What Is Third Party Liability in Oregon?

"I was satisfied once John Bell took over my case."

"Communication was always timely."

What Is Third Party Liability in Oregon?

When you get into an accident, it's easy to get lost in the legal jargon. But one concept is at the heart of nearly every personal injury case: third party liability.

So, what is it? Think of it as a basic rule of fairness. The person or company that caused your injury is the one who should be financially responsible for the fallout. It’s not your burden to bear.

In this legal story, there are three main characters. You are the first party. Your own insurance company is the second party. The person or company that hurt you? That's the third party. This simple idea is what allows you to seek justice and compensation.

What Does Third Party Liability Actually Mean for Your Case?

Let's dive a little deeper. Third party liability is the legal principle that forces a person or business to pay for the harm they cause through carelessness or a wrongful act. It's the engine that powers the entire liability insurance industry—a massive global market valued at around $290.5 billion in 2024.

This type of insurance is what protects people and businesses from financial ruin when they make a mistake that injures someone else. You can dig into the latest industry statistics to see just how big this market is.

A third party claim is what you file when someone other than yourself is responsible for your injuries. This "third party" could be anyone: another driver who ran a red light, a store owner who didn't clean up a spill, or even the manufacturer of a defective product.

The Key Players in a Third Party Claim

To really get a handle on this, it helps to know who's who. Every Oregon personal injury claim has a cast of characters, and understanding their roles makes the whole process much clearer.

Here's a quick breakdown of the key parties involved in a typical third party liability claim and what they do.

Key Parties in a Third Party Liability Claim

| The First Party | The injured person seeking compensation. | You, after being hurt in a car crash. |

| The Second Party | Your own insurance company. | Your auto insurer, who you file a PIP claim with. |

| The Third Party | The individual or entity at fault for the injury. | The other driver who caused the accident. |

| The Third Party's Insurer | The insurance company covering the at-fault party. | The at-fault driver's car insurance company. |

Knowing these roles from the start helps you see the road ahead. You’ll understand who you're dealing with and why they're involved in your case.

In essence, a third party liability claim is about holding the right person accountable. It’s a legal tool designed to make sure the financial weight of an accident rests on the shoulders of the one who caused it—not the person who was innocently injured.

The Three Pillars of a Successful Claim

When we talk about holding a third party responsible for an injury, it’s about more than just pointing a finger. To build a successful claim, you have to prove three specific things.

Think of it like building a sturdy legal argument—your case needs to stand on three solid pillars. If any one of them is shaky, the whole thing can come tumbling down. These aren't complicated legal secrets; they're grounded in straightforward, common-sense ideas about responsibility.

Let’s break them down one by one.

The First Pillar: Duty of Care

First, you have to show that the other person had a Duty of Care. This is simply a legal term for a responsibility to act in a way that doesn't cause harm to others. It’s the unwritten rulebook that keeps society functioning safely.

For instance, every driver on an Oregon road has a duty to follow traffic laws and pay attention. A business owner has a duty to maintain a safe environment for customers, like mopping up a spill before someone slips. This duty is the baseline expectation we have for each other.

The Second Pillar: Breach of Duty

Once you've established that a duty existed, the next step is proving a Breach of Duty. This is the moment the other party failed to meet their responsibility. They broke the rules, either through a careless action or by failing to act when they should have.

A driver texting behind the wheel and blowing through a stop sign has obviously breached their duty to drive safely. Likewise, a landlord who knows a stair is broken but does nothing to fix it has also breached their duty. The breach is the specific mistake that put you in harm's way.

A successful claim is a story told in three parts: a responsibility was owed, that responsibility was broken, and your injury was the direct result. Each part is as crucial as the last.

The Third Pillar: Causation

This brings us to the final, and arguably most important, pillar: Causation. You have to draw a direct line from the other party’s mistake to your actual injuries. In simple terms, you must prove that because they were negligent, you got hurt.

It’s not enough to show that a driver was speeding. You have to prove that their speeding caused the crash that left you with a concussion and a stack of medical bills. This connection is the legal glue that holds the entire case together.

Getting a handle on how these pillars work is the first step. To dig deeper, you can learn more about the specifics of a third party claim in Oregon and see how these concepts play out in the real world.

Navigating The Claim Process Step By Step

When you're dealing with an injury, the idea of filing a legal claim can feel overwhelming. It’s easy to get lost in the details. But think of it like a roadmap—once you understand the key steps, the path forward becomes much clearer.

The journey starts the moment the incident happens. And your very first priority? Your health.

Immediate Actions After an Injury

What you do in the first few hours and days after an injury is crucial. These initial actions lay the groundwork for your entire claim by establishing the facts and documenting the real-world impact of someone else's negligence.

- Get Medical Help: This is non-negotiable. See a doctor immediately, even if you think you're okay. Some serious injuries, like concussions or internal bleeding, don't show symptoms right away. A doctor's visit creates an official medical record that directly links your injuries to the accident.

- Report It Officially: If you were in a car crash, call the police. If you slipped and fell at a store, find the manager and make sure an incident report is filed. An official report is an unbiased account of what happened.

- Collect Your Own Evidence: If you're physically able, use your phone. Take pictures and videos of the scene, your injuries, and any property damage. Talk to anyone who saw what happened and get their name and number. This firsthand evidence can be incredibly powerful later on.

Building and Pursuing Your Claim

After you've addressed the immediate crisis, the focus shifts to building your case for compensation. This is where careful organization and clear communication really matter. You and your attorney will start pulling together all the documentation needed to prove the other party was at fault.

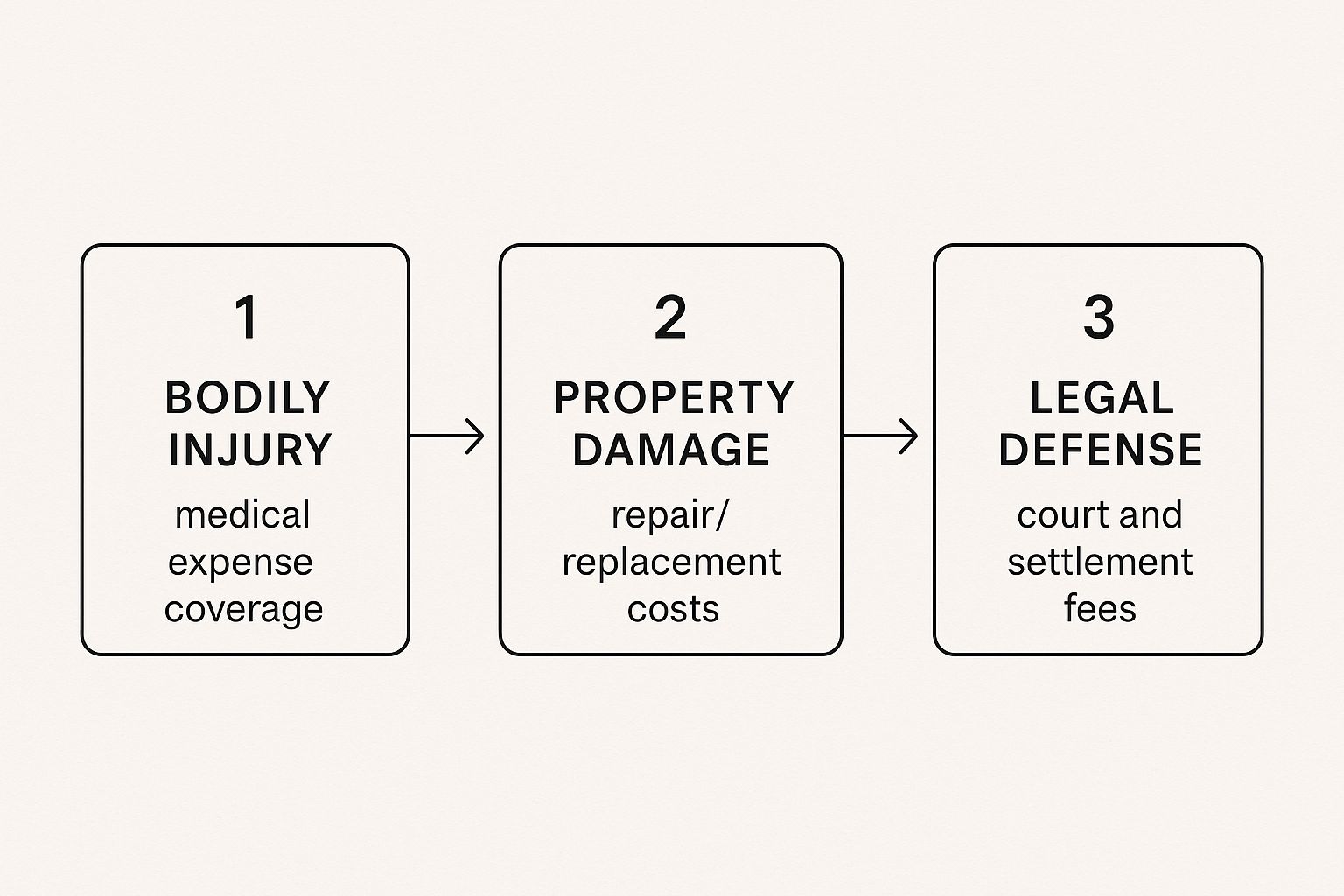

The infographic below breaks down the main types of damages that a third-party liability claim can cover.

As you can see, a successful claim helps cover everything from medical treatments and lost wages to the cost of repairing your property and even the legal fees involved.

A strong claim is built on a foundation of clear evidence. Every medical bill, witness statement, and photograph tells a piece of the story, proving the third party’s responsibility for your damages.

Next, we move into negotiations. Your attorney will draft and send a formal demand letter to the at-fault party's insurance company. This letter lays out your case and specifies the compensation you’re seeking. The insurer will review it and respond, kicking off a back-and-forth negotiation. It's worth knowing that the vast majority of personal injury claims—over 95%—are settled at this stage without ever going to court.

But what if the insurance company digs in its heels and refuses to make a fair offer? That’s when filing a lawsuit becomes the necessary next step. While it sounds intimidating, sometimes it's the only way to get an insurer to take your claim seriously. You can get a much more detailed breakdown by reading our guide on navigating the personal injury claims process.

These kinds of liability issues are becoming more and more significant. The global market for managing third-party risks was valued at a staggering $7.42 billion in 2023 and is expected to balloon to $20.59 billion by 2030. This explosive growth shows just how critical these claims are in our interconnected world.

Real-World Examples of Liability Cases

Legal concepts can feel a bit theoretical and distant. But the idea of what is third party liability clicks into place when you see it play out in the real world. These aren't just abstract rules; they're situations that happen every day across Oregon, changing people's lives in an instant.

The classic example is a car crash. Let's say you're waiting at a red light in Eugene when a distracted driver slams into you from behind. That driver is the third party. Their negligence—texting instead of watching the road—makes them legally responsible for your injuries, lost income, and the damage to your car.

This is exactly why we have mandatory motor third party liability insurance. It’s a safety net designed to cover the harm an at-fault driver causes. The market for this type of coverage is projected to hit a staggering $1800 billion by 2035, which really shows you just how common these situations are.

Beyond Car Accidents

While car accidents are everywhere, third party liability pops up in countless other places. A valid claim can come from a situation you'd never expect, but they all share the same root cause: someone failed to provide a safe environment, and you got hurt because of it.

Here are a few common scenarios we see all the time:

- Premises Liability: A shopper in a Portland grocery store slips and falls on a wet floor. If there was no "wet floor" sign, the store owner (the third party) failed in their duty to keep customers safe and can be held liable.

- Dog Bites: A dog owner in Salem lets their dog roam off-leash where it shouldn't be, and it bites someone walking by. That owner is the responsible third party for failing to control their animal.

- Defective Products: You buy an electric scooter with a faulty brake system. When the brakes fail, you crash and get seriously injured. The manufacturer is the third party responsible for releasing a dangerous product.

The key takeaway is that a third party can be anyone—an individual, a business, or even a government entity—whose negligence directly leads to your injury. The setting can change, but the principle of responsibility remains the same.

To help you visualize this better, here’s a quick breakdown of common third party scenarios.

Common Third Party Liability Scenarios

This table illustrates how the same legal principle applies across different situations, from a simple slip-and-fall to a complex product malfunction.

| Premises Liability | Property Owner (e.g., store, landlord) | Failing to clean up a spill or fix a broken stair. |

| Product Liability | Manufacturer or Designer | Selling a product with a known defect, like faulty brakes. |

| Medical Malpractice | Doctor, Nurse, or Hospital | Misdiagnosing a condition or making a surgical error. |

| Construction Site | Subcontractor or General Contractor | Creating an unsafe condition that injures another worker. |

Each of these examples involves an independent party whose actions (or inactions) created the hazard that led to an injury.

Complex Cases in the Workplace

Workplace injuries, especially on busy construction sites, can get complicated. Oregon’s workers' compensation system usually means you can’t sue your own boss if you get hurt on the job. But that doesn't mean you're out of options. You can absolutely file a third party claim if someone other than your employer caused your injury.

For example, a general contractor hires an outside electrical company to wire a new building. That electrician does a sloppy job, and a light fixture they installed falls and hits a roofer working for a completely different company.

The injured roofer can’t sue their own roofing company, but they have a strong third party claim against the negligent electrical company. It's a perfect illustration of how understanding specific contractor insurance requirements is critical for businesses operating in these multi-employer environments.

How Insurance Companies Fight Your Claim

When you get hurt, you’d think the at-fault party’s insurance company would step up and do the right thing. Unfortunately, that's rarely the case. Insurance companies are for-profit businesses, and their main goal is to protect their own bottom line. That means paying out as little as they possibly can.

Even with a rock-solid third-party liability claim, you have to be ready for a fight. Insurers have armies of adjusters and lawyers on staff whose entire job is to find ways to reduce, delay, or flat-out deny your claim.

Common Tactics Used by Insurance Adjusters

Insurance adjusters have a well-worn playbook they use to minimize what they have to pay you. They might sound friendly and concerned on the phone, but make no mistake—they are not on your side. Every question they ask is designed to get you to say something that could hurt your case.

Here are a few of the most common arguments you can expect to hear:

- Comparative Negligence: They will do everything they can to shift some of the blame for the accident onto you. In Oregon, if you’re found to be even 10% at fault, your final compensation gets cut by that same percentage.

- Questioning Your Injuries: The adjuster will likely suggest your injuries aren't as bad as you say they are. They might even dig for old medical records to argue that a pre-existing condition is the real cause of your pain, not the accident.

- Lowball Settlement Offers: One of their favorite moves is to make a quick, low offer right after the accident. They’re hoping your financial stress will push you to accept it before you even know the true cost of your injuries.

An insurance company's first offer is almost never its best offer. It's just the opening move in a negotiation where they have all the power—and accepting it can mean leaving thousands of dollars on the table.

Fighting Back with a Solid Strategy

The best way to counter the insurance company's tactics is to see them coming. When you know their playbook, you can build a strategy to beat them at their own game. It all comes down to presenting a case backed by such overwhelming evidence that they have no choice but to take you seriously.

Being prepared is your best defense. A good first step is to get familiar with common insurance adjuster tricks so you can recognize them when they happen.

Building a powerful case means leaving no stone unturned. This involves meticulously collecting witness statements, hiring accident reconstruction experts if needed, and compiling clear, detailed medical records that connect your injuries directly to the incident. Each piece of evidence you gather chips away at the insurance company's arguments.

In the end, it often boils down to sharp negotiation skills. We've put together a guide that explains more about how to negotiate an insurance settlement and what it takes to get the full amount you're owed. A seasoned attorney handles this entire process for you, making sure you avoid costly mistakes and present the strongest claim possible.

Why an Attorney Is Your Strongest Ally

Trying to navigate a third-party liability claim alone is a tough road. It’s like stepping into a high-stakes negotiation where the other side holds all the cards. Insurance companies, at the end of the day, are businesses, and their main goal is to protect their bottom line by paying out as little as possible.

This is precisely where having a skilled personal injury attorney in your corner can change everything.

An attorney doesn't just help; they level the playing field. They’ve seen every tactic insurance adjusters use and know exactly how to push back. More importantly, they have the experience to see the full picture of your claim's value—not just the immediate medical bills, but the future costs and the very real impact of pain and suffering. These are the kinds of damages that are incredibly difficult to calculate on your own.

Maximizing Your Recovery and Protecting Your Rights

A seasoned lawyer knows how to build a case that is solid and prepared for any challenge. They take over the stressful parts, like handling all communication with the insurance company and managing the mountain of complex paperwork. Many legal pros even use tools like legal dictation software to make sure every detail is documented perfectly.

When an attorney represents you, it sends a powerful message. It tells the insurance company you won’t be lowballed or intimidated into accepting an unfair settlement. It shows you're serious.

Your lawyer’s job is to be your advocate, period. They make sure every deadline is met and all evidence is used effectively to build the strongest possible case. With them handling the legal fight, you can finally put your energy where it belongs: on your recovery.

Common Questions We Hear About Liability Claims

After an injury, the questions start flooding in. They're rarely abstract legal theories; they're practical, urgent, and deeply personal. When you're trying to figure out what a third party liability claim means for you, you need clear answers.

This section tackles some of the most common questions we hear from our clients right here in Oregon, cutting through the legal jargon to give you the information you need to move forward.

How Long Do I Have to File a Claim in Oregon?

In Oregon, the clock is always ticking. Generally, you have two years from the date of your injury to file a personal injury lawsuit. This is called the statute of limitations, and it’s a hard deadline. Miss it, and the courthouse doors will likely be closed to you forever.

But there are crucial exceptions. If your claim is against a government agency, you have a much shorter window—just 180 days—to give them formal notice of your intent to sue. Because of these complexities, it's vital to act fast to protect your legal rights.

Waiting too long is one of the most heartbreaking and preventable mistakes we see. The moment an accident happens, evidence starts to degrade and memories fade. Don't let time work against you.

What Happens If the Other Person Has No Insurance?

It’s a scenario that causes a lot of anxiety, and for good reason. What if the person who hit you is uninsured or doesn't have enough insurance to cover your medical bills? Thankfully, there's often a safety net built into your own policy.

This is where your Uninsured/Underinsured Motorist (UM/UIM) coverage comes into play. Think of it as your own insurance stepping into the shoes of the at-fault party. You can file a claim with your insurer to cover the damages the other driver should have paid for.

Can I File Both a Workers' Comp and a Third Party Claim?

Absolutely. This is a critical point that many people injured on the job miss. Workers' compensation is designed to be your sole remedy against your employer, but it does nothing to prevent you from seeking justice from a negligent third party.

Imagine you're a delivery driver who gets T-boned by a distracted driver. You can collect your workers' comp benefits for medical bills and lost wages. At the same time, you can file a separate third party claim against the at-fault driver to recover compensation for things workers' comp won't touch, like pain and suffering.

At Bell Law, our job is to bring clarity to complex situations and guide you through the process. If these questions bring up more of your own, visit us online to schedule a consultation and get the answers you deserve.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.