Oregon's Workers Comp Claim Process Explained

"I was satisfied once John Bell took over my case."

"Communication was always timely."

Oregon's Workers Comp Claim Process Explained

The moment you get hurt on the job, the clock starts ticking on your workers' comp claim. What you do in those first few hours is absolutely critical. Getting these initial steps right can make all the difference in getting your medical bills paid and covering your lost wages.

Your First Moves in the Workers' Comp Claim Process

Everything is a blur after a workplace accident. It’s stressful, you’re in pain, and it’s hard to think straight. But the actions you take right away lay the groundwork for your entire claim. Think of it like pouring the foundation for a house—if you mess it up, everything that comes after will be unstable.

Your two immediate priorities are simple: take care of your health and make sure there's a clear record of what happened.

If you wait, you give the insurance company an opening. They might start questioning how bad your injury really is or if it even happened at work. Every single thing you do, from telling your supervisor to seeing a doctor, becomes a piece of your story.

Get Medical Help Right Away

Your health comes first. Always. Even if you think it's just a minor tweak or a small slip, get checked out by a doctor immediately. Some serious injuries, like concussions or internal issues, don't always show obvious symptoms right away.

Heading to an urgent care clinic, the ER, or your own doctor does two crucial things for you:

- It protects your health. You get a real diagnosis and a treatment plan.

- It creates a medical record. This is powerful proof that officially connects your injury to the incident at work. Make sure you tell the doctor exactly how, when, and where you got hurt. That first medical report is one of the strongest pieces of evidence you can have.

Officially Tell Your Employer About the Injury

You have to let your employer know you were injured, and you need to do it as soon as you possibly can. Telling your manager is a good first step, but you absolutely must follow it up in writing. An email or filling out an official company incident report creates a paper trail that can't be denied.

When you've been injured at work, the initial aftermath can feel overwhelming. This quick checklist breaks down the most important actions you need to take right away to protect both your health and your potential claim.

Immediate Actions After a Work Injury

| Seek Medical Attention | Your health is the priority. It also creates the first official medical record linking the injury to your work. | No legal deadline, but do it the same day if possible. |

| Notify Your Supervisor | Tell your immediate supervisor or manager about the incident as soon as it happens, even verbally at first. | Report immediately. This starts the formal process. |

| Submit a Written Report | Follow up your verbal report with an email or by filling out a company incident report form. | Creates undeniable proof of when you reported the injury. |

| File Form 801 | This is the official "Report of Job Injury or Illness" in Oregon that formally starts your claim. | Your employer must provide it. It's your responsibility to ensure it gets filed. |

| Document Everything | Note the date, time, witnesses, and exactly what happened. Keep copies of all paperwork. | Your memory can fade. Written notes are invaluable later. |

Following these steps methodically ensures you're not just reacting to the situation but actively managing it from the very beginning.

In Oregon, you technically have 90 days to report a work injury, but waiting that long is a huge mistake.

The best practice is to report it the same day it happens—or even within the hour. Any delay gives the insurance company a reason to argue that your injury isn't actually work-related.

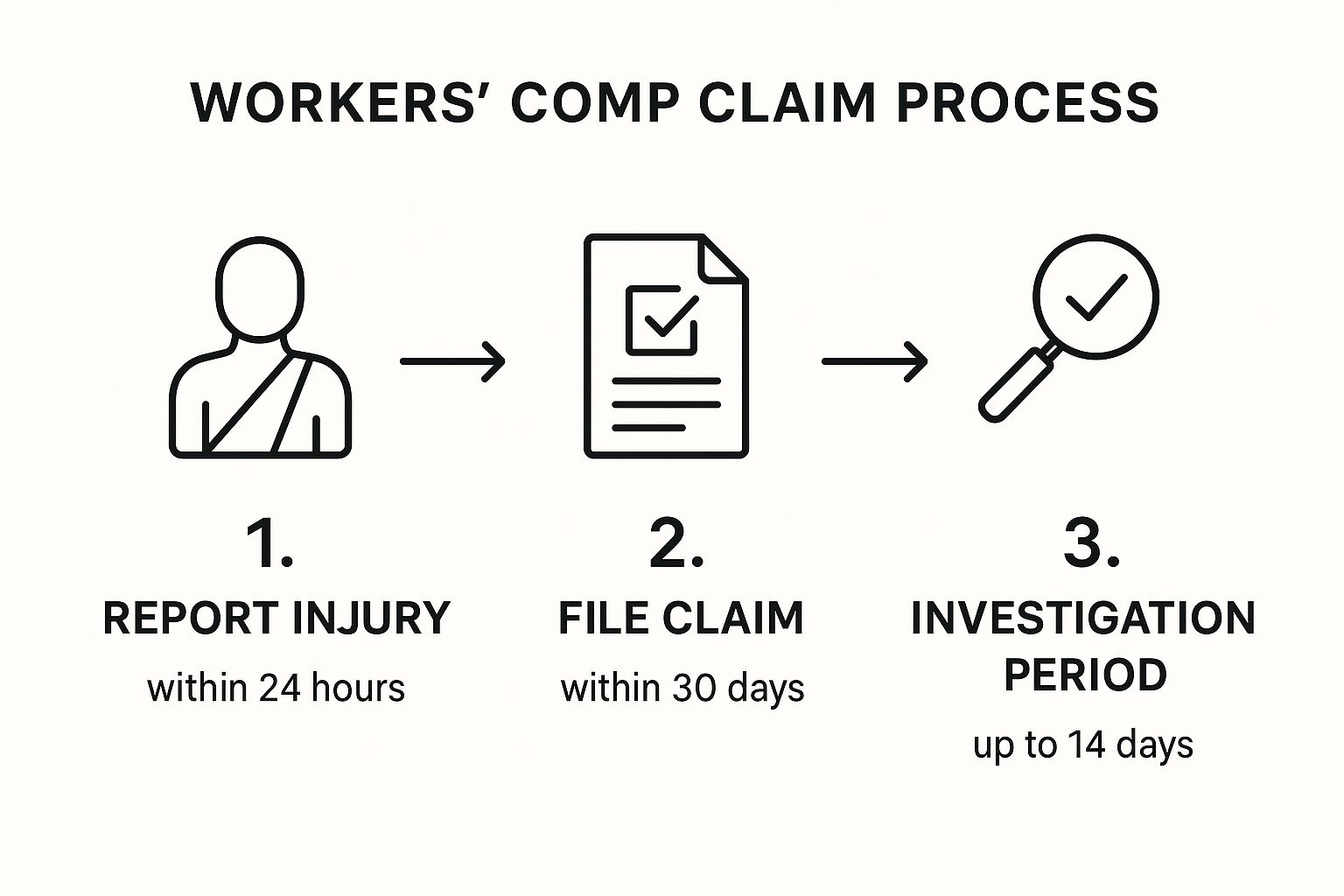

This graphic provides a great overview of how quickly the process moves from your initial report to the insurer's investigation.

As you can see, your first actions set everything else in motion. It's also worth noting that while you're navigating your recovery, employers are dealing with the logistical side of things, which often involves effective sick absence management to handle the time you need to be away from work.

Filing Your Claim and Waiting on the Insurer's Decision

So, you’ve reported your injury and seen a doctor. Now the formal workers comp claim process kicks into high gear, and this is where the paperwork really starts to matter. Your focus should shift to a specific document: the "Worker's and Physician's Report for Workers' Compensation Claim," which everyone just calls Form 801.

Think of this form as the official starting pistol for your claim. After you report an injury, your employer is legally required to provide you with one. Your job is to fill out your section with absolute precision. Get the details right. Small mistakes—like getting the date of injury wrong or being too vague about what happened—can cause major headaches and give the insurance company an easy excuse to question your claim from the get-go.

Once you and your doctor have completed your parts, the ball is out of your court, for a little while anyway. Your employer has five days to send that completed form over to their workers' compensation insurer. This is when a critical waiting period begins.

The Insurer's 60-Day Decision Window

In Oregon, the insurance company gets 60 days from the day your employer was notified about your injury to make a decision. That two-month stretch can feel agonizingly long, but it helps to know what’s happening behind the scenes.

During this time, the claims adjuster is doing their homework. They’ll be scrutinizing your Form 801, poring over your initial medical records, and possibly even calling you, your supervisor, or coworkers who witnessed the incident.

They're essentially trying to answer three core questions:

- Did an injury actually happen?

- Did it arise "out of and in the course of employment"?

- Are you a covered employee under their policy?

This is precisely why your first steps—reporting the injury immediately and getting detailed medical documentation—are so important. That initial evidence is the bedrock of your entire case. To get a better handle on the specifics, it's worth understanding what it takes to https://www.belllawoffices.com/qualify-for-workers-compensation/.

Getting the Decision Notice

Sometime within those 60 days, you’ll get a formal notice in the mail. It's a simple piece of paper, but it will dictate everything that happens next. It will either be an acceptance or a denial.

A Notice of Acceptance is good news. It means the insurer agrees your injury is work-related and will begin covering medical bills and lost wages. But don't just celebrate—read that notice very carefully. It will list the exact medical conditions they are accepting. For instance, they might accept your "lumbar strain" but leave out the "herniated disc" your doctor actually diagnosed. This is a huge deal, because they will only pay for treatment related to the accepted condition.

A Denial means the insurer is refusing to pay. The notice has to explain why. Maybe they believe the injury happened at home, it's a pre-existing condition, or you waited too long to report it. Whatever the reason, a denial isn't the end of the line. It's the beginning of the appeals process.

Key Takeaway: An accepted claim only covers the specific conditions listed on the Notice of Acceptance. Always check that the accepted diagnosis matches what your doctor found to avoid a fight over medical treatment down the road.

The Role of Medical Evidence in Your Claim

When it comes to your workers' compensation claim, nothing matters more than your medical records. Seriously. The documentation from your doctors is the single most important factor that will make or break your case. Think of strong, consistent medical evidence as your best weapon in this entire process.

It all starts with who you see for treatment. In Oregon, you almost always have the right to choose your own attending physician. This is a huge decision. This doctor isn't just treating your injury; they're the one documenting its severity, connecting it to your job, and explaining how it impacts your ability to work.

You absolutely have to be an open book with your doctor. Don't ever downplay your pain or try to tough it out. Every single detail is important, whether it’s a sharp pain that shoots down your leg or the fact that your fingers have been going numb. Your medical chart needs to tell the complete story of your injury and your road to recovery.

The So-Called "Independent" Medical Examination

Sooner or later, you'll probably get a letter in the mail scheduling you for an Independent Medical Examination (IME). The name is a little deceiving. This exam is ordered and paid for by the insurance company, and the doctor they choose is hired to give them a second opinion on your condition—not to help you.

Why do they do this? Insurers use IMEs to find reasons to challenge your claim. They might be trying to argue your injury isn't work-related, that it's not as bad as you say, or that you're as good as you're going to get.

You have to go into this appointment prepared. Here’s what you need to remember:

- Be Honest: Don't ever exaggerate your symptoms, but don't minimize your pain either. The key is consistency. What you tell the IME doctor needs to line up with what you’ve been telling your own physician all along.

- Be Detailed: When the doctor asks how you got hurt, describe exactly what happened. When they ask about your symptoms, explain the real-world impact. Tell them you can't sleep through the night, you struggle to lift a bag of groceries, or you can't sit for more than ten minutes without pain.

- Be Professional: This doctor is watching everything. They'll note if you're on time, your attitude, and even how you walk from the waiting room or get up from the exam table. Their report will be full of these little observations.

The IME is a make-or-break moment. The insurance company can use this one report to deny your treatment, cut off your benefits, or try to close your claim. You have to take this appointment as seriously as a heart attack.

Curative Care vs. Palliative Care

As you continue treatment, your medical records will start to make a distinction between two types of care, and this difference is critical for what gets covered.

Curative care is any treatment meant to actually heal or improve your condition. Think of things like surgery to repair a torn rotator cuff, physical therapy to regain strength, or medication to reduce inflammation. Insurers are required to cover any curative care that’s reasonable and necessary.

Palliative care, on the other hand, is treatment that just makes you feel better without fixing the underlying problem. This could be ongoing chiropractic visits or pain management injections after your condition has stabilized. Insurers fight tooth and nail to avoid paying for palliative care.

The moment your doctor notes a shift from curative to palliative care, it's a huge signal that you might be reaching maximum medical improvement (MMI)—the point where you aren't expected to get any better. This change has a direct ripple effect on your benefits and often kicks off the process of determining any permanent disability.

Navigating your workers' comp disability rating is one of the most complex stages of a claim, and having clear, undeniable medical evidence is the only way to get a fair outcome. The strength of that documentation will ultimately decide the extent of your permanent impairment.

How to Handle a Claim Denial or Dispute

Getting that denial letter in the mail is a gut punch. It’s incredibly frustrating and can feel like a dead end, but I can’t stress this enough: a denial is not the final word. It’s just the insurance company’s first move in a fight you can absolutely still win.

This is the point where the process gets a lot more complicated. You’ve shifted from filling out paperwork to entering a formal legal dispute. The system is designed to give you a chance to prove your case, but you have to be fast and strategic.

Initiating the Appeals Process

Your first official move after a denial in Oregon is to request a hearing by filing an appeal with the Workers’ Compensation Board. This isn't just another form; it's a formal legal action that tells the insurer you are officially challenging their decision.

You have a very strict deadline: 60 days from the date the denial was mailed. This is one of the most unforgiving deadlines in the entire system. If you miss this window, the door on your claim can slam shut for good, no matter how strong your case is.

Filing this appeal kicks off what’s known as the litigation phase. An Administrative Law Judge (ALJ) gets assigned to your case, and the real work of building your argument begins. This is where having an experienced attorney in your corner becomes essential. For a deeper look, our guide on what to do if your workers' comp claim is denied walks through these crucial next steps.

Navigating the Litigation and Hearing

Once you’ve requested a hearing, the legal gears start turning. This entire phase is about gathering evidence and preparing for the hearing itself, which is basically a small-scale trial for your claim.

Two of the most important parts of this stage are discovery and depositions.

- Discovery: This is where both sides exchange information. Your attorney will demand all the documents the insurer has on your claim—medical reports, their internal notes, even surveillance footage if they have it. At the same time, the insurer's lawyer will ask for information from you.

- Depositions: A deposition is your formal, sworn testimony given outside of a courtroom. The insurer's attorney will question you about the accident, your injuries, your medical history, and how the injury affects your daily life. Everything you say is recorded by a court reporter and becomes official evidence for your hearing.

Let’s look at a classic real-world scenario. The insurer denies your claim, arguing that your back injury is from a "pre-existing degenerative disc disease" and had nothing to do with your work.

To counter this, your attorney will get medical evidence from your doctor directly linking the worsening of your condition to the specific work incident. They might even hire a medical expert to provide an opinion that proves while the condition existed, it was the work injury that tipped the scales, causing the need for treatment and your inability to work.

Be prepared for this process to take time. While Oregon’s system has its own timeline, it helps to look at other states to understand how long these disputes can drag on. In California, for example, insurers paid out $12 billion in losses in 2020, and it takes around 11 years to resolve 95% of their indemnity claims. You can find more of these eye-opening workers' compensation statistics on getforesight.com.

Eventually, your case will go to a hearing before the ALJ. Both sides will present their evidence, call witnesses to testify, and make their legal arguments. The judge will then issue a final written decision. They can either agree with the insurer and uphold the denial, or they can overturn it, forcing the insurer to accept your claim.

A denial is a serious roadblock, but it is far from the end of the road. With the right strategy and solid evidence, it's a barrier that can be overcome.

Understanding Settlements and Closing Your Claim

Sooner or later, especially if there's been some back-and-forth on your claim, the conversation will likely turn to settlement. Don't think of this as throwing in the towel. It's often a smart, strategic move for everyone involved, offering a clean break and a way to avoid dragging things out in court.

Settling your claim means you agree to close out some, or all, of your benefits in return for a lump-sum payment. It gives you certainty and puts you back in control of your life. But it’s a big decision, and it’s final.

In Oregon, workers' comp settlements generally come in two flavors.

Claim Disposition Agreements (CDA)

The most common way to completely close out a claim is with a Claim Disposition Agreement, or CDA. When you sign a CDA, you're agreeing to trade nearly all of your future benefits for a single, tax-free payout. The one thing you don't give up is your right to medical care for the accepted condition.

So, what are you trading away?

- Any future time-loss payments if your condition gets worse.

- Permanent disability awards (PPD or PTD).

- Job retraining assistance.

- Survivor benefits for your dependents.

Let's say you have an accepted knee injury. A CDA gives you a chunk of cash now, but if that knee requires another surgery five years from now, you can’t get wage loss benefits while you recover. It’s a clean slate, but it closes the door on most future financial help from the claim.

Disputed Claim Settlements (DCS)

A Disputed Claim Settlement (DCS) is a different animal altogether. This is what you use to resolve a specific fight, usually when the insurance company has denied your whole claim or a specific diagnosis. You agree to take a payment and, in return, you give up your right to fight that particular denial any further.

The key difference is that a DCS doesn't have to close your entire claim. Imagine the insurer accepted your "shoulder sprain" but denied the "torn rotator cuff" your doctor diagnosed. A DCS would let you settle the denied rotator cuff part of the claim for a sum of money, while keeping your claim for the sprain open.

A settlement is a permanent, binding agreement. Deciding to accept a CDA or a DCS is one of the biggest moments in your claim. Never sign anything until you are absolutely certain you understand what rights you are giving up forever.

How Settlement Amounts Are Negotiated

There isn't some neat little formula for figuring out a settlement value. It's a negotiation, pure and simple. The final number is based on the potential value of all the future benefits you're agreeing to walk away from.

A good attorney will sit down and crunch the numbers, looking at the real-world factors:

- Future Medical Needs: What will it cost to manage your injury for the rest of your life?

- Permanent Impairment: What would your permanent disability award likely be worth if you didn't settle?

- Earning Power: If you can't go back to your old line of work, what's the financial hit over your career?

- The Risk Factor: What are the odds of winning or losing if this thing ends up in front of a judge?

The insurance adjuster is doing the exact same math on their end. The settlement amount you land on is a compromise between what you think the claim is worth and what they think their risk is.

This whole process can feel overwhelming, and it's true that not everyone has the same experience. Research shows that while about 77% of injured workers feel positive about their claim process, things like age and gender can influence outcomes. You can read more about these different experiences in the full research about claim satisfaction.

This is where having a professional on your side makes a difference. An attorney's job is to level that playing field and make sure the settlement reflects the true value of what you’re giving up—not just the lowball number the insurer wants to pay.

Common Questions About the Oregon Workers Comp Process

Trying to make sense of the Oregon workers' compensation system can feel overwhelming. It’s like learning a whole new language filled with specific rules and deadlines. Even when you’re trying to do everything right, questions and concerns are bound to pop up.

Let's walk through some of the most common—and stressful—questions we hear from injured workers every day during the workers comp claim process.

Can I Be Fired for Filing a Workers Comp Claim?

This is probably the biggest fear on every injured worker's mind, and thankfully, the answer is a firm No. Oregon law is very clear on this: it is illegal for an employer to punish you for filing a legitimate workers' comp claim.

This protection, found in Oregon Revised Statute 659A.040, isn't just about getting fired. Retaliation can be much more subtle. Keep an eye out for things like:

- A sudden, unexplained demotion.

- Your hours getting drastically cut.

- Being assigned all the worst tasks that nobody else wants.

- A noticeable shift toward a hostile or uncomfortable work environment.

If you suspect your employer is penalizing you for your claim, you can file a discrimination complaint. Just be sure to document everything—every comment, every schedule change, every incident. Proving retaliation requires a clear paper trail.

Do I Have to Use the Doctor My Employer Recommends?

In most cases, you absolutely do not. Oregon gives you the right to choose your own attending physician for a work-related injury. This is a big deal.

The main exception is if your employer is part of a Managed Care Organization (MCO). If they are, you’ll have to see a doctor within that MCO's network, at least for your initial treatment. But even then, you're not stuck. You can usually switch to another doctor within the same network if you feel the first one isn't a good fit.

Your doctor is arguably your most important ally in a workers' comp claim. Having a physician who knows your history and is genuinely focused on your recovery can make all the difference. Don't give up your right to choose unless you are absolutely certain your employer is in an MCO.

What Happens if My Injury Gets Worse Over Time?

This happens more often than you’d think. What started as a nagging backache could eventually be diagnosed as a herniated disc needing surgery. The system has a specific process for this, known as a "worsening condition" claim.

If your condition deteriorates, you have up to five years from the date your original claim was closed to file for the aggravated condition. The key to a successful worsening claim is solid medical evidence. Your doctor must be able to draw a clear, direct line showing that the new, more serious issue is a direct result of that original workplace injury.

Can I Work a Second Job While on Workers Comp?

Tread very, very carefully here. The short answer is maybe, but the risks are high if you get it wrong.

Any work restrictions your doctor gives you—like no lifting over 10 pounds or no standing for more than an hour—apply to everything you do, not just the job where you got hurt.

If your doctor has you on a 10-pound lifting restriction for a shoulder injury, you can't go work a weekend gig that involves moving 20-pound boxes. That's a fast track to being accused of fraud, which could not only end your benefits but might even lead to criminal charges.

Be completely transparent. Before you even think about picking up a side job, talk to your doctor and your attorney. It's just not worth the risk.

For a quick summary, we've put the key points into a simple reference table.

FAQ Quick Reference

Here are the direct answers to those pressing questions, all in one place.

| Can I be fired for filing? | No, it is illegal for an employer to retaliate against you. | Document any negative changes to your job after filing a claim. |

| Must I see the company doctor? | No, unless your employer is in a Managed Care Organization (MCO). | You generally have the right to choose your own doctor. |

| What if my injury worsens? | You can file a "worsening condition" claim within five years. | Strong medical evidence linking the new issue to the old injury is essential. |

| Can I work a second job? | Only if the work complies with all your medical restrictions. | Never perform work that violates your doctor-ordered limitations. |

Having these answers helps you stand up for your rights and navigate the workers comp claim process with more confidence.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.