How Does Back Pay Work for SSI? A Complete Guide

"I was satisfied once John Bell took over my case."

"Communication was always timely."

How Does Back Pay Work for SSI? A Complete Guide

If you've been waiting on a decision for your Supplemental Security Income (SSI) benefits, you've probably heard the term "back pay." But what does it actually mean?

Think of it this way: back pay is the lump sum of benefits the Social Security Administration (SSA) owes you for the time you spent waiting for your claim to be approved. It covers the months between when you first filed your application and when the SSA finally gave you the green light. It’s like getting paid for a job you were doing all along—in this case, the "job" was simply waiting while being eligible.

What Is SSI Back Pay and Why Does It Build Up

Applying for SSI is rarely a quick process. The SSA has to do its due diligence, which means thoroughly reviewing your medical condition, your income, and any assets you own. This isn't something that happens overnight; it can take months, and if your initial claim is denied and you have to appeal, it can even take years.

But your bills don't stop just because you're waiting for a decision. Back pay exists to bridge that financial gap. It’s the SSA’s way of making you whole for the period you were eligible for benefits but weren't receiving them.

The Application Gap Creates the Debt

The main reason back pay accumulates is because of that gap between when you file and when you're approved. Let's walk through a simple example. Say you applied for SSI in January, but your claim wasn't officially approved until October of the same year.

Assuming you met all the eligibility rules from the start, the SSA now owes you payments for all those months you were waiting. Your payments would be calculated from the month after you applied, so you would be owed benefits for February through October—that's nine months of back pay.

This delay is a standard part of the process and can be caused by a few things:

- Initial Review: The SSA has to collect and verify all your medical records and financial statements.

- Need for More Information: Sometimes, they might need more evidence from you or your doctors, which adds time.

- The Appeals Process: A denial is a major setback. If you have to appeal, each stage of the process can add several more months to your wait time.

A crucial piece of the puzzle is the strict asset limit for SSI. If your assets are over the limit, you won't be eligible, which means no monthly benefits and no back pay. To see if you're on the right track, you can use a helpful tool like this SSI Asset Calculator.

SSI vs. SSDI: How Back Pay Differs

It's easy to get SSI and Social Security Disability Insurance (SSDI) confused, but their back pay rules are completely different. Getting them straight is essential.

SSI back pay only goes back to the month after you submitted your application. There's no exception. If you applied in June, the earliest your back pay can start is July, no matter how long you were disabled before that. SSDI, on the other hand, can sometimes pay retroactive benefits for a period before you even applied.

Here's a table to quickly break down the key distinctions between SSI and SSDI back pay.

SSI vs SSDI Back Pay Key Differences at a Glance

| Start Date | The month after the application date. | Can start up to 12 months before the application date. |

| Basis | Financial need and disability. | Work history (credits) and disability. |

| Payment Method | Paid in up to 3 installments, 6 months apart. | Typically paid in a single lump sum. |

| Five-Month Wait | No waiting period applies. | A mandatory 5-month waiting period from disability onset. |

As you can see, the programs are structured very differently, which directly impacts how and when you receive your money.

While this gives you a good overview, the world of Social Security benefits is complex. To get a deeper understanding of the program's rules and requirements, you can learn more about https://www.belllawoffices.com/supplemental-security-income-ssi/ here.

Pinpointing Your SSI Back Pay Start Date

When you're trying to figure out your SSI back pay, there’s one date that trumps all others: your application date. Think of it as the starting pistol for the entire process. It’s the single most important factor in determining how much money the Social Security Administration (SSA) owes you.

For Supplemental Security Income, the rule is simple and absolute. Your eligibility for back pay begins on the first day of the month following the month you officially file your claim. This is what's known as your protective filing date, and it's the official starting line for accumulating the benefits you're waiting on.

The One Date That Matters

Let's walk through an example to make this crystal clear. Say you submit your SSI application on March 20th. Your back pay clock doesn't start ticking right away. Instead, your eligibility for payments kicks in on April 1st. It doesn't matter if you've been disabled for years prior; the SSA only considers your application month when calculating back pay.

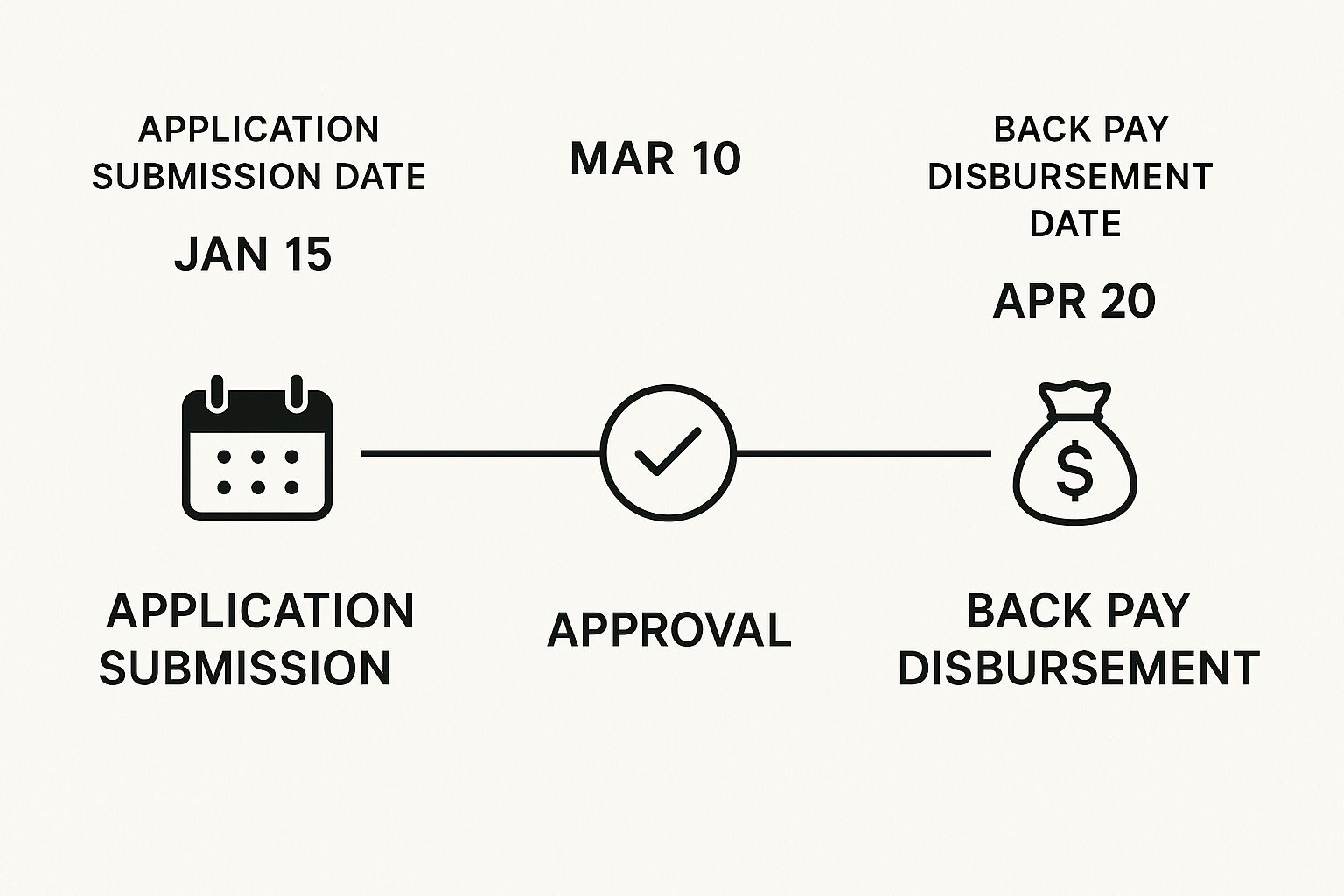

This visual breaks down the key moments in the journey from filing your application to receiving your payment.

As you can see, the time that passes between when you apply and when you're finally approved is the period that builds up your total back pay amount.

One of the biggest points of confusion for people is the disability onset date—the date the SSA agrees your disability actually began. While that date is absolutely essential for Social Security Disability Insurance (SSDI) claims, it plays no role in your SSI back pay calculation. This is a crucial difference to understand, as mixing them up can lead to a lot of frustration.

For SSI, the clock for back pay starts the month after you file your application, regardless of when your disability actually began. Your application date is the only start date that counts.

Getting this rule straight from the beginning is half the battle. The other half is making sure your initial application is filed correctly to establish that all-important date. If you're just starting out, getting some guidance on how to properly apply for SSI in Portland Oregon can offer much-needed support and peace of mind.

To recap, just remember these key takeaways:

- Application Month: This is the anchor for your entire back pay calculation.

- Eligibility Start: Benefits begin to accrue from the first day of the very next month.

- Disability Onset Date: For SSI back pay, this date is irrelevant. Don't let it confuse you.

By focusing on your application date, you can set realistic expectations for the benefits you are rightfully owed.

How the SSA Calculates Your Back Pay Amount

Figuring out exactly how the Social Security Administration (SSA) calculates your back pay can feel a bit like decoding a secret formula. But once you understand the logic, it's actually pretty straightforward.

Think of it this way: the SSA goes back in time, month by month, to figure out what you should have received if your benefits were approved instantly. They reconstruct your financial picture for that entire waiting period.

The starting point for every single month is the maximum Federal Benefit Rate (FBR). This is the highest possible monthly SSI payment set by the federal government for that specific year. So, for each month you were waiting, the SSA starts with that number.

Of course, it's not that simple. Very few people end up with the full FBR for their back pay. From that maximum amount, the SSA subtracts what they call "countable income" for each month. This is where your personal financial situation comes into play, as the final tally depends entirely on what you had coming in while your application was pending.

Subtracting Countable Income and Deductions

So, what exactly is countable income? It's any money or support you received that the SSA figures could have been used for essential needs like food and housing. This is the biggest reason your final back pay amount might be less than you initially thought.

The SSA will comb through your records for the whole waiting period, looking for things to subtract.

Common examples of countable income include:

- Earned Income: Any wages you made from a job, even if it was just part-time.

- Unearned Income: This covers things like unemployment benefits, state disability payments, pensions, or even cash gifts from relatives.

- In-Kind Support and Maintenance (ISM): This is a big one that often surprises people. If a friend or family member helped you out by paying your rent or buying your groceries, the SSA views that support as a form of income and will make a deduction for it.

Let's walk through a quick example. Say you waited 10 months for your SSI approval, and during that time you managed to work a small part-time job, earning $285 a month.

The SSA doesn't count all of that against you. They apply a specific formula: first, they ignore the first $85 of what you earned. Then, they only count half of what's left.

- $285 (what you earned) - $85 (standard exclusions) = $200

- $200 / 2 = $100 (your monthly countable income)

If the maximum FBR for that year was $943, the SSA would then subtract your $100 of countable income. That means your back pay for each of those months would be $843. They do this for every single month you were waiting.

Key Takeaway: Your back pay isn't a single lump sum based on today's rate. It's a detailed, month-by-month calculation that starts with the maximum benefit for each specific month and then subtracts any income or financial help you got along the way.

This careful, step-by-step process is how the SSA ensures the payment reflects your actual financial need during the time your application was in limbo. Knowing how these deductions work gives you a much clearer picture of what to realistically expect.

Understanding How SSI Back Pay Is Paid Out

When your SSI claim is finally approved after a long wait, seeing the back pay amount you’re owed can feel like a huge weight has been lifted. But here’s something that catches many people by surprise: that money probably won’t show up as one big check. The Social Security Administration (SSA) has specific rules for how it handles large back pay awards.

This is where the installment payment rule comes in. It’s a common point of confusion, but the SSA put it in place to protect your eligibility. If your back pay award is over a certain amount, the SSA will almost always break it up into smaller payments.

The "Three-Times-the-Limit" Rule Explained

So, what counts as a "large" amount? The SSA has a simple formula. If your total back pay is more than three times the current monthly Federal Benefit Rate (FBR), they'll split the payment.

For example, in 2024, the FBR for an individual is $943. That means any back pay award over $2,829 (which is $943 x 3) will likely be paid in installments. These payments are typically sent out six months apart, with a maximum of three installments. You can find more details about SSI back pay regulations on pisegna-zimmerman.com.

This rule isn't there to make things difficult. It actually serves a couple of important purposes:

- It Protects Your Benefits: A big lump-sum deposit could easily push your bank balance over the strict SSI asset limit ($2,000 for an individual). If that happens, you could be kicked off SSI and even lose your Medicaid for the next month.

- It Encourages Financial Stability: Spreading the money out helps ensure it lasts. The SSA’s goal is to provide a steady financial cushion for your ongoing needs, not a one-time windfall that can be spent too quickly.

Keep in Mind: Your first installment is usually capped at three times the FBR. The SSA will then send a second payment six months later, and if there’s still a balance, a final payment six months after that.

What If You Need the Money Now? Requesting a Lump Sum

While installments are the default, the rule isn't totally rigid. The SSA knows that while you were waiting for benefits, you probably fell behind on bills or had to put off major expenses. If you have urgent needs, you can ask for a larger payment or even the entire lump sum.

To get an exception, you have to prove to the SSA that you have a pressing need for the funds. They won't just take your word for it; you’ll need to provide documentation like eviction notices, repair estimates, or medical bills to back up your request.

Here are a few common reasons the SSA might approve a larger or lump-sum payment:

- You need the money to avoid eviction or foreclosure on your home.

- You plan to use the funds to purchase a home.

- You have essential home repairs that can't wait, like a leaky roof or a broken furnace.

- You have outstanding medical or dental bills that aren't covered by Medicaid.

- You need to buy an essential item, like a car to get to your doctor’s appointments.

To make this request, you need to contact your local SSA office directly. Be ready to explain your situation clearly and provide copies of the documents that prove you have these specific, urgent debts.

Key Differences Between SSI and SSDI Back Pay

While both Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) offer a lifeline, the way they handle back pay is completely different. It's a common and costly mistake to confuse the two, leading to big surprises about how much money you'll get and when. Nailing down these differences is key, especially if you think you might qualify for both.

The biggest distinction boils down to when the clock starts. For SSI, benefits can only begin on the first day of the month after you file your application. It doesn't matter when your disability actually began. SSDI, however, plays by a different set of rules, which can sometimes work in your favor through retroactive benefits.

Retroactive Pay and Waiting Periods

SSDI has a rule that can be a real game-changer. The program allows for retroactive payments for up to 12 months before your application date, but only if you can prove your disability started back then. SSI has nothing like this; your application date is the absolute earliest your eligibility can begin.

But here’s the catch with SSDI: there's a mandatory five-month waiting period. From the day the SSA decides your disability began (your "established onset date"), you won't get paid for the first five full months. SSI, on the other hand, has no waiting period at all. Once you’re approved, your eligibility kicks in the month after you apply.

Payment Methods and Amounts

How the money lands in your bank account also varies significantly. SSI back pay is usually paid out in installments. This is done to help you stay under the program's strict asset limits. If your back pay is more than three times the current monthly federal benefit rate, the SSA will split it into as many as three payments, sent six months apart.

SSDI back pay is almost always delivered as one single lump sum. This makes sense when you remember what each program is for. SSI is a needs-based program for people with very limited income and resources, while SSDI is an insurance program you paid into with your work credits.

With SSDI, your back pay is capped at 12 months before your application date, and it never covers the first five months after your disability began because of that waiting period.

To help you see these critical differences side-by-side, here’s a quick breakdown.

Detailed Breakdown of SSI vs SSDI Back Pay Rules

This table offers a clear comparison of the specific rules that determine how back pay is handled for Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI).

| Start Date | The month after you apply. | Your onset date, minus the 5-month wait. |

| Retroactive Pay | Not available before application. | Up to 12 months before application. |

| Waiting Period | None. | Mandatory 5-month wait. |

| Payment Method | Installments for large amounts. | Typically a single lump sum. |

Understanding these distinctions is crucial for managing your expectations and financial planning during the application process.

While getting these specific rules straight is a must, you might also want to look into the bigger picture of how to maximize your Social Security benefits. Successfully navigating the Social Security system means knowing the unique playbook for every program you deal with.

What SSI Back Pay Actually Means for People

It’s easy to get lost in the rules and calculations, but let's talk about what SSI back pay really means in the real world. This isn't just about a delayed check; for millions of Americans, it's a financial lifeline that can completely change their situation.

The Supplemental Security Income program is designed to help some of our most vulnerable neighbors. According to the Social Security Administration, as of August 2025, there are roughly 7.4 million people receiving SSI benefits. Take a look at who that includes:

- About 1 million children under 18

- 3.9 million adults of working age

- 2.5 million seniors aged 65 and older

For a deeper dive into these numbers, you can explore the demographics on the SSA’s official site.

A Much-Needed Financial Reset

Let's be honest—the standard monthly SSI payment often doesn't stretch far enough to cover all the basics. Now, imagine waiting months, or even years, for your application to be approved. During that long, stressful period, bills don't stop. Rent comes due, utilities need to be paid, and medical costs can pile up, leading to serious debt.

That's where back pay comes in. It's the money that helps people get back on their feet. It’s what they use to pay off overdue rent to avoid eviction, settle overwhelming medical debt, or finally buy essentials they couldn't afford while waiting.

So, when we talk about how back pay works for SSI, we're not just discussing a retroactive payment. We're talking about a fundamental tool that helps restore a sense of stability and security for individuals and families who desperately need it.

Common Questions About SSI Back Pay

Even when you think you have a handle on the SSI process, a few specific questions always seem to pop up about back pay. It's a confusing part of the system, no doubt. Let's walk through some of the most common concerns to clear things up.

How Long Does It Take to Get SSI Back Pay?

Once you get that long-awaited approval notice, you can typically expect the first installment of your back pay to arrive within about 60 days. Sometimes, if the amount is small enough to be paid in one lump sum, you might even see it sooner.

Of course, this isn't a hard-and-fast rule. A more complicated case that requires the Social Security Administration (SSA) to do manual calculations might take a bit longer. The best thing you can do to speed things up is to make absolutely sure the SSA has your correct direct deposit information on file.

Will My Lawyer Get Paid From My Back Pay?

Yes, they will. If you've hired an attorney to help with your Social Security disability claim, their payment is handled directly from your back pay award. It's a standard practice that makes the whole thing much simpler for you.

By law, an attorney's fee is capped at 25% of your total back pay, and it can't go over a maximum amount set by the SSA (which is currently $7,200). The SSA takes care of this automatically, sending the fee to your lawyer and the rest of the money to you.

This setup means you don't have to worry about coming up with money for legal fees out of your own pocket. The process can be tough, and understanding the benefits of hiring a lawyer for your SSI case is often the first step toward getting the professional help that can make a real difference.

Can I Spend My Back Pay on Anything?

You bet. It's your money, and you can use it for whatever you need to get back on your feet and improve your quality of life. Most people find it's a lifeline for catching up on all the things that fell behind while they were waiting for their benefits to be approved.

People often use their back pay for things like:

- Getting current on rent or a mortgage.

- Paying off overdue utility bills and other debts.

- Handling much-needed repairs for their home or car.

- Covering medical bills or co-pays that Medicaid didn't handle.

The one crucial thing to remember is the SSI asset limit. Once you’ve taken care of your immediate needs, you have to make sure your total "countable assets" stay below the $2,000 limit for an individual so you don't jeopardize your future monthly payments.

At Bell Law, we know that getting the benefits you're entitled to is about more than just money—it's about regaining your stability and peace of mind. If you're in Oregon and struggling with an SSI claim, our team is ready to provide the expert guidance you need. Visit us at https://www.belllawoffices.com to see how we can help.

Disclaimer: The information on this page is provided for general informational purposes only and is not legal advice. Reading this content does not create an attorney-client relationship. For advice about your specific situation, please contact a licensed attorney.