.

Only if they conclude there is absolutely no work you can adjust to will your claim finally be approved.

To help you visualize this entire process, here’s a quick summary of the questions the SSA asks at each stage.

The 5-Step Medical Evaluation Process

| 1 | Are you engaging in Substantial Gainful Activity? | If you're earning over a certain amount per month, your claim is denied, regardless of your medical issue. |

| 2 | Is your medical condition "severe"? | Your condition must significantly limit basic work activities for at least 12 months. If not, you're denied. |

| 3 | Does your condition meet or equal a "Blue Book" listing? | If your medical evidence matches the specific criteria for a listed impairment, you are approved. |

| 4 | Can you perform any of your past relevant work? | If the SSA finds you can still do a job you held in the last 15 years, your claim is denied. |

| 5 | Can you adjust to any other type of work? | If there are other, less demanding jobs in the economy you could do, you are denied. If not, you're approved. |

Successfully navigating these five steps is the key to getting the support you need. As of December 2023, over 8.7 million disabled workers were receiving SSDI benefits, with an average monthly payment of $1,537.13. The most common conditions were musculoskeletal disorders, which accounted for about 34.1% of all cases.

Gathering the Evidence for Your Claim

Winning a Social Security disability claim isn't just about being sick or injured; it's about proving it. You have to build an undeniable case, supported by a mountain of organized, compelling evidence. Think of yourself as building a legal case, because that’s essentially what this is.

Your claim is only as strong as the documents you provide to the Social Security Administration (SSA). A disorganized or incomplete file is one of the fastest tickets to a denial letter. This is your practical guide to getting every piece of paper the SSA needs to see, right from the start.

Your Personal Information Checklist

First things first, the SSA needs to know who you are. This part is pretty straightforward, but you can’t skip it. Getting these basics right from the beginning prevents simple clerical errors that can cause frustrating delays down the road.

Before you do anything else, round up these core documents:

- Birth Certificate: An original or a certified copy.

- Social Security Card: To verify your Social Security number.

- Proof of U.S. Citizenship or Lawful Alien Status: This could be your passport, birth certificate, or naturalization papers.

- Marriage and Divorce Records: If this applies to you, have the dates, locations, and names of former spouses ready.

- Children’s Information: You’ll need birth certificates and Social Security numbers for any minor children.

These documents confirm your identity and family status, which can actually impact the amount of benefits you and your dependents might receive.

A winning disability claim is built on a foundation of overwhelming evidence. Every document you provide is another brick in that foundation, making your case stronger and more difficult for the SSA to deny.

The Heart of Your Claim: Medical Records

This is it. This is where your claim will be won or lost. Your medical evidence needs to paint a clear, consistent, and detailed picture of your limitations. It’s simply not enough to tell the SSA you have a certain condition; you have to show them, with exhaustive proof, exactly how that condition stops you from being able to work.

Your medical file should be as complete as you can possibly make it. Gather everything you can find related to your disability, including:

- Names and Contact Information: Make a comprehensive list of every single doctor, hospital, clinic, and therapist you've seen.

- Dates of Treatment: Keep a log of every appointment, surgery, and therapy session.

- Medical Test Results: This means everything—MRIs, CT scans, X-rays, blood work, psychological evaluations, and any other diagnostic tests.

- Physician’s Notes: These are crucial. They contain your doctor's real-time observations about your symptoms, your physical and mental limitations, and their professional opinion on your prognosis.

- Prescription History: Get a list of every medication you take, the dosage, and why it was prescribed.

This collection of documents becomes the objective proof of your disability. The SSA examiner will comb through these records to figure out your Residual Functional Capacity (RFC)—what you can still do despite your impairments—and see if your condition is severe enough to meet their strict medical rules.

Documenting Your Work History

Finally, the SSA needs a clear picture of your work life to complete their evaluation. This is where they look at your past jobs (Steps 4 and 5 of their process) to see if you could still do that work, or if there’s any other, less demanding job you could do instead.

You’ll need to put together a detailed summary of your employment for the past 15 years. For every job you held in that timeframe, be prepared with:

- Job Titles and Dates of Employment: A simple list of each position.

- Detailed Job Descriptions: Don't just write "cashier" or "mechanic." Think about the specifics. How much did you have to lift, and how often? How long did you stand, walk, or sit each day? What specific mental tasks were required?

- Pay Information: You can back this up with old W-2s or tax returns.

This information gives the SSA the context they need. It helps them understand the skills you have and the physical exertion you're used to, which is absolutely vital when they decide whether other jobs in the national economy are a realistic option for you.

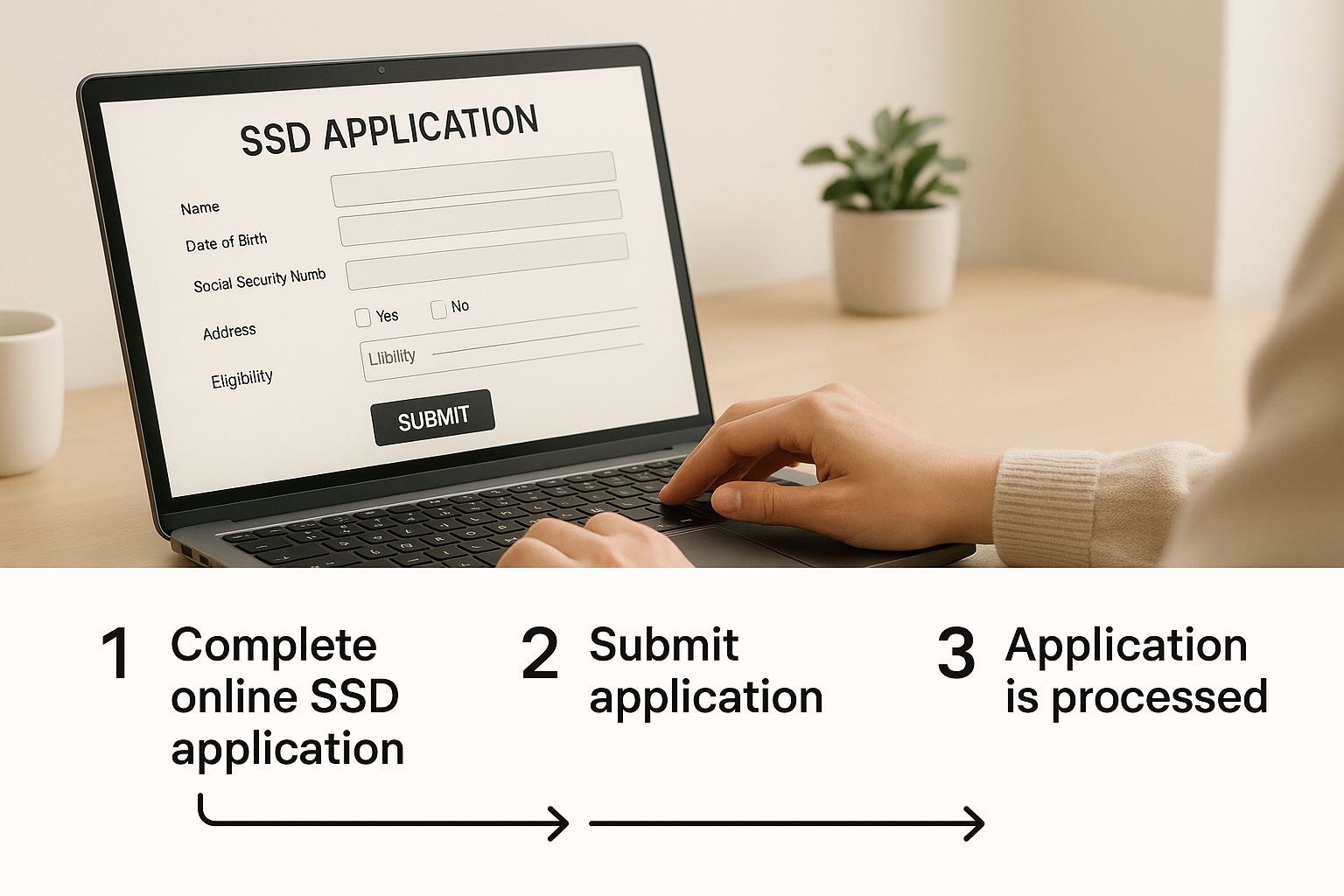

What Happens After You Apply for Disability?

Hitting "submit" on your disability application is a huge milestone, but it’s really just the beginning. From here, your claim starts a long journey through a complex system. Knowing the path it takes can help manage expectations and ease some of the stress of waiting.

Think of it like a relay race. You hand the baton to your local Social Security office first. Their job isn't to decide if you're medically disabled; they're just checking the basics. They'll verify your non-medical requirements—things like your age, work history, and citizenship.

Once they give the green light on the non-medical side, they pass your file to a different agency to handle the heavy lifting.

The State Agency Takes Over: Disability Determination Services

The next runner in this race is a state agency called Disability Determination Services (DDS). While it’s a state-level office, it works for the Social Security Administration, and its sole purpose is to make the medical decision on your claim.

The DDS is where disability examiners and medical consultants dig into the details. They'll pour over every doctor's note, lab result, and treatment record you've provided. This is the stage where that five-step evaluation process we talked about earlier gets put into action, as they work to determine if your condition truly prevents you from working.

What if They Need More Information?

It’s pretty common for the DDS to find that the medical evidence in your file doesn't paint a complete picture. Maybe your records are a bit dated, or they don’t have enough specific detail about how your condition limits you day-to-day.

When that happens, the examiner usually does one of two things:

- Reach out to your doctors: They might send a form or call your doctor’s office directly to get more specific information about your diagnosis and limitations.

- Schedule a Consultative Examination (CE): The DDS can send you to an independent doctor for an exam, and the SSA pays for it.

A Consultative Examination (CE) isn't for treatment. It's a one-time appointment designed to give the DDS a current, objective snapshot of your medical condition. The doctor's report goes straight back to the examiner to help them make a decision.

This whole process highlights the immense hurdles people with disabilities often face. The 2024 Global Disability Inclusion Report points out that worldwide, people with disabilities face major gaps in health and employment, and the recent pandemic only made things worse. This struggle to access essential services makes navigating a bureaucratic process like this even more of a challenge. You can learn more about these global challenges to disability inclusion on globaldisabilitysummit.org.

The Initial Decision and What Comes Next

Once the DDS examiner has everything they need, including any CE reports, they will make the initial decision on your claim.

If your application is approved, congratulations! You’ll get an award letter in the mail explaining how much your benefits will be and when they will start.

If your claim is denied, you'll receive a notice explaining why. Don't panic—this is far from the end of the line. You have the right to appeal the decision, which kicks off a whole new process with several more steps, like reconsideration and a hearing with a judge.

Common Mistakes That Can Sink Your Application

Getting approved for Social Security disability benefits is a tough road, and it’s heartbreaking to see strong claims get denied because of simple, avoidable mistakes. Knowing what these common traps are ahead of time is one of the best things you can do to build a solid case right from the start.

Lots of people think a diagnosis is a golden ticket, but one of the biggest stumbles is not providing enough medical proof. The SSA needs to see more than just the name of your condition; they need cold, hard evidence showing exactly how it stops you from being able to work. If your file is thin on records or shows big gaps in treatment, you’re basically inviting them to deny you.

Underestimating How Much Treatment History Matters

Another classic mistake is not following your doctor’s orders. If your doctor tells you to go to physical therapy, take a certain medication, or have a procedure, and you don't do it—the SSA might conclude your condition isn't as bad as you say.

This is a really big deal. If you had to stop treatment because you couldn't afford it or the side effects were unbearable, you must have your doctor write that down in your chart. If there's no official reason documented, it just looks like you aren’t taking your health seriously, and that can torpedo your entire claim.

The SSA looks at whether you're following prescribed medical advice as a huge clue to how severe your condition really is. If you don't comply and there’s no good, documented reason why, they can interpret it as proof that your impairment isn't truly disabling.

Telling Different Stories

Your story has to be the same, no matter who you’re telling it to. Everything you put on your application forms, say in your interviews, and what’s in your doctor's notes has to line up perfectly. A frequent slip-up is telling your doctor you’re doing okay while telling the SSA you’re completely incapacitated.

For instance, if you tell your doctor you can still do a little gardening but then write on your disability forms that you can't stand for more than five minutes, that’s a massive red flag. The examiners are trained to hunt for these kinds of contradictions.

The best way to avoid this is to be brutally honest with everyone, all the time:

- Your Doctors: Give them the full story—your daily struggles, what the pain really feels like, and what you truly can and can’t do.

- The SSA: Make sure every detail on your forms matches what your medical records say.

- Yourself: It can be helpful to keep a daily journal of your symptoms. This isn't for the SSA, but for you, so you can recall details accurately when you need to.

Finally, so many people simply miss deadlines. The disability process is loaded with strict timelines, especially for appeals. If you get a denial, you only have 60 days to appeal it. Miss that window, and you might have to start the whole frustrating process over from square one, potentially losing out on months or even years of back pay. Stay on top of your mail and respond to the SSA immediately.

Answering Your Top Questions About Disability Requirements

Even when you think you have a handle on the basics, the world of Social Security disability requirements can throw some curveballs. It’s natural to have questions about your specific situation. Let’s clear up some of the most common points of confusion we hear from clients every day.

How Long Does My Disability Have to Last?

This is a big one. The SSA requires your condition to have lasted or be expected to last for at least one continuous year. A terminal diagnosis also meets this "durational requirement."

A common misconception is that you have to be out of work for a full year before you can even apply. That's not true. You should file your claim as soon as you and your doctor know your condition will keep you from working for at least 12 months.

Can I Work a Little and Still Qualify for Benefits?

Technically, yes, but it's walking a very fine line. The SSA has a hard income limit known as Substantial Gainful Activity (SGA). If your monthly earnings go over this amount (which changes each year), your claim is almost guaranteed to be denied.

Be careful even if you're earning under the SGA limit. The SSA will scrutinize any work activity. They might decide that even part-time work proves you could handle a full-time job, which could sink your entire case. Always report any and all earnings right away.

What Happens If My Application Is Denied?

First off, don't panic. A denial is disappointing, but it's incredibly common—most initial applications are turned down. This is where the appeals process begins.

You have 60 days from the date on your denial letter to file your first appeal, called a "Request for Reconsideration." If that's denied, the next step is to request a hearing with an Administrative Law Judge (ALJ). This hearing is often the best chance many people have to get approved. The appeals can go even further, to the Appeals Council and Federal Court, if needed.

Trying to navigate a denial and the appeals process alone can feel like an impossible task. The attorneys at Bell Law Offices, PC live and breathe Social Security Disability law and can guide you through every stage. Contact us to make sure your rights are protected and you have the strongest case possible for the benefits you need. You can find out more by visiting us at https://www.belllawoffices.com.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.